Home Insurance Quote

Securing home insurance is an essential step in protecting one of your most valuable assets. The process of obtaining a quote can be complex, as it involves various factors that insurance providers consider when assessing the risks associated with your property. This article aims to provide an in-depth guide to understanding the ins and outs of home insurance quotes, offering insights and tips to navigate this crucial financial decision.

Understanding Home Insurance Quotes

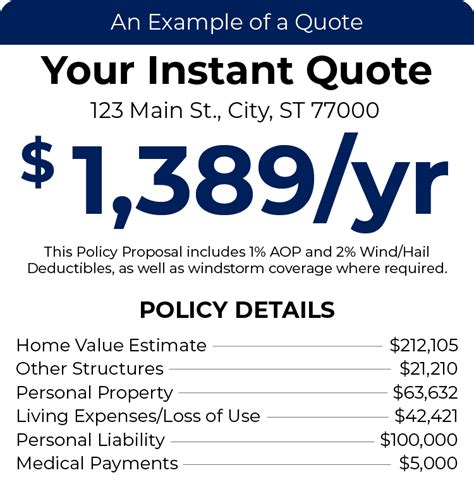

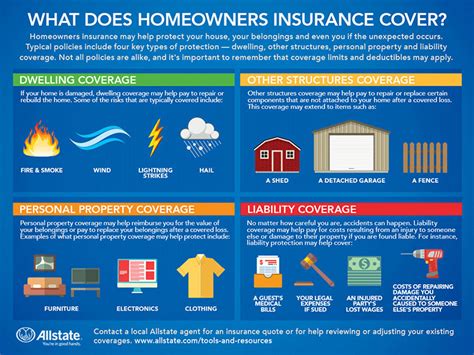

A home insurance quote is an estimate of the cost of insuring your home and its contents. It is tailored to your specific circumstances and provides an indication of the premium you would pay if you were to purchase a policy from the insurer. Quotes are influenced by a multitude of factors, each playing a significant role in determining the level of risk associated with insuring your home.

Key Factors Influencing Home Insurance Quotes

Several key factors contribute to the complexity of home insurance quotes. These include the location of your home, its construction and design, the value of your belongings, and any additional features or risks associated with the property. Let’s delve into each of these factors to gain a clearer understanding.

Location: The Role of Geography

One of the primary considerations in home insurance quotes is the geographical location of your property. Insurers assess the risks associated with various regions, taking into account factors such as crime rates, natural disasters, and even proximity to emergency services. For instance, homes in areas prone to flooding, wildfires, or hurricanes may attract higher premiums due to the increased likelihood of claims.

| Location Type | Insurance Risk |

|---|---|

| Coastal Regions | High risk of storms and flooding |

| Urban Areas | Increased crime rates and potential for vandalism |

| Rural Settings | Longer response times for emergency services |

Construction and Design: The Building’s Impact

The construction and design of your home are critical factors in determining insurance quotes. Insurers assess the age, type, and condition of your home, as well as any modifications or additions you’ve made. For example, older homes may require more extensive coverage due to potential issues with aging infrastructure, while newer homes may benefit from modern construction techniques that enhance resilience against natural disasters.

Value of Belongings: Assessing Your Assets

The value of your personal belongings is another crucial consideration in home insurance quotes. Insurers will ask about the contents of your home, including high-value items like jewelry, artwork, or electronics. Accurate valuation of your belongings ensures that you have sufficient coverage in the event of theft, damage, or loss. It’s essential to provide honest and detailed information to avoid underinsurance, which can lead to financial difficulties in the event of a claim.

Additional Features and Risks: A Comprehensive View

Home insurance quotes also take into account any additional features or risks associated with your property. This can include factors such as the presence of a swimming pool, trampolines, or home-based businesses. These features may increase the likelihood of accidents or claims, impacting the overall cost of your insurance.

| Additional Feature | Insurance Impact |

|---|---|

| Swimming Pool | Increased risk of accidents and liability claims |

| Home Office | Potential for higher coverage needs due to business-related risks |

| Trampoline | Higher risk of injuries, especially for children |

Obtaining a Home Insurance Quote

Now that we’ve explored the key factors influencing home insurance quotes, let’s delve into the process of obtaining a quote and the steps you can take to secure the best coverage for your needs.

The Quoting Process: Step-by-Step Guide

Obtaining a home insurance quote typically involves the following steps:

- Gathering Information: Before contacting an insurer, gather all relevant details about your home and its contents. This includes the age, construction type, square footage, and any recent renovations or additions. Make a list of valuable items and their estimated values, and consider any unique features or potential risks associated with your property.

