Basic Insurance

Understanding the fundamentals of insurance is crucial for navigating life's uncertainties and protecting what matters most. In today's complex world, insurance serves as a safety net, offering financial security and peace of mind. This comprehensive guide will delve into the world of basic insurance, exploring its types, benefits, and how it can be tailored to meet individual needs.

Unraveling the Basics of Insurance

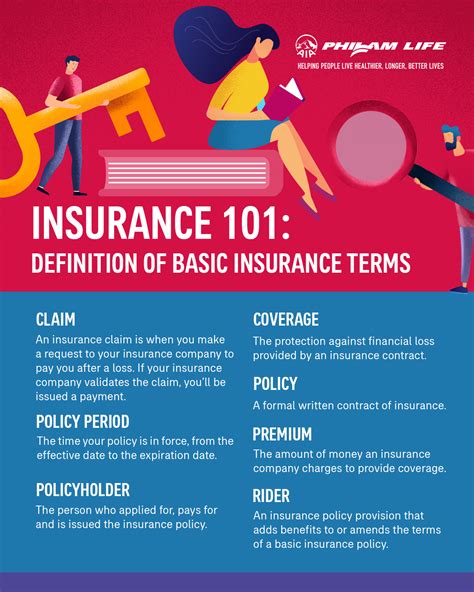

Insurance, at its core, is a contract or policy between an individual (the policyholder) and an insurance company. It is designed to provide financial protection against potential losses or damages, be it to property, health, or other assets. By paying regular premiums, policyholders transfer the risk of financial loss to the insurer, ensuring they are covered in the event of unforeseen circumstances.

The concept of insurance is built on the principle of risk pooling, where a large group of people contribute to a fund that covers the losses of those who experience an insured event. This collective approach ensures that the financial burden of a few is shared by many, making it an effective tool for managing risks.

Types of Basic Insurance Policies

Life Insurance: A Pillar of Financial Security

Life insurance is a cornerstone of basic insurance, offering financial protection to individuals and their families in the event of death. It provides a lump-sum payment, known as a death benefit, to the policyholder’s beneficiaries, ensuring they are financially secure even after the insured passes away.

There are two main types of life insurance policies: term life insurance and permanent life insurance. Term life insurance offers coverage for a specific period, typically 10-30 years, and is often more affordable. Permanent life insurance, on the other hand, provides coverage for the policyholder's entire life and also includes a cash value component that grows over time.

Key Considerations for Life Insurance:

- Coverage Amount: Determine the right amount of coverage based on your financial goals and family's needs.

- Policy Type: Choose between term and permanent life insurance based on your long-term financial planning.

- Beneficiaries: Designate beneficiaries and ensure they are aware of their rights under the policy.

Health Insurance: Protecting Your Well-being

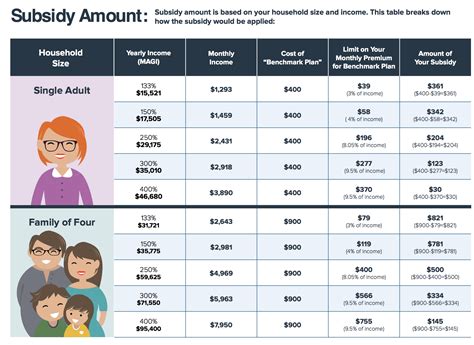

Health insurance is vital for safeguarding individuals and families against the high costs of medical care. It provides coverage for various healthcare services, including doctor visits, hospital stays, prescription medications, and more.

Health insurance plans can be categorized into several types, including employer-sponsored plans, individual plans, and government-sponsored programs like Medicare and Medicaid. Each type offers different levels of coverage and benefits, tailored to the needs of specific populations.

Key Factors in Health Insurance:

- Network of Providers: Ensure your preferred healthcare providers are in-network to minimize out-of-pocket costs.

- Coverage Limits: Understand the limits and exclusions of your plan to avoid unexpected expenses.

- Prescription Drug Coverage: Review the formulary to ensure your essential medications are covered.

Homeowner's Insurance: Safeguarding Your Abode

Homeowner's insurance is designed to protect one of the most significant investments most people make: their home. It provides coverage for the structure of the home, as well as personal belongings, against various perils such as fire, theft, and natural disasters.

