The General Car Insurance Login

Welcome to our comprehensive guide on "The General Car Insurance Login." In this article, we will explore the process of accessing your car insurance account with The General, a renowned insurance provider. Whether you're a new policyholder or an existing customer, understanding how to log in securely and efficiently is essential for managing your insurance needs. Let's dive into the details and uncover the steps to a seamless login experience.

Understanding The General Car Insurance Login

The General Car Insurance, a subsidiary of American Family Insurance, offers a user-friendly online platform for policyholders to manage their car insurance policies. The login process is designed to provide secure access to your account, allowing you to view policy details, make payments, update personal information, and access various insurance-related services.

With a focus on convenience and customer satisfaction, The General has implemented a straightforward login system, ensuring a hassle-free experience for its customers. In this section, we will break down the login process step by step, providing you with a clear understanding of how to access your car insurance account effortlessly.

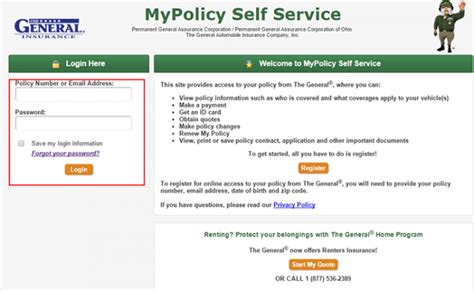

Step 1: Navigating to the Login Page

To begin the login process, you'll need to access the official login page of The General Car Insurance. This can be easily done by visiting their website directly or by using the dedicated login URL, which is typically https://www.thegeneral.com/login. This URL will direct you to the secure login portal, ensuring a safe and encrypted connection.

Alternatively, if you have bookmarked the login page or have received an email with a direct link, you can simply click on the provided link to access the login page instantly. The General prioritizes user convenience, making the login process accessible and straightforward.

Step 2: Entering Your Credentials

Once you're on the login page, you'll be greeted with a simple and intuitive interface. Here, you'll need to enter your login credentials, which typically consist of your username or email address and your corresponding password.

If you're a new user or have forgotten your login details, The General provides a convenient "Forgot Username/Password" link on the login page. By clicking on this link, you'll be guided through a secure process to retrieve or reset your login information. This ensures that your account remains secure and accessible, even if you encounter any login-related challenges.

For added security, The General may also employ additional authentication measures, such as two-factor authentication (2FA). This extra layer of security ensures that only authorized individuals can access your account, providing peace of mind and protecting your sensitive insurance information.

Step 3: Logging In and Exploring Your Account

After successfully entering your credentials, you'll gain access to your personalized car insurance dashboard. Here, you'll find a wealth of information and tools to manage your policy effectively. The dashboard typically includes the following key features:

- Policy Overview: A comprehensive summary of your car insurance policy, including coverage details, policy limits, and renewal dates.

- Payment Options: Secure and convenient methods to make insurance payments, such as credit card, debit card, or electronic funds transfer.

- Policy Updates: The ability to update personal information, add or remove vehicles, and make changes to your coverage as needed.

- Claims Center: A dedicated section to report and track claims, providing a streamlined process for handling any insurance-related incidents.

- Help and Support: Access to customer support resources, including FAQs, contact information, and live chat or phone support options.

The General's online platform is designed with user experience in mind, offering a seamless and intuitive interface. You can easily navigate through different sections, access important documents, and stay informed about your car insurance policy at all times.

Security Measures and Best Practices

Maintaining the security of your insurance account is of utmost importance. The General employs robust security measures to protect your personal and financial information. Here are some best practices to ensure a secure login experience:

- Use Strong Passwords: Create unique and complex passwords that include a combination of uppercase and lowercase letters, numbers, and special characters. Avoid using easily guessable information, such as your name or birthdate.

- Enable Two-Factor Authentication: Take advantage of The General's 2FA option to add an extra layer of security. This typically involves receiving a one-time code via SMS or an authentication app, ensuring that only you can access your account.

- Regularly Update Your Credentials: It's a good practice to change your password periodically to further enhance security. This prevents unauthorized access and ensures that your account remains protected.

- Use Secure Devices and Networks: Access your insurance account from trusted devices and secure networks. Avoid public Wi-Fi networks, as they may pose security risks. Ensure your devices have up-to-date antivirus software installed.

By following these security best practices, you can rest assured that your car insurance account with The General is well-protected, allowing you to manage your policy with peace of mind.

Benefits of Online Account Management

Logging into your car insurance account with The General offers a range of benefits that enhance your overall insurance experience. Here's a closer look at some of the advantages:

Convenience and Accessibility

The online login platform provides 24/7 accessibility, allowing you to manage your insurance needs at your convenience. Whether you're at home, on the go, or traveling, you can access your account from any device with an internet connection. This flexibility ensures that you're always in control of your policy, making it easy to make payments, view policy details, and stay informed.

