Provider Insurance

The landscape of healthcare services is complex and multifaceted, and one of its crucial aspects is provider insurance. This term refers to the various types of insurance policies that protect healthcare providers, including doctors, nurses, and other medical professionals, against potential liabilities and risks associated with their practice. In an industry where patient care and well-being are paramount, the significance of provider insurance cannot be overstated. This comprehensive guide delves into the world of provider insurance, shedding light on its intricacies, benefits, and importance for both healthcare professionals and their patients.

Understanding Provider Insurance: A Comprehensive Overview

Provider insurance serves as a vital safety net for healthcare providers, safeguarding them from a range of potential issues that could arise during the course of their professional duties. These issues can include medical malpractice claims, workplace injuries, property damage, and even cyber threats. By having the right insurance coverage, healthcare providers can mitigate financial risks and focus on delivering quality patient care without the constant worry of unforeseen liabilities.

The scope of provider insurance is broad, encompassing a variety of policies tailored to meet the unique needs of different healthcare professionals. Some common types of provider insurance include:

- Medical Malpractice Insurance: This is arguably the most critical coverage for healthcare providers. It protects against claims of medical negligence or errors, which can lead to costly legal battles and damage a provider's reputation.

- General Liability Insurance: This type of insurance covers a wide range of risks, such as property damage, slip-and-fall accidents, and other incidents that could occur in a healthcare facility.

- Professional Liability Insurance: Also known as errors and omissions (E&O) insurance, this policy covers claims arising from professional services provided, including misdiagnosis or inaccurate treatment plans.

- Workers' Compensation Insurance: Essential for healthcare facilities, this insurance provides coverage for employees who suffer work-related injuries or illnesses, ensuring they receive medical care and financial support during their recovery.

- Cyber Liability Insurance: In today's digital age, healthcare providers must protect sensitive patient data. Cyber liability insurance covers costs associated with data breaches, hacking, and other cyber threats.

Each type of insurance serves a specific purpose, and often, healthcare providers will need a combination of these policies to ensure comprehensive coverage. The specific risks and needs of a provider's practice will dictate the type and level of insurance required.

The Importance of Provider Insurance: Protecting Professionals and Patients

The significance of provider insurance extends beyond the healthcare professionals themselves. It plays a crucial role in maintaining the integrity and stability of the entire healthcare system.

Financial Protection for Healthcare Providers

Healthcare is an inherently risky profession, with providers facing potential liabilities every day. Medical malpractice suits, for instance, can be devastating financially. Even if a provider is found not at fault, the legal costs alone can be prohibitive. Provider insurance steps in to cover these expenses, ensuring that providers can continue their practice without the fear of financial ruin.

Additionally, provider insurance can cover the cost of settlements or judgments in the event a provider is found liable for medical negligence. This financial protection allows providers to focus on their patients' needs without the distraction of potential financial burdens.

Ensuring Quality Patient Care

The primary goal of any healthcare provider is to deliver the highest quality of care to their patients. Provider insurance plays a pivotal role in supporting this mission by:

- Attracting and Retaining Top Talent: Healthcare facilities with robust provider insurance packages are more attractive to skilled professionals. This, in turn, ensures that patients receive care from the best and most qualified providers.

- Reducing Provider Stress: The knowledge that they are protected against potential liabilities can reduce the stress levels of healthcare providers. This can lead to improved job satisfaction and better patient outcomes.

- Encouraging Risk Management: Provider insurance often comes with risk management services. These services help providers identify and mitigate potential risks, ultimately enhancing patient safety and care quality.

Protecting Patient Trust and Confidence

Patients place their trust in healthcare providers, expecting the best possible care. Provider insurance reinforces this trust by demonstrating a commitment to patient safety and well-being. When patients know that their providers are adequately insured, it can enhance their confidence in the healthcare system.

Moreover, provider insurance can help mitigate the impact of medical errors or adverse events. By providing coverage for such incidents, insurance can ensure that patients receive the necessary support and compensation, fostering a culture of accountability and trust.

The Role of Provider Insurance in Healthcare Facilities

Provider insurance is not just about individual healthcare professionals; it also plays a critical role at the institutional level. Healthcare facilities, whether they are hospitals, clinics, or private practices, must ensure that their providers are adequately insured to maintain their reputation and operational stability.

Maintaining Facility Reputation

Healthcare facilities are judged by the quality of their providers. A facility associated with reputable and well-insured professionals is more likely to attract patients and maintain its positive reputation. On the other hand, a facility with providers who are underinsured or lack the necessary coverage may face scrutiny and negative publicity, impacting its long-term success.

Ensuring Operational Continuity

Provider insurance is essential for the smooth operation of healthcare facilities. By ensuring that providers are protected against potential liabilities, facilities can focus on their core mission: delivering quality patient care. Without adequate insurance, facilities may face disruptions due to provider absences or financial strains, impacting their ability to serve their communities.

