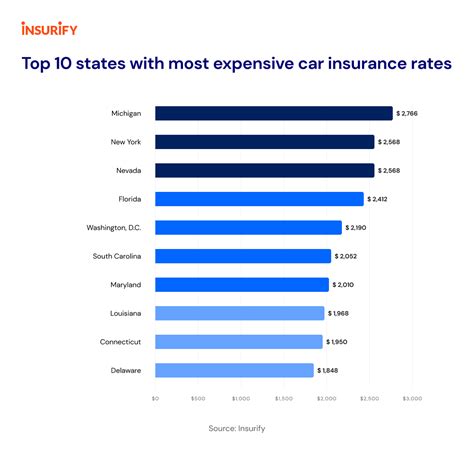

Cheap Car Insurance In Michigan

Michigan, known as the Great Lakes State, is a beautiful place to live and drive, but finding affordable car insurance can be a challenging task for residents. With unique insurance laws and a history of high rates, understanding the factors that influence costs and knowing how to navigate the market are crucial. This article aims to provide an in-depth guide to securing cheap car insurance in Michigan, offering valuable insights and strategies to help drivers save money without compromising on coverage.

Understanding Michigan’s Unique Insurance Landscape

Michigan has a reputation for high car insurance rates, which can be attributed to several factors. Firstly, the state operates under a no-fault insurance system, meaning that drivers must carry personal injury protection (PIP) coverage to cover their own medical expenses and lost wages after an accident, regardless of who is at fault. This unique system, aimed at providing quick and efficient compensation, often results in higher insurance premiums.

Additionally, Michigan has a high incidence of fraud, which further drives up insurance costs. Fraudulent activities, such as staged accidents and exaggerated injury claims, contribute to the overall cost of insurance for all drivers in the state. The state's dense population and high rates of car ownership also play a role in the higher insurance premiums.

Despite these challenges, there are strategies to find affordable car insurance in Michigan. Understanding the factors that influence rates and knowing how to optimize your coverage and shopping process can lead to significant savings.

Factors Influencing Car Insurance Rates in Michigan

Several key factors determine car insurance rates in Michigan. These include:

Driver Profile

- Age and Gender: Younger drivers, particularly males under 25, often face higher premiums due to their perceived higher risk of accidents. As drivers age, their rates typically decrease.

- Driving Record: A clean driving record with no accidents or violations can lead to lower premiums. Conversely, a history of accidents or traffic violations will increase insurance costs.

- Credit Score: In Michigan, insurance companies are allowed to consider credit scores when determining rates. A good credit score can result in lower premiums.

Vehicle Details

- Make and Model: Certain car makes and models are more expensive to insure due to higher repair costs or a higher likelihood of theft.

- Vehicle Usage: How and where you use your vehicle can impact rates. For instance, commuting long distances or driving in high-risk areas may lead to higher premiums.

- Safety Features: Vehicles equipped with advanced safety features like lane departure warning systems or automatic emergency braking may qualify for insurance discounts.

Location

The city or town where you reside and park your vehicle can significantly impact your insurance rates. Urban areas with higher populations and denser traffic often have higher insurance premiums due to increased accident risks and theft rates.

Insurance Coverage and Deductibles

The level of coverage you choose and your selected deductibles play a crucial role in determining your insurance costs. Higher coverage limits and lower deductibles generally result in higher premiums, while opting for lower coverage and higher deductibles can reduce your monthly payments.

Strategies to Find Cheap Car Insurance in Michigan

Despite the challenges of Michigan’s insurance landscape, there are effective strategies to find affordable coverage. Here are some tips to consider:

Shop Around and Compare Rates

Michigan has a competitive insurance market, so shopping around for quotes from multiple providers is essential. Use online quote comparison tools or work with an insurance broker who can provide quotes from various insurers. By comparing rates, you can identify the most affordable options for your specific circumstances.