- Selecting Insurers: Research and compare different insurance providers to find those that offer coverage tailored to your needs. Look for insurers with a solid reputation, financial stability, and a range of coverage options. Consider seeking recommendations from friends, family, or financial advisors.

- Contacting Insurers: Reach out to your selected insurers through their websites, by phone, or in person. Provide them with the detailed information you've gathered about your home and its contents. Be prepared to answer questions about your home's construction, any past claims, and the value of your belongings.

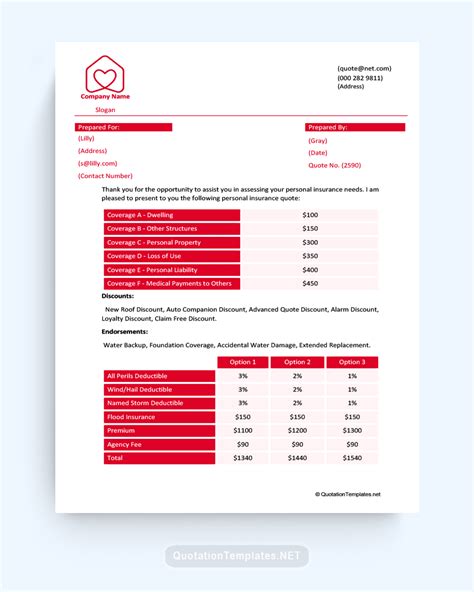

- Reviewing Quotes: Once you've received quotes from multiple insurers, carefully review and compare them. Look beyond just the premium cost and consider the coverage limits, deductibles, and any additional benefits or exclusions. Assess the financial stability and customer service reputation of each insurer.

- Negotiating and Finalizing: If you're satisfied with a particular quote, negotiate with the insurer to secure the best possible terms. Discuss any potential discounts, such as those for safety features, multi-policy discounts, or loyalty programs. Once you've agreed on the terms, finalize the policy and make the necessary payments.

Tips for Securing the Best Home Insurance Quote

To ensure you obtain the most advantageous home insurance quote, consider the following tips:

- Bundle Policies: Explore the option of bundling your home insurance with other policies, such as auto insurance or life insurance. Many insurers offer discounts for multiple policies, making it more cost-effective.

- Enhance Home Security: Install security features like alarm systems, surveillance cameras, or fire suppression systems. These measures can significantly reduce your insurance premiums by mitigating potential risks.

- Review Coverage Annually: Regularly review your home insurance policy to ensure it aligns with your changing needs and circumstances. Life events such as renovations, marriages, or the birth of a child may impact your coverage requirements.

- Understand Deductibles: Deductibles are the amount you pay out of pocket before your insurance coverage kicks in. Consider raising your deductible to lower your premium, but ensure it remains manageable in the event of a claim.

- Maintain a Clean Claims History: A history of frequent claims can lead to higher premiums or even policy cancellations. Aim to keep your claims record clean, and only file claims for significant losses.

Common Misconceptions and Frequently Asked Questions

Understanding home insurance quotes can be a complex process, and it’s natural to have questions and concerns. Let’s address some common misconceptions and provide answers to frequently asked questions.

Is home insurance mandatory?

+While home insurance is not legally mandatory in all regions, it is highly recommended. It provides financial protection against a range of risks, including fire, theft, and natural disasters. Without insurance, you may be left financially vulnerable in the event of an unforeseen circumstance.

How do I choose the right coverage limits?

+Choosing the right coverage limits involves assessing the value of your home and its contents. Ensure your coverage limits are sufficient to cover the cost of rebuilding or replacing your home and belongings. Consider working with an insurance agent or broker who can guide you through this process.

What happens if I underinsure my home?

+Underinsuring your home can leave you financially exposed in the event of a claim. If your home is damaged or destroyed, you may receive less than the actual cost of repairs or rebuilding. It's crucial to accurately assess the value of your home and its contents to avoid underinsurance.

Are there any discounts available for home insurance?

+Yes, many insurers offer discounts for various reasons. These can include discounts for bundling policies, installing security features, or being claim-free for a certain period. Additionally, some insurers provide loyalty discounts for long-term customers. It's worth inquiring about these discounts when obtaining quotes.

In conclusion, obtaining a home insurance quote is a crucial step in safeguarding your home and its contents. By understanding the key factors that influence quotes and following the outlined steps, you can secure the best coverage for your needs. Remember to regularly review and update your insurance policy to ensure it remains adequate as your circumstances change.