Private Auto Insurance

Private auto insurance is a crucial aspect of financial planning for individuals and families, providing protection against potential risks and unforeseen accidents on the road. With a diverse range of coverage options, this type of insurance offers peace of mind and financial security, ensuring that policyholders can navigate life's unexpected twists and turns with confidence. This comprehensive guide delves into the intricacies of private auto insurance, exploring its various facets, benefits, and how it empowers drivers to safeguard their vehicles, themselves, and their loved ones.

Understanding Private Auto Insurance

Private auto insurance, also known as personal auto insurance, is a type of coverage specifically designed to protect private vehicles and their owners. It serves as a contractual agreement between an individual and an insurance provider, offering financial protection in the event of accidents, theft, or other incidents involving the insured vehicle.

The primary purpose of private auto insurance is to mitigate the financial burden that can arise from vehicle-related incidents. It provides coverage for a range of scenarios, including but not limited to:

- Physical damage to the insured vehicle due to accidents, natural disasters, or vandalism.

- Bodily injury and property damage liability, covering costs arising from accidents caused by the insured driver.

- Medical expenses for the insured driver and passengers, regardless of fault.

- Protection against uninsured or underinsured motorists.

- Rental car reimbursement and other additional benefits.

Private auto insurance policies are tailored to meet the unique needs of individual drivers and their vehicles. Factors such as the make and model of the car, the driver's age and driving history, and the geographic location all influence the cost and coverage of the policy.

Types of Coverage

Private auto insurance policies typically offer a range of coverage options, allowing policyholders to customize their protection to suit their specific needs and budget. Here are some common types of coverage included in private auto insurance policies:

Liability Coverage

Liability coverage is a fundamental component of private auto insurance. It provides protection in the event that the insured driver is found at fault for an accident. This coverage can be further divided into two main categories:

- Bodily Injury Liability: Covers medical expenses and compensation for the injuries sustained by the other party involved in the accident.

- Property Damage Liability: Covers the cost of repairing or replacing the other party's vehicle or property damaged in the accident.

Liability coverage is mandatory in most states and is designed to protect the insured driver from financial liability resulting from accidents they cause.

Collision Coverage

Collision coverage provides protection for the insured vehicle in the event of an accident, regardless of fault. It covers the cost of repairing or replacing the vehicle if it collides with another vehicle, object, or rolls over. This coverage is particularly valuable for newer or more expensive vehicles, as it can help mitigate the financial impact of costly repairs or replacements.

Comprehensive Coverage

Comprehensive coverage offers protection for the insured vehicle against non-collision incidents. This can include damage caused by fire, theft, vandalism, natural disasters, or other unforeseen events. Comprehensive coverage is an essential component of private auto insurance, as it provides a safety net against a wide range of potential risks.

Medical Payments Coverage

Medical payments coverage, also known as MedPay, provides coverage for medical expenses incurred by the insured driver and passengers, regardless of who is at fault in an accident. This coverage can be especially valuable in situations where the insured driver or passengers require immediate medical attention, as it ensures prompt payment for necessary treatments.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage provides protection for the insured driver in the event of an accident involving a driver who is either uninsured or does not have adequate insurance coverage. This coverage can help cover the insured driver’s medical expenses, lost wages, and other related costs.

Additional Coverage Options

Private auto insurance policies may also offer a range of additional coverage options, including:

- Rental Car Reimbursement: Covers the cost of renting a vehicle while the insured car is being repaired or replaced.

- Roadside Assistance: Provides emergency services such as towing, flat tire repair, or battery jump-start.

- Gap Insurance: Covers the difference between the insured vehicle's actual cash value and the outstanding loan balance in the event of a total loss.

- Personal Injury Protection (PIP): Covers medical expenses, lost wages, and other related costs for the insured driver and passengers, regardless of fault.

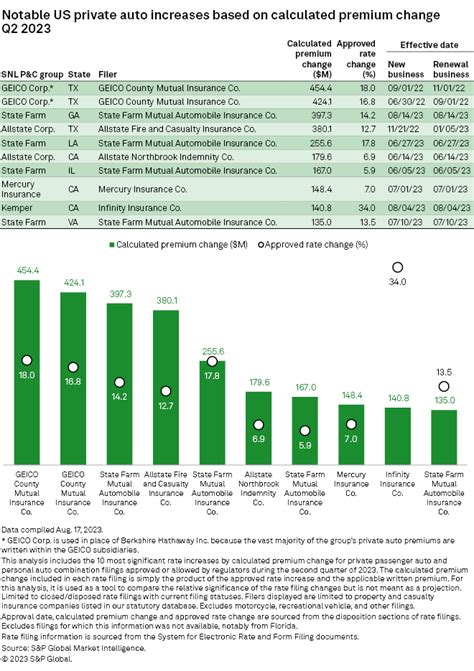

Factors Influencing Private Auto Insurance Rates

The cost of private auto insurance can vary significantly depending on several factors. Insurance providers use these factors to assess the level of risk associated with insuring a particular driver and vehicle. Here are some key factors that influence private auto insurance rates:

