Insure Quotes

The world of insurance is a complex and intricate system that plays a crucial role in our daily lives. From protecting our health to safeguarding our assets, insurance quotes are the gateway to understanding the financial safety nets available to us. In this comprehensive guide, we will delve into the intricacies of insure quotes, exploring their significance, the process of obtaining them, and the impact they have on our financial decisions.

Whether you're a homeowner, a business owner, or simply an individual seeking peace of mind, understanding insurance quotes is essential. These quotes provide a glimpse into the potential costs and coverage options tailored to your specific needs. By demystifying the process, we aim to empower readers with the knowledge to make informed choices when it comes to their insurance requirements.

The Significance of Insure Quotes

In the realm of insurance, quotes serve as a vital tool for both consumers and insurance providers. For individuals and businesses, insurance quotes offer a transparent glimpse into the potential costs and coverage available for various risks. By comparing quotes from different providers, consumers can make informed decisions, ensuring they obtain the most suitable and cost-effective coverage for their unique circumstances.

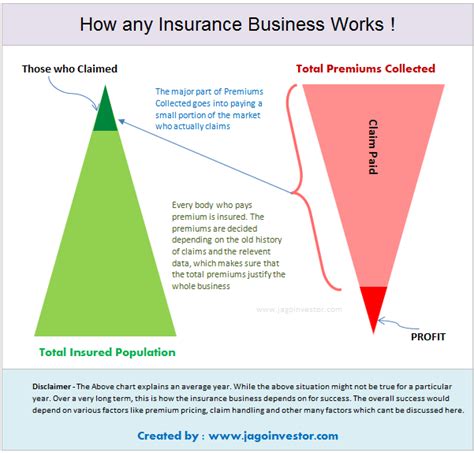

From a provider's perspective, insurance quotes are a strategic mechanism for assessing risk and setting premiums. By evaluating factors such as an individual's or business's location, age, health status, or industry, insurers can calculate the likelihood of claims and determine appropriate premiums. This process ensures that insurance remains a viable and sustainable financial tool for all parties involved.

Understanding the Quote Process

Obtaining an insurance quote involves a comprehensive evaluation of various factors specific to the type of insurance being sought. Whether it’s home insurance, auto insurance, health insurance, or business insurance, the quote process delves into the unique aspects of each coverage category.

Home Insurance Quotes

When seeking a home insurance quote, insurers consider the location, size, and construction materials of the property. Additional factors such as the home’s age, any recent renovations, and the presence of security features play a role in determining the quote. Moreover, the individual’s claims history and the local crime rate are also factored into the equation.

| Category | Considered Factors |

|---|---|

| Property Details | Location, Size, Construction, Renovations |

| Risk Factors | Age of Property, Security Features, Claims History |

| External Factors | Local Crime Rate, Natural Disaster Risk |

Auto Insurance Quotes

Auto insurance quotes involve a thorough assessment of the vehicle, its driver, and the intended usage. Key factors include the make, model, and year of the vehicle, the driver’s age and driving record, and the purpose of the vehicle (personal, business, or pleasure). Additionally, the geographic location and the individual’s credit score are considered when determining auto insurance quotes.

Health Insurance Quotes

Health insurance quotes are influenced by a range of personal health factors. Insurers consider the individual’s age, gender, pre-existing medical conditions, and family medical history. Lifestyle choices such as smoking or excessive alcohol consumption also impact health insurance quotes. Moreover, the desired level of coverage and any preferred healthcare providers play a role in determining the quote.

Business Insurance Quotes

Business insurance quotes are tailored to the specific needs and risks associated with the business. Insurers evaluate factors such as the industry, the business’s location, the number of employees, and the nature of its operations. Additionally, the business’s financial health, claims history, and any unique exposures (such as environmental risks) are considered when calculating business insurance quotes.

Comparing Quotes: A Comprehensive Approach

Once you’ve obtained insurance quotes from various providers, the process of comparison becomes crucial. It’s essential to delve beyond the surface-level premium costs and consider the fine print of each policy. Here’s a comprehensive checklist to ensure you make an informed decision when comparing insurance quotes:

- Coverage Limits: Ensure the policy provides adequate coverage for your specific needs. For instance, in the case of home insurance, verify that the coverage limit aligns with the replacement cost of your home and its contents.

