Dept Of Insurance Ca

The Department of Insurance, California, also known as the Department of Insurance (DOI) or Insurance Department, plays a crucial role in regulating and overseeing the insurance industry within the state of California. With a vast and diverse population, California faces unique challenges in ensuring fair and accessible insurance practices for its residents. This article delves into the functions, initiatives, and impact of the DOI, shedding light on its vital contributions to the state's insurance landscape.

Unveiling the Department of Insurance (DOI): A Guardian of California’s Insurance Sector

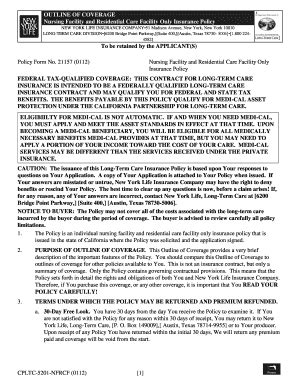

Established with the primary objective of safeguarding the interests of California’s consumers, the Department of Insurance stands as a regulatory authority, overseeing a wide range of insurance sectors. From automobile and health insurance to property and casualty policies, the DOI’s jurisdiction extends across various insurance types, ensuring compliance with state laws and protecting policyholders from fraudulent or unethical practices.

At the helm of the DOI is the Commissioner of Insurance, a publicly elected official who serves a four-year term. The Commissioner's role is pivotal, as they are responsible for setting the department's strategic direction and implementing policies that promote a fair and competitive insurance marketplace. The current Commissioner, Ricardo Lara, has been at the forefront of several significant initiatives, aiming to enhance consumer protection and foster a more inclusive insurance environment.

Key Functions and Responsibilities of the DOI

The Department of Insurance’s functions are multifaceted, encompassing a wide array of responsibilities aimed at regulating the insurance industry and protecting consumers. Here’s an overview of its key roles:

- Consumer Protection: The DOI acts as a watchdog, ensuring that insurance companies adhere to state laws and regulations. It investigates complaints, conducts market conduct examinations, and takes legal action against insurers engaging in unfair practices.

- Rate Regulation: One of the critical responsibilities of the DOI is reviewing and approving insurance rates. It scrutinizes proposed rate changes to ensure they are not excessive, inadequate, or unfairly discriminatory, thereby preventing insurers from exploiting consumers.

- Market Conduct Examinations: The DOI conducts regular examinations of insurance companies to assess their compliance with laws and regulations. These examinations cover areas such as financial stability, marketing practices, and claims handling, ensuring insurers operate ethically and transparently.

- Licensing and Enforcement: The DOI is responsible for licensing insurance agents, brokers, and companies. It also enforces disciplinary actions against those found to be in violation of insurance laws, including the suspension or revocation of licenses.

- Consumer Education: Recognizing the importance of informed consumers, the DOI provides educational resources and outreach programs. These initiatives aim to empower individuals to make informed decisions and understand their rights and responsibilities regarding insurance coverage.

By fulfilling these functions, the DOI strives to create a balanced and equitable insurance marketplace, where consumers can access affordable and reliable coverage while insurers operate in a competitive and compliant environment.

Promoting Equity and Access: DOI’s Initiatives for a Fair Insurance Landscape

The Department of Insurance has undertaken several notable initiatives to address specific challenges and promote a more equitable insurance environment in California. These initiatives reflect the DOI’s commitment to consumer protection and fair practices.

Access to Affordable Healthcare

With the aim of ensuring that all Californians have access to affordable healthcare, the DOI has implemented several measures. One such initiative is the expansion of Medi-Cal, California’s Medicaid program, which provides healthcare coverage to low-income individuals and families. The DOI works closely with healthcare providers and insurers to improve the accessibility and affordability of healthcare services, particularly for vulnerable populations.

Protecting Consumers from Fraud and Scams

Fraud and scams in the insurance industry pose significant risks to consumers. To combat these issues, the DOI has established a dedicated Consumer Services Division. This division is tasked with investigating and prosecuting insurance-related fraud, including fraudulent claims, identity theft, and deceptive sales practices. By actively pursuing and prosecuting fraudsters, the DOI aims to deter fraudulent activities and protect the financial interests of California’s residents.

Promoting Diversity and Inclusion in the Insurance Sector

Recognizing the importance of diversity and inclusion, the DOI has launched initiatives to foster a more inclusive insurance marketplace. These efforts include promoting diversity in the insurance workforce and encouraging insurers to adopt inclusive practices. By embracing diversity, the DOI aims to create an insurance industry that better reflects the diverse population of California, ensuring equitable access to coverage and services.

