Direct Auto Insurance Companies

Welcome to an in-depth exploration of the world of Direct Auto Insurance Companies, a unique segment within the insurance industry that has revolutionized the way drivers obtain coverage. In today's fast-paced digital era, these companies offer a convenient and often cost-effective alternative to traditional insurance providers. This article aims to delve into the specifics, shedding light on what sets them apart, how they operate, and why they are a popular choice for many motorists.

Understanding Direct Auto Insurance

Direct auto insurance is a modern approach to automobile coverage, distinguished by its direct-to-consumer business model. Unlike traditional insurance agencies, which often involve intermediaries such as brokers or agents, direct insurance companies sell their policies directly to the customer, typically through online platforms or telephone services. This streamlined process can offer significant advantages, both in terms of convenience and cost-efficiency.

The Rise of Direct Auto Insurance Companies

The concept of direct insurance gained traction with the advent of the internet and digital technology. As consumers became more comfortable with online transactions, the idea of purchasing insurance policies directly from the insurer gained popularity. This shift was further accelerated by the COVID-19 pandemic, which prompted many consumers to opt for contactless services, including insurance.

Today, direct auto insurance companies are a significant force in the industry, catering to a wide range of drivers, from those seeking basic liability coverage to those requiring more comprehensive plans. Their success lies in their ability to tailor policies to individual needs and offer competitive rates through their efficient, direct-to-consumer approach.

Key Advantages of Direct Auto Insurance

- Convenience: Customers can purchase policies directly online, eliminating the need for in-person meetings with agents.

- Cost-Effectiveness: By cutting out intermediaries, these companies often offer lower premiums compared to traditional insurers.

- Flexibility: Direct insurers typically provide a wider range of coverage options, allowing customers to choose policies that suit their specific needs.

- Customer Control: With direct insurance, customers have more control over their policy, including the ability to manage their account and make changes online.

Leading Direct Auto Insurance Companies

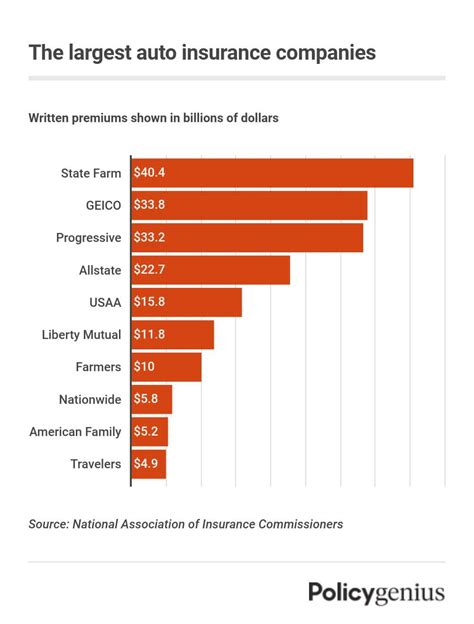

The direct auto insurance market is home to several prominent players, each offering its own unique features and benefits. Here’s a closer look at some of the industry leaders:

Geico

Geico (Government Employees Insurance Company) is a well-known name in the direct insurance space. With a focus on affordable rates and a wide range of coverage options, Geico has become a popular choice for many drivers. They offer policies tailored to various needs, including standard auto insurance, motorcycle insurance, and RV insurance, among others.

| Policy Type | Coverage Options |

|---|---|

| Auto Insurance | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Medical Payments, Personal Injury Protection, Rental Car Reimbursement |

| Motorcycle Insurance | Liability, Collision, Comprehensive, Uninsured Motorist, Accessories Coverage, Roadside Assistance |

| RV Insurance | Liability, Comprehensive, Collision, Emergency Expenses, Personal Effects Coverage, Vacation Liability |

Geico also boasts an extensive network of repair shops and offers 24/7 customer support, ensuring that policyholders receive prompt assistance when needed.

