Homeowners Insurance Coverages Explained

Homeowners insurance is a vital aspect of protecting one's most valuable asset—their home. This essential coverage provides financial security and peace of mind to homeowners, ensuring they are prepared for unexpected events and potential disasters. With a wide range of coverages available, it's crucial to understand the intricacies of homeowners insurance to make informed decisions and secure the right protection for your home and belongings.

Understanding the Basics of Homeowners Insurance

Homeowners insurance, often referred to as home insurance, is a comprehensive policy designed to safeguard your residence and its contents from various perils. It serves as a safety net, offering financial compensation in the event of damage, loss, or liability arising from covered incidents. Here’s a closer look at the fundamental aspects of homeowners insurance.

Key Components of a Homeowners Insurance Policy

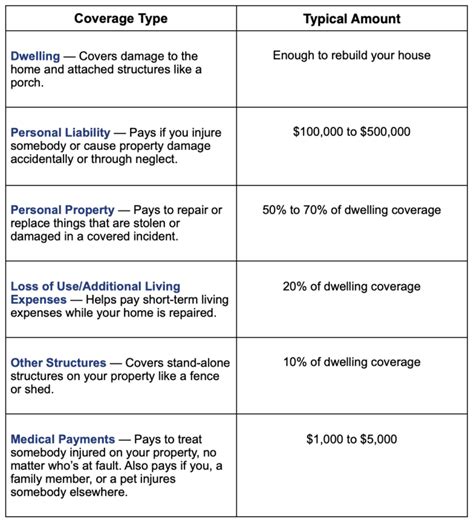

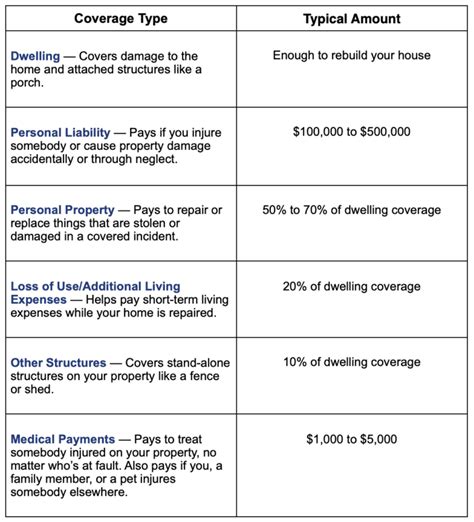

A typical homeowners insurance policy consists of several critical components, each offering specific types of coverage. These include:

- Dwelling Coverage: This is the core of your policy, providing protection for the structure of your home. It covers repairs or rebuilding costs if your home is damaged due to covered perils such as fire, storms, or vandalism.

- Personal Property Coverage: This coverage safeguards the contents of your home, including furniture, electronics, clothing, and other personal belongings. It ensures that if these items are damaged or stolen, you can replace them.

- Liability Coverage: Liability protection is a crucial aspect of homeowners insurance. It covers you in case someone is injured on your property or if you are found legally responsible for causing property damage or bodily injury to others.

- Additional Living Expenses (ALE): In the event your home becomes uninhabitable due to a covered loss, ALE coverage provides financial assistance for temporary living expenses, such as hotel stays or restaurant meals, until you can return to your home.

- Medical Payments Coverage: This coverage offers medical expense reimbursement for injuries sustained by guests on your property, regardless of liability.

Common Perils Covered by Homeowners Insurance

Homeowners insurance policies typically provide coverage for a wide range of perils, including but not limited to:

- Fire

- Lightning

- Windstorms (including hurricanes and tornadoes)

- Hail

- Explosions

- Smoke

- Vandalism

- Theft

- Falling objects (such as trees or branches)

- Weight of ice and snow

- Freezing of plumbing (sudden and accidental)

- Damage from vehicles (such as a car crashing into your home)

It's important to note that floods and earthquakes are not typically covered by standard homeowners insurance policies. Separate policies or endorsements are often required for these specific perils.

Policy Deductibles and Limits

When purchasing homeowners insurance, you’ll need to consider the policy deductible and coverage limits. The deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Higher deductibles often result in lower premiums, so it’s a balance between affordability and financial preparedness.

