Marketplace Insurance Telephone Number

Welcome to this comprehensive guide on the Marketplace Insurance Telephone Number. This article will delve into the world of insurance, focusing on the specific aspect of contacting insurance providers through telephone services. In today's fast-paced world, efficient customer support is crucial, and understanding how to navigate the insurance landscape is essential for both consumers and businesses.

Understanding Marketplace Insurance

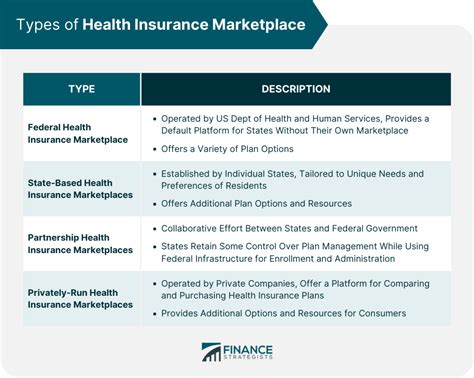

Marketplace insurance refers to the platform or system where individuals and businesses can compare and purchase insurance policies from multiple providers. These marketplaces, often government-regulated, aim to provide a transparent and competitive environment for insurance shopping. By centralizing various insurance options, marketplaces empower consumers to make informed choices and find the best coverage for their needs.

Marketplace insurance encompasses a wide range of coverage types, including health insurance, auto insurance, home insurance, and more. Each type of insurance serves a specific purpose, protecting individuals and businesses from financial risks associated with accidents, illnesses, property damage, and other unforeseen events.

The Significance of Telephone Support in Insurance

In the insurance industry, telephone support plays a pivotal role in connecting policyholders and prospective customers with insurance providers. While online platforms and digital tools have revolutionized the insurance landscape, telephone support remains a critical channel for personalized assistance and complex inquiries.

Here are some key reasons why telephone support is indispensable in the insurance sector:

- Complex Queries: Insurance policies often involve intricate details and specific clauses. Telephone support allows customers to discuss their unique situations, seek clarification on coverage, and receive tailored advice from experienced agents.

- Quick Resolution: When faced with urgent matters, such as filing a claim or reporting an incident, telephone support offers a rapid response. Agents can guide customers through the necessary steps, ensuring a timely resolution to their concerns.

- Personalized Service: Insurance is a highly personalized domain, as policies are tailored to individual needs. Telephone support provides a human touch, allowing agents to build rapport and offer customized solutions based on each customer's circumstances.

- Emergency Assistance: In critical situations, such as accidents or natural disasters, telephone support becomes a lifeline. Insurance providers can offer immediate guidance, coordinate emergency services, and provide peace of mind during challenging times.

- Complex Claims: Some insurance claims are complex and require in-depth discussions. Telephone support facilitates open communication between customers and claims adjusters, ensuring a comprehensive understanding of the claim and a fair resolution process.

Marketplace Insurance Telephone Number: A Comprehensive Guide

When it comes to contacting insurance providers through the marketplace, having the correct telephone number is essential. In this section, we will provide a detailed guide to finding and utilizing the Marketplace Insurance Telephone Number effectively.

Locating the Telephone Number

To find the Marketplace Insurance Telephone Number, you can follow these steps:

- Visit the Official Website: Start by navigating to the official website of the insurance marketplace. This is often the primary source of accurate and up-to-date contact information.

- Explore Contact Options: Look for a dedicated "Contact Us" or "Customer Support" section on the website. Here, you will find various ways to connect with the marketplace, including telephone numbers, email addresses, and live chat options.

- Check Department-Specific Numbers: Some insurance marketplaces offer department-specific telephone numbers. For instance, there might be separate numbers for sales inquiries, customer support, claims, and billing. Ensure you select the number relevant to your query.

- Utilize Online Directories: If you are unable to locate the telephone number on the official website, try reputable online directories. These directories often list contact details for various businesses, including insurance marketplaces. However, always cross-verify the information with official sources.

- Refer to Policy Documents: If you already have an insurance policy through the marketplace, check your policy documents or billing statements. These documents often provide important contact information, including telephone numbers, for various purposes.

Using the Telephone Number Effectively

Once you have the Marketplace Insurance Telephone Number, here are some tips to ensure a smooth and productive conversation:

- Prepare Your Questions: Before making the call, jot down your queries or concerns. This helps you stay organized and ensures you cover all the important points during the conversation.

- Have Your Policy Information Ready: If your query is related to a specific policy, have your policy number and other relevant details readily available. This saves time and allows the agent to access your information quickly.

- Be Clear and Concise: When explaining your situation or inquiry, be as clear and concise as possible. This helps the agent understand your needs accurately and provides them with the context to offer the best assistance.

- Listen and Take Notes: During the call, actively listen to the agent's responses and take notes if needed. This ensures you retain important information and can follow up on any action items discussed.

- Ask for Clarification: If you have any doubts or require further explanation, don't hesitate to ask for clarification. Insurance policies can be complex, and agents are there to guide you through any confusing aspects.

- Document the Conversation: Consider recording the call or taking detailed notes to refer back to later. This is especially useful when discussing important matters, such as claim procedures or policy changes.

