Insurance Plans Health

In today's complex and ever-evolving healthcare landscape, understanding the intricacies of insurance plans is crucial. The right health insurance coverage can be a game-changer, offering peace of mind and financial protection during unexpected medical emergencies. However, navigating the myriad of insurance options and their unique features can be a daunting task for many individuals and families. This comprehensive guide aims to shed light on the essential aspects of insurance plans, empowering readers to make informed decisions about their healthcare coverage.

Unraveling the Complexity: A Comprehensive Guide to Insurance Plans

Insurance plans are a fundamental component of modern healthcare systems, providing individuals and families with the means to access quality medical care without incurring substantial financial burdens. The complexity of these plans, however, often leaves consumers overwhelmed and unsure of their best options. This guide seeks to demystify the world of insurance plans, offering a clear and concise understanding of the key concepts, types, and considerations that underpin this critical aspect of healthcare.

Understanding the Fundamentals: Types of Insurance Plans

The insurance market offers a wide array of plan types, each with its own unique features and benefits. Here’s a breakdown of some of the most common types:

- Indemnity Plans (Fee-for-Service): These plans provide the most flexibility, allowing individuals to choose their healthcare providers without any restrictions. The insurer reimburses the policyholder based on the actual medical expenses incurred.

- Managed Care Plans:

- Health Maintenance Organizations (HMOs): HMOs typically require members to select a primary care physician (PCP) who coordinates their healthcare. Referrals are often necessary to see specialists, and services outside the network may not be covered.

- Preferred Provider Organizations (PPOs): PPOs offer more flexibility than HMOs, allowing members to choose any healthcare provider, although costs may be lower when using providers within the network. No referrals are typically required.

- Point-of-Service (POS) Plans: POS plans combine features of HMOs and PPOs. Members choose a PCP but have the option to receive out-of-network services with higher out-of-pocket costs.

- High-Deductible Health Plans (HDHPs) with Health Savings Accounts (HSAs): HDHPs have higher deductibles, but members can contribute to tax-advantaged HSAs to cover eligible medical expenses.

- Short-Term Health Insurance: Designed for temporary coverage, these plans offer limited benefits and may not cover pre-existing conditions.

Key Considerations for Choosing the Right Plan

Selecting the appropriate insurance plan involves careful consideration of various factors, including:

- Premium Costs: Balancing the cost of monthly premiums with the coverage needed is essential. Higher premiums may indicate more comprehensive coverage.

- Deductibles and Out-of-Pocket Limits: Understanding deductibles and out-of-pocket maximums is crucial. Higher deductibles can result in lower premiums, but members may need to pay more upfront before insurance coverage kicks in.

- Network of Providers: In-network providers are typically more cost-effective, so it’s important to ensure that preferred healthcare providers are included in the plan’s network.

- Coverage for Specific Services: Different plans may offer varying levels of coverage for services like prescription drugs, mental health treatment, and specialty care. Ensure the plan aligns with your healthcare needs.

- Flexibility and Customization: Some plans offer customizable options, allowing members to tailor coverage to their specific needs and budgets.

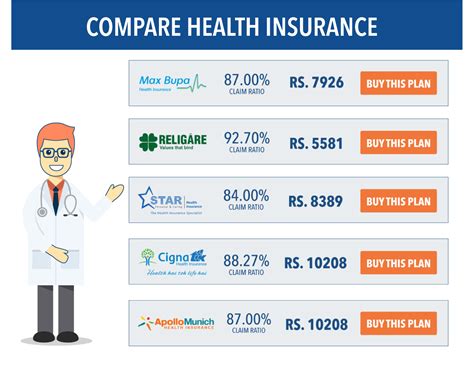

Analyzing Performance and Value: A Real-World Example

To illustrate the practical implications of these considerations, let’s examine a hypothetical scenario. Imagine a family with two parents and two children residing in a metropolitan area. They are considering two insurance plans: Plan A and Plan B.

| Plan | Premium | Deductible | Out-of-Pocket Max | Network Size | Prescription Coverage |

|---|---|---|---|---|---|

| Plan A | $500/month | $2,000 | $5,000 | Large Network | Generous Coverage |

| Plan B | $450/month | $3,000 | $7,000 | Limited Network | Basic Coverage |

In this scenario, Plan A offers a larger network and more comprehensive prescription coverage, which may be beneficial for a family with specific healthcare needs. However, the higher premium and deductible could be a financial burden, especially if the family doesn't anticipate significant medical expenses. On the other hand, Plan B provides a more cost-effective option with lower premiums and deductibles, but the limited network and basic prescription coverage may pose challenges.