Coverage limits, on the other hand, refer to the maximum amount your insurance company will pay for a covered loss. It's crucial to ensure that your coverage limits align with the actual value of your home and its contents to avoid underinsurance.

| Policy Component | Description |

|---|---|

| Dwelling Coverage | Covers the structure of your home, including walls, roof, and permanent fixtures. |

| Personal Property Coverage | Protects your belongings inside the home, from furniture to electronics. |

| Liability Coverage | Provides financial protection if you're sued or found legally responsible for injuries or property damage. |

| Additional Living Expenses (ALE) | Covers temporary living expenses if your home becomes uninhabitable due to a covered loss. |

| Medical Payments Coverage | Reimburses medical expenses for injuries sustained by guests on your property. |

Additional Coverages and Endorsements

While the standard homeowners insurance policy offers a robust range of coverages, certain unique circumstances or high-value items may require additional protection. Here’s an exploration of some of the most common additional coverages and endorsements available.

Valuable Personal Property Coverage

For homeowners with high-value items such as jewelry, fine art, collectibles, or expensive electronics, standard personal property coverage may not provide sufficient protection. Valuable personal property coverage, also known as schedules or riders, allows you to specify and insure these items separately. This ensures that you receive the full replacement cost for these valuable possessions in the event of a loss.

Water Backup Coverage

Water backup coverage is an essential endorsement for homeowners concerned about the potential for water damage. This coverage provides protection in the event that water backs up through sewers or drains, causing damage to your home or its contents. It’s particularly beneficial for homes with basements or those located in areas prone to heavy rainfall or flooding.

Identity Theft Coverage

In today’s digital age, identity theft has become an increasingly common concern. Identity theft coverage provides financial assistance and resources to help you recover from identity theft. This coverage can include reimbursement for expenses incurred while restoring your identity, as well as access to credit monitoring services.

Business Pursuits Coverage

If you operate a home-based business, your standard homeowners insurance policy may not provide adequate liability coverage. Business pursuits coverage extends your liability protection to cover business-related activities conducted from your home. This endorsement ensures that you’re protected in the event of a lawsuit arising from your business operations.

Personal Liability Umbrella Coverage

For homeowners seeking an extra layer of liability protection, personal liability umbrella coverage is an excellent option. This endorsement provides additional liability coverage beyond the limits of your standard homeowners insurance policy. It’s particularly beneficial for those with substantial assets or who engage in high-risk activities, as it offers protection against catastrophic losses.

| Additional Coverage | Description |

|---|---|

| Valuable Personal Property Coverage | Provides separate coverage for high-value items like jewelry and art. |

| Water Backup Coverage | Protects against water damage from sewer or drain backups. |

| Identity Theft Coverage | Offers financial assistance and resources for identity theft recovery. |

| Business Pursuits Coverage | Extends liability protection for home-based businesses. |

| Personal Liability Umbrella Coverage | Provides an additional layer of liability coverage for high-risk individuals or activities. |

Understanding Policy Exclusions and Limitations

While homeowners insurance provides extensive coverage, it’s important to understand the limitations and exclusions that may apply to your policy. These exclusions are critical to review to ensure you’re fully aware of the scenarios where your insurance coverage may not apply.

Common Policy Exclusions

Here are some of the most common exclusions and limitations found in homeowners insurance policies:

- Earth Movement: Standard homeowners insurance policies typically exclude coverage for damage caused by earthquakes, volcanic eruptions, and landslides. Separate policies or endorsements are required for these perils.

- Flooding: Flood damage, whether from heavy rainfall, overflowing rivers, or coastal storms, is generally not covered by homeowners insurance. A separate flood insurance policy is necessary to protect against this peril.

- Intentional Acts: Homeowners insurance does not cover damage or losses caused by intentional acts, such as arson or vandalism committed by the policyholder or their household members.

- Ordinary Maintenance: The policy does not cover damage resulting from a lack of proper maintenance, such as roof leaks due to neglected repairs.

- Nuclear Hazards: Coverage for nuclear incidents, including nuclear reaction or radiation, is typically excluded.

- War and Military Action: Damage caused by war, including declared or undeclared war, as well as military action, is generally not covered.

Limitations on Certain Perils

In addition to exclusions, homeowners insurance policies may also impose limitations on coverage for specific perils. Here are a few examples:

- Wind and Hail: In regions prone to hurricanes and tornadoes, homeowners insurance policies often have separate deductibles for wind and hail damage. These deductibles can be higher than the standard deductible for other perils.

- Water Damage: While water damage from sudden and accidental causes, such as burst pipes, is typically covered, gradual water damage, such as that caused by long-term leaks, may be excluded or have limited coverage.

- Theft: Coverage for theft often has limits, and high-value items may require separate coverage or endorsements.

Important Policy Limitations

Here are some key limitations to be aware of when reviewing your homeowners insurance policy:

- Dwelling Coverage Limits: Ensure that your dwelling coverage limit is sufficient to rebuild your home in the event of a total loss. This limit should reflect the current cost of construction in your area.

