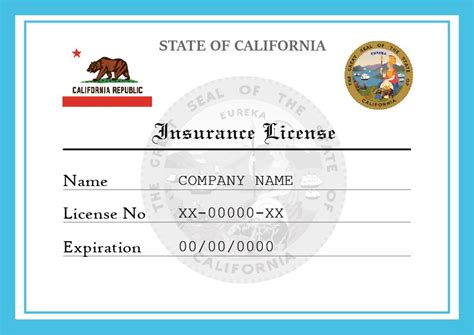

State Of California Insurance License Lookup

For those navigating the complex world of insurance, understanding the credentials and qualifications of insurance professionals is crucial. The State of California, being one of the largest insurance markets in the United States, has a robust system in place to ensure the integrity and competence of its insurance agents and brokers. This guide delves into the process of conducting an insurance license lookup in California, offering a comprehensive overview for consumers, businesses, and anyone interested in the state's insurance industry.

Understanding the California Insurance License

The California Department of Insurance (CDI) is the regulatory body responsible for overseeing the insurance industry within the state. It issues and regulates various types of insurance licenses, each with specific requirements and scopes of practice. These licenses ensure that professionals in the insurance field meet the necessary standards of knowledge, ethics, and conduct.

Types of Insurance Licenses in California

California offers a range of insurance licenses, each catering to different roles and specialties within the industry. Here’s a breakdown of some of the common licenses:

- Life and Disability Insurance Agent License: This license allows individuals to sell life, disability, and annuity products.

- Property and Casualty Insurance Agent License: For those interested in selling property, liability, and other casualty insurance products.

- Personal Lines Agent License: A specialized license for agents who focus on personal lines of insurance, including auto, homeowners, and renters insurance.

- Public Adjuster License: Enables license holders to represent policyholders in insurance claims settlements.

- Broker License: Brokers have a broader scope than agents, allowing them to transact any kind of insurance, including life, health, property, and casualty.

- Surplus Lines Broker License: A specialized license for brokers who place coverage with non-admitted insurers.

Each of these licenses requires specific education, training, and examination processes, ensuring that license holders possess the necessary knowledge and skills.

The California Insurance License Lookup Process

The CDI provides an online platform, the California License Information website, for the public to access information about insurance professionals and entities. This platform is an essential tool for consumers and businesses to verify the legitimacy and credentials of insurance agents and brokers.

Step-by-Step Guide to License Lookup

- Access the California License Information Website: Begin by visiting the official website of the California Department of Insurance. The license lookup tool can be found in the “Consumer Information” or “License Information” section.

- Search by Name or License Number: You can initiate a search by entering the name of the insurance professional or the specific license number. If searching by name, ensure you provide accurate details, including the individual’s full name and any middle initials.

- Select the Correct Record: The search results may display multiple records, especially if you’re searching by name. Carefully review the details to select the correct record. Pay attention to the license type, issue date, and the individual’s address to ensure you have the right person.

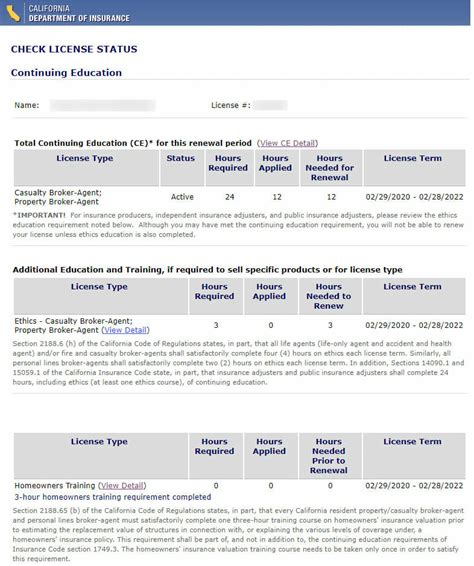

- Review License Information: Once you’ve selected the correct record, you’ll be presented with detailed information about the license. This includes the license type, status (active, inactive, suspended, or revoked), the date it was issued, and its expiration date. You’ll also find details about the individual’s appointments with various insurance carriers.

