Average Price Of Insurance

The average price of insurance is a crucial metric for both individuals and businesses alike, as it provides a benchmark for understanding the cost of various insurance policies. This comprehensive analysis delves into the factors influencing insurance premiums, explores regional variations, and examines the trends shaping the insurance landscape. By understanding the average price of insurance, consumers can make informed decisions and navigate the market with confidence.

Understanding the Average Insurance Premium

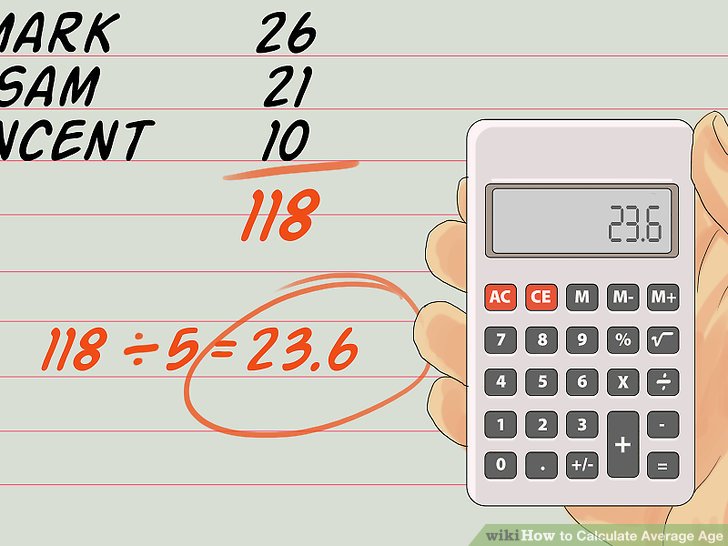

The average insurance premium represents the typical cost that individuals or businesses incur for their insurance coverage. It serves as a valuable indicator of the financial commitment required to secure protection against various risks. However, it is essential to recognize that the average price is just an estimate and can vary significantly based on numerous factors.

Factors Influencing Insurance Premiums

Insurance premiums are determined by a complex interplay of variables, each contributing to the overall cost. Here are some key factors that influence insurance prices:

- Risk Assessment: Insurance companies meticulously assess the risks associated with each policyholder. Factors such as age, health status, driving record, and claim history play a significant role in determining premiums. For instance, younger drivers are often charged higher premiums due to their higher risk profile.

- Coverage Type and Limits: The type of insurance coverage chosen also impacts premiums. Policies with broader coverage and higher limits typically command higher prices. For example, a comprehensive car insurance policy that includes collision and liability coverage will likely cost more than a basic liability-only policy.

- Location and Geographical Factors: Regional variations can significantly affect insurance costs. Areas prone to natural disasters, high crime rates, or dense populations may experience higher premiums. Insurance companies consider the unique risks associated with each location when setting prices.

- Claim Frequency and Severity: Past claim history is a crucial factor in premium calculation. Insurance companies analyze the frequency and severity of claims to assess the risk profile of a policyholder. Individuals or businesses with a history of frequent or costly claims may face higher premiums.

- Insurance Provider and Competition: The insurance market is highly competitive, and different providers offer varying rates. Shopping around and comparing quotes from multiple insurers can lead to significant savings. Additionally, the level of competition in a particular market can influence the average premium.

- Policy Add-ons and Optional Coverages: Insurance policies often come with optional add-ons or endorsements that enhance coverage. These additional features can increase the overall premium, but they provide extra protection in specific situations. It is essential to carefully consider the value of these add-ons before opting for them.

Regional Variations in Insurance Premiums

Insurance premiums can vary significantly across different regions, making it crucial for consumers to understand these regional differences. Here are some key insights into regional variations:

- Urban vs. Rural Areas: Urban areas tend to have higher insurance premiums compared to rural regions. This is primarily due to the higher density of population, increased traffic, and a greater risk of accidents and theft in urban settings. On the other hand, rural areas often experience lower premiums due to reduced risk factors.

- State-Specific Regulations: Each state or region may have its own set of regulations and laws governing the insurance industry. These regulations can impact the cost of insurance. For instance, states with stricter regulations regarding mandatory coverage requirements may have higher average premiums.