- Deductibles: Compare deductibles, which are the out-of-pocket expenses you pay before the insurance coverage kicks in. Lower deductibles often result in higher premiums, so strike a balance that suits your financial comfort.

- Policy Exclusions: Carefully review the fine print to identify any exclusions or limitations within the policy. Certain events or circumstances may not be covered, so ensure you're aware of these restrictions.

- Additional Benefits: Look for value-added benefits such as emergency road service in auto insurance or wellness programs in health insurance. These extras can enhance the overall value of the policy.

- Provider Reputation: Research the insurer's reputation and financial stability. A reputable insurer with a strong financial standing ensures the policy's longevity and the timely processing of claims.

- Customer Service: Assess the insurer's customer service reputation. Efficient and responsive customer service can make a significant difference in times of need.

- Policy Flexibility: Evaluate the policy's flexibility, especially if your circumstances or needs may change over time. Some policies offer more customizable options to adapt to evolving situations.

- Renewal Options: Understand the renewal process and any potential premium increases. Certain insurers offer incentives for long-term customers, while others may have strict renewal criteria.

- Discounts: Inquire about potential discounts such as bundle deals (combining multiple policies), loyalty discounts, or safety features (in the case of auto insurance). These discounts can significantly reduce your overall premium.

- Claims Process: Familiarize yourself with the insurer's claims process, including any required documentation and the average processing time. A streamlined and efficient claims process can provide peace of mind.

By meticulously evaluating these aspects, you can make an informed decision when selecting an insurance policy that best suits your needs and provides the necessary financial protection.

The Impact of Insure Quotes on Financial Decisions

Insurance quotes have a profound impact on the financial decisions we make. For individuals and businesses, understanding the costs and coverage options presented by quotes allows for strategic financial planning. Whether it’s budgeting for insurance premiums or making adjustments to reduce potential risks, quotes provide the necessary insights.

Furthermore, insurance quotes play a pivotal role in risk management. By assessing the potential costs associated with various risks, individuals and businesses can implement measures to mitigate these risks. This proactive approach not only reduces the likelihood of financial losses but also enhances overall financial stability.

The Future of Insure Quotes: Embracing Technology

The insurance industry is undergoing a digital transformation, and the future of insurance quotes is shaped by technological advancements. Online quote comparison platforms and mobile apps are making the process more accessible and efficient. Real-time data analysis and predictive modeling are enhancing the accuracy of quotes, providing consumers with more precise estimates.

Additionally, the rise of telematics and connected devices is revolutionizing auto insurance quotes. By collecting real-time driving data, insurers can offer personalized premiums based on an individual's driving behavior. This shift towards usage-based insurance not only incentivizes safer driving but also empowers consumers with more control over their insurance costs.

Conclusion: Empowering Financial Security

Insure quotes are the foundation of financial security, offering a glimpse into the potential costs and coverage options available to individuals and businesses. By understanding the quote process, comparing quotes comprehensively, and embracing technological advancements, we can make informed decisions that safeguard our assets, health, and overall well-being. Insurance quotes are not just numbers; they are a roadmap to a more secure financial future.

How often should I review my insurance quotes?

+It’s advisable to review your insurance quotes annually or whenever your circumstances change significantly. Life events such as marriage, childbirth, or purchasing a new home may impact your insurance needs. Regularly reviewing your quotes ensures you stay updated with the most suitable coverage and premiums.

What factors can lead to insurance quote fluctuations?

+Insurance quote fluctuations can be influenced by various factors, including changes in your personal circumstances (e.g., age, health status), modifications to your property or assets, and even external factors like natural disasters or economic trends. It’s essential to stay informed about these potential influences to make informed insurance decisions.

How can I reduce my insurance costs without compromising coverage?

+To reduce insurance costs while maintaining adequate coverage, consider increasing your deductibles (within your financial comfort zone), bundling multiple policies with the same insurer to qualify for discounts, and implementing risk-reducing measures (e.g., installing security systems, maintaining a clean driving record). These strategies can help lower your premiums without sacrificing essential coverage.