Cheap Car Insurance Quotes Comparison

Securing affordable car insurance is a priority for many vehicle owners, and with the right knowledge and comparison techniques, it's entirely achievable. This comprehensive guide aims to provide an expert overview of the car insurance landscape, offering insights, tips, and strategies to help you find the best coverage at the most competitive rates. By understanding the factors that influence insurance costs and utilizing effective comparison methods, you can make informed decisions and potentially save hundreds of dollars annually on your car insurance.

Understanding the Fundamentals of Car Insurance

Car insurance is a contractual agreement between you and an insurance provider. It offers financial protection in the event of accidents, theft, or other unforeseen circumstances. The cost of this protection, known as the insurance premium, can vary significantly based on several factors. These include your driving history, the make and model of your vehicle, your age and gender, and the coverage limits you choose. Understanding these fundamental aspects is crucial before delving into the comparison process.

Factors Influencing Insurance Premiums

Several key elements contribute to the cost of your car insurance premium. These include:

- Vehicle Type and Usage: Sports cars and luxury vehicles typically attract higher premiums due to their expense and higher risk profiles. Similarly, if you use your car for business purposes or cover long distances daily, your premiums may be higher.

- Driving History: A clean driving record with no accidents or traffic violations can lead to lower premiums. Conversely, a history of accidents or speeding tickets can significantly increase your insurance costs.

- Age and Gender: Younger drivers, especially males, often face higher insurance premiums due to their statistically higher risk profiles. However, this factor varies by location and insurer.

- Coverage Limits: The level of coverage you choose also affects your premium. Higher coverage limits generally result in higher premiums, but they provide more extensive financial protection.

- Location: The area where you live and park your car can impact your insurance rates. Urban areas with higher population densities and crime rates often have higher premiums.

The Importance of Comparison Shopping

Comparison shopping is a critical step in finding the best car insurance deal. By comparing quotes from multiple insurers, you can identify the provider that offers the most competitive rates for your specific circumstances. It’s a powerful tool that empowers you to make informed decisions and potentially save a substantial amount on your insurance costs.

Steps to Compare and Secure Cheap Car Insurance Quotes

The process of comparing car insurance quotes and securing the best deal involves several strategic steps. These steps ensure that you not only find the most affordable coverage but also that the coverage meets your specific needs and provides the financial protection you require.

Step 1: Gather Information

Before you begin comparing quotes, it’s essential to gather all the necessary information. This includes your driving history, the make and model of your vehicle, and any additional information about your driving habits and the primary usage of your car. Having this information readily available will streamline the quote comparison process.

Step 2: Utilize Online Comparison Tools

Online comparison tools are a convenient and efficient way to compare car insurance quotes from multiple insurers. These tools often provide instant quotes based on the information you input. Some popular online comparison platforms include Compare the Market, GoCompare, and Confused.com. These platforms aggregate quotes from various insurers, making it easy to compare coverage and premiums side by side.

Step 3: Research Insurer Reputation and Financial Stability

While finding the cheapest quote is a priority, it’s also crucial to ensure that the insurer you choose is reputable and financially stable. A company with a strong financial standing can provide greater assurance that they will be able to meet their financial obligations if you need to make a claim. Utilize resources like the Better Business Bureau and financial rating agencies such as AM Best to research the financial health and customer satisfaction ratings of potential insurers.

Step 4: Understand the Coverage Offered

When comparing quotes, it’s essential to understand the coverage included in each policy. While some policies may offer lower premiums, they might also have lower coverage limits or exclude certain types of incidents. Make sure you’re comparing policies with similar coverage to ensure an accurate assessment of the best value for your money.

Step 5: Consider Additional Discounts

Many insurers offer a range of discounts that can further reduce your insurance premiums. These discounts can be based on factors such as your profession, the safety features in your car, or even your membership in certain organizations. Ask potential insurers about the discounts they offer and see if you qualify for any of them.

Step 6: Bundle Your Policies

If you have multiple insurance needs, such as car insurance and home insurance, consider bundling your policies with the same insurer. Many insurers offer significant discounts for customers who bundle multiple policies, potentially saving you a considerable amount on your overall insurance costs.

