Health Insurance Travel Us

The concept of health insurance for travel within the United States is an essential aspect of healthcare coverage that often goes overlooked by many individuals. While the US healthcare system is renowned for its advanced medical facilities and expertise, the cost of medical treatments can be astronomical, especially for those without adequate insurance coverage. This article aims to provide a comprehensive guide to understanding the intricacies of health insurance for travel within the US, covering everything from the basics to advanced strategies for optimizing coverage.

Understanding Health Insurance for Travel in the US

Health insurance is a crucial component of financial planning, especially when it comes to travel. For US citizens and residents, having appropriate health insurance coverage is not only a wise decision but often a legal requirement. While traveling within the US, unexpected medical emergencies can occur, and the costs associated with such incidents can be substantial. This is where health insurance plays a vital role in providing financial protection and access to quality healthcare.

Health insurance policies for travel within the US typically offer coverage for a wide range of medical services, including emergency room visits, hospital stays, surgical procedures, prescription medications, and sometimes even mental health services. The level of coverage and the specific benefits provided can vary significantly depending on the insurance plan and the insurer.

Key Considerations for Choosing Health Insurance

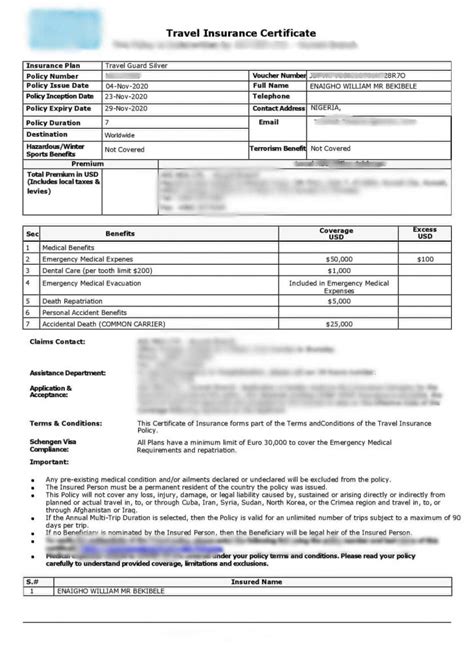

When selecting a health insurance plan for travel within the US, there are several key factors to consider. Firstly, it is essential to understand the scope of coverage provided by the plan. This includes the types of medical services covered, any limitations or exclusions, and the level of financial protection offered. Plans with higher premiums often provide more comprehensive coverage, but it is crucial to assess your individual needs and the likelihood of requiring specific types of medical care.

Additionally, the network of healthcare providers associated with the insurance plan is a critical consideration. Some insurance plans have preferred provider organizations (PPOs) or health maintenance organizations (HMOs) that restrict the choice of healthcare facilities and practitioners. It is advisable to choose a plan that offers a wide network of providers, especially if you have a preferred hospital or specialist you wish to visit.

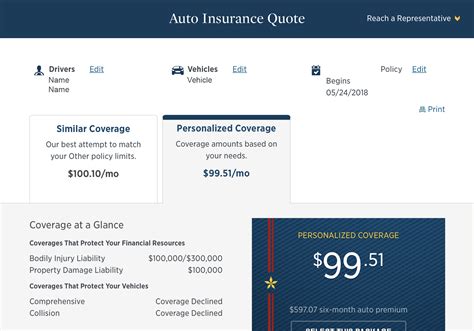

Another important factor is the cost-sharing structure of the plan. This refers to the out-of-pocket expenses you may incur, such as deductibles, copayments, and coinsurance. Plans with lower premiums often have higher cost-sharing amounts, so it is essential to strike a balance between affordability and financial protection. Understanding the cost-sharing structure can help you estimate the potential out-of-pocket costs you may face in the event of a medical emergency.

| Insurance Plan | Premium Cost | Deductible | Copayment | Coinsurance |

|---|---|---|---|---|

| Plan A | $350/month | $1,500 | 20% | 80% |

| Plan B | $400/month | $1,000 | 15% | 75% |

| Plan C | $500/month | $500 | 10% | 60% |

Navigating the US Healthcare System with Health Insurance

Once you have chosen an appropriate health insurance plan for your travel within the US, it is essential to understand how to navigate the healthcare system effectively. This involves knowing how to utilize your insurance coverage, choose the right healthcare providers, and manage any potential issues that may arise.

Using Your Health Insurance Effectively

Understanding the specifics of your health insurance plan is key to making the most of your coverage. Familiarize yourself with the plan’s benefits, including any pre-authorization requirements for specific treatments or procedures. Knowing your coverage limits and any out-of-pocket expenses can help you budget effectively and plan for any potential costs.

It is also beneficial to have a clear understanding of your insurance plan's network of providers. Many plans offer discounts or preferred rates when you visit in-network healthcare facilities and practitioners. Utilizing these networks can help you save money and ensure that your insurance coverage is maximized.

Choosing the Right Healthcare Providers

When it comes to choosing healthcare providers, it is essential to consider factors such as proximity, reputation, and specialization. If you have a specific medical condition or require specialized care, it is advisable to research and select providers with expertise in those areas. Online reviews and recommendations from trusted sources can be valuable in making informed decisions.

