What Is Insurence

In today's complex world, understanding the intricacies of insurance is more crucial than ever. It's a financial safety net that offers protection and peace of mind against various uncertainties and risks. This article aims to delve into the world of insurance, providing an in-depth analysis of its types, benefits, and implications.

The Basics of Insurance

Insurance, at its core, is a contractual agreement between an individual or entity (the policyholder) and an insurance company. This agreement, known as an insurance policy, outlines the terms and conditions under which the insurance company agrees to provide financial protection to the policyholder in the event of a specified loss, damage, or liability.

The primary purpose of insurance is to transfer the financial burden of potential losses from the policyholder to the insurance company. By paying regular premiums, the policyholder purchases this protection, ensuring that they are financially covered in the face of unforeseen events.

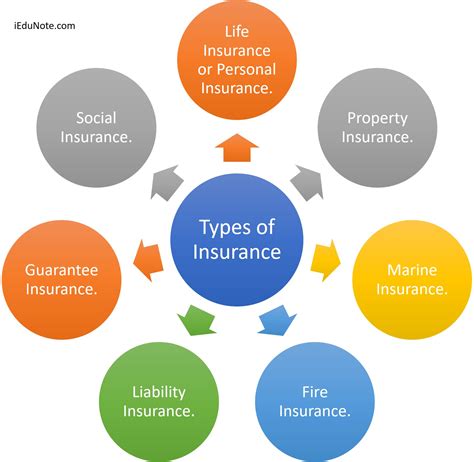

Types of Insurance

The insurance industry is vast and diverse, offering a wide range of products to cater to different needs and risks. Here are some of the most common types of insurance:

Life Insurance

Life insurance provides financial security to the policyholder’s beneficiaries in the event of their death. It can help cover funeral expenses, outstanding debts, and provide a financial cushion for loved ones left behind.

Health Insurance

Health insurance is designed to cover the costs of medical care, including hospital stays, doctor visits, prescription drugs, and preventive care. It helps individuals and families manage the financial burden of healthcare expenses.

Auto Insurance

Auto insurance protects vehicle owners and drivers against financial loss in the event of an accident, theft, or other vehicle-related damages. It typically includes liability coverage, collision coverage, and comprehensive coverage.

Homeowners Insurance

Homeowners insurance provides coverage for a homeowner’s dwelling, personal property, and liability. It offers protection against damages caused by natural disasters, theft, and other perils.

Business Insurance

Business insurance is tailored to the needs of businesses, offering protection against various risks such as property damage, liability claims, business interruption, and more. It helps ensure the financial stability and continuity of a business.

Travel Insurance

Travel insurance provides coverage for unexpected events that may occur during a trip, such as trip cancellations, medical emergencies, lost luggage, and more. It offers peace of mind to travelers and helps mitigate the financial impact of travel-related issues.

How Insurance Works

Insurance operates on the principle of risk pooling. When many individuals or entities contribute premiums to an insurance fund, the risk of a significant loss is spread across a large group. This allows the insurance company to offer coverage to policyholders at a manageable cost.

When a policyholder experiences a covered loss, they file a claim with the insurance company. The insurance company then evaluates the claim to determine its validity and the extent of the covered loss. If the claim is approved, the insurance company pays out the agreed-upon amount to the policyholder, helping them recover financially from the loss.

Risk Assessment and Premiums

Insurance companies carefully assess the risks associated with each policy. They consider various factors, such as the policyholder’s age, health status, occupation, location, and the type of coverage desired. Based on this assessment, they determine the premium, which is the amount the policyholder pays for the insurance coverage.

Premiums are calculated to ensure that the insurance company can cover potential claims while maintaining a profitable business. The higher the perceived risk, the higher the premium is likely to be. However, insurance companies also offer discounts and incentives to encourage safe behavior and reduce risks.

Benefits of Insurance

Insurance provides numerous benefits to individuals, businesses, and society as a whole. Here are some key advantages:

Financial Protection

The primary benefit of insurance is financial protection. It ensures that policyholders are not left financially devastated by unexpected events. Whether it’s a serious illness, a car accident, or a natural disaster, insurance provides the means to recover and rebuild.

Peace of Mind

Knowing that you have insurance coverage can bring a sense of security and peace of mind. It allows individuals and businesses to focus on their daily lives and pursuits without constantly worrying about potential financial losses.

Risk Management

Insurance is a powerful tool for risk management. By transferring the financial risk to an insurance company, policyholders can mitigate the impact of unforeseen events and make informed decisions about their finances and future.

Access to Expertise

Insurance companies employ experts in various fields, such as risk assessment, claims handling, and legal matters. Policyholders can benefit from this expertise, ensuring that they receive the best possible guidance and support when it comes to managing risks and resolving claims.

The Future of Insurance

The insurance industry is constantly evolving to keep pace with technological advancements and changing consumer needs. Here are some trends and implications for the future of insurance:

Digital Transformation

Insurance companies are increasingly adopting digital technologies to enhance their services. This includes online policy management, digital claims processing, and the use of data analytics to improve risk assessment and customer experience.

Personalized Insurance

With the availability of vast amounts of data, insurance companies are moving towards more personalized insurance products. They can now offer tailored coverage based on an individual’s unique circumstances and preferences, providing a more customized and efficient insurance experience.

Insurtech Innovations

The rise of insurtech companies is revolutionizing the insurance industry. These startups leverage technology to offer innovative insurance products and services, such as usage-based insurance, peer-to-peer insurance, and parametric insurance. These new models are challenging traditional insurance models and providing consumers with more choices.

Focus on Prevention

Insurance companies are increasingly recognizing the value of prevention over cure. They are incentivizing policyholders to adopt healthy lifestyles, drive safely, and take measures to protect their property. By promoting preventive measures, insurance companies can reduce the frequency and severity of claims, benefiting both policyholders and the industry.

Conclusion

Insurance is a vital aspect of modern life, offering protection, peace of mind, and financial security. From life insurance to health, auto, and business insurance, there is a policy to suit every need. Understanding the types of insurance, how they work, and their benefits can empower individuals and businesses to make informed decisions about their insurance coverage.

As the insurance industry continues to evolve, it is essential to stay informed about the latest trends and innovations. By embracing digital transformation, personalized insurance, and preventive measures, insurance companies and policyholders can work together to create a more resilient and sustainable future.

How does insurance benefit society as a whole?

+Insurance plays a crucial role in promoting social and economic stability. By providing financial protection, it helps individuals and businesses recover from losses, reducing the strain on public resources and supporting overall economic growth.

What are some common misconceptions about insurance?

+One common misconception is that insurance is only for major disasters or accidents. In reality, insurance covers a wide range of risks, including everyday incidents and unexpected expenses. Another misconception is that insurance is too expensive, but with the right policy and careful comparison, insurance can be affordable and provide valuable protection.

How can I choose the right insurance policy for my needs?

+To choose the right insurance policy, assess your specific needs and risks. Consider factors such as your age, health, occupation, location, and the value of your assets. Compare different policies and insurers, and don’t hesitate to seek advice from insurance professionals to ensure you get the coverage that suits your circumstances.