- Natural Disaster Prone Areas: Regions prone to natural disasters, such as hurricanes, earthquakes, or floods, often face higher insurance premiums. Insurance companies consider the increased risk of damage and claims in these areas, leading to elevated prices for property and liability insurance.

- Crime Rates and Security: Areas with higher crime rates may experience elevated insurance premiums, particularly for property and vehicle insurance. Insurance providers factor in the risk of theft, vandalism, and other criminal activities when setting prices.

- Competition and Market Penetration: The level of competition in a particular region can influence insurance prices. Areas with a high concentration of insurance providers may benefit from more competitive pricing. On the other hand, regions with limited options may face higher premiums due to reduced competition.

| Region | Average Annual Premium |

|---|---|

| Urban Center X | $2,500 |

| Suburban Area Y | $1,800 |

| Rural Region Z | $1,200 |

Trends Shaping the Insurance Landscape

The insurance industry is constantly evolving, influenced by technological advancements, changing consumer behaviors, and regulatory developments. Understanding these trends is essential for staying informed about the future of insurance pricing.

Digital Transformation and Online Insurance

The digital revolution has significantly impacted the insurance industry, leading to the rise of online insurance platforms and digital distribution channels. Insurers are leveraging technology to offer convenient and efficient services, including online quote comparisons, policy management, and claims processing. This shift towards digital insurance has the potential to reduce overhead costs and, consequently, impact insurance premiums.

Telematics and Usage-Based Insurance

Telematics technology, which utilizes data transmission and GPS tracking, is transforming the insurance landscape. Usage-based insurance (UBI) policies are gaining popularity, particularly in the automotive sector. These policies monitor driving behavior, such as miles driven, speed, and braking patterns, to determine premiums. UBI offers the potential for personalized pricing, rewarding safe drivers with lower premiums.

Regulatory Changes and Market Dynamics

Regulatory bodies play a crucial role in shaping the insurance market. Changes in regulations, such as the introduction of new coverage requirements or the implementation of consumer protection measures, can impact insurance premiums. Additionally, market dynamics, including mergers and acquisitions among insurance providers, can lead to shifts in pricing strategies.

The Impact of Inflation and Economic Factors

Economic factors, including inflation and interest rates, can influence insurance premiums. Inflation can increase the cost of claims, leading to higher premiums. Additionally, changes in interest rates can impact the investment returns of insurance companies, affecting their ability to offer competitive pricing. Monitoring economic trends is essential for understanding their potential impact on insurance costs.

Strategies for Managing Insurance Costs

While the average insurance premium provides a valuable reference point, consumers can employ various strategies to manage their insurance costs effectively. Here are some tips to consider:

- Shop Around: Compare quotes from multiple insurance providers to find the best rates. Online comparison tools and insurance brokers can simplify this process.

- Bundle Policies: Many insurance companies offer discounts when you bundle multiple policies, such as home and auto insurance, under one provider.

- Maintain a Clean Record: A clean driving or claim history can lead to lower premiums. Avoid accidents and violations to keep your insurance costs down.

- Explore Discounts: Insurance providers offer various discounts, such as safe driver discounts, loyalty discounts, or discounts for certain professions. Inquire about available discounts to maximize your savings.

- Adjust Coverage Limits: Review your coverage limits regularly and adjust them based on your needs. Higher limits provide more protection but may increase your premiums. Find the right balance between coverage and cost.

- Consider Alternative Options: Explore alternative insurance options, such as mutual insurance companies or captive insurance, which may offer competitive rates.

The Future of Insurance Pricing

The insurance industry is poised for significant changes in the coming years, driven by technological advancements, regulatory reforms, and evolving consumer expectations. Here are some key trends and predictions for the future of insurance pricing:

Personalized Insurance Pricing

Advancements in data analytics and machine learning are enabling insurance providers to offer highly personalized pricing. By leveraging vast amounts of data, insurers can develop sophisticated risk models that take into account an individual’s unique characteristics and behaviors. This shift towards personalized pricing will lead to more accurate risk assessments and potentially lower premiums for those who exhibit lower risk profiles.

