Liability Insurance Auto

In the realm of personal finance and vehicle ownership, liability insurance plays a pivotal role in safeguarding individuals and their assets. This type of insurance is a critical component of responsible vehicle ownership, providing a financial safety net in the event of an accident. As an essential aspect of vehicle coverage, liability insurance is mandated by law in many jurisdictions, ensuring that drivers are protected from the potentially devastating financial consequences of an at-fault accident.

This article aims to provide an in-depth exploration of auto liability insurance, delving into its nuances, benefits, and implications. By understanding the intricacies of this coverage, drivers can make informed decisions about their insurance policies, ensuring they have the right protection in place.

Understanding Auto Liability Insurance

Auto liability insurance is a form of coverage that protects drivers from financial liability in the event of an accident for which they are deemed at fault. It provides a crucial safety net, covering the costs associated with property damage, bodily injury, or other legal expenses that may arise from an accident. This coverage is designed to shield drivers from potentially ruinous financial outcomes, ensuring that they can meet their legal obligations without facing bankruptcy.

The key components of auto liability insurance include bodily injury liability and property damage liability. Bodily injury liability covers the costs associated with injuries sustained by others in an accident, including medical expenses, lost wages, and pain and suffering. Property damage liability, on the other hand, covers the costs of repairing or replacing damaged property, such as other vehicles, buildings, or even personal items.

Bodily Injury Liability Coverage

Bodily injury liability is a critical aspect of auto liability insurance, as it provides coverage for the costs associated with physical injuries sustained by others in an accident. This coverage can include medical expenses, such as hospital stays, surgeries, and ongoing treatment, as well as other related costs, such as rehabilitation and physical therapy. Additionally, it can cover lost wages if the injured party is unable to work due to their injuries.

In some cases, bodily injury liability may also extend to non-economic damages, such as pain and suffering, emotional distress, and loss of consortium (the loss of companionship, affection, or sexual relations with a spouse or partner due to the injuries sustained in the accident). These non-economic damages can be significant and often form a substantial portion of the overall liability claim.

The limits of bodily injury liability coverage can vary depending on the policy and the jurisdiction in which the policy is held. It is important for drivers to carefully review their policy limits to ensure they have adequate coverage. In some cases, it may be advisable to opt for higher limits, especially if the driver frequently operates their vehicle in high-risk areas or carries passengers.

Property Damage Liability Coverage

Property damage liability coverage is another crucial component of auto liability insurance. This coverage protects drivers from the financial burden of repairing or replacing damaged property resulting from an accident for which they are at fault. It can cover a wide range of property types, including other vehicles, buildings, fences, signs, and even personal belongings that may be damaged in an accident.

For example, if a driver accidentally collides with another vehicle, causing significant damage, their property damage liability coverage would kick in to cover the costs of repairing or replacing the other vehicle. This coverage ensures that the driver is not personally responsible for these expenses, which can often be substantial.

Similar to bodily injury liability coverage, property damage liability limits can vary depending on the policy and jurisdiction. It is essential for drivers to understand their policy limits and ensure they have sufficient coverage to protect themselves from potentially large financial liabilities.

The Importance of Adequate Coverage

Having adequate auto liability insurance coverage is of paramount importance for several reasons. Firstly, it ensures that drivers can meet their legal obligations in the event of an accident. In many jurisdictions, drivers are required by law to carry a minimum level of liability insurance to protect others on the road. Failing to meet these requirements can result in legal penalties, including fines and even the suspension of driving privileges.

Secondly, adequate liability coverage provides peace of mind. It ensures that drivers are protected from the potentially catastrophic financial consequences of an at-fault accident. Without sufficient coverage, a single accident could lead to significant financial hardship, including hefty legal fees, medical bills, and property repair or replacement costs. Liability insurance acts as a safety net, ensuring that drivers can recover from an accident without facing bankruptcy.

Additionally, having adequate liability coverage can also protect a driver's personal assets. In some cases, if the damages exceed the policy limits, the injured party may pursue the driver's personal assets, such as their home, savings, or other valuables, to recover the remaining costs. By carrying sufficient liability coverage, drivers can avoid this scenario, ensuring that their personal assets remain protected.

Factors Affecting Liability Insurance Premiums

The cost of auto liability insurance, often referred to as the premium, can vary significantly depending on several factors. Understanding these factors can help drivers make informed decisions about their coverage and potentially save money on their insurance costs.

One of the primary factors influencing liability insurance premiums is the driver's driving record. Insurance companies closely examine a driver's history, including any accidents, traffic violations, and claims made in the past. A clean driving record generally results in lower premiums, while a history of accidents or violations can lead to higher rates.

The type of vehicle being insured is another critical factor. Insurance companies consider the make, model, and year of the vehicle, as well as its safety ratings and repair costs. Vehicles that are more expensive to repair or those that have a higher likelihood of being involved in accidents may incur higher premiums.

The coverage limits chosen by the driver also play a significant role in determining premiums. Higher coverage limits generally result in higher premiums, as the insurance company is taking on more financial risk. However, it's important to strike a balance between cost and coverage, ensuring that the policy provides adequate protection without being overly expensive.

The deductible, which is the amount the driver pays out of pocket before the insurance coverage kicks in, is another factor that affects premiums. Choosing a higher deductible can lead to lower premiums, as it reduces the financial risk borne by the insurance company. However, it's important to consider the potential financial burden of a higher deductible in the event of an accident.

Choosing the Right Liability Insurance

Selecting the right auto liability insurance involves carefully considering several factors to ensure that the coverage meets the driver’s needs while remaining cost-effective. Here are some key considerations when choosing liability insurance:

Assessing Risk Profile

Every driver has a unique risk profile, influenced by factors such as driving habits, location, and vehicle type. It’s crucial to assess one’s risk profile honestly to determine the appropriate level of coverage. For example, drivers who frequently commute in high-traffic areas or have a history of accidents may require higher coverage limits to adequately protect themselves.

