The Personal Insurance

In today's dynamic world, safeguarding our personal assets and well-being has become an essential aspect of our lives. Personal insurance policies play a crucial role in providing financial security and peace of mind, offering protection against various unforeseen events and circumstances. This article delves into the realm of personal insurance, exploring its significance, types, benefits, and how it can be tailored to meet individual needs.

Understanding Personal Insurance

Personal insurance is a broad term encompassing various types of insurance policies designed to protect individuals and their families from financial losses arising from unforeseen events. These policies are tailored to cover specific risks and provide financial assistance during challenging times. The primary objective of personal insurance is to offer a safety net, ensuring individuals can maintain their standard of living and cover unexpected expenses without straining their finances.

The Importance of Personal Insurance

In an unpredictable world, personal insurance serves as a vital tool to mitigate risks and provide financial stability. Here’s why it is essential:

Financial Security

Personal insurance policies offer a robust financial safety net, protecting individuals and their families from potential financial ruin. By covering unexpected expenses, such as medical bills, property damage, or loss of income, personal insurance ensures individuals can maintain their financial stability and focus on recovery without the added burden of monetary concerns.

Peace of Mind

The knowledge that one has a comprehensive insurance policy in place provides a sense of reassurance and peace of mind. Knowing that you are financially protected against life’s uncertainties allows individuals to focus on their daily lives, careers, and personal goals without constant worry.

Risk Mitigation

Personal insurance helps individuals manage and mitigate various risks. Whether it’s health-related issues, accidents, natural disasters, or legal liabilities, insurance policies provide coverage for a wide range of scenarios, reducing the potential impact on an individual’s financial well-being.

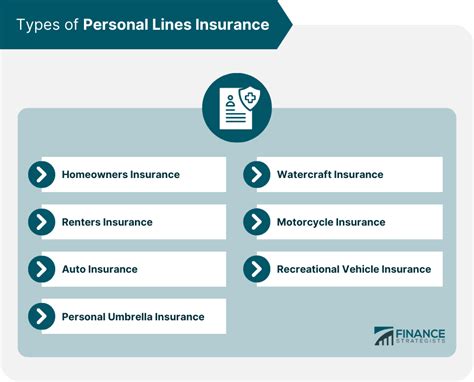

Types of Personal Insurance

Personal insurance encompasses a diverse range of policies, each designed to address specific needs and risks. Here are some common types of personal insurance:

Health Insurance

Health insurance is perhaps the most crucial form of personal insurance, covering medical expenses arising from illnesses, injuries, and preventive care. It ensures individuals have access to quality healthcare without incurring excessive costs. Health insurance policies vary, offering different coverage levels, deductibles, and co-payment structures.

Life Insurance

Life insurance provides financial protection to the policyholder’s family in the event of their death. It ensures that loved ones are taken care of financially, covering expenses such as funeral costs, outstanding debts, and providing a source of income for dependents. Life insurance policies come in various forms, including term life, whole life, and universal life insurance.

Disability Insurance

Disability insurance steps in when an individual is unable to work due to a disabling injury or illness. It provides a portion of the policyholder’s income, helping them meet financial obligations and maintain their standard of living. Disability insurance is especially crucial for individuals whose livelihoods depend on their physical or mental capabilities.

Property Insurance

Property insurance, including homeowners’ insurance and renters’ insurance, protects individuals’ assets, such as homes, apartments, and personal belongings. It covers damages caused by natural disasters, theft, or accidental damage, providing financial assistance for repairs or replacements.

Liability Insurance

Liability insurance safeguards individuals from financial losses arising from legal liabilities. This includes accidents, injuries, or property damage caused by the policyholder, for which they may be held responsible. Liability insurance is essential for individuals who own property or engage in activities that could potentially lead to legal claims.

Travel Insurance

Travel insurance provides coverage for unexpected events while traveling, such as trip cancellations, medical emergencies, or lost luggage. It offers peace of mind during vacations or business trips, ensuring individuals can address unforeseen circumstances without incurring substantial financial losses.

Benefits of Personal Insurance

Personal insurance offers a multitude of benefits, making it an indispensable tool for financial planning and risk management. Here are some key advantages:

Risk Coverage

Personal insurance policies cover a wide range of risks, from health-related issues to property damage and legal liabilities. By insuring against these risks, individuals can avoid significant financial losses and maintain their financial stability.

Financial Planning

Insurance policies provide a structured approach to financial planning. By paying regular premiums, individuals can systematically build a financial safety net, ensuring they are prepared for unexpected events and can manage their finances effectively.

Peaceful Retirement

For individuals approaching retirement, personal insurance plays a vital role in ensuring a comfortable and worry-free retirement. Life insurance and health insurance policies provide financial support during retirement, covering medical expenses and ensuring a steady income stream for retired individuals.

Tax Benefits

Certain personal insurance policies, such as health insurance and life insurance, offer tax benefits. These benefits can reduce the overall tax liability, providing additional financial advantages to policyholders.

