Auto Insurance Coverage

Auto insurance, or car insurance, is a vital aspect of vehicle ownership, providing financial protection and peace of mind to drivers worldwide. This comprehensive guide will delve into the intricacies of auto insurance coverage, exploring its importance, key components, and the factors that influence policy costs and benefits.

Understanding Auto Insurance Coverage

Auto insurance is a contract between an individual (the policyholder) and an insurance company. In exchange for premium payments, the insurance provider agrees to financially protect the policyholder against specific risks associated with owning and operating a motor vehicle.

The primary purpose of auto insurance is to safeguard policyholders from potentially devastating financial losses resulting from accidents, theft, or other unforeseen events involving their vehicles. It also provides coverage for liability claims made against the policyholder by third parties who suffer bodily injury or property damage caused by the policyholder's vehicle.

Key Components of Auto Insurance Coverage

Auto insurance policies are tailored to meet the unique needs of policyholders, and they typically consist of several essential coverage types. These components can vary depending on the jurisdiction and the specific policy selected, but some fundamental coverages include:

Liability Coverage

Liability coverage is a cornerstone of auto insurance. It protects the policyholder from financial responsibility for bodily injury or property damage caused to others as a result of an accident for which the policyholder is deemed at fault. This coverage is often mandated by law in many regions and is crucial for safeguarding against costly lawsuits.

- Bodily Injury Liability: Covers medical expenses, lost wages, and pain and suffering for individuals injured in an accident caused by the policyholder.

- Property Damage Liability: Pays for repairs or replacement of property damaged by the policyholder's vehicle, including other vehicles, structures, or personal property.

Comprehensive Coverage

Comprehensive coverage, also known as “Other Than Collision” (OTC) coverage, provides protection against damage to the insured vehicle that is not caused by a collision. This can include damage from theft, vandalism, natural disasters, falling objects, and collisions with animals.

Collision Coverage

Collision coverage pays for repairs or replacement of the insured vehicle after an accident, regardless of fault. This coverage is essential for protecting the policyholder’s investment in their vehicle and ensuring they can quickly get back on the road after an incident.

Personal Injury Protection (PIP)

PIP, or Personal Injury Protection, is a type of coverage that provides medical benefits to the policyholder and their passengers, regardless of who is at fault in an accident. It covers medical expenses, loss of income, and other related costs associated with injuries sustained in a covered accident.

Uninsured/Underinsured Motorist Coverage

This coverage protects the policyholder in the event of an accident with a driver who has no insurance or insufficient insurance to cover the damages. It ensures that the policyholder receives compensation for their injuries and property damage, even if the at-fault driver cannot provide adequate financial coverage.

Factors Influencing Auto Insurance Costs

The cost of auto insurance policies can vary significantly depending on several factors. Understanding these factors can help policyholders make informed decisions when selecting coverage and managing their insurance expenses.

Vehicle Type and Usage

The type of vehicle being insured plays a crucial role in determining insurance costs. Factors such as the make, model, year, and safety features of the vehicle can impact the premium. Additionally, the intended use of the vehicle, whether for personal, commercial, or high-risk activities, can influence the level of coverage required and the associated costs.

Driver Profile and History

The insurance company considers the driver’s profile and history when calculating premiums. This includes factors such as age, gender, driving experience, and driving record. Young and inexperienced drivers, for instance, are often considered high-risk and may face higher premiums. Conversely, mature drivers with a clean driving record may benefit from lower rates.

Location and Usage Patterns

The policyholder’s location and usage patterns are significant considerations. Areas with high crime rates, heavy traffic, or a history of severe weather conditions may have higher insurance rates. Additionally, the number of miles driven annually and the purpose of those trips (commuting, leisure, business) can impact insurance costs.