Understanding Policy Options

Insurance companies offer a range of policy options, each with its own set of features and benefits. It’s essential to understand the differences between these options and choose the one that best aligns with one’s needs. For instance, some policies may offer additional coverage for rental cars or provide legal defense in the event of a lawsuit, which could be beneficial for certain drivers.

Comparing Quotes

Obtaining quotes from multiple insurance providers is crucial to finding the best deal. Insurance rates can vary significantly between companies, and by comparing quotes, drivers can identify the most cost-effective option without compromising on coverage. It’s important to note that the cheapest quote may not always be the best choice, as it’s essential to consider the reputation and financial stability of the insurance company as well.

Considering Bundling Options

Many insurance companies offer discounts when customers bundle multiple policies, such as auto and home insurance. Bundling can lead to significant savings, so it’s worth exploring these options, especially if the driver is also in the market for other types of insurance coverage.

The Future of Auto Liability Insurance

As the automotive industry continues to evolve, so too will the landscape of auto liability insurance. The rise of autonomous vehicles and advanced driver-assistance systems (ADAS) is likely to have a significant impact on liability coverage in the coming years.

With the increasing adoption of autonomous driving technologies, the question of liability in the event of an accident becomes more complex. While these technologies are designed to enhance safety, they are not infallible, and accidents can still occur. As such, the responsibility for these accidents and the resulting financial liabilities will need to be carefully delineated, with insurance policies evolving to address these new scenarios.

Additionally, the growing popularity of ride-sharing services and car-sharing platforms is also likely to influence the future of auto liability insurance. These services often have their own insurance policies, but the interaction between personal and commercial insurance policies in the event of an accident can be complex. As these services become more prevalent, insurance providers will need to adapt their policies to ensure adequate coverage for all parties involved.

The Role of Technology in Liability Insurance

Technology is already playing a significant role in the auto insurance industry, with telematics and usage-based insurance (UBI) gaining traction. Telematics devices collect data on driving behavior, such as speed, acceleration, and braking, while UBI policies offer insurance rates based on an individual’s actual driving habits.

These technologies have the potential to revolutionize auto liability insurance, offering more personalized and accurate rates. By incentivizing safe driving behavior, telematics and UBI can reduce the number of accidents and, consequently, the financial liabilities associated with them. This could lead to more affordable liability insurance for responsible drivers.

Emerging Trends and Innovations

The insurance industry is constantly evolving, and several emerging trends and innovations are poised to shape the future of auto liability insurance. These include:

- Blockchain Technology: Blockchain has the potential to revolutionize insurance by enhancing transparency, security, and efficiency. It can facilitate smart contracts, automate claims processing, and provide a tamper-proof record of transactions.

- Artificial Intelligence (AI): AI is being increasingly used in insurance for risk assessment, fraud detection, and personalized underwriting. It can analyze vast amounts of data to identify patterns and make more accurate predictions, leading to more efficient and effective insurance policies.

- Pay-As-You-Drive (PAYD) Insurance: PAYD insurance, also known as pay-per-mile insurance, is a model where premiums are based on the actual miles driven. This model can incentivize eco-friendly driving habits and reduce insurance costs for low-mileage drivers.

Conclusion

Auto liability insurance is a vital component of responsible vehicle ownership, providing a crucial safety net for drivers and their assets. By understanding the intricacies of this coverage, drivers can make informed decisions about their insurance policies, ensuring they have the right protection in place. As the automotive industry continues to evolve, so too will the landscape of auto liability insurance, with emerging technologies and trends shaping the future of this critical coverage.

What is the difference between liability insurance and full coverage insurance?

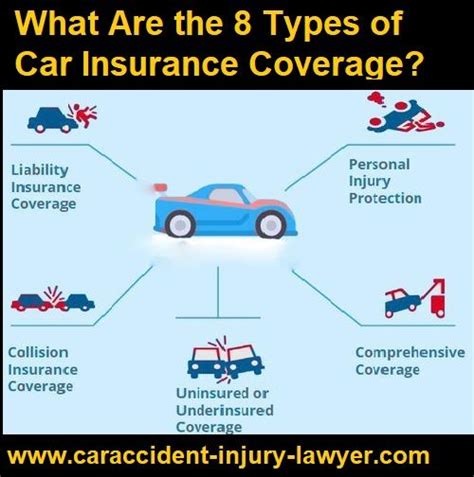

+Liability insurance provides coverage for damages caused to others in an accident for which the insured driver is at fault. Full coverage insurance, on the other hand, includes liability coverage but also provides additional coverage for damages to the insured vehicle, regardless of fault. Full coverage typically includes collision and comprehensive coverage, which cover damages from accidents and non-accident-related incidents, respectively.

How much liability insurance do I need?

+The amount of liability insurance you need depends on various factors, including your risk tolerance, assets, and state requirements. As a general guideline, experts recommend carrying liability limits of at least 100,000 for bodily injury per person, 300,000 for bodily injury per accident, and $100,000 for property damage. However, it’s important to review your specific situation and consider purchasing higher limits if you have significant assets to protect.

Can I be sued if I don’t have enough liability insurance coverage?

+Yes, if the damages exceed your liability insurance limits, the injured party may pursue a lawsuit against you to recover the remaining costs. This is why it’s crucial to have adequate liability coverage to protect your personal assets. It’s also important to note that certain states have financial responsibility laws, which may require you to pay out-of-pocket for damages if you don’t carry enough liability insurance.