Understand Your Coverage Needs

Assess your insurance needs and customize your coverage accordingly. While Michigan’s no-fault system requires you to carry PIP coverage, you can choose the level of coverage that suits your budget and preferences. Additionally, consider other coverages like collision, comprehensive, and liability insurance, tailoring them to your needs.

Explore Discounts

Insurance companies in Michigan offer a range of discounts to attract customers. These may include:

- Multi-Policy Discounts: Bundling your car insurance with other policies, such as home or renters insurance, can lead to significant savings.

- Safe Driver Discounts: Maintaining a clean driving record for a certain period often qualifies you for discounts.

- Good Student Discounts: Students with good grades (usually a GPA of 3.0 or higher) may be eligible for insurance discounts.

- Safety Feature Discounts: Having advanced safety features in your vehicle can result in lower premiums.

- Low Mileage Discounts: If you drive fewer miles annually, you may qualify for a low mileage discount.

Optimize Your Driving Habits

Practicing safe driving habits can not only reduce your risk of accidents but also lower your insurance premiums. Avoid driving during high-risk hours, such as rush hour traffic, and consider using public transportation or carpooling to reduce your mileage. Additionally, taking defensive driving courses can lead to insurance discounts and improved driving skills.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an option that charges premiums based on your actual driving habits. This type of insurance uses telematics devices to track factors like mileage, time of day, and braking habits. If you drive less frequently or have safer driving habits, you may qualify for lower premiums with usage-based insurance.

Review Your Policy Regularly

Insurance rates can change over time due to various factors, including changes in your personal circumstances, vehicle usage, or market conditions. Regularly reviewing your policy and shopping around for better rates can help you stay on top of potential savings opportunities.

Consider a Higher Deductible

Increasing your deductible can lead to lower insurance premiums. However, this strategy requires careful consideration, as it means you’ll have to pay more out of pocket in the event of a claim. Assess your financial situation and comfort level with risk before opting for a higher deductible.

Choosing the Right Insurance Provider

When selecting an insurance provider, it’s essential to consider factors beyond just the premium cost. Look for a reputable company with a strong financial standing and a good claims handling reputation. Read reviews and compare customer satisfaction ratings to ensure you’re choosing a provider who will deliver reliable service when you need it most.

Online Tools and Resources

Utilize online resources to streamline your insurance shopping process. Websites like the Michigan Department of Insurance and Financial Services provide valuable information on insurance laws, consumer guides, and resources to help you understand your rights and options as a Michigan driver.

Professional Advice

Consulting with an insurance professional can provide valuable insights tailored to your specific circumstances. An insurance agent or broker can guide you through the process, explain your coverage options, and help you identify potential savings opportunities.

Conclusion

Finding cheap car insurance in Michigan is achievable with the right knowledge and strategies. By understanding the unique insurance landscape, exploring your coverage options, and utilizing effective shopping techniques, you can secure affordable insurance without compromising on quality. Remember to regularly review your policy, shop around for better rates, and take advantage of available discounts to stay on top of your insurance costs.

Frequently Asked Questions

What is the average cost of car insurance in Michigan?

+

The average cost of car insurance in Michigan can vary widely based on individual factors such as age, driving record, and vehicle type. However, according to recent data, the average annual premium in Michigan is around $2,500.

How can I lower my car insurance premiums in Michigan?

+

To lower your premiums, consider shopping around for quotes from multiple insurers, exploring discounts such as multi-policy or safe driver discounts, optimizing your coverage needs, and practicing safe driving habits.

Are there any unique discounts available for Michigan residents?

+

Yes, Michigan residents may be eligible for unique discounts such as the Michigan Catastrophic Claims Association (MCC) surcharge reduction, which is applied to policies that include PIP coverage. Additionally, some insurers offer discounts for green vehicles or those equipped with advanced safety features.

Can I get cheap car insurance if I have a poor driving record?

+

While a poor driving record can significantly impact insurance rates, it’s still possible to find affordable coverage. Consider exploring usage-based insurance options, which may provide more favorable rates based on your actual driving habits rather than your history. Additionally, maintaining a clean driving record for a certain period may lead to lower premiums over time.