Business Health Insurance Plans

Health insurance is a vital aspect of any successful business strategy, especially when it comes to ensuring the well-being of employees and maintaining a productive work environment. In today's competitive landscape, offering comprehensive health insurance plans is not only a moral responsibility but also a strategic advantage for businesses. This article aims to delve into the intricacies of business health insurance plans, exploring their importance, key features, and the benefits they bring to both employers and employees.

Understanding the Significance of Business Health Insurance

In an era where healthcare costs are skyrocketing, businesses play a crucial role in providing access to affordable and comprehensive medical coverage. By offering health insurance plans, companies demonstrate their commitment to employee welfare and long-term success. Let’s explore the key reasons why business health insurance plans are indispensable:

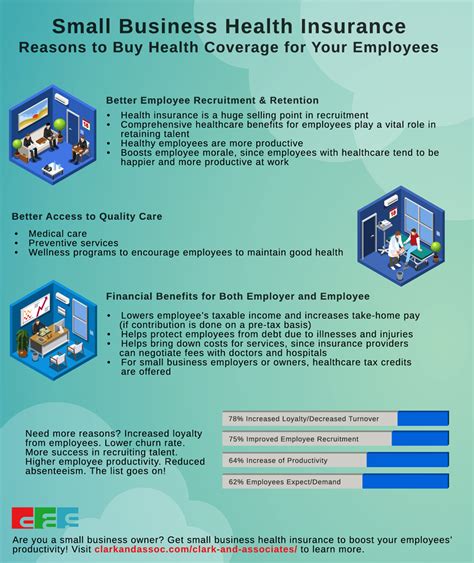

Attracting and Retaining Top Talent

In a highly competitive job market, prospective employees often prioritize companies that offer robust health insurance benefits. A competitive and comprehensive health insurance plan acts as a powerful magnet, attracting skilled professionals who value their well-being and that of their families. Moreover, providing excellent health coverage fosters employee loyalty, reducing turnover rates and contributing to a stable and productive workforce.

Promoting Employee Health and Well-being

Employee health is directly linked to productivity and overall business performance. Business health insurance plans encourage employees to prioritize their health, seek regular medical check-ups, and address any health concerns promptly. By covering preventive care, diagnostic tests, and treatments, these plans empower employees to take control of their health, leading to reduced absenteeism and enhanced productivity.

Mitigating Financial Burdens

Healthcare expenses can be a significant financial burden for individuals and families. Business health insurance plans alleviate this burden by providing coverage for a wide range of medical services, including doctor visits, hospitalizations, prescription medications, and specialized treatments. By sharing the cost of healthcare, employers ensure that their employees can access necessary medical care without facing crippling financial hardships.

Key Features of Comprehensive Business Health Insurance Plans

A well-designed business health insurance plan offers a comprehensive range of benefits, tailored to meet the diverse needs of employees. Here are some essential features to consider when evaluating or designing a health insurance plan for your business:

Coverage Options

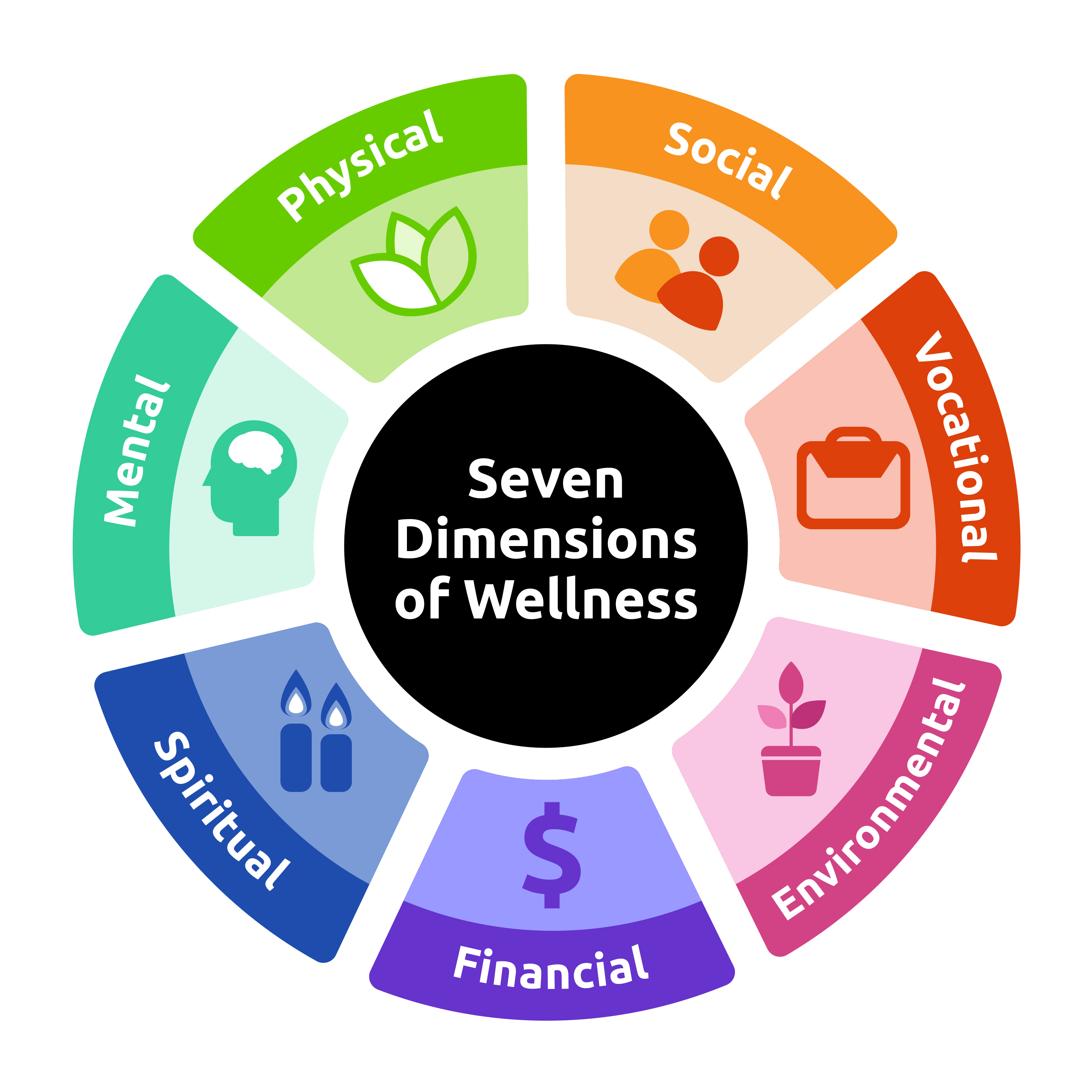

Businesses should offer a variety of coverage options to cater to different employee needs. This may include individual plans, family plans, and options for employees with pre-existing conditions. Additionally, providing coverage for vision, dental, and mental health services is crucial for a holistic approach to employee well-being.

Network of Healthcare Providers

A robust network of healthcare providers is vital to ensure employees have access to quality medical care. When selecting an insurance provider, businesses should consider the availability of in-network doctors, specialists, and hospitals in their area. A comprehensive network reduces out-of-pocket expenses for employees and simplifies the process of finding suitable healthcare professionals.

Flexible Plan Designs

Recognizing that employees have varying healthcare needs, businesses should offer flexible plan designs. This may include options for high-deductible health plans (HDHPs) paired with health savings accounts (HSAs) for those seeking tax advantages, or more traditional plans with lower deductibles and co-pays for employees who prefer predictability in their healthcare expenses.

Preventive Care and Wellness Programs

Incorporating preventive care and wellness initiatives into health insurance plans is a strategic approach to promoting employee health. These programs may include annual check-ups, screenings, immunizations, and access to health coaches or nutritionists. By encouraging proactive health management, businesses can reduce the incidence of chronic diseases and improve overall employee health outcomes.

Pharmaceutical Coverage

Prescription medications are a significant component of healthcare expenses. Business health insurance plans should provide comprehensive pharmaceutical coverage, including a wide range of medications at affordable prices. Negotiating discounts with pharmaceutical companies and offering mail-order options for chronic medications can further reduce costs for both employees and the business.

Mental Health and Substance Abuse Coverage

Mental health and substance abuse disorders are prevalent and often overlooked. A comprehensive health insurance plan should include coverage for mental health services, counseling, and substance abuse treatment. By removing barriers to accessing mental health care, businesses can support employees struggling with these issues and promote overall well-being.

Telehealth Services

Telehealth services have gained popularity, especially in recent times. Business health insurance plans should consider including telehealth options, allowing employees to access medical advice and consultations remotely. This not only improves convenience but also reduces the need for in-person visits, saving time and resources for both employees and healthcare providers.

The Impact of Business Health Insurance on Employee Satisfaction

Offering a robust health insurance plan has a profound impact on employee satisfaction and overall job satisfaction. When employees feel that their employer cares about their well-being, it fosters a sense of loyalty and commitment to the organization. Here are some ways in which business health insurance plans positively influence employee satisfaction:

Peace of Mind

Knowing that they have access to quality healthcare without incurring excessive financial burdens provides employees with a sense of security and peace of mind. This reassurance extends beyond the workplace, impacting their personal lives and overall well-being.

Improved Health Outcomes

Comprehensive health insurance plans encourage employees to take an active role in managing their health. By providing coverage for preventive care, employees are more likely to seek regular check-ups, address health concerns early on, and adopt healthier lifestyles. Improved health outcomes lead to increased energy, productivity, and overall job satisfaction.

Work-Life Balance

Health insurance plans that cover a wide range of services, including mental health support and wellness programs, contribute to a healthier work-life balance. Employees can better manage stress, maintain their physical health, and prioritize self-care, leading to enhanced job satisfaction and reduced burnout.

