Top Ten Car Insurance

Car insurance is a vital aspect of vehicle ownership, providing financial protection and peace of mind for drivers. With countless options available in the market, choosing the right car insurance can be a daunting task. This article aims to guide you through the process by presenting a comprehensive analysis of the top car insurance providers, highlighting their unique features, coverage options, and customer satisfaction.

The Importance of Car Insurance: Protecting Your Investment

Car insurance serves as a safety net, protecting drivers and their vehicles from financial burdens resulting from accidents, theft, or other unforeseen events. It is a legal requirement in most countries and plays a crucial role in ensuring road safety and accountability. By selecting the right insurance policy, drivers can customize their coverage to match their specific needs and preferences.

Top 10 Car Insurance Providers: A Comprehensive Overview

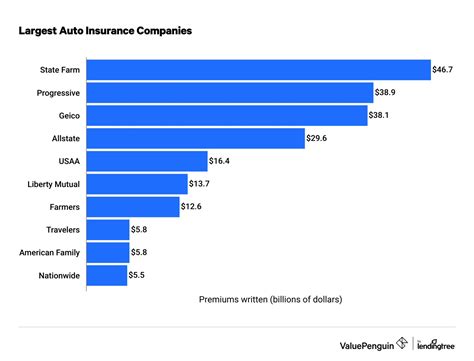

In the competitive world of car insurance, several providers have emerged as industry leaders, offering comprehensive coverage and exceptional customer service. Here, we present the top 10 car insurance providers, along with a detailed analysis of their key features and benefits.

1. State Farm

State Farm is one of the largest and most reputable car insurance providers in the United States. With a strong focus on customer satisfaction, they offer a wide range of coverage options, including liability, collision, comprehensive, and personal injury protection. State Farm’s innovative Drive Safe & Save program rewards safe driving habits with discounts, making it an attractive choice for conscientious drivers.

Key Features:

- Personalized coverage plans

- Competitive rates

- Discounts for safe driving and multiple policies

- 24⁄7 customer support

2. Geico

Geico, known for its catchy advertising campaigns, has built a solid reputation as a reliable car insurance provider. They offer a comprehensive suite of coverage options, catering to a wide range of drivers. Geico’s online platform provides a seamless experience, allowing customers to manage their policies efficiently and access their account information anytime, anywhere.

Key Features:

- Multiple coverage options

- Online policy management

- Discounts for military personnel and federal employees

- 24-hour claims service

3. Progressive

Progressive has revolutionized the car insurance industry with its innovative approach and technology-driven solutions. They offer a Name Your Price tool, allowing customers to choose their coverage limits and price range, giving them control over their policy. Progressive also provides a range of additional benefits, such as gap coverage and rental car reimbursement.

Key Features:

- Customizable coverage

- Discounts for safe driving and multi-policy holders

- Online policy comparison tool

- 24⁄7 claims reporting

4. Allstate

Allstate is a trusted name in the insurance industry, offering a comprehensive range of car insurance products. They provide personalized coverage plans, taking into account the unique needs of each driver. Allstate’s Drivewise program encourages safe driving by offering discounts based on driving behavior.

Key Features:

- Personalized coverage plans

- Discounts for safe driving and loyal customers

- 24⁄7 customer support and claims service

- Accident forgiveness options

5. USAA

USAA is a leading insurance provider specifically catering to military members, veterans, and their families. With a strong focus on customer service, they offer competitive rates and comprehensive coverage tailored to the unique needs of the military community. USAA’s Military Discount program provides significant savings for eligible policyholders.

Key Features:

- Military-focused coverage and discounts

- Competitive rates

- 24⁄7 customer support and claims service

- Vehicle storage and deployment coverage options

6. Farmers Insurance

Farmers Insurance is known for its commitment to customer service and community involvement. They offer a wide range of coverage options, including standard liability, comprehensive, and collision coverage. Farmers also provides additional benefits, such as rental car coverage and pet injury protection.

Key Features:

- Personalized coverage plans

- Community-focused initiatives

- Discounts for loyal customers and multiple policies

- 24⁄7 claims support

7. Liberty Mutual

Liberty Mutual is a well-established insurance provider, offering a comprehensive range of car insurance policies. They provide flexible coverage options, allowing customers to choose the level of protection that suits their needs. Liberty Mutual’s RightTrack program rewards safe driving with potential discounts.

Key Features:

- Flexible coverage options

- Discounts for safe driving and multi-policy holders

- Online policy management

- 24⁄7 claims assistance

8. Nationwide

Nationwide is a prominent insurance provider, offering a diverse range of car insurance policies. They cater to a wide spectrum of drivers, providing customized coverage plans. Nationwide’s Vanishing Deductible program rewards policyholders for accident-free years by reducing their deductible.

Key Features:

- Customizable coverage plans

- Accident-free rewards

- Discounts for safe driving and loyalty

- 24⁄7 claims support and roadside assistance

9. Esurance

Esurance is a tech-forward insurance provider, leveraging digital platforms to enhance the customer experience. They offer a wide range of coverage options, including standard liability, collision, and comprehensive coverage. Esurance’s online tools provide an efficient and convenient way to manage policies and file claims.

