Nationwide Insurance Nationwide Insurance

In the vast landscape of the insurance industry, Nationwide Insurance stands as a prominent name, offering a comprehensive range of financial protection services. With a rich history and a commitment to innovation, Nationwide has become a trusted partner for millions of individuals and businesses across the United States. In this in-depth exploration, we delve into the world of Nationwide Insurance, uncovering its origins, key offerings, and the impact it has had on the insurance sector.

A Legacy of Financial Protection: Nationwide Insurance’s Story

The journey of Nationwide Insurance began in 1925, during a time when the concept of comprehensive insurance coverage was still evolving. Founded in Columbus, Ohio, by a group of visionary leaders, Nationwide initially focused on providing affordable auto insurance to farmers and rural residents. This focus on accessibility and community needs set the tone for the company’s future success.

Over the decades, Nationwide Insurance expanded its reach and product offerings. It recognized the changing landscape of American life and adapted its services to meet the evolving needs of its customers. From its early days as a provider of auto insurance, Nationwide grew to offer a diverse range of insurance products, including homeowners, renters, life, and business insurance. This strategic diversification positioned Nationwide as a one-stop shop for financial protection, catering to individuals, families, and enterprises alike.

One of the key strengths of Nationwide Insurance lies in its ability to embrace technological advancements. The company has consistently invested in innovative solutions, from digitizing its processes to developing cutting-edge mobile apps. This commitment to technology has not only enhanced customer experience but has also allowed Nationwide to offer competitive pricing and efficient claims processing, setting it apart in a highly competitive market.

Comprehensive Insurance Solutions: Nationwide’s Product Portfolio

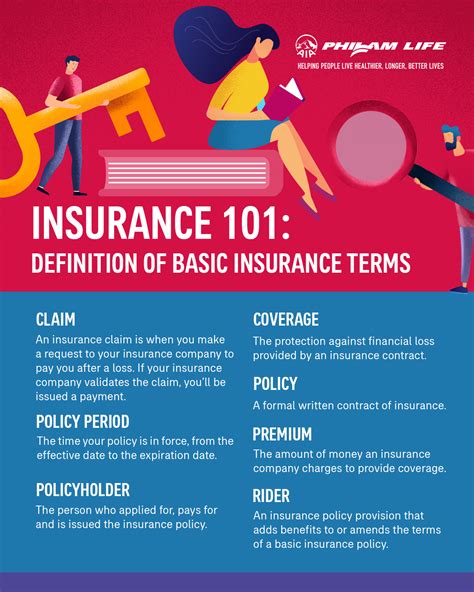

Nationwide Insurance boasts an extensive product portfolio, ensuring that its customers can find tailored solutions for their unique needs. Here’s a glimpse into some of the key offerings:

Auto Insurance

The foundation of Nationwide’s business, auto insurance, remains a cornerstone of its success. With a range of coverage options, from liability to comprehensive and collision insurance, Nationwide caters to diverse driving needs. Additionally, the company offers unique features like Vanishing Deductible®, which rewards safe driving by reducing deductibles over time.

Homeowners Insurance

For homeowners, Nationwide provides comprehensive coverage, safeguarding against a wide range of potential risks. From natural disasters to theft and vandalism, Nationwide’s policies offer peace of mind. The company’s customizable plans allow homeowners to choose the level of coverage that suits their specific needs, ensuring that their most valuable asset is protected.

Renters Insurance

Recognizing the needs of renters, Nationwide offers specialized insurance plans. These policies cover personal belongings, provide liability protection, and offer additional living expenses coverage in case of a covered loss. With Nationwide’s renters insurance, individuals can enjoy the freedom of renting without worrying about potential financial burdens.

Life Insurance

Nationwide’s life insurance offerings provide financial security and peace of mind to policyholders and their loved ones. The company offers a variety of life insurance products, including term life, whole life, and universal life insurance. These policies can be tailored to meet individual needs, whether it’s covering final expenses, providing income replacement, or building a legacy.

Business Insurance

For small businesses and large corporations alike, Nationwide provides a comprehensive suite of business insurance solutions. From general liability to workers’ compensation and commercial auto insurance, Nationwide helps businesses mitigate risks and protect their operations. The company’s business insurance offerings are designed to be flexible, allowing businesses to customize their coverage as their needs evolve.

Nationwide’s Commitment to Community and Innovation

Beyond its insurance offerings, Nationwide Insurance is deeply rooted in community involvement and a commitment to innovation. The company actively supports various charitable initiatives and causes, demonstrating its dedication to making a positive impact beyond its core business.

One notable initiative is the Nationwide Children's Hospital, which the company has been a proud supporter of for over a decade. This hospital, located in Columbus, Ohio, provides world-class pediatric care and has become a symbol of hope and healing for countless families. Nationwide's support has been instrumental in expanding the hospital's reach and improving the lives of children facing health challenges.

In the realm of innovation, Nationwide continues to push boundaries. The company has been at the forefront of developing cutting-edge insurance products and services. For instance, its On Your Side® program offers customers personalized support and resources, ensuring they receive the guidance they need to make informed insurance decisions. Additionally, Nationwide has embraced the potential of emerging technologies, exploring opportunities in areas like blockchain and artificial intelligence to enhance its services.

The Impact of Nationwide Insurance: A Market Leader’s Perspective

Nationwide Insurance’s influence extends far beyond its customer base. As a market leader, the company’s decisions and innovations have shaped the insurance industry as a whole. Its commitment to accessibility and community involvement has inspired other insurers to follow suit, fostering a more inclusive and customer-centric industry.

Furthermore, Nationwide's focus on technology and innovation has set a new standard for the industry. By leveraging technology to streamline processes and enhance customer experience, Nationwide has demonstrated the potential for insurers to adapt to the digital age. This has not only improved efficiency but has also opened up new avenues for customer engagement and satisfaction.

In the competitive landscape of insurance, Nationwide's success serves as a testament to its ability to adapt, innovate, and provide exceptional value to its customers. Its comprehensive range of insurance products, coupled with a commitment to community and technological advancement, positions Nationwide as a trusted partner for individuals and businesses seeking financial protection and peace of mind.

| Insurance Type | Key Features |

|---|---|

| Auto Insurance | Customizable coverage, Vanishing Deductible®, competitive pricing |

| Homeowners Insurance | Comprehensive protection, customizable plans, disaster coverage |

| Renters Insurance | Personal property coverage, liability protection, additional living expenses |

| Life Insurance | Term life, whole life, universal life options, income replacement |

| Business Insurance | General liability, workers' comp, commercial auto, flexible coverage |

How does Nationwide Insurance compare to other leading insurers in terms of customer satisfaction and claims handling?

+Nationwide Insurance consistently ranks highly in customer satisfaction surveys, known for its efficient claims handling and personalized support. Its On Your Side® program and focus on technology have contributed to positive customer experiences.

What sets Nationwide’s life insurance products apart from competitors?

+Nationwide offers a flexible range of life insurance options, including term, whole, and universal life policies. These plans can be tailored to individual needs, providing financial security and peace of mind.

How has Nationwide Insurance embraced technology to enhance its services?

+Nationwide has invested in digital tools and mobile apps, streamlining processes and offering customers convenient access to their policies and support. The company also explores emerging technologies like blockchain for future innovations.