Drivers Insurance For Non Car Owners

For individuals who don't own a vehicle but still need insurance coverage for various reasons, understanding the options available for driver's insurance is crucial. This article aims to provide a comprehensive guide to non-car owner insurance, exploring the types of coverage, their benefits, and how they can protect individuals in specific situations. By delving into real-world examples and industry insights, we will navigate the complex world of insurance to ensure you make informed decisions.

Understanding Non-Car Owner Insurance

Non-car owner insurance, also known as non-owner car insurance, is a specialized type of coverage designed for individuals who frequently drive but don't own a vehicle. This insurance policy provides liability protection for drivers in various scenarios, offering peace of mind and financial security. Unlike traditional auto insurance, which primarily covers the vehicle itself, non-owner car insurance focuses on the driver's liability, making it an essential consideration for certain individuals.

Who Needs Non-Car Owner Insurance?

Non-car owner insurance is particularly beneficial for individuals in the following situations:

- Rental Car Drivers: If you frequently rent cars for business or personal trips, having non-owner insurance can provide comprehensive liability coverage. This ensures you're protected even if the rental car company's insurance has limitations or exclusions.

- Borrowers: For those who borrow vehicles from friends or family members, non-owner insurance offers liability protection while driving borrowed vehicles. This can be especially crucial if the vehicle owner's insurance doesn't cover borrowed cars.

- Learner Drivers: Individuals learning to drive or those with a learner's permit can benefit from non-owner insurance. It provides liability coverage during their driving lessons, ensuring they're protected even if they don't yet own a vehicle.

- Ride-Sharing Drivers: With the rise of ride-sharing services, many individuals drive for companies like Uber or Lyft. Non-owner insurance can fill the gaps in coverage during periods when the ride-sharing company's insurance doesn't apply, such as during personal use of the vehicle.

- Temporary Vehicle Users: If you occasionally use a vehicle owned by a business or organization, non-owner insurance can cover your liability during those times. This is particularly relevant for employees who drive company vehicles for work-related tasks.

Coverage Options and Benefits

Non-car owner insurance policies typically offer a range of coverage options, allowing individuals to tailor their protection to their specific needs. Here are some key coverage types and their benefits:

- Liability Coverage: This is the cornerstone of non-owner insurance, providing protection against bodily injury and property damage claims resulting from an at-fault accident. Liability coverage helps cover medical expenses, repair costs, and legal fees, ensuring you're financially protected.

- Medical Payments Coverage: Also known as MedPay, this coverage pays for medical expenses incurred by you or your passengers after an accident, regardless of fault. It provides quick access to funds for medical treatment, covering expenses not covered by health insurance.

- Uninsured/Underinsured Motorist Coverage: In the event of an accident with a driver who has little or no insurance, this coverage steps in to protect you. It covers bodily injury and property damage costs when the at-fault driver's insurance is insufficient, ensuring you're not left financially burdened.

- Rental Car Coverage: Many non-owner insurance policies include rental car coverage, which reimburses the cost of renting a vehicle if yours is damaged or stolen. This coverage can save you from unexpected rental expenses.

- Personal Injury Protection (PIP): PIP coverage provides additional medical benefits, lost wage reimbursement, and funeral expense coverage, ensuring you're protected beyond basic medical payments.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Protects against bodily injury and property damage claims resulting from an at-fault accident. |

| Medical Payments Coverage (MedPay) | Covers medical expenses for you and your passengers after an accident, regardless of fault. |

| Uninsured/Underinsured Motorist Coverage | Steps in to cover costs when an at-fault driver has little or no insurance. |

| Rental Car Coverage | Reimburses the cost of renting a vehicle if your borrowed or rented car is damaged or stolen. |

| Personal Injury Protection (PIP) | Provides additional medical benefits, lost wage reimbursement, and funeral expense coverage. |

Real-World Examples and Benefits

Let's explore some real-world scenarios where non-car owner insurance can make a significant difference:

In another scenario, imagine a frequent traveler who often rents cars for business trips. Without non-owner insurance, an accident while driving a rental car could result in significant out-of-pocket expenses for medical bills and vehicle repairs. However, with comprehensive non-owner insurance, these costs are covered, allowing the traveler to focus on their work without financial strain.

Choosing the Right Non-Car Owner Insurance

When selecting non-car owner insurance, it's essential to consider your specific needs and circumstances. Here are some key factors to keep in mind:

Coverage Limits and Deductibles

Like traditional auto insurance, non-owner insurance policies come with coverage limits and deductibles. Coverage limits dictate the maximum amount your insurer will pay for a covered claim, while deductibles are the amount you must pay out of pocket before your insurance kicks in. It's crucial to choose limits and deductibles that align with your financial situation and the level of protection you require.