Tailored Coverage

Personal insurance policies can be customized to meet individual needs. Policyholders can choose coverage limits, deductibles, and additional riders to ensure their insurance plan aligns with their specific requirements and financial capabilities.

Choosing the Right Personal Insurance

Selecting the appropriate personal insurance policies can be a complex task, given the multitude of options available. Here are some key considerations to help individuals make informed decisions:

Assess Your Needs

Begin by evaluating your personal and financial situation. Identify the risks you want to insure against and the level of coverage you require. Consider factors such as your age, health, occupation, assets, and financial goals.

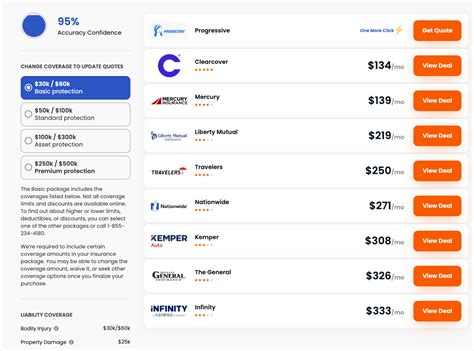

Research Insurance Providers

Explore different insurance providers and compare their offerings. Look for reputable companies with a strong financial background and positive customer reviews. Evaluate their policies, coverage limits, deductibles, and additional benefits to find the best fit for your needs.

Understand Policy Terms

Read the policy documents carefully to understand the terms and conditions. Pay attention to coverage limits, exclusions, and any specific conditions that may impact your claim eligibility. Ensure you are comfortable with the policy’s terms before making a commitment.

Seek Professional Advice

Consider consulting an insurance advisor or financial planner who can provide expert guidance based on your specific circumstances. They can help you navigate the complexities of personal insurance and ensure you make informed choices.

Compare Premiums

Premiums, or the regular payments for insurance coverage, vary between providers and policies. Compare the premiums to find a balance between affordable coverage and the level of protection you require. Remember, the lowest premium may not always offer the best value.

Personal Insurance and the Future

The landscape of personal insurance is evolving, driven by technological advancements and changing consumer needs. Here’s a glimpse into the future of personal insurance:

Digitalization

The insurance industry is embracing digitalization, with online platforms and mobile apps making it easier for individuals to access and manage their insurance policies. Digital insurance provides convenience, real-time updates, and efficient claim processes, enhancing the overall customer experience.

Personalized Coverage

Advancements in data analytics and machine learning enable insurance providers to offer more personalized coverage. By analyzing individual risk factors and lifestyle choices, insurance companies can tailor policies to meet specific needs, providing precise and efficient protection.

Wellness and Prevention

The focus on wellness and preventive care is gaining prominence in the insurance industry. Health insurance policies are increasingly incorporating incentives and rewards for policyholders who maintain healthy lifestyles, encouraging proactive health management and reducing the need for costly medical interventions.

AI-Powered Claims

Artificial Intelligence (AI) is revolutionizing the claims process, making it faster and more efficient. AI-powered systems can analyze and process claims data, reducing the time and effort required for claim settlements. This technology ensures policyholders receive timely compensation, enhancing their overall satisfaction.

Environmental and Sustainability Focus

With growing environmental concerns, insurance providers are exploring ways to support sustainability. Some companies offer incentives for policyholders who adopt eco-friendly practices, while others are developing specialized insurance products to address climate-related risks, such as natural disasters and extreme weather events.

Conclusion

Personal insurance is a powerful tool for individuals to secure their financial future and protect against life’s uncertainties. By understanding the different types of personal insurance, their benefits, and how to choose the right policies, individuals can make informed decisions to safeguard their well-being and that of their loved ones. As the insurance industry continues to evolve, embracing technology and sustainability, personal insurance will play an even more pivotal role in shaping a financially secure and resilient future.

What is the difference between term life insurance and whole life insurance?

+Term life insurance provides coverage for a specific period, typically 10-30 years, and is generally more affordable. Whole life insurance, on the other hand, offers lifelong coverage and accumulates cash value over time, making it more expensive but providing long-term financial benefits.

How can I determine the right amount of life insurance coverage?

+Determining the right coverage amount involves considering factors such as your income, debts, outstanding loans, and financial obligations. A general rule of thumb is to aim for coverage that is 10-15 times your annual income, but it’s essential to consult a financial advisor for a personalized assessment.

What should I do if I need to file an insurance claim?

+If you need to file an insurance claim, contact your insurance provider as soon as possible. Provide them with all relevant details and documentation related to the incident. Follow their instructions and cooperate with any investigations to ensure a smooth claims process.

Can I switch insurance providers or policies?

+Yes, you can switch insurance providers or policies. However, it’s essential to review your current policy’s terms and conditions, especially regarding cancellation fees or penalties. Compare different providers and policies to find the best fit for your needs and ensure a seamless transition.

How often should I review my personal insurance coverage?

+It’s recommended to review your personal insurance coverage annually or whenever there are significant life changes, such as marriage, the birth of a child, purchasing a new home, or starting a new business. Regular reviews ensure your coverage remains adequate and aligned with your evolving needs.