Driver’s Age and Driving History

Insurance providers closely examine a driver’s age and driving history when determining insurance rates. Younger drivers, especially those under the age of 25, are often considered higher risk due to their lack of experience on the road. Similarly, drivers with a history of accidents, traffic violations, or insurance claims may also face higher insurance premiums.

Vehicle Type and Usage

The make, model, and age of the insured vehicle play a significant role in determining insurance rates. Vehicles that are more expensive to repair or replace, or those that are frequently targeted by thieves, may incur higher insurance costs. Additionally, the primary use of the vehicle (e.g., commuting, business, pleasure) can also influence rates.

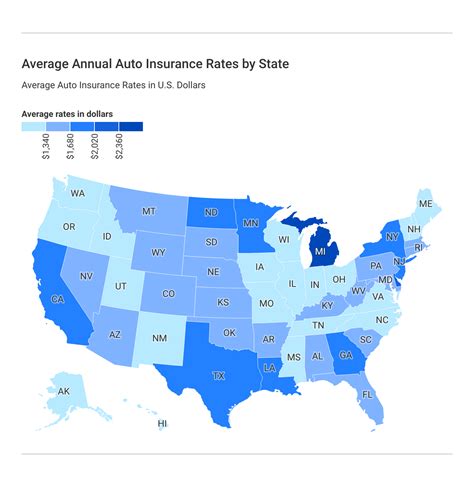

Geographic Location

The geographic location where the insured vehicle is primarily driven and parked can have a substantial impact on insurance rates. Areas with higher rates of accidents, thefts, or natural disasters may result in higher insurance premiums. Additionally, urban areas often have higher insurance costs compared to rural areas due to increased traffic and the higher likelihood of accidents.

Credit History

In many states, insurance providers are allowed to consider an individual’s credit history when determining insurance rates. Individuals with a good credit history are often viewed as lower risk and may qualify for more favorable insurance rates. Conversely, those with poor credit may face higher insurance costs.

Deductibles and Coverage Limits

The deductibles and coverage limits chosen by the policyholder also influence the cost of private auto insurance. A higher deductible (the amount the policyholder pays out of pocket before insurance coverage kicks in) typically results in lower insurance premiums, while lower deductibles often lead to higher premiums. Similarly, higher coverage limits (the maximum amount the insurance provider will pay for a covered claim) can also increase insurance costs.

The Claims Process

When an insured driver is involved in an accident or experiences a covered incident, they must initiate the claims process to receive the benefits outlined in their private auto insurance policy. Here’s a step-by-step guide to the claims process:

- Contact Your Insurance Provider: As soon as possible after the incident, contact your insurance provider to report the claim. Provide them with all relevant details, including the date, time, location, and circumstances of the incident.

- Gather Information: Collect all necessary information related to the incident, including the other party's contact and insurance details, photographs of the damage, witness statements, and any other relevant documentation.

- Cooperate with the Insurance Adjuster: An insurance adjuster will be assigned to handle your claim. Cooperate fully with the adjuster by providing all requested information and documentation. The adjuster will assess the extent of the damage and determine the appropriate coverage and compensation.

- Receive Payment or Repair Authorization: Once the insurance adjuster has completed their assessment, you will receive either a payment for the agreed-upon amount or authorization to have your vehicle repaired at a designated repair shop.

- Monitor the Repair Process (if applicable): If your vehicle requires repairs, ensure that the repair shop provides regular updates on the progress. Once the repairs are complete, inspect the vehicle to ensure that all issues have been addressed to your satisfaction.

Tips for Choosing the Right Private Auto Insurance

Selecting the right private auto insurance policy can be a complex decision. Here are some tips to help you make an informed choice:

- Compare Multiple Quotes: Obtain quotes from several insurance providers to compare coverage options and premiums. This will help you identify the best value for your specific needs.