Insurtech Disruption

Insurtech startups are disrupting the traditional insurance industry with innovative technologies and business models. These companies are leveraging artificial intelligence, blockchain, and other emerging technologies to streamline processes, enhance customer experiences, and reduce costs. As Insurtech continues to gain traction, it is expected to drive down insurance premiums by increasing competition and efficiency in the market.

Regulatory Reforms and Consumer Protection

Regulatory bodies are increasingly focused on consumer protection and ensuring fair pricing practices in the insurance industry. Upcoming reforms may include measures to promote transparency, prevent discrimination, and enhance competition. These reforms have the potential to benefit consumers by creating a more equitable insurance market and potentially reducing premiums.

The Role of Big Data and Analytics

Big data analytics is transforming the insurance industry by enabling insurers to make data-driven decisions. By analyzing vast amounts of data, insurance companies can identify patterns, trends, and correlations that were previously hidden. This data-driven approach allows insurers to price policies more accurately, identify emerging risks, and develop innovative products tailored to specific consumer segments. As the insurance industry continues to embrace big data analytics, it is expected to lead to more efficient pricing models and potentially lower premiums.

The Impact of Climate Change and Environmental Factors

Climate change and environmental factors are expected to play a significant role in shaping insurance pricing in the future. As extreme weather events become more frequent and severe, insurers will need to reassess their risk models and pricing strategies. This may lead to increased premiums in regions vulnerable to natural disasters, such as coastal areas prone to hurricanes or regions susceptible to wildfires. Additionally, insurers may incentivize environmentally friendly practices by offering discounts for eco-conscious behaviors or adopting sustainable business practices themselves.

The Rise of Parametric Insurance

Parametric insurance is an innovative approach to insurance coverage that pays out based on predefined parameters, rather than actual losses. This type of insurance is particularly useful for covering low-frequency, high-impact events, such as natural disasters or cyber attacks. Parametric insurance policies can provide rapid payouts, reducing the financial burden on policyholders and enabling faster recovery. As parametric insurance gains traction, it has the potential to disrupt traditional insurance models and offer more affordable coverage options for certain risks.

Conclusion

The average price of insurance is a valuable reference point for consumers, providing insights into the typical costs associated with various insurance policies. However, it is essential to recognize that insurance premiums are influenced by a multitude of factors, including risk assessment, coverage type, location, and claim history. By understanding these factors and staying informed about industry trends, consumers can make informed decisions and effectively manage their insurance costs.

The insurance landscape is continually evolving, driven by technological advancements, regulatory reforms, and changing consumer expectations. Personalized insurance pricing, Insurtech disruption, and the embrace of big data analytics are expected to shape the future of insurance pricing, potentially leading to more efficient and affordable coverage options. Additionally, the impact of climate change and environmental factors will play a significant role in insurance pricing, with insurers reassessing their risk models to adapt to a changing climate.

As consumers navigate the insurance market, it is crucial to stay proactive, shop around for the best rates, and explore alternative options. By staying informed and taking advantage of the evolving insurance landscape, individuals and businesses can secure the protection they need while managing their insurance costs effectively.

How often should I review my insurance coverage and premiums?

+It is recommended to review your insurance coverage and premiums annually or whenever your circumstances change significantly. Life events such as marriage, having children, buying a new home, or changing jobs can impact your insurance needs. Regularly reviewing your coverage ensures that you have adequate protection and are not overpaying for unnecessary coverage.

Can I negotiate my insurance premiums with providers?

+While insurance premiums are typically set based on standardized rates, there may be some room for negotiation in certain situations. If you have a long-standing relationship with your insurance provider or have multiple policies with them, you can discuss your options and inquire about potential discounts or rate adjustments. However, it is important to remember that insurance companies have their own pricing strategies, and negotiation may not always be successful.

What are some common insurance discounts that I should be aware of?

+Insurance companies offer a variety of discounts to policyholders. Some common discounts include safe driver discounts for maintaining a clean driving record, loyalty discounts for long-term customers, multi-policy discounts for bundling multiple insurance policies with the same provider, and discounts for certain professions or memberships. It is worth exploring these discounts to potentially lower your insurance premiums.