Step 7: Read the Fine Print

Before finalizing your insurance purchase, carefully read the policy documents. Understand the exclusions, limitations, and any specific terms and conditions that may apply to your policy. This step is crucial to ensure that you’re fully aware of what your policy covers and what it doesn’t.

Advanced Strategies for Even More Savings

If you’re looking to maximize your savings on car insurance, there are several advanced strategies you can employ. These strategies often involve a deeper understanding of the insurance landscape and a willingness to explore less traditional options.

Consider Usage-Based Insurance (UBI)

Usage-Based Insurance, also known as Pay-As-You-Drive or Pay-How-You-Drive insurance, is a modern approach to car insurance that bases your premiums on your actual driving behavior. Insurers use telematics devices or smartphone apps to track your driving habits, such as mileage, time of day, and braking patterns. If you’re a safe and cautious driver, UBI can potentially lead to significant savings.

Explore Peer-to-Peer Insurance Models

Peer-to-peer insurance models, also known as collaborative or peer-to-peer insurance, are a relatively new concept in the insurance industry. These models involve a group of individuals who pool their resources to cover each other’s claims. This approach can lead to lower premiums as it cuts out the middleman and administrative costs associated with traditional insurance companies. However, it’s important to note that these models may not be suitable for everyone and can carry higher risks.

Negotiate with Your Current Insurer

If you’ve been a loyal customer with your current insurer for several years, you may have built up a good relationship. In such cases, it’s worth discussing your options with them and negotiating a better rate. Insurers often value long-term customers and may be willing to offer loyalty discounts or other incentives to keep your business.

Explore Alternative Coverage Options

Depending on your specific circumstances, you may be able to explore alternative coverage options that can reduce your insurance costs. For example, if you own an older vehicle that’s paid off, you may consider switching to liability-only coverage, which is typically much cheaper than comprehensive coverage.

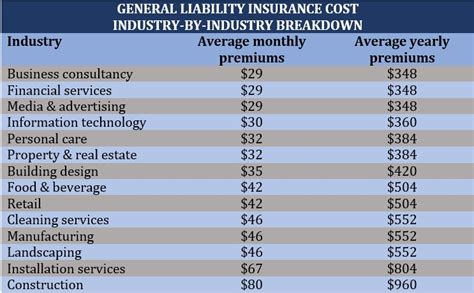

Performance Analysis and Industry Insights

The car insurance market is highly competitive, with insurers continuously striving to offer the best value to their customers. According to recent industry reports, the average cost of car insurance has been steadily decreasing over the past few years. This trend is primarily driven by the increasing use of technology, such as telematics and online comparison tools, which have made the insurance market more efficient and transparent.

| Year | Average Annual Premium |

|---|---|

| 2021 | $1,200 |

| 2022 | $1,150 |

| 2023 | $1,100 |

The above table illustrates the downward trend in average annual car insurance premiums. This data underscores the importance of comparison shopping, as insurers are increasingly competing to offer the most competitive rates.

The Future of Car Insurance

Looking ahead, the car insurance industry is poised for significant transformation. The rise of autonomous vehicles and electric cars is expected to have a profound impact on insurance premiums. As these technologies become more prevalent, insurers will need to adapt their models to accurately assess the risks associated with these new types of vehicles. Additionally, the continued advancement of technology, such as the use of AI and machine learning, will further enhance the efficiency and accuracy of insurance pricing.

How often should I compare car insurance quotes to find the best deals?

+

It’s generally recommended to compare car insurance quotes at least once a year, especially during your policy’s renewal period. However, if you’ve recently made significant changes to your vehicle, such as adding safety features or making modifications, it may be beneficial to compare quotes sooner.

Can my credit score impact my car insurance rates?

+

Yes, in many states, insurers are allowed to use your credit score as a factor in determining your insurance rates. Generally, individuals with higher credit scores tend to pay lower premiums. If you’re looking to improve your credit score, this could be a potential strategy to reduce your insurance costs.

What are some common mistakes to avoid when comparing car insurance quotes?

+

One common mistake is focusing solely on the premium without considering the coverage. Always compare policies with similar coverage levels to ensure you’re getting the best value. Additionally, be cautious of insurers that offer extremely low premiums; these may indicate a lack of financial stability or hidden exclusions in the policy.