Additionally, it is crucial to verify that your chosen healthcare providers accept your insurance plan. Some providers may only accept certain insurance plans or may have specific requirements for out-of-network coverage. Checking with both your insurance provider and the healthcare facility beforehand can help avoid unexpected costs or complications.

Managing Potential Issues

Despite your best efforts, unexpected issues can still arise when utilizing health insurance for travel within the US. These may include denied claims, billing errors, or disputes with healthcare providers. It is important to be proactive in addressing such issues and knowing your rights as an insured individual.

If you encounter a denied claim, it is advisable to contact your insurance provider promptly to understand the reason for the denial and explore any available appeal options. Similarly, if you identify any billing errors, such as incorrect charges or overcharges, it is essential to bring these to the attention of both your insurance provider and the healthcare facility to resolve the issue promptly.

Maximizing Health Insurance Benefits for Travel

To get the most out of your health insurance coverage while traveling within the US, there are several strategies and best practices you can employ. These strategies can help you optimize your benefits, minimize costs, and ensure a smoother healthcare experience.

Pre-Travel Planning and Preparation

Before embarking on your travel, it is crucial to take the time to thoroughly review your health insurance plan and understand its coverage limits and exclusions. This includes familiarizing yourself with any pre-existing condition limitations and any requirements for obtaining prior authorization for specific treatments or procedures.

Additionally, it is beneficial to create a list of essential contact information, including your insurance provider's customer service number, as well as any emergency hotlines or helplines provided by your insurance plan. Having this information readily available can be invaluable in the event of a medical emergency.

Utilizing Telehealth Services

Telehealth services have become increasingly popular and widely available, providing a convenient and accessible way to receive medical advice and care remotely. Many health insurance plans now offer telehealth benefits, allowing you to consult with healthcare professionals via video conferencing, telephone calls, or secure messaging platforms.

Utilizing telehealth services can be especially beneficial when traveling within the US, as it eliminates the need to visit a physical healthcare facility for minor ailments or non-emergency situations. This not only saves time and money but also reduces the risk of exposure to potential infections or illnesses.

Managing Chronic Conditions

If you have a chronic condition, such as diabetes, asthma, or hypertension, it is crucial to ensure that your health insurance plan provides adequate coverage for the management and treatment of your condition. This includes coverage for prescription medications, regular check-ups, and any specialized treatments or therapies you may require.

It is also advisable to have a sufficient supply of any necessary medications before you travel. This can help avoid potential interruptions in your treatment and ensure that you have access to your medications even if you encounter delays or unexpected circumstances during your journey.

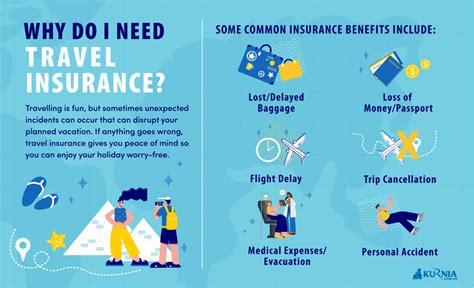

Understanding Emergency Care Coverage

While no one plans for a medical emergency, it is essential to understand how your health insurance plan covers emergency care. This includes understanding the process for accessing emergency services, any specific requirements for out-of-network emergency care, and the potential out-of-pocket costs associated with emergency treatments.

It is also beneficial to be aware of any limitations or exclusions related to emergency care coverage. For example, some insurance plans may have specific requirements for follow-up care or may not cover certain types of emergency transportation, such as air ambulance services.

Conclusion: Empowering Your Healthcare Journey

Health insurance for travel within the US is an essential tool for protecting your financial well-being and ensuring access to quality healthcare. By understanding the intricacies of your insurance plan, navigating the healthcare system effectively, and employing strategic best practices, you can optimize your coverage and make the most of your healthcare benefits.

Remember, being proactive, well-informed, and prepared can make a significant difference in your healthcare journey. Stay informed about your insurance coverage, choose your healthcare providers wisely, and don't hesitate to seek assistance or clarification from your insurance provider when needed. With the right approach, you can empower yourself to make the most of your health insurance and travel with peace of mind.

What happens if I require emergency medical care while traveling within the US, and I don’t have health insurance coverage?

+In the event of an emergency, it is important to seek medical attention regardless of your insurance status. However, without health insurance, you may be responsible for the full cost of your medical care, which can be extremely expensive. It is advisable to purchase travel health insurance or check if your existing health insurance plan provides coverage for emergency care while traveling within the US.

Are there any government-funded healthcare programs that provide coverage for low-income individuals traveling within the US?

+Yes, there are government-funded healthcare programs such as Medicaid and the Children’s Health Insurance Program (CHIP) that provide coverage for low-income individuals and families. These programs vary by state, so it is essential to check the specific eligibility requirements and coverage details for your state.

Can I use my health insurance plan from my home state while traveling within the US?

+Most health insurance plans provide coverage for out-of-state travel within the US. However, it is crucial to review your plan’s benefits and network of providers to understand any limitations or restrictions. Some plans may require prior authorization for out-of-state care, while others may have specific requirements for obtaining emergency treatment while traveling.