- Verify Additional Details: The license lookup tool provides comprehensive information, including any disciplinary actions taken against the license holder. This is crucial for assessing the reliability and trustworthiness of the insurance professional.

Key Features of the License Lookup Tool

The California License Information website offers several features to enhance the license lookup process:

- Advanced Search: If you’re unsure of an individual’s name or license number, the advanced search feature allows you to search by city, county, or ZIP code. This can be particularly useful when you have limited information.

- License Status Alerts: The website provides alerts and notifications when a license status changes. This ensures that consumers and businesses are promptly informed about any updates, such as license suspensions or revocations.

- Mobile Accessibility: The license lookup tool is optimized for mobile devices, making it convenient to access information on the go. This is especially beneficial for individuals who need quick verification while meeting with insurance professionals.

Tip: Always verify the license status and details of an insurance professional before engaging their services. This simple step can protect you from fraudulent activities and ensure you're working with a legitimate and trustworthy individual.

Importance of Insurance License Verification

Verifying the insurance license of a professional is a critical step in safeguarding your insurance interests. Here’s why it’s essential:

- Legitimacy and Trust: A licensed insurance professional has met the state’s standards for education, training, and ethics. Verifying their license ensures they are legitimate and can be trusted with your insurance needs.

- Legal Compliance: In California, it’s a legal requirement for insurance professionals to hold a valid license for the type of insurance they sell. By checking their license, you ensure they are operating within the law.

- Protection from Fraud: License verification helps prevent insurance fraud. Scammers may pose as insurance agents to deceive unsuspecting individuals. By checking their license, you can identify and avoid such fraudulent activities.

- Professional Competence: Licensed professionals have demonstrated a level of knowledge and competence in their field. This ensures they can provide accurate information and guidance, helping you make informed insurance decisions.

What to Do if a License is Expired or Suspended

If your license lookup reveals that an insurance professional’s license is expired or suspended, it’s crucial to take the following steps:

- Contact the CDI: Reach out to the California Department of Insurance to report the expired or suspended license. This helps the CDI take appropriate action and protect the public from potential harm.

- Seek Alternative Services: Consider working with another licensed insurance professional who has an active and valid license. You can use the license lookup tool to find reputable alternatives in your area.

Remember, protecting your insurance interests starts with ensuring you're dealing with legitimate and licensed professionals. The California insurance license lookup process is a powerful tool to achieve this, empowering consumers and businesses to make informed decisions and maintain trust in the insurance industry.

Conclusion

In a complex and dynamic industry like insurance, the California insurance license lookup process serves as a beacon of transparency and trust. It empowers individuals to make informed choices, ensures compliance with regulatory standards, and helps maintain the integrity of the insurance market. By understanding and utilizing this process, consumers and businesses can navigate the insurance landscape with confidence, knowing they are protected and supported by licensed professionals.

How often should I verify an insurance professional’s license?

+It’s a good practice to verify an insurance professional’s license before engaging their services and periodically thereafter, especially if you have an ongoing relationship with them. This ensures that they remain in good standing and are authorized to provide insurance services.

What if I can’t find a license for an insurance professional I’m interested in?

+If you’re unable to find a license for an insurance professional, it’s a red flag. It could indicate that they are not licensed or that their license is not currently active. In such cases, it’s best to avoid engaging their services and report the matter to the CDI.

Are there any additional steps I should take when verifying an insurance license?

+Yes, in addition to verifying the license status, it’s recommended to check for any disciplinary actions or complaints against the license holder. This information is often available on the CDI’s website and can provide valuable insights into the professional’s reliability.

Can I verify the license of an insurance professional from another state?

+Yes, each state has its own licensing and regulatory body. To verify an insurance professional’s license from another state, you’ll need to visit the website of that state’s insurance department or licensing board. The process may vary slightly, but the basic steps remain similar.