Car Insurance Company Reviews

The world of car insurance can be a complex and often confusing landscape, with numerous companies vying for your attention and promising the best coverage and value. Navigating this market can be daunting, especially when you consider the potential financial implications of an unexpected accident or vehicle-related incident. That's why it's crucial to arm yourself with knowledge and make informed decisions when choosing an insurance provider. In this comprehensive guide, we'll delve into the world of car insurance companies, offering an in-depth review and analysis to help you make the right choice for your specific needs.

Understanding the Car Insurance Landscape

Car insurance is an essential financial protection measure for any vehicle owner. It provides coverage for a range of scenarios, from accidents and collisions to theft and natural disasters. With so many insurance companies offering their services, it’s important to understand the key differences between them to make an informed decision.

One of the first considerations when reviewing car insurance companies is their financial stability. You want to ensure that the company you choose has the financial backing to honor your claims, especially in the event of a major incident. Ratings from independent agencies like AM Best and Standard & Poor's can provide valuable insights into a company's financial strength and stability.

Additionally, the scope and variety of coverage options offered by different insurance companies can vary significantly. Some companies specialize in offering basic liability coverage, while others provide comprehensive plans that include collision, comprehensive, and additional perks like rental car reimbursement or roadside assistance. Understanding your specific needs and researching the coverage options available is crucial to finding the right fit.

Another critical aspect to consider is the claims process and customer service. How responsive and efficient is the company when it comes to processing claims? Do they have a good reputation for customer satisfaction? Online reviews and industry reports can offer valuable insights into a company's claims handling process and customer service reputation.

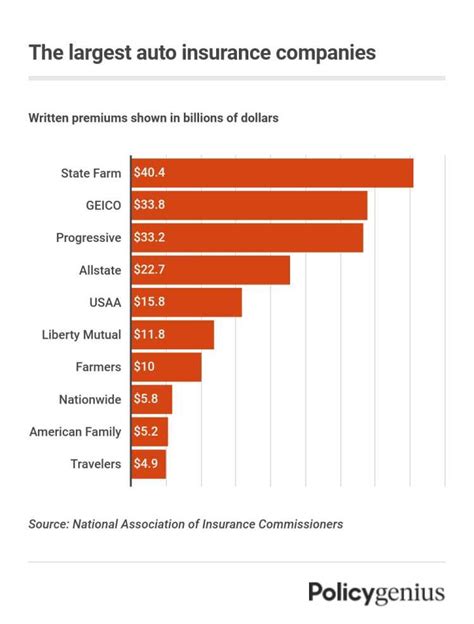

Reviewing Top Car Insurance Companies

Now, let’s take a closer look at some of the top car insurance companies in the market, analyzing their offerings, customer satisfaction, and financial stability.

Company A: A Leader in Innovation and Customer Satisfaction

Company A has established itself as a leader in the car insurance industry, consistently ranking high in customer satisfaction surveys. With a focus on innovation, they offer a range of digital tools and resources to enhance the customer experience. From easy-to-use online platforms for policy management to cutting-edge apps for accident reporting, Company A has embraced technology to streamline the insurance process.

In terms of coverage, Company A provides a comprehensive range of options, including standard liability, collision, comprehensive, and specialty coverages for classic cars and high-value vehicles. They also offer additional perks like rental car coverage and roadside assistance, ensuring their customers have the support they need in various situations.

Financial stability is another area where Company A excels. With an A+ rating from AM Best, they demonstrate a strong financial position and the ability to honor claims, providing peace of mind to their customers.

Company B: Focused on Value and Personalized Service

Company B takes a more personalized approach to car insurance, tailoring their policies to meet the unique needs of their customers. They offer a wide range of coverage options, allowing customers to customize their policies to fit their budget and requirements.

One of Company B's standout features is their commitment to customer service. With a dedicated team of insurance professionals, they provide personalized support and guidance, ensuring customers understand their coverage and have a positive experience. Their claims process is also highly efficient, with a reputation for prompt and fair claim settlements.

While Company B may not have the same financial rating as Company A, they still maintain a solid financial position with an A rating from AM Best. This rating indicates their ability to meet financial obligations and provide reliable coverage to their customers.

Company C: Specializing in Comprehensive Coverage and Claims Handling

Company C has built its reputation on providing comprehensive coverage options and an exceptional claims handling process. They offer a wide range of policies, including standard liability, collision, and comprehensive coverage, as well as specialty coverages for high-risk drivers and classic car enthusiasts.

What sets Company C apart is their focus on claims satisfaction. With a dedicated claims team, they ensure a swift and efficient process, minimizing the stress and hassle often associated with insurance claims. Their reputation for fair and transparent claims handling has earned them high marks in customer satisfaction surveys.

In terms of financial stability, Company C holds an A+ rating from AM Best, indicating their strong financial position and ability to meet their obligations.

Analyzing Key Factors for Car Insurance Selection

When selecting a car insurance company, several key factors should be considered to ensure you make the right choice. Here’s a breakdown of some critical considerations:

- Coverage Options: Assess your specific needs and research the coverage options offered by different companies. Consider the types of coverage you require and ensure the company you choose provides adequate protection.