Managing Risk and Compliance

Healthcare facilities must adhere to a myriad of regulations and standards to maintain their licenses and accreditations. Provider insurance can help facilities manage these risks by providing coverage for regulatory breaches or compliance failures. This ensures that facilities can operate within the boundaries of the law and maintain their legitimacy.

Choosing the Right Provider Insurance: A Guide for Healthcare Professionals

Selecting the appropriate provider insurance is a critical decision for healthcare professionals. The process can be complex, given the variety of policies and coverage options available. Here’s a guide to help providers make an informed choice:

Assess Your Specific Risks

Every healthcare profession carries unique risks. For instance, a surgeon’s risks will differ significantly from those of a general practitioner or a mental health counselor. Understanding your specific risks is the first step in choosing the right insurance.

Consider factors such as the nature of your practice, the types of procedures you perform, and the potential for adverse events. This assessment will help you identify the types of insurance coverage you need most.

Research Insurance Companies and Policies

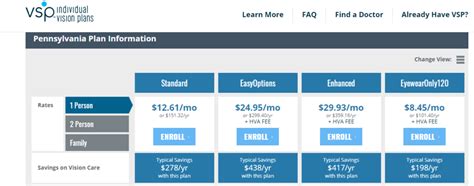

Not all insurance companies are created equal. It’s crucial to research and compare different providers to find one that offers policies tailored to your needs. Look for companies with a strong reputation in the healthcare industry and a track record of paying claims promptly.

When comparing policies, pay attention to the coverage limits, deductibles, and any exclusions. Ensure that the policy covers all the risks you've identified in your risk assessment.

Consider Bundled Policies

Some insurance companies offer bundled policies that combine multiple types of coverage, such as medical malpractice and professional liability insurance. These bundles can be cost-effective and convenient, as they simplify the insurance process. However, make sure the bundled policy provides adequate coverage for all your identified risks.

Consult with an Insurance Professional

Navigating the world of provider insurance can be complex, especially for those new to the field. Consulting with an insurance professional who specializes in healthcare can provide valuable insights and guidance. These experts can help you understand your options, tailor policies to your needs, and ensure you’re getting the best value for your money.

The Future of Provider Insurance: Trends and Innovations

The field of provider insurance is constantly evolving, driven by advancements in healthcare, changes in the legal landscape, and shifts in patient expectations. Here are some key trends and innovations shaping the future of provider insurance:

Telehealth and Virtual Care

The rise of telehealth and virtual care platforms has presented new challenges and opportunities for provider insurance. As more healthcare services move online, insurers are adapting their policies to cover the unique risks associated with virtual patient interactions, such as data privacy and security breaches.

AI and Machine Learning

Artificial intelligence (AI) and machine learning are transforming various aspects of healthcare, including risk assessment and claims management. Insurance companies are leveraging these technologies to enhance their underwriting processes, making them more accurate and efficient. This can lead to better-tailored policies and more precise risk assessments for healthcare providers.

Focus on Preventative Care

There’s a growing emphasis on preventative care in the healthcare industry, with providers and insurers alike recognizing the benefits of keeping patients healthy and avoiding costly treatments. Some insurance companies are offering incentives and discounts to providers who implement effective preventative care strategies, rewarding them for keeping their patients healthy and reducing the likelihood of costly claims.

Enhanced Risk Management Services

Many insurance companies are expanding their risk management services to provide more comprehensive support to healthcare providers. These services can include educational resources, regular risk assessments, and support in implementing best practices to mitigate potential risks. By helping providers identify and address risks proactively, insurers can reduce the likelihood of claims and enhance patient safety.

Conclusion: The Critical Role of Provider Insurance in Healthcare

Provider insurance is an indispensable component of the healthcare ecosystem, offering crucial protection to healthcare providers and, by extension, their patients. It safeguards providers against financial ruin, ensures the continuity of quality patient care, and maintains the integrity of the healthcare system. As the field of healthcare evolves, so too must provider insurance, adapting to new technologies, practices, and risks to continue providing the essential protection that healthcare providers and their patients rely on.

What happens if a healthcare provider doesn’t have adequate insurance coverage?

+Healthcare providers without adequate insurance coverage face significant risks. They may be personally liable for any claims or lawsuits, which can result in substantial financial losses. Additionally, they could face professional consequences, including the loss of their license or reputation, which could impact their ability to practice.

How can providers ensure they have the right level of insurance coverage?

+Providers should conduct a thorough risk assessment to identify the specific risks associated with their practice. Based on this assessment, they can work with insurance professionals to tailor policies that provide adequate coverage. Regular reviews of insurance policies are also essential to ensure they remain aligned with changing risks and regulations.

What role do healthcare facilities play in provider insurance?

+Healthcare facilities are responsible for ensuring that their providers have adequate insurance coverage. They should provide guidance and support to their providers in obtaining the necessary insurance policies. Additionally, facilities should have their own comprehensive insurance coverage to protect against institutional risks and liabilities.