Key Features:

- Online policy management and claims filing

- Competitive rates

- Discounts for safe driving and multiple policies

- 24⁄7 customer support

10. Mercury Insurance

Mercury Insurance is a leading provider of car insurance, offering competitive rates and personalized coverage plans. They specialize in providing insurance for high-risk drivers, making them a reliable choice for those with unique insurance needs. Mercury’s Accident Forgiveness program offers a fresh start for drivers with a clean record.

Key Features:

- Personalized coverage for high-risk drivers

- Competitive rates

- Accident forgiveness options

- 24⁄7 claims service

Factors to Consider When Choosing Car Insurance

When selecting a car insurance provider, it’s essential to consider several key factors to ensure you choose the right policy for your needs. Here are some crucial aspects to evaluate:

- Coverage Options: Assess the range of coverage options provided by each insurer. Look for policies that offer comprehensive coverage, including liability, collision, comprehensive, and additional benefits like rental car reimbursement or roadside assistance.

- Pricing and Discounts: Compare prices and available discounts. Many insurers offer discounts for safe driving, multiple policies, or loyalty. These savings can significantly reduce your insurance premiums.

- Customer Service: Evaluate the insurer’s reputation for customer service. Look for providers with a strong track record of responsive and helpful customer support, as well as efficient claims handling.

- Policy Management: Consider the insurer’s online tools and resources for policy management. Efficient online platforms can streamline the process of updating your policy, making payments, and filing claims.

- Claims Process: Research the insurer’s claims process, including their response time, ease of filing a claim, and customer satisfaction ratings related to claims handling.

Tips for Getting the Best Car Insurance Deal

To ensure you secure the best car insurance deal, consider the following tips:

- Shop Around: Compare quotes from multiple insurers to find the best rates and coverage options that align with your needs.

- Bundle Policies: Consider bundling your car insurance with other policies, such as home or renters insurance, to potentially save on premiums.

- Review Your Coverage Annually: Regularly review your insurance policy to ensure it still meets your needs and take advantage of any new discounts or coverage options.

- Practice Safe Driving: Maintain a clean driving record to qualify for safe driver discounts and potentially lower your insurance premiums.

- Consider Additional Coverages: Evaluate your specific needs and consider adding optional coverages, such as gap insurance or rental car reimbursement, to enhance your protection.

The Future of Car Insurance: Trends and Innovations

The car insurance industry is constantly evolving, driven by technological advancements and changing consumer needs. Here are some trends and innovations shaping the future of car insurance:

- Telematics and Usage-Based Insurance (UBI): Telematics devices and UBI programs are gaining popularity, allowing insurers to track driving behavior and offer personalized premiums based on real-time data.

- Artificial Intelligence (AI) and Machine Learning: AI and machine learning are being utilized to improve risk assessment, streamline claims processing, and enhance customer service through chatbots and virtual assistants.

- Connected Car Technology: With the rise of connected car technology, insurers are exploring ways to leverage vehicle data to offer more accurate and customized insurance policies.

- Pay-As-You-Drive (PAYD) Insurance: PAYD insurance models are becoming more prevalent, allowing drivers to pay insurance premiums based on actual mileage, providing flexibility and potentially reducing costs for low-mileage drivers.

- In-Vehicle Safety Features: Insurers are increasingly offering discounts for vehicles equipped with advanced safety features, such as automatic emergency braking and lane departure warning systems.

Conclusion: Making an Informed Choice

Choosing the right car insurance provider is a critical decision that can impact your financial security and peace of mind. By evaluating the top insurance providers, considering key factors, and staying informed about industry trends, you can make an informed choice that best suits your needs. Remember to compare quotes, assess coverage options, and leverage discounts to secure the best car insurance deal.

FAQ

What is the average cost of car insurance in the United States?

+

The average cost of car insurance in the United States varies depending on factors such as location, driving record, and the coverage chosen. According to recent data, the national average annual premium is around $1,674. However, it’s important to note that rates can significantly differ based on individual circumstances.

Are there any discounts available for car insurance policies?

+

Yes, many car insurance providers offer a variety of discounts to help reduce premiums. Common discounts include safe driver discounts, multi-policy discounts (when you bundle car insurance with other policies), loyalty discounts, and discounts for certain professions or affiliations.

How can I file a claim with my car insurance provider?

+

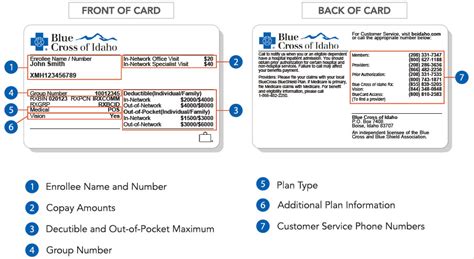

To file a claim with your car insurance provider, you typically need to contact their customer service or claims department. You’ll be guided through the process, which may involve providing details of the incident, photos or videos of the damage, and any relevant documentation. It’s advisable to review your policy’s specific claims process and have your policy information readily available.