This analysis highlights the importance of evaluating insurance plans based on individual circumstances and healthcare requirements. A deep understanding of these factors can empower consumers to make informed decisions, ensuring they select a plan that offers the best value and coverage for their unique situation.

The Future of Insurance Plans: Trends and Innovations

The insurance landscape is continuously evolving, driven by advancements in technology, changing consumer preferences, and shifting healthcare paradigms. Here’s a glimpse into some of the emerging trends and innovations shaping the future of insurance plans:

Telemedicine and Virtual Care

The integration of telemedicine and virtual care services into insurance plans is a growing trend. These technologies offer convenient access to healthcare professionals, reducing the need for in-person visits and associated costs. Many insurance providers now cover virtual consultations, providing policyholders with an efficient and cost-effective way to manage their healthcare needs.

Personalized Health Plans

The concept of personalized health plans is gaining traction, offering tailored coverage based on an individual’s unique health profile, risk factors, and lifestyle choices. These plans aim to provide more targeted and cost-effective coverage, addressing specific health concerns and promoting preventive care.

Incentivizing Healthy Behaviors

In an effort to encourage healthier lifestyles and reduce healthcare costs, some insurance providers are offering incentives for policyholders who engage in healthy behaviors. These incentives may include discounts on premiums, reward programs for meeting health goals, or reduced copayments for certain preventive services.

Digital Health Solutions

The rise of digital health solutions, such as health apps and wearable devices, is transforming the insurance industry. These technologies enable insurers to gather real-time health data, track policyholder behavior, and offer more personalized coverage and recommendations. Additionally, digital solutions streamline administrative processes, enhancing efficiency and reducing costs.

AI and Machine Learning

Artificial Intelligence (AI) and machine learning are being leveraged to analyze vast amounts of healthcare data, identify patterns, and make more accurate predictions about healthcare needs and costs. These technologies can enhance risk assessment, fraud detection, and claim processing, ultimately improving the efficiency and accuracy of insurance operations.

Conclusion: Navigating the Future with Confidence

As the insurance industry continues to evolve, staying informed about the latest trends and innovations is crucial for consumers. By understanding the potential benefits and implications of these advancements, individuals can make more proactive decisions about their healthcare coverage. The future of insurance plans promises increased personalization, improved access to care, and enhanced efficiency, ultimately empowering policyholders to take control of their health and financial well-being.

Frequently Asked Questions

How do I choose the right insurance plan for my family’s needs?

+When selecting an insurance plan for your family, consider factors such as your healthcare needs, the network of providers, prescription coverage, and cost. Evaluate the plan’s deductibles, out-of-pocket maximums, and premium costs, and ensure that it aligns with your family’s budget and anticipated healthcare expenses.

What is the difference between an HMO and a PPO plan?

+An HMO (Health Maintenance Organization) plan typically requires members to choose a primary care physician (PCP) and obtain referrals to see specialists. Services outside the network are often not covered. In contrast, a PPO (Preferred Provider Organization) plan offers more flexibility, allowing members to choose any healthcare provider, although costs may be lower when using in-network providers.

Can I switch insurance plans if I’m not satisfied with my current coverage?

+Yes, you have the option to switch insurance plans during open enrollment periods or if you experience a qualifying life event, such as a job change, marriage, or birth of a child. Review your plan’s guidelines and consult with insurance experts to understand your options for changing coverage.

What are the benefits of telemedicine and virtual care in insurance plans?

+Telemedicine and virtual care offer convenient access to healthcare services, reducing the need for in-person visits and associated costs. These technologies enhance accessibility, particularly for individuals with limited mobility or those residing in remote areas. Additionally, virtual consultations can be more efficient and cost-effective, providing timely medical advice and treatment.