Real-Time Updates and Notifications

With The General's online account management, you'll receive real-time updates and notifications regarding your car insurance policy. This includes important reminders, such as upcoming renewal dates, payment due dates, and any changes to your coverage. By staying informed, you can ensure that your policy remains up-to-date and aligned with your insurance requirements.

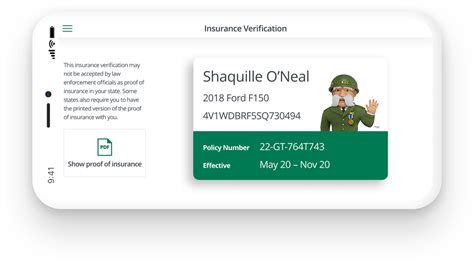

Paperless Documentation and Storage

The General's online platform promotes a paperless environment, allowing you to access and store important insurance documents digitally. You can easily download and save policy documents, ID cards, and other relevant paperwork, ensuring that you always have access to them when needed. This eco-friendly approach reduces paper waste and provides a convenient way to organize your insurance-related files.

Quick Claims Processing

In the event of an insurance claim, having access to your online account can significantly streamline the claims process. The General's online platform offers a dedicated claims center, where you can initiate and track your claims in real-time. This efficient process saves time and ensures that your claim is processed promptly, providing you with the support you need during unexpected incidents.

Exploring Additional Features and Resources

Beyond the basic login and account management features, The General's online platform offers a range of additional tools and resources to enhance your insurance experience. Let's explore some of these valuable features:

Policy Comparison and Customization

The General understands that insurance needs can vary, and they provide a user-friendly platform to compare and customize your car insurance policy. You can easily explore different coverage options, adjust limits, and choose add-ons that align with your specific requirements. This flexibility ensures that you're getting the right coverage at a competitive price.

Educational Resources and Tips

The General believes in empowering its customers with knowledge. Their online platform often includes educational resources, articles, and tips related to car insurance. These resources cover a wide range of topics, from understanding different coverage types to staying informed about insurance trends. By providing valuable insights, The General ensures that you're well-equipped to make informed decisions about your insurance coverage.

Roadside Assistance and Emergency Services

In the event of a roadside emergency, The General's online platform can be a lifesaver. Many insurance providers, including The General, offer roadside assistance services that can be accessed through your online account. These services may include towing, battery jump-starts, flat tire changes, and even emergency fuel delivery. Having this information readily available ensures that you can quickly access the necessary support during unexpected situations.

Partner Discounts and Rewards

The General often partners with various businesses and organizations to offer exclusive discounts and rewards to its policyholders. These partnerships can provide savings on everyday expenses, such as dining, shopping, or entertainment. By logging into your account, you can explore these partnerships and take advantage of the discounts and rewards available to you as a valued customer.

Frequently Asked Questions (FAQ)

Q: Can I log in to my account using my mobile device?

+Yes, The General's login platform is optimized for mobile devices, ensuring a seamless login experience on smartphones and tablets. You can access your account on the go, making it convenient to manage your insurance needs anytime, anywhere.

<div class="faq-item">

<div class="faq-question">

<h3>Q: What if I forget my username or password?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The General provides a "Forgot Username/Password" link on the login page. By clicking on this link, you'll be guided through a secure process to retrieve or reset your login information. Follow the instructions provided to regain access to your account.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Q: How can I update my personal information or add a new vehicle to my policy?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Once logged in, navigate to the "Policy Updates" section of your dashboard. Here, you'll find options to update personal details, add or remove vehicles, and make other necessary changes to your car insurance policy. Simply follow the prompts and provide the required information to ensure your policy remains accurate.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Q: Is my insurance account information secure on The General's platform?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Absolutely! The General prioritizes the security of your account and employs robust measures to protect your personal and financial information. The platform utilizes encryption protocols and may offer additional security features like two-factor authentication (2FA) to ensure that your data remains safe and secure.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Q: Can I pay my insurance premiums online?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, The General offers convenient online payment options. Once logged in, navigate to the "Payment Options" section of your dashboard. Here, you'll find various payment methods, including credit card, debit card, or electronic funds transfer. Simply select your preferred method and follow the prompts to make a secure payment.</p>

</div>

</div>

</div>

Logging into your car insurance account with The General is a straightforward and secure process, providing you with the tools and resources to manage your policy effectively. By following the steps outlined in this guide and utilizing the additional features available on their online platform, you can make the most of your insurance experience. Stay informed, stay secure, and enjoy the convenience of online account management with The General Car Insurance.