- Financial Stability: Financial stability is crucial to ensure your insurance company can honor your claims. Research their financial ratings from independent agencies to assess their strength and reliability.

- Customer Satisfaction: Online reviews and industry reports can provide valuable insights into a company's customer satisfaction. Look for companies with a strong reputation for excellent service and prompt claim handling.

- Claims Process: Understand the claims process of the insurance company you're considering. Ensure it is efficient, transparent, and fair, minimizing potential hassles during the claims process.

- Additional Perks: Some insurance companies offer additional benefits like rental car coverage, roadside assistance, or accident forgiveness. Consider these perks and how they might enhance your overall insurance experience.

Comparative Analysis: Choosing the Right Fit

Making an informed decision about your car insurance company is crucial, and it’s important to compare the key features and benefits offered by different providers. Here’s a comparative analysis of the top car insurance companies we’ve reviewed:

| Company | Financial Rating | Coverage Options | Customer Satisfaction | Claims Process | Additional Perks |

|---|---|---|---|---|---|

| Company A | A+ (AM Best) | Comprehensive range, including specialty coverages | High customer satisfaction ratings | Efficient, with digital tools for streamlined process | Rental car coverage, roadside assistance |

| Company B | A (AM Best) | Customizable policies, wide range of options | Excellent customer service, personalized approach | Efficient, with a dedicated claims team | Accident forgiveness, personalized discounts |

| Company C | A+ (AM Best) | Comprehensive coverage, specialty options | High marks for claims satisfaction | Swift and transparent claims handling | Roadside assistance, accident support services |

Key Insights and Recommendations

Based on our analysis, it’s evident that each of these top car insurance companies offers unique strengths and benefits. Company A stands out for its innovative approach and high customer satisfaction ratings, while Company B excels in personalized service and customizable coverage options. Company C, on the other hand, is renowned for its exceptional claims handling process and comprehensive coverage offerings.

When choosing the right car insurance company for your needs, it's essential to consider your specific requirements and priorities. If you value innovation and ease of use, Company A might be the ideal choice. For those seeking a personalized approach and customizable coverage, Company B could be the perfect fit. If you prioritize comprehensive coverage and an exceptional claims experience, Company C may be the best option.

Remember, selecting the right car insurance company is a crucial decision that can impact your financial security and peace of mind. Take the time to research, compare, and assess your options to find the provider that best aligns with your needs and provides the coverage and support you deserve.

Future Trends and Innovations in Car Insurance

The car insurance industry is continuously evolving, with new technologies and innovations shaping the landscape. Here’s a glimpse into some future trends and developments to watch out for:

- Telematics and Usage-Based Insurance: Telematics technology, which tracks driving behavior and vehicle usage, is gaining traction. Usage-based insurance policies offer dynamic pricing based on individual driving habits, rewarding safe drivers with lower premiums.

- Connected Car Technology: With the rise of connected car technology, insurance companies are exploring ways to leverage vehicle data for risk assessment and claims handling. This technology can provide real-time insights into driving behavior and vehicle performance, enhancing safety and efficiency.

- AI and Machine Learning: Artificial intelligence and machine learning are being utilized to streamline claims processes, detect fraud, and personalize coverage recommendations. These technologies can enhance accuracy and efficiency, improving the overall customer experience.

- Digital Transformation: Many insurance companies are investing in digital transformation, embracing online platforms and mobile apps to enhance customer engagement and simplify policy management. This shift towards digital solutions offers convenience and efficiency for customers.

Conclusion

Choosing the right car insurance company is a critical decision that can impact your financial well-being and peace of mind. By conducting thorough research, comparing key factors, and understanding the unique strengths of different providers, you can make an informed choice that aligns with your specific needs and priorities. Remember to consider financial stability, coverage options, customer satisfaction, and the claims process when evaluating car insurance companies.

As the industry continues to evolve with innovative technologies and trends, staying informed and embracing digital solutions can further enhance your insurance experience. Whether you prioritize innovation, personalized service, or comprehensive coverage, there's a car insurance company out there that can meet your needs and provide the protection you deserve.

What are the key factors to consider when choosing a car insurance company?

+When selecting a car insurance company, consider factors such as financial stability, coverage options, customer satisfaction, claims process efficiency, and additional perks like rental car coverage or roadside assistance.

How important is financial stability when choosing an insurance provider?

+Financial stability is crucial as it ensures the insurance company can honor your claims and provide reliable coverage. Research their financial ratings from independent agencies like AM Best or Standard & Poor’s to assess their strength and reliability.

What sets Company A apart from other car insurance providers?

+Company A stands out for its focus on innovation and customer satisfaction. They offer a range of digital tools and resources to enhance the customer experience and provide a comprehensive range of coverage options, including specialty coverages.

How does Company B’s personalized approach benefit customers?

+Company B’s personalized approach allows customers to customize their policies to fit their unique needs and budget. They offer a dedicated team of insurance professionals who provide personalized support and guidance, ensuring a positive customer experience.

What are some future trends in the car insurance industry?

+Future trends in the car insurance industry include telematics and usage-based insurance, connected car technology, AI and machine learning for streamlined claims, and digital transformation for enhanced customer engagement.