Employee Engagement

Businesses that actively engage with their employees to understand their healthcare needs and provide tailored insurance plans foster a culture of trust and collaboration. When employees feel heard and valued, they are more likely to be engaged and committed to the organization’s success.

Cost Considerations and Employer Strategies

While providing comprehensive health insurance plans is essential, businesses must also consider the financial implications. Here are some strategies employers can employ to manage costs while offering competitive health insurance benefits:

Utilize Group Purchasing Power

By negotiating with insurance providers as a group, businesses can leverage their collective purchasing power to secure more favorable rates and coverage options. Collaborating with industry associations or partnering with other businesses can further enhance negotiating leverage.

Offer Incentives for Healthy Behaviors

Implementing wellness programs and offering incentives for employees who adopt healthy habits can reduce healthcare costs over time. Encouraging physical activity, healthy eating, and stress management can lead to a healthier workforce, resulting in fewer claims and lower insurance premiums.

Educate Employees on Plan Options

Providing clear and concise information about the available health insurance plans is crucial. Educating employees on the benefits and costs associated with each plan empowers them to make informed choices. This can lead to more efficient utilization of healthcare services and reduce unnecessary expenses.

Utilize Technology for Cost Management

Employers can leverage technology to streamline healthcare cost management. This may include utilizing digital platforms for plan administration, claims processing, and providing employees with tools to compare healthcare providers and procedures based on cost and quality.

The Future of Business Health Insurance: Innovations and Trends

The landscape of business health insurance is evolving, driven by technological advancements and changing employee expectations. Here are some emerging trends and innovations that are shaping the future of business health insurance plans:

Digital Health Solutions

The integration of digital health solutions, such as wearable devices and health apps, is transforming the way employees manage their health. These technologies provide real-time health data, encourage healthy behaviors, and enable remote monitoring, all of which contribute to better health outcomes and reduced healthcare costs.

Personalized Medicine

Advances in genomics and personalized medicine are revolutionizing healthcare. Business health insurance plans are increasingly incorporating genetic testing and precision medicine approaches to tailor treatments and preventive measures to individual needs. This precision-based approach can lead to more effective healthcare interventions and improved patient outcomes.

Value-Based Care Models

Value-based care models are gaining traction, shifting the focus from volume-based healthcare to quality-based outcomes. These models incentivize healthcare providers to deliver efficient and effective care, improving patient experiences and reducing costs. Business health insurance plans are adapting to incorporate value-based care principles, rewarding providers for achieving better health outcomes.

Remote Patient Monitoring

Remote patient monitoring technologies enable healthcare providers to track and manage patients’ health conditions remotely. This approach is particularly beneficial for chronic disease management, reducing the need for frequent in-person visits and improving patient engagement. Business health insurance plans are exploring ways to integrate remote monitoring into their benefit offerings.

Employee-Centric Plan Designs

As employee expectations evolve, businesses are adopting more employee-centric plan designs. This involves offering customizable plans that allow employees to choose coverage options based on their individual needs and preferences. By involving employees in the decision-making process, businesses can enhance plan engagement and satisfaction.

Conclusion: The Evolving Role of Business Health Insurance

In conclusion, business health insurance plans are no longer just a benefit; they are a strategic investment in the well-being and success of a company’s greatest asset - its employees. By offering comprehensive and tailored health insurance coverage, businesses can attract top talent, promote employee health and satisfaction, and mitigate financial burdens associated with healthcare expenses.

As the landscape of healthcare continues to evolve, businesses must remain agile and responsive to emerging trends and innovations. By staying informed and adapting their health insurance strategies, employers can ensure that their plans remain competitive, cost-effective, and aligned with the diverse needs of their workforce. Ultimately, a well-designed health insurance plan is a powerful tool for businesses to foster a healthy, engaged, and productive workforce, driving long-term success and sustainability.

What factors should businesses consider when choosing a health insurance provider?

+When selecting a health insurance provider, businesses should consider factors such as the provider’s reputation, network of healthcare professionals, plan options and coverage, customer service, and claim processing efficiency. It’s essential to assess the provider’s ability to meet the specific needs of the business and its employees.

How can businesses encourage employees to utilize their health insurance benefits effectively?

+Businesses can encourage effective utilization of health insurance benefits by providing comprehensive education and communication about the available plans. Holding informational sessions, distributing written materials, and offering one-on-one consultations can help employees understand their coverage and make informed decisions about their healthcare.

What are some common challenges businesses face when implementing health insurance plans, and how can they be addressed?

+Common challenges include rising healthcare costs, employee understanding and utilization of benefits, and administrative complexities. Businesses can address these challenges by negotiating cost-effective plans, providing clear communication and education, and utilizing technology for efficient plan management and employee engagement.

How can businesses measure the impact and success of their health insurance plans?

+Businesses can measure the success of their health insurance plans by tracking key metrics such as employee satisfaction surveys, claim utilization rates, healthcare costs, and the overall health and well-being of the workforce. Analyzing these metrics can provide insights into the effectiveness of the plan and areas for improvement.