- Personal Property Coverage Limits: Review the limits for personal property coverage to ensure they align with the value of your belongings. Consider purchasing additional coverage for high-value items.

- Liability Coverage Limits: Evaluate your liability coverage limits based on your assets and potential liability risks. Higher limits provide greater protection in the event of a lawsuit.

- Policy Deductibles: Understand the deductibles applicable to different types of losses. Higher deductibles can reduce your premium, but they also increase your out-of-pocket expenses in the event of a claim.

The Claims Process and Tips for Smooth Resolution

When a covered loss occurs, the claims process becomes a critical aspect of homeowners insurance. Understanding the steps involved and following best practices can help ensure a smooth and timely resolution, minimizing the stress and inconvenience associated with filing a claim.

Reporting a Claim

If you experience a loss that is potentially covered by your homeowners insurance policy, the first step is to report the claim to your insurance company. You can typically do this by calling the company’s claims hotline or submitting a claim online through their website. Provide as much detail as possible about the incident, including the date, time, and nature of the loss.

Documentation and Evidence

To support your claim, it’s essential to gather documentation and evidence of the loss. This may include photographs or videos of the damage, a detailed inventory of lost or damaged items, and any relevant receipts or invoices. If possible, take steps to prevent further damage and preserve evidence, such as covering broken windows or damaged roofs.

Assessing the Damage

After reporting the claim, your insurance company will send an adjuster to assess the damage. The adjuster will inspect the property, review your documentation, and determine the extent of the loss. It’s important to cooperate fully with the adjuster and provide any additional information or access they may require.

Understanding Your Coverage and Policy Limits

Before filing a claim, review your policy documents to understand your coverage and policy limits. This includes verifying the coverage for the specific type of loss you’ve experienced and confirming the applicable deductibles and limits. Understanding your policy ensures that you have realistic expectations about the potential payout and helps avoid surprises during the claims process.

Timely Communication and Cooperation

Effective communication and cooperation with your insurance company are crucial throughout the claims process. Respond promptly to requests for information and provide all necessary documentation in a timely manner. Keep detailed records of all communications, including dates, times, and the names of individuals you speak with.

Working with Contractors and Repairs

If repairs are required, select reputable contractors who can provide estimates and complete the work efficiently. Ensure that the contractors are licensed and insured, and obtain multiple estimates to ensure competitive pricing. It’s important to coordinate with your insurance company and their adjusters to ensure that the repairs are covered and approved.

Resolving Disputes and Seeking Professional Help

In the event of a dispute with your insurance company regarding the value of your claim or the extent of coverage, consider seeking professional assistance. This may include hiring a public adjuster or an attorney specializing in insurance claims. These professionals can advocate on your behalf and help ensure that you receive a fair settlement.

Learning from the Experience

After resolving a claim, take the opportunity to review your policy and make any necessary adjustments. This may include increasing coverage limits, adding additional endorsements, or reevaluating your deductibles. Learning from the experience can help you better prepare for future claims and ensure that you have the right level of protection for your home and belongings.

Tips for Choosing the Right Homeowners Insurance Provider

Selecting the right homeowners insurance provider is a critical decision that can significantly impact your financial security and peace of mind. With numerous insurance companies offering various coverage options and pricing structures, it’s essential to approach the selection process with careful consideration. Here are some valuable tips to help you choose the best homeowners insurance provider for your needs.

Assess Your Coverage Needs

Before shopping for homeowners insurance, take the time to evaluate your specific coverage needs. Consider the value of your home, the cost of rebuilding, and the replacement value of your personal belongings. Determine whether you have any unique circumstances, such as high-value items or a home-based business, that may require additional coverage.

Research Insurance Companies

Conduct thorough research on reputable insurance companies in your area. Look for companies with a strong financial rating, indicating their ability to pay claims. Check online reviews and customer satisfaction ratings to gauge the level of service and claims handling experience of different providers.

Compare Coverage Options and Prices

Obtain quotes from multiple insurance companies to compare coverage options and prices. Ensure that you’re comparing policies with similar coverage limits and deductibles to make an apples-to-apples comparison. Consider both the initial premium and the potential for discounts or rewards offered by different providers.

Review Policy Details and Exclusions

When comparing policies, carefully review the policy details and exclusions. Understand the coverage limits, deductibles, and any specific exclusions or limitations that may apply. Ensure that the policy aligns with your coverage needs and provides adequate protection for your home and belongings.

Consider Customer Service and Claims Handling

The quality of customer service and claims handling can significantly impact your experience as a policyholder. Look for insurance companies with a reputation for prompt and fair claims processing. Check online reviews and ask for referrals from friends and family to gauge