Auto Insurance Quotes

When it comes to protecting your vehicle and finances, auto insurance is a crucial aspect of responsible vehicle ownership. Obtaining auto insurance quotes is a fundamental step in ensuring you have adequate coverage at a reasonable cost. In this comprehensive guide, we will delve into the world of auto insurance quotes, exploring the factors that influence them, the process of obtaining accurate quotes, and strategies to secure the best coverage for your needs.

Understanding Auto Insurance Quotes

Auto insurance quotes are estimates provided by insurance companies, outlining the cost of coverage for a specific vehicle and driver. These quotes are tailored to individual circumstances, considering factors such as the make and model of the car, driving history, location, and desired coverage limits. By requesting quotes from multiple insurers, drivers can compare options and make informed decisions about their auto insurance coverage.

Factors Influencing Auto Insurance Quotes

Several key factors play a significant role in determining auto insurance quotes. These include:

- Vehicle Information: The type of car, its age, and safety features can impact insurance rates. Luxury vehicles and sports cars often have higher premiums due to their repair costs and potential for accidents.

- Driver’s Profile: Your driving record, age, gender, and marital status are considered. Young drivers and those with a history of accidents or violations may face higher premiums.

- Location: The area where you live and drive influences rates. Urban areas with higher population density and accident rates may result in increased insurance costs.

- Coverage Limits: The level of coverage you choose affects your quote. Comprehensive and collision coverage, as well as liability limits, can impact the overall cost.

- Discounts: Insurance companies offer various discounts, such as safe driver discounts, multi-policy discounts, and good student discounts. These can significantly reduce your insurance premiums.

Obtaining Accurate Auto Insurance Quotes

To ensure you receive accurate auto insurance quotes, consider the following steps:

- Gather Information: Have your vehicle’s details, including make, model, year, and VIN, readily available. Also, prepare your driver’s license, registration, and any recent insurance documents.

- Compare Multiple Quotes: Reach out to at least three insurance providers to compare quotes. Online quote comparison tools can be a convenient way to gather multiple quotes in one place.

- Provide Accurate Details : Be honest and provide accurate information about your driving history, vehicle usage, and desired coverage. Misrepresenting information can lead to issues when making a claim.

- Explore Coverage Options: Discuss different coverage options with insurance agents to understand the benefits and costs. Consider the appropriate levels of liability, collision, comprehensive, and additional coverage options like rental car reimbursement.

- Review Policy Terms: Pay attention to the policy terms and conditions, including deductibles, coverage exclusions, and renewal processes. Ensure you understand the fine print before committing to a policy.

Tips for Securing the Best Auto Insurance Quote

Here are some strategies to help you find the most suitable auto insurance quote:

- Shop Around: Don’t settle for the first quote you receive. Compare quotes from multiple insurers to find the best value for your needs.

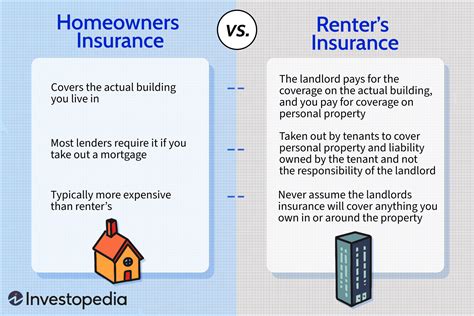

- Bundle Policies: Consider bundling your auto insurance with other policies, such as homeowners or renters insurance. Many insurers offer discounts for multiple policy bundles.

- Maintain a Good Driving Record: A clean driving record can significantly reduce your insurance premiums. Avoid accidents and violations to keep your record clean.

- Increase Your Deductible: Opting for a higher deductible can lower your insurance premiums. However, ensure you can afford the deductible in the event of a claim.

- Explore Telematics Programs: Some insurers offer telematics programs that track your driving behavior. Safe driving habits can lead to discounted premiums.

The Importance of Regular Policy Review

Obtaining auto insurance quotes is not a one-time event. It’s essential to regularly review and update your policy to ensure you have adequate coverage and are not overpaying. Life circumstances, such as moving to a new location, purchasing a new vehicle, or getting married, can impact your insurance needs.

Performance Analysis and Future Implications

When analyzing auto insurance quotes, it’s crucial to assess the performance and reliability of insurance providers. Look for insurers with a strong financial rating and a positive track record of handling claims efficiently. Consider customer reviews and feedback to gauge the insurer’s reputation and customer satisfaction.

Additionally, stay informed about industry trends and changes in auto insurance regulations. Keeping up with these developments can help you make informed decisions and take advantage of new opportunities to save on insurance costs.

| Insurance