Progressive

Progressive is another prominent player in the direct insurance market. Known for its innovative products and customer-centric approach, Progressive offers a wide array of insurance options, including auto, home, and life insurance.

One of Progressive's standout features is its Name Your Price® tool, which allows customers to set their desired premium amount and then explore the coverage options that fit within that budget. This unique approach puts price control in the hands of the customer, offering a level of flexibility not often found in the insurance industry.

Esurance

Esurance is a direct-to-consumer insurance company that specializes in auto insurance and is known for its digital-first approach. With a focus on convenience and simplicity, Esurance offers an entirely online experience, from obtaining quotes to purchasing policies and managing accounts.

Esurance also provides a mobile app that allows customers to manage their policies on the go, file claims, and access their ID cards. Their DriveSense® program offers a discount for safe driving, utilizing a small device plugged into the car's OBD-II port to track driving habits and provide feedback on areas for improvement.

How Direct Auto Insurance Works

The process of obtaining direct auto insurance is straightforward and typically involves the following steps:

- Online Quote: Customers provide information about their vehicle, driving history, and desired coverage. The insurer uses this data to generate a quote.

- Policy Selection: Based on the quote, customers choose the coverage options that best suit their needs and budget.

- Purchase: The policy is purchased directly through the insurer's website or over the phone. Payment options typically include credit/debit cards and online banking.

- Policy Management: Customers can manage their policy online, making changes, adding endorsements, or filing claims as needed.

Key Considerations

While direct auto insurance offers numerous benefits, there are a few considerations to keep in mind:

- Limited Personalized Service: Direct insurers primarily operate online, so customers may have limited access to personal assistance from agents or brokers.

- Policy Comparison: With a wide range of options available, it's essential to compare policies carefully to ensure you're getting the best value for your money.

- Customer Service: While direct insurers often offer 24/7 customer support, the quality of service can vary. It's important to research and read reviews before choosing a provider.

The Future of Direct Auto Insurance

The direct auto insurance market is expected to continue its growth trajectory in the coming years. With technological advancements and an increasing preference for digital services, direct insurers are well-positioned to cater to the needs of modern consumers.

Looking ahead, we can expect to see further innovation in policy customization, with insurers offering more tailored coverage options to meet the diverse needs of drivers. Additionally, the integration of telematics and connected car technologies is likely to play a significant role, providing insurers with real-time driving data and enabling more accurate risk assessment and pricing.

Conclusion

Direct auto insurance companies have carved out a significant niche in the insurance industry, offering a convenient and often cost-effective alternative to traditional agencies. With their direct-to-consumer business model, these companies provide a level of flexibility and control that appeals to many motorists. As the industry evolves, direct insurers are poised to continue leading the way, offering innovative solutions and a customer-centric approach.

FAQ

What is the average cost of direct auto insurance?

+The cost of direct auto insurance can vary widely depending on factors such as the insurer, the coverage options chosen, and the customer’s driving history and location. On average, direct insurers offer competitive rates compared to traditional agencies, often ranging from 500 to 1500 annually for a standard policy. However, it’s important to note that individual quotes can be significantly higher or lower based on personal circumstances.

Do direct auto insurance companies offer discounts?

+Yes, many direct auto insurance companies offer a variety of discounts to their customers. These can include multi-policy discounts (for bundling auto insurance with other types of insurance, such as home or life insurance), good student discounts (for students with a certain GPA), and safe driver discounts (for drivers with a clean driving record). Some insurers also offer loyalty discounts for long-term customers.

How do direct auto insurance companies handle claims?

+Direct auto insurance companies typically have dedicated claims departments that handle all aspects of the claims process. Customers can file claims online or over the phone, and many insurers offer 24⁄7 claims reporting for urgent situations. Once a claim is filed, the insurer will investigate the incident, assess the damage, and determine the appropriate level of compensation. Many direct insurers also offer claims tracking tools that allow customers to monitor the progress of their claim online.