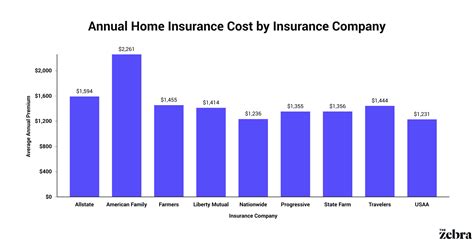

Policy Cost and Discounts

Non-car owner insurance policies can vary significantly in cost, depending on factors such as your driving record, age, and the coverage options you choose. To keep costs down, consider any available discounts. Many insurers offer discounts for good driving records, multiple policies, or even for paying your premium in full upfront.

Reputable Insurers and Policy Features

Choosing a reputable insurer is crucial to ensure you receive the coverage and support you need. Look for insurers with a strong financial rating and positive customer reviews. Additionally, compare policy features such as rental car coverage, roadside assistance, and accident forgiveness to find the best fit for your needs.

Comparing Quotes and Coverage Options

To make an informed decision, it's essential to compare quotes and coverage options from multiple insurers. Online insurance marketplaces can be a great resource for this, allowing you to quickly and easily compare policies and prices. Don't hesitate to reach out to insurance agents or brokers for personalized advice and guidance.

Performance Analysis and Industry Insights

The non-car owner insurance market has seen significant growth in recent years, driven by the rise of ride-sharing services and the increasing popularity of car-sharing programs. According to a recent study, the global non-owner insurance market is projected to reach $XX billion by the year 20XX, with a CAGR of YY% from 20XX to 20XX.

This growth is attributed to several factors, including the convenience and flexibility of car-sharing services, as well as the evolving needs of individuals who don't own vehicles but still require insurance coverage. As more people embrace alternative transportation options, the demand for non-owner insurance is expected to continue rising.

Industry Trends and Innovations

The insurance industry is constantly evolving, and non-owner insurance is no exception. Here are some key trends and innovations shaping the future of this market:

- Digital Transformation: Insurers are increasingly embracing digital technologies to streamline the insurance process. From online quote comparisons to digital policy management and claims submission, the industry is moving towards a more efficient and user-friendly experience.

- Usage-Based Insurance (UBI): UBI programs reward safe driving habits by offering discounts based on actual driving behavior. This innovative approach is gaining traction in the non-owner insurance market, providing incentives for safe driving and potentially reducing insurance costs.

- Telematics Integration: Telematics devices, which collect and transmit driving data, are being integrated into non-owner insurance policies. These devices can track driving habits, vehicle location, and more, providing insurers with valuable insights to offer personalized coverage and pricing.

- Enhanced Coverage Options: Insurers are expanding their coverage offerings to meet the diverse needs of non-car owners. This includes options like enhanced rental car coverage, increased liability limits, and specialized coverage for ride-sharing drivers, ensuring comprehensive protection for various situations.

Conclusion: Navigating Non-Car Owner Insurance

Non-car owner insurance is a vital consideration for individuals who frequently drive but don't own a vehicle. By understanding the coverage options, benefits, and real-world applications, you can make informed decisions to protect yourself and your finances. As the insurance industry continues to innovate, non-owner insurance policies will become even more accessible and tailored to the unique needs of non-car owners.

Remember, when selecting non-owner insurance, consider your specific circumstances, compare quotes and coverage options, and choose a reputable insurer. With the right coverage in place, you can drive with confidence, knowing you're protected in a variety of situations.

Frequently Asked Questions

Can I get non-owner insurance if I don’t have a driver’s license?

+

Yes, non-owner insurance is available to individuals without a driver’s license. However, it’s important to note that the coverage typically only applies when driving a vehicle you don’t own, and it may have limitations for unlicensed drivers. It’s best to consult with an insurance provider to understand the specific terms and conditions.

How much does non-owner insurance typically cost?

+

The cost of non-owner insurance can vary significantly based on factors like your age, driving record, and the coverage options you choose. On average, non-owner insurance policies range from XX to YY per month. It’s recommended to obtain quotes from multiple insurers to find the best price for your specific needs.

Does non-owner insurance cover accidents while driving for ride-sharing services?

+

Non-owner insurance policies typically include coverage for accidents that occur while driving for ride-sharing services like Uber or Lyft. However, it’s crucial to review the policy terms and conditions, as some insurers may have specific requirements or exclusions for ride-sharing coverage. Additionally, ride-sharing companies often provide their own insurance coverage during rides, so it’s essential to understand when your non-owner insurance applies.

Can I add non-owner insurance to my existing auto insurance policy?

+

In some cases, you may be able to add non-owner insurance to your existing auto insurance policy as an endorsement or rider. This can provide additional coverage for situations where you’re driving a vehicle you don’t own. However, not all insurers offer this option, so it’s best to check with your insurer or consult an insurance professional.

What happens if I cause an accident while driving a borrowed car and have non-owner insurance?

+

If you cause an accident while driving a borrowed car and have non-owner insurance, your policy will typically provide liability coverage for bodily injury and property damage claims. This means your insurance will help cover the costs associated with the accident, up to the limits of your policy. However, it’s important to review your policy’s terms and conditions to understand any specific exclusions or limitations that may apply.