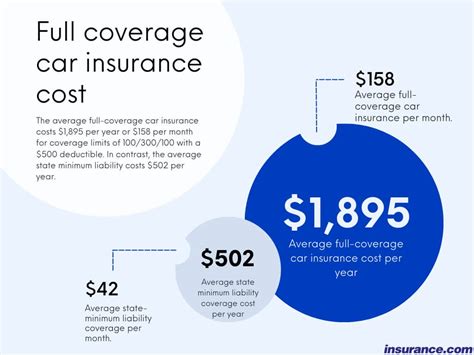

Coverage and Deductibles

The level of coverage chosen by the policyholder directly affects the premium. Higher coverage limits generally result in higher premiums. Additionally, policyholders can opt for higher deductibles, which reduce the premium but require them to pay more out of pocket in the event of a claim.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Protects against bodily injury and property damage claims made by others. |

| Comprehensive Coverage | Covers non-collision related damages, such as theft and natural disasters. |

| Collision Coverage | Pays for repairs or replacement of the insured vehicle after an accident. |

| Personal Injury Protection (PIP) | Provides medical benefits to the policyholder and passengers regardless of fault. |

| Uninsured/Underinsured Motorist Coverage | Protects the policyholder in accidents with uninsured or underinsured drivers. |

Performance Analysis and Insights

When analyzing auto insurance coverage, it’s essential to consider the performance and reliability of the insurance provider. Here are some key insights to help policyholders make informed choices:

Claims Handling and Customer Satisfaction

Research the insurance company’s reputation for handling claims efficiently and fairly. Look for customer reviews and ratings to gauge their responsiveness and overall customer satisfaction. A reputable insurer should provide prompt and transparent claims processes, ensuring policyholders receive the benefits they are entitled to without unnecessary delays.

Financial Strength and Stability

The financial stability of the insurance provider is crucial. Opt for companies with a strong financial standing, as this ensures they can honor their commitments and pay out claims even in challenging economic times. Rating agencies like A.M. Best and Standard & Poor’s provide assessments of insurance companies’ financial strength, offering valuable insights into their long-term viability.

Discounts and Bundle Options

Many insurance companies offer discounts to policyholders who meet certain criteria. These can include safe driving records, loyalty discounts for long-term customers, and multi-policy discounts for bundling auto insurance with other coverage types, such as homeowners or renters insurance. Exploring these options can help policyholders save money without compromising on coverage.

Future Implications and Trends

The auto insurance industry is continually evolving, driven by technological advancements and changing consumer expectations. Here are some key trends and future implications to consider:

Telematics and Usage-Based Insurance (UBI)

Telematics technology allows insurance companies to monitor driving behavior and usage patterns in real time. UBI policies, which use telematics data to calculate premiums, are gaining popularity. These policies reward safe driving habits and can lead to significant cost savings for policyholders who maintain good driving records.

Connected Car Technology

The rise of connected car technology, including advanced driver-assistance systems (ADAS) and vehicle-to-everything (V2X) communication, is expected to have a significant impact on auto insurance. Connected cars can provide valuable data on driving behavior, vehicle performance, and accident avoidance, potentially leading to more accurate risk assessments and personalized insurance offerings.

Autonomous Vehicles and Liability Shifts

As autonomous vehicles become more prevalent, the traditional liability model for auto insurance may need to adapt. The shift from human-driven vehicles to autonomous vehicles could lead to a reevaluation of liability, with manufacturers and technology providers potentially bearing more responsibility for accidents. This could result in new insurance products and coverage models tailored to the unique risks associated with autonomous driving.

Digitalization and InsurTech Innovations

The insurance industry is undergoing a digital transformation, with InsurTech startups and established insurers leveraging technology to enhance customer experiences and streamline processes. This includes digital policy management, instant claims processing, and personalized insurance recommendations based on data analytics. Policyholders can expect more convenient and efficient interactions with their insurers in the future.

Frequently Asked Questions (FAQ)

How do I choose the right auto insurance coverage for my needs?

+When selecting auto insurance coverage, consider your unique circumstances and the level of protection you require. Assess your financial ability to pay for repairs or replacement in the event of an accident, and choose coverage that aligns with your budget and risk tolerance. It’s essential to review your policy regularly and adjust coverage as your needs change.

What are some common exclusions in auto insurance policies?

+Auto insurance policies typically exclude coverage for intentional damage, wear and tear, mechanical breakdowns, and certain types of vehicle modifications. It’s crucial to carefully review the policy’s exclusions to understand what is and isn’t covered, ensuring you have the appropriate protection for your vehicle.

Can I switch auto insurance providers if I’m not satisfied with my current policy?

+Absolutely! Policyholders have the freedom to shop around and compare insurance providers. If you’re not satisfied with your current policy or believe you can find better coverage and rates elsewhere, it’s a good idea to explore your options. Just ensure you understand the terms of your existing policy, including any cancellation fees or penalties, before making a switch.