- Understand Your Coverage Needs: Assess your unique circumstances and determine the level of coverage you require. Consider factors such as the value of your vehicle, your driving habits, and your financial ability to cover potential out-of-pocket expenses.

- Review Policy Exclusions: Carefully read the policy document to understand any exclusions or limitations that may apply. Ensure that you are comfortable with the terms and conditions outlined in the policy.

- Consider Additional Coverage: Evaluate your specific needs and consider adding optional coverage, such as rental car reimbursement or roadside assistance, to enhance your protection.

- Maintain a Clean Driving Record: A clean driving record can help you qualify for lower insurance premiums. Avoid traffic violations and accidents to keep your insurance costs down.

- Shop Around Regularly: Insurance rates can fluctuate over time, so it's a good idea to shop around and compare quotes annually or whenever your policy is up for renewal. You may find more competitive rates or better coverage options with other providers.

Future Trends in Private Auto Insurance

The private auto insurance industry is constantly evolving to keep pace with technological advancements and changing consumer needs. Here are some emerging trends and developments that are shaping the future of private auto insurance:

Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and GPS to track driving behavior, is gaining popularity in the insurance industry. Usage-based insurance policies, also known as pay-as-you-drive or pay-how-you-drive policies, use telematics data to calculate insurance premiums based on an individual’s actual driving habits. This technology rewards safe drivers with lower premiums and provides insurance providers with more accurate risk assessments.

Connected Car Technology

The integration of connected car technology, such as advanced driver-assistance systems (ADAS) and vehicle-to-everything (V2X) communication, is transforming the driving experience. These technologies not only enhance safety but also provide insurance providers with valuable data on driving behavior and vehicle performance. Insurance companies are exploring ways to leverage this data to offer more personalized and tailored coverage options.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are revolutionizing the insurance industry. These technologies are being used to automate various processes, such as claims handling and risk assessment. By analyzing vast amounts of data, AI and ML algorithms can identify patterns and make more accurate predictions, enabling insurance providers to offer more efficient and customized insurance products.

Digital Transformation

The insurance industry is undergoing a digital transformation, with many providers investing in online platforms and mobile applications to enhance the customer experience. Policyholders can now manage their policies, file claims, and access real-time updates through these digital channels, making the entire insurance process more convenient and efficient.

Increased Focus on Risk Prevention

Insurance providers are increasingly emphasizing risk prevention and safety measures to reduce the frequency and severity of accidents. This includes promoting safe driving practices, offering discounts for completing defensive driving courses, and providing incentives for installing safety features in vehicles. By incentivizing safe driving behaviors, insurance companies aim to reduce claims and lower insurance costs for policyholders.

Conclusion

Private auto insurance is a vital component of financial planning, providing essential protection for drivers and their vehicles. By understanding the different types of coverage, the factors influencing insurance rates, and the claims process, policyholders can make informed decisions and ensure they have the appropriate level of protection. With the insurance industry’s focus on innovation and technological advancements, the future of private auto insurance looks promising, offering more personalized and efficient coverage options to meet the evolving needs of drivers.

What is the difference between private auto insurance and commercial auto insurance?

+Private auto insurance is designed for personal vehicles used for non-commercial purposes, while commercial auto insurance covers vehicles used for business purposes. Commercial auto insurance provides broader coverage, including liability for business-related accidents and protection for commercial vehicles.

How can I lower my private auto insurance premiums?

+To lower your insurance premiums, you can consider increasing your deductible, maintaining a clean driving record, shopping around for quotes, and exploring discounts offered by insurance providers. Additionally, some providers offer discounts for bundling multiple policies (e.g., auto and home insurance) or for completing defensive driving courses.

What should I do if I’m involved in an accident?

+If you’re involved in an accident, the first step is to ensure the safety of yourself and others involved. Call the police to report the accident and exchange contact and insurance information with the other party. Take photographs of the scene and any visible damage. Notify your insurance provider as soon as possible to initiate the claims process.

How often should I review my private auto insurance policy?

+It’s recommended to review your insurance policy annually or whenever your circumstances change significantly. This includes changes in your driving habits, vehicle usage, or personal life events (e.g., marriage, moving to a new location, adding a teen driver to your policy). Regularly reviewing your policy ensures that your coverage remains adequate and aligned with your needs.

Can I switch insurance providers if I find a better deal?

+Absolutely! Shopping around for insurance quotes is a great way to find the best deal. If you find a more competitive policy with another provider, you can switch insurance companies. Most providers offer a hassle-free process for transferring your coverage, and you can often save money by comparing quotes and switching providers.