How Much Life Insurance

Determining the right amount of life insurance is a crucial financial decision that can provide peace of mind for both you and your loved ones. It ensures that your family is protected and financially secure in the event of your untimely passing. The amount of life insurance you need is unique to your individual circumstances and goals. In this comprehensive guide, we will delve into the various factors that influence the calculation of life insurance needs and provide you with expert insights to help you make an informed decision.

Understanding Life Insurance Coverage

Life insurance is a contract between you and an insurance company. In exchange for premium payments, the insurance provider promises to pay a specified amount to your beneficiaries upon your death. This financial protection can help cover a range of expenses, including funeral costs, outstanding debts, and long-term financial obligations such as mortgage payments or your children’s education.

There are primarily two types of life insurance: term life insurance and permanent life insurance. Term life insurance offers coverage for a specified period, typically ranging from 10 to 30 years. It is often more affordable and suitable for individuals with temporary financial obligations. On the other hand, permanent life insurance, including whole life and universal life policies, provides lifelong coverage and often includes a cash value component that can be accessed during your lifetime.

Factors Influencing Life Insurance Needs

When determining how much life insurance you require, several key factors come into play. These include your current financial situation, future goals, and the specific needs of your loved ones. Let’s explore each of these factors in detail:

1. Financial Obligations and Debts

One of the primary reasons for purchasing life insurance is to ensure that your debts are paid off and your loved ones are not burdened with financial obligations in the event of your passing. Consider your outstanding loans, mortgages, credit card debts, and any other financial commitments. The life insurance coverage should be sufficient to settle these debts, allowing your beneficiaries to maintain their standard of living.

| Debt Type | Outstanding Balance |

|---|---|

| Mortgage | $250,000 |

| Student Loans | $50,000 |

| Credit Card Debt | $10,000 |

In the example above, the total debt amounts to $310,000. This figure should be a significant consideration when calculating your life insurance needs.

2. Income Replacement

Life insurance is often used to replace the income that your family relies on. If you were to pass away, the insurance proceeds can help maintain your family’s financial stability and cover their daily expenses, such as groceries, utilities, and other necessary costs.

To calculate the income replacement need, consider the following:

- Current Annual Income: This is the starting point for determining how much income your family would require to maintain their current lifestyle.

- Future Income Projections: Estimate your income growth over time, taking into account promotions, raises, and potential career advancements.

- Inflation Rate: Account for the impact of inflation on your family's future expenses. Adjust your income projections accordingly.

For example, if your current annual income is $80,000, and you expect a 3% annual income growth rate, your future income needs could be calculated as follows:

- Year 1: $80,000

- Year 2: $82,400 (3% growth)

- Year 3: $84,824 (3% growth)

- ...and so on

By calculating the present value of these future income needs, you can determine the amount of life insurance coverage required to replace your income.

3. Funeral and Burial Costs

Funeral and burial expenses can be a significant financial burden for your loved ones. On average, these costs can range from 8,000 to 12,000 or more, depending on the funeral arrangements and location. Life insurance coverage should include an amount sufficient to cover these expenses, ensuring your family doesn’t have to worry about immediate financial strain during their time of grief.

| Funeral Cost Component | Estimated Cost |

|---|---|

| Casket | $3,000 |

| Funeral Home Services | $2,500 |

| Embalming and Preparation | $1,000 |

| Cemetery Plot and Graveside Service | $2,000 |

| Obituary Notices and Flowers | $500 |

| Other Miscellaneous Costs | $1,000 |

| Total Estimated Funeral Cost | $10,000 |

4. Education Funding

If you have children or plan to have them in the future, life insurance can play a crucial role in funding their education. College tuition fees continue to rise, and providing a solid education for your children can be a significant financial goal. Calculate the estimated cost of higher education for each child and factor it into your life insurance coverage needs.

| Child's Name | Estimated College Tuition |

|---|---|

| Child 1 | $200,000 |

| Child 2 | $220,000 |

| Total Education Funding Required | $420,000 |

5. Retirement Planning

Life insurance can also be used to enhance your retirement planning. If you are the primary income earner in your household, ensuring that your spouse or partner has sufficient funds for retirement becomes crucial. Consider the amount needed to maintain their desired lifestyle and include it in your life insurance calculations.

6. Other Specific Needs

Every family’s circumstances are unique. You may have additional specific needs or goals, such as funding a business venture, providing for a special-needs child, or covering the cost of long-term care. Take these into account when determining your life insurance coverage requirements.