Enhancing Consumer Education and Outreach

The DOI understands that informed consumers are essential to a healthy insurance marketplace. As such, it has invested in various consumer education programs and outreach initiatives. These programs provide resources and information to help individuals understand their insurance options, navigate the claims process, and recognize potential scams. By empowering consumers with knowledge, the DOI aims to reduce the likelihood of financial loss and promote a more trusting relationship between consumers and insurers.

| Initiative | Impact |

|---|---|

| Expansion of Medi-Cal | Increased access to healthcare for low-income individuals and families |

| Consumer Services Division | Enhanced protection against insurance fraud and scams |

| Diversity and Inclusion Programs | Fosters a more inclusive insurance industry, reflecting California's diversity |

| Consumer Education Programs | Empowers consumers to make informed insurance decisions and reduces financial risks |

Performance Analysis: Assessing the Impact of DOI’s Regulatory Measures

The effectiveness of the Department of Insurance’s regulatory measures can be evaluated through various performance indicators. These indicators provide insights into how well the DOI is achieving its objectives of consumer protection and market stability.

Consumer Complaint Resolution

One of the primary metrics for assessing the DOI’s performance is the timely resolution of consumer complaints. The DOI aims to address and resolve complaints promptly, ensuring that consumers receive fair treatment and that insurance companies are held accountable. The department’s success in this regard can be measured by the number of complaints resolved within a specified timeframe and the overall satisfaction of consumers with the resolution process.

Market Conduct Examinations

Regular market conduct examinations are crucial for identifying and addressing potential issues within the insurance industry. The DOI’s performance in this area can be evaluated by the frequency and thoroughness of these examinations. A well-performing DOI should conduct comprehensive examinations, identify areas of non-compliance, and take appropriate enforcement actions to correct these issues.

Rate Regulation and Affordability

The DOI’s role in rate regulation is critical to ensuring that insurance remains affordable for Californians. The department’s performance in this area can be assessed by analyzing the impact of its rate reviews on insurance affordability. This includes examining the average increase or decrease in insurance premiums, the number of rate filings approved or rejected, and the overall satisfaction of consumers with insurance affordability.

Enforcement and Disciplinary Actions

The DOI’s enforcement and disciplinary actions are essential for maintaining a compliant insurance marketplace. The department’s performance in this domain can be evaluated by the number and severity of enforcement actions taken against insurers. This includes the issuance of cease and desist orders, fines, and license suspensions or revocations. A well-performing DOI should demonstrate a consistent and effective approach to enforcing insurance laws and regulations.

| Performance Indicator | Measurement |

|---|---|

| Consumer Complaint Resolution | Percentage of complaints resolved within a specified timeframe, consumer satisfaction ratings |

| Market Conduct Examinations | Frequency of examinations, number of identified non-compliance issues, enforcement actions taken |

| Rate Regulation and Affordability | Average premium changes, number of rate filings approved/rejected, consumer satisfaction with affordability |

| Enforcement and Disciplinary Actions | Number and severity of enforcement actions, fines imposed, license suspensions/revocations |

Future Implications: Shaping the Insurance Landscape in California

As the insurance industry continues to evolve, the Department of Insurance faces both opportunities and challenges in shaping the future of insurance in California. By staying proactive and adapting to emerging trends, the DOI can further enhance its regulatory framework and protect the interests of California’s residents.

Adapting to Technological Advancements

The rapid advancement of technology has transformed the insurance industry, with the rise of digital platforms, telematics, and data analytics. The DOI must stay abreast of these technological innovations to ensure that regulatory measures keep pace with the industry’s evolution. This includes addressing issues such as data privacy, cybersecurity, and the ethical use of technology in insurance practices.

Addressing Climate Change and Natural Disasters

California, like many other regions, is vulnerable to the impacts of climate change, including wildfires, droughts, and extreme weather events. The DOI plays a crucial role in mitigating the financial risks associated with these disasters. By working closely with insurers and adopting proactive measures, the department can help ensure that California’s residents have access to affordable insurance coverage, even in high-risk areas.

Promoting Financial Inclusion and Equity

Ensuring that insurance coverage is accessible and affordable to all Californians, regardless of their socio-economic status, is a key challenge for the DOI. The department can continue to promote financial inclusion by supporting initiatives that provide insurance coverage to underserved communities, such as low-income individuals and families, immigrants, and those with pre-existing conditions.

Strengthening Consumer Education and Empowerment

Empowering consumers to make informed decisions about their insurance coverage remains a priority for the DOI. By investing in consumer education programs and digital tools, the department can help individuals better understand their insurance options, navigate the claims process, and recognize potential scams. This approach not only protects consumers but also fosters a more trusting relationship between insurers and policyholders.

What is the role of the Department of Insurance in California?

+The Department of Insurance is responsible for regulating and overseeing the insurance industry in California. It aims to protect consumers, ensure fair practices, and promote a competitive insurance marketplace.

How does the DOI contribute to consumer protection?

+The DOI investigates complaints, conducts market conduct examinations, and takes legal action against insurers engaging in unfair practices. It also reviews insurance rates to prevent excessive or discriminatory pricing.

What initiatives has the DOI undertaken to promote equity in the insurance sector?

+The DOI has initiatives focused on expanding healthcare access, protecting consumers from fraud, promoting diversity and inclusion, and enhancing consumer education and outreach.

How does the DOI assess its performance in regulating the insurance industry?

+The DOI evaluates its performance through metrics such as consumer complaint resolution, market conduct examinations, rate regulation, and enforcement actions. These indicators help assess the effectiveness of its regulatory measures.