Key Components of Homeowner's Insurance:

- Dwelling Coverage: This covers the physical structure of your home.

- Personal Property Coverage: Protects your belongings against damage or loss.

- Liability Coverage: Provides protection if someone is injured on your property.

- Additional Living Expenses: Covers temporary living expenses if your home becomes uninhabitable due to a covered event.

Auto Insurance: Navigating the Roads with Confidence

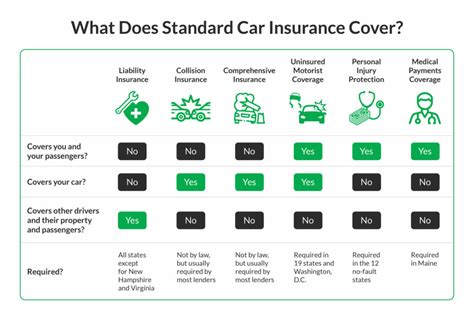

Auto insurance is mandatory in most countries and states, providing coverage for vehicles and their drivers in the event of accidents, theft, or other damages. It offers financial protection and can help cover the costs of repairs, medical bills, and legal expenses.

Key Types of Auto Insurance Coverage:

- Liability Coverage: Covers bodily injury and property damage to others caused by you.

- Comprehensive Coverage: Protects against non-collision events like theft, vandalism, and natural disasters.

- Collision Coverage: Covers damage to your vehicle in an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Provides protection if you're involved in an accident with a driver who has little or no insurance.

Tailoring Insurance to Your Needs

One of the strengths of insurance is its adaptability. Policyholders can customize their coverage to fit their unique circumstances and priorities. Whether it's adjusting the limits of liability, adding optional riders to a policy, or choosing between different types of coverage, insurance offers a flexible approach to risk management.

For instance, in health insurance, individuals can opt for higher deductibles to reduce monthly premiums, while those with specific health conditions may choose plans with more comprehensive coverage and lower out-of-pocket costs.

The Role of Insurance Agents and Brokers

Navigating the world of insurance can be complex, and that’s where insurance agents and brokers come in. These professionals are trained to assess individual needs and guide policyholders toward the most suitable insurance products. They can provide personalized advice, help compare policies, and ensure that clients understand the nuances of their coverage.

Working with an insurance agent or broker can be especially beneficial for those with unique circumstances, such as high-value assets, complex financial portfolios, or specific health concerns. These professionals can tailor insurance solutions to address these unique needs.

The Future of Insurance: Innovation and Technology

The insurance industry is evolving rapidly, driven by technological advancements and changing consumer expectations. Insurtech, a term used to describe the fusion of insurance and technology, is revolutionizing the way insurance is delivered and experienced.

From digital underwriting processes that streamline policy applications to the use of telematics in auto insurance for personalized rates based on driving behavior, technology is enhancing the efficiency and personalization of insurance products.

Additionally, the rise of parametric insurance, which uses predefined triggers to determine payouts, is transforming the way certain risks are insured, particularly in the context of climate-related events.

Conclusion

Basic insurance is an essential component of financial planning, offering protection and peace of mind in an uncertain world. Whether it’s safeguarding your health, home, or financial future, insurance provides a vital safety net. By understanding the types of insurance available and tailoring coverage to individual needs, policyholders can navigate life’s challenges with confidence, knowing they are prepared for whatever the future holds.

How much life insurance coverage do I need?

+The amount of life insurance coverage you need depends on various factors, including your financial goals, family obligations, and debt. A common rule of thumb is to have coverage that is 10-15 times your annual income. However, it’s best to consult with a financial advisor or insurance agent to determine the right coverage amount based on your specific circumstances.

What factors affect health insurance costs?

+Health insurance costs can be influenced by several factors, including your age, location, tobacco use, and the level of coverage you choose. Plans with lower deductibles and more comprehensive benefits tend to have higher premiums. Additionally, the number of people covered under a plan and the specific healthcare providers in your network can impact costs.

Can I customize my homeowner’s insurance policy?

+Absolutely! Homeowner’s insurance policies can be customized to fit your specific needs. You can adjust coverage limits, add endorsements for valuable items like jewelry or artwork, and even opt for additional coverage for specific risks like flood or earthquake, depending on your location and concerns.