Cheap Car Insurance Comparison

Finding affordable car insurance is a priority for many drivers, especially with the rising costs of vehicle ownership. The market is vast and diverse, offering a range of policies and providers to cater to different needs and budgets. This comprehensive guide will delve into the world of cheap car insurance, comparing options, analyzing coverage, and providing expert insights to help you make an informed decision.

Understanding Cheap Car Insurance

Cheap car insurance, or low-cost auto insurance, is a popular choice for drivers seeking affordable coverage. It offers essential protection at a reduced price, making it an attractive option for those on a tight budget or looking to minimize their insurance expenses. However, it’s crucial to understand that cheap insurance often comes with trade-offs, and it may not provide the same level of comprehensive coverage as more expensive policies.

Key Considerations for Affordable Policies

When considering cheap car insurance, there are several key factors to keep in mind. Firstly, the level of coverage offered is typically more basic, focusing on liability coverage rather than extensive protection for your vehicle. Secondly, policy limits may be lower, which can impact the amount of compensation you receive in the event of an accident or claim.

Additionally, deductibles (the amount you pay out-of-pocket before the insurance kicks in) tend to be higher with cheap insurance, which can make small claims less worthwhile. Lastly, policy exclusions may be more prevalent, meaning certain situations or types of damage may not be covered.

| Consideration | Explanation |

|---|---|

| Coverage | Typically focuses on liability, offering less comprehensive protection for your vehicle. |

| Policy Limits | Lower limits may result in reduced compensation for accidents or claims. |

| Deductibles | Higher deductibles mean you pay more upfront before insurance coverage takes effect. |

| Exclusions | Cheap insurance often comes with more exclusions, limiting the situations covered. |

Comparing Cheap Car Insurance Providers

The market for cheap car insurance is highly competitive, with numerous providers offering affordable policies. To make an informed choice, it’s crucial to compare different providers and their offerings. Here’s a breakdown of some popular options and their unique features.

Provider A: Focus on Discounts

Provider A is known for its commitment to providing affordable insurance options. They offer a range of discounts to make their policies even more attractive. Some key features include:

- Multi-Policy Discounts: Combining your car insurance with other policies, such as home or life insurance, can result in significant savings.

- Good Driver Discounts ”: Safe driving practices can lead to substantial discounts on your insurance premium.

- Pay-As-You-Drive Programs: These innovative programs allow you to pay based on your actual mileage, making it an attractive option for low-mileage drivers.

Provider A also boasts an easy-to-use online platform, allowing customers to manage their policies and make changes quickly. Their customer service is highly rated, with quick response times and a dedicated team to assist with any queries.

Provider B: Comprehensive Coverage Options

Provider B stands out for its focus on providing comprehensive coverage at affordable prices. They offer a wide range of policy options to cater to different needs. Here are some key features:

- Customizable Policies: You can tailor your insurance coverage to your specific needs, ensuring you only pay for what you require.

- Roadside Assistance: Many policies include roadside assistance as a standard feature, providing peace of mind in case of emergencies.

- Accident Forgiveness: This feature ensures your rates won’t increase after your first at-fault accident, offering long-term savings.

Provider B also has a strong reputation for claims handling, with a dedicated team that ensures prompt and fair settlements. Their online tools are user-friendly, allowing for easy policy management and quick quotes.

Provider C: Specialization in Cheap Insurance

Provider C has established itself as a leader in the cheap car insurance market. They specialize in providing low-cost options without compromising on quality. Here’s what sets them apart:

- Lowest Rates Guarantee: Provider C promises to beat any competing quote, ensuring you get the best deal available.

- Flexible Payment Options: They offer various payment plans, including monthly, quarterly, or annual payments, providing financial flexibility.

- Simple and Transparent Policies: Their policies are designed to be straightforward, making it easy to understand your coverage and avoid hidden fees or surprises.

Provider C also has an extensive network of agents who can provide personalized advice and assistance, ensuring you get the right policy for your needs.

| Provider | Key Features |

|---|---|

| Provider A | Discounts, Pay-As-You-Drive, Easy Online Platform, Responsive Customer Service |

| Provider B | Comprehensive Coverage, Customizable Policies, Roadside Assistance, Efficient Claims Handling |

| Provider C | Lowest Rates Guarantee, Flexible Payment Options, Simple Policies, Extensive Agent Network |

Analyzing Performance and Reputation

When choosing a cheap car insurance provider, it’s crucial to assess their performance and reputation in the market. Here’s a closer look at some key factors to consider.

Financial Stability and Ratings

Financial stability is a critical aspect of any insurance company. Ensure the provider you choose has a strong financial rating, indicating their ability to pay claims promptly. Reputable rating agencies, such as AM Best or Standard & Poor’s, provide insights into a company’s financial health. Look for providers with stable ratings and a solid track record of financial reliability.

Customer Satisfaction and Reviews

Customer satisfaction is a powerful indicator of a provider’s performance. Research customer reviews and ratings to gauge their overall satisfaction. Look for patterns in the feedback, such as prompt claim settlements, responsive customer service, and fair treatment. Positive reviews can provide valuable insights into the provider’s reputation and reliability.

Additionally, consider the provider’s response to negative reviews. A company that actively addresses customer concerns and works towards resolution demonstrates a commitment to customer satisfaction.

Claims Handling and Settlement

The efficiency of a provider’s claims handling process is crucial. Look for providers with a dedicated and experienced claims team. Prompt and fair settlement of claims is essential to ensure you receive the compensation you’re entitled to without delays or hassles. Consider factors such as:

- Average claim processing time

- Customer feedback on claim settlements

- Accessibility of the claims department

- Use of technology to streamline the claims process

A provider with a well-organized and efficient claims process can provide peace of mind in the event of an accident or incident.

Future Implications and Industry Trends

The car insurance industry is constantly evolving, with new technologies and trends shaping the future of insurance. Here’s a glimpse into the potential implications and trends that may impact cheap car insurance in the coming years.

Telematics and Usage-Based Insurance

Telematics, the use of technology to track driving behavior, is gaining traction in the insurance industry. Usage-based insurance (UBI) programs use telematics to monitor driving habits, offering discounts to safe drivers. This trend is likely to continue, with more providers adopting UBI to incentivize safe driving and offer personalized rates.

Digital Transformation and Online Platforms

The digital transformation of the insurance industry is underway, with providers investing in online platforms and mobile apps. This shift towards digital convenience allows customers to manage their policies, file claims, and access information quickly and easily. Cheap car insurance providers are likely to enhance their online presence, making it more convenient for customers to interact and transact.

Regulatory Changes and Market Dynamics

Regulatory changes and market dynamics can impact the car insurance industry. Factors such as changing legislation, economic shifts, and industry consolidation can influence the availability and pricing of cheap insurance. It’s essential to stay informed about these changes and their potential impact on your insurance options.

Additionally, the increasing popularity of electric vehicles and autonomous driving technologies may lead to new insurance products and coverage options, shaping the future landscape of cheap car insurance.

Conclusion

Finding cheap car insurance is a balancing act, requiring careful consideration of coverage, providers, and industry trends. While affordable policies offer financial relief, it’s essential to understand the trade-offs and choose a provider that aligns with your needs and priorities. By comparing options, analyzing performance, and staying informed about industry developments, you can make an informed decision and secure the best value for your insurance needs.

What is the average cost of cheap car insurance per month?

+

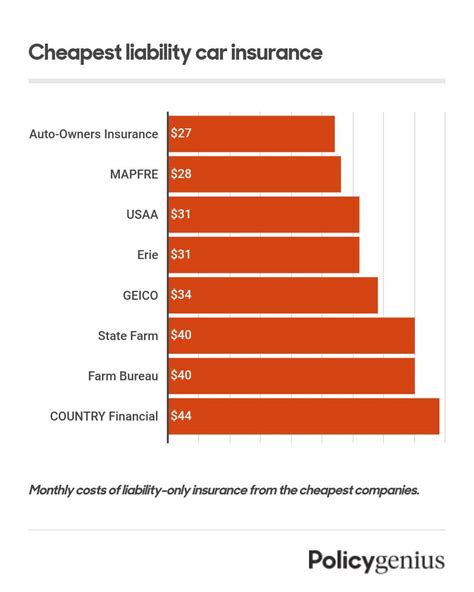

The average cost of cheap car insurance can vary widely depending on factors such as location, driving history, and the chosen provider. However, as a general guideline, you can expect to pay around 50 to 150 per month for a basic liability-only policy. It’s important to note that this range is an estimate and your specific premium may be higher or lower based on your individual circumstances.

How can I further reduce my car insurance costs beyond cheap insurance options?

+

There are several strategies to reduce your car insurance costs beyond opting for cheap insurance. These include shopping around and comparing quotes from multiple providers, bundling your insurance policies (e.g., combining car and home insurance), maintaining a good driving record, and taking advantage of available discounts. Additionally, consider increasing your deductible, as a higher deductible can lower your premium but requires a larger out-of-pocket payment in the event of a claim.

Are there any drawbacks to choosing the cheapest car insurance option available?

+

While cheap car insurance can save you money, it’s important to be aware of potential drawbacks. The cheapest options often come with limited coverage, meaning you may not be fully protected in the event of an accident. Additionally, cheap insurance policies may have higher deductibles, which can result in larger out-of-pocket expenses when filing a claim. It’s crucial to carefully review the policy terms and understand the coverage limits to ensure you have adequate protection for your needs.