Common Queries and Their Solutions

Here are some common queries that individuals often have when contacting insurance providers through the marketplace, along with their respective solutions:

| Query | Solution |

|---|---|

| How do I update my personal information (e.g., address, contact details)? | Call the Marketplace Insurance Telephone Number and provide your policy number. The agent will guide you through the process of updating your personal information. Alternatively, you can access your online account and make the changes yourself. |

| I want to make a claim. What is the process? | Contact the claims department using the dedicated claims telephone number. Explain the details of your claim, and the agent will guide you through the necessary steps. They may request additional documentation or provide a claim form for you to complete. |

| Can I switch insurance providers within the marketplace? | Yes, it is often possible to switch providers. Call the Marketplace Insurance Telephone Number and inquire about the process. The agent can assist you in comparing different policies and help you make an informed decision. |

| I have a billing inquiry. How can I resolve it? | Reach out to the billing department using the provided telephone number. Explain your billing concern, and the agent will investigate the issue. They may request additional information or provide a solution to resolve the billing discrepancy. |

| What are the coverage options for my specific needs (e.g., health, auto)? | Contact the sales or customer support department. Describe your needs and the agent will guide you through the available coverage options. They can provide tailored recommendations based on your circumstances and budget. |

The Future of Insurance Customer Support

As technology continues to advance, the insurance industry is evolving to meet the changing needs and preferences of consumers. While telephone support remains crucial, other channels are gaining prominence as well.

Digital Transformation in Insurance

Insurance providers are investing in digital transformation to enhance their customer support offerings. Here are some key trends and developments:

- Online Portals: Many insurance companies are developing comprehensive online portals where customers can manage their policies, make payments, file claims, and access important documents. These portals provide a convenient and efficient way to handle insurance-related tasks.

- Mobile Apps: Mobile applications are becoming increasingly popular in the insurance sector. These apps offer features such as policy management, claim tracking, and emergency assistance, providing customers with instant access to their insurance information on the go.

- Chatbots and AI: Artificial Intelligence (AI) and chatbots are being utilized to provide instant support and answers to common queries. These technologies can handle simple inquiries, freeing up human agents to focus on more complex issues.

- Video Conferencing: Video conferencing technology is being integrated into insurance customer support, allowing agents and customers to connect face-to-face virtually. This enhances the personal touch and enables more effective communication, especially for complex matters.

The Role of Telephone Support in a Digital Age

Despite the rise of digital channels, telephone support continues to hold its place as a vital component of insurance customer support. Here’s why:

- Human Connection: While digital tools offer convenience, there are times when a human connection is invaluable. Complex situations, emotional moments, or delicate inquiries often require the empathy and expertise of a real person.

- Personalized Guidance: Telephone support allows agents to provide personalized guidance based on individual circumstances. This level of customization is challenging to achieve through automated channels, making telephone support irreplaceable for certain scenarios.

- Rapid Response in Emergencies: In urgent situations, such as accidents or natural disasters, telephone support offers an immediate response. Customers can receive guidance and support from trained professionals, ensuring a swift and effective resolution.

- Complex Query Resolution: Certain queries may require in-depth discussions and explanations. Telephone support provides a platform for open dialogue, allowing agents to thoroughly understand the customer's situation and offer comprehensive solutions.

Conclusion

The Marketplace Insurance Telephone Number serves as a vital link between policyholders and insurance providers. Understanding how to locate and utilize this number effectively empowers individuals to navigate the insurance landscape with confidence. While digital channels are transforming the industry, telephone support remains an indispensable tool for personalized assistance and complex inquiries.

As the insurance industry continues to evolve, embracing technology and digital innovation, the role of telephone support will adapt and complement these advancements. By combining the strengths of both digital and human-centric support, insurance providers can deliver an exceptional customer experience, ensuring peace of mind and financial protection for all.

How can I ensure I am calling the official Marketplace Insurance Telephone Number and not a scammer?

+To verify the authenticity of the telephone number, always cross-reference it with official sources. Visit the insurance marketplace’s official website and compare the number provided there with the one you intend to call. Additionally, look for any security badges or trust seals on the website, indicating its legitimacy.

Are there any additional fees associated with calling the Marketplace Insurance Telephone Number?

+Typically, there are no additional fees for calling the Marketplace Insurance Telephone Number. However, it is advisable to check with your phone service provider to understand any potential long-distance or international call charges, especially if you are calling from a different region or country.

What if I am unable to reach an agent during business hours? Are there alternative support options available?

+If you are unable to connect with an agent during business hours, most insurance marketplaces offer alternative support options. These may include live chat, email support, or even an automated callback system. Additionally, you can explore their online resources, such as FAQs or knowledge bases, for quick answers to common queries.

Can I make changes to my insurance policy over the telephone, or do I need to visit a physical location?

+Depending on the insurance provider and the nature of the changes, you may be able to make certain policy modifications over the telephone. However, for significant changes or those requiring detailed discussions, it is often recommended to visit a physical location or contact an agent directly to ensure a comprehensive understanding and accurate processing of your request.

How can I ensure my privacy and security when discussing sensitive insurance matters over the telephone?

+To ensure privacy and security, always verify the authenticity of the telephone number and the identity of the agent you are speaking with. Look for security measures such as caller ID verification or two-factor authentication. Additionally, avoid sharing sensitive information, such as your social security number or financial details, unless you are certain of the agent’s identity and the secure nature of the call.