Life Insurance Calculation Methods

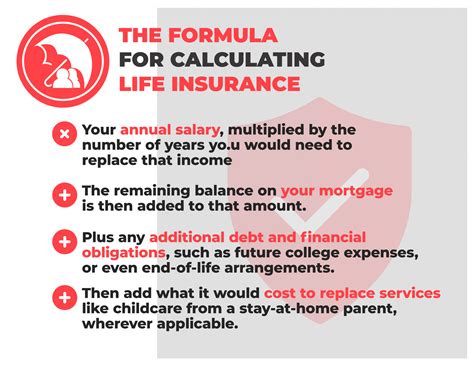

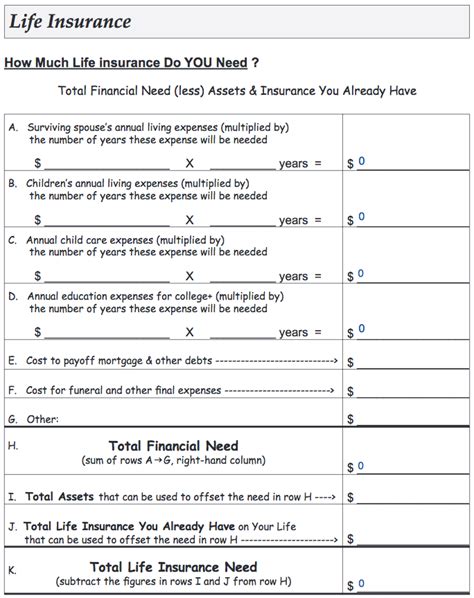

Now that we’ve explored the various factors influencing life insurance needs, let’s delve into the methods you can use to calculate the appropriate coverage amount:

1. The Rule of Thumb Method

A commonly used rule of thumb suggests that you should have life insurance coverage amounting to 10 to 15 times your annual income. While this method is simple and quick, it may not account for your specific financial obligations and goals. It is a good starting point but should be adjusted based on your unique circumstances.

2. Needs-Based Calculation

The needs-based calculation method involves adding up all the financial obligations and goals we discussed earlier. By totaling the amounts required for debt repayment, income replacement, funeral costs, education funding, and any other specific needs, you can determine the minimum coverage amount you should aim for.

3. Income Replacement Ratio

Another approach is to calculate the income replacement ratio. This method considers the percentage of your income that you want your life insurance to provide for your family. For example, if you earn 100,000 annually and want your life insurance to replace 75% of your income, you would need coverage amounting to 75,000 per year.

4. Online Life Insurance Calculators

Numerous online tools and calculators are available to help you estimate your life insurance needs. These calculators often consider various factors, including your age, income, debts, and financial goals. While they can provide a quick estimate, it’s important to note that these tools may not capture all the nuances of your specific situation.

Additional Considerations

As you navigate the process of determining your life insurance needs, keep the following considerations in mind:

1. Inflation and Future Value

When calculating your life insurance needs, it’s essential to account for inflation. Over time, the cost of living increases, and your financial obligations may grow. Ensure that your life insurance coverage takes into account the future value of your debts, income, and other financial goals.

2. Review and Adjust Regularly

Your life insurance needs are not static. As your financial situation evolves, your coverage requirements may change. Regularly review your policy and adjust it as necessary. Significant life events such as marriage, the birth of a child, a career change, or the purchase of a new home may require an update to your life insurance coverage.

3. Consult a Financial Advisor

If you’re unsure about how much life insurance you need or want a more personalized assessment, consider consulting a qualified financial advisor. They can provide expert guidance tailored to your specific circumstances and help you make informed decisions about your life insurance coverage.

Conclusion

Determining the right amount of life insurance is a critical step in securing your family’s financial future. By understanding your financial obligations, income needs, and specific goals, you can make an informed decision about the coverage amount that suits your unique circumstances. Remember, life insurance is a flexible tool that can be adjusted as your life changes, ensuring that your loved ones are always protected.

How much life insurance do I need if I’m single with no dependents?

+If you’re single with no dependents, you may still have financial obligations, such as outstanding debts or funeral expenses. Calculate the total amount needed to cover these costs and consider purchasing a term life insurance policy with sufficient coverage to settle these debts.

Is life insurance necessary if I have significant savings and investments?

+While savings and investments can provide financial security, life insurance offers additional protection. It ensures that your loved ones have immediate access to funds to cover short-term expenses and prevents them from having to liquidate assets during a time of grief. Consider purchasing life insurance to complement your savings and provide a safety net.

Can I increase my life insurance coverage over time?

+Yes, many life insurance policies allow you to increase your coverage amount as your needs change. This can be particularly useful if you experience significant life events, such as marriage, the birth of a child, or a major career advancement. Contact your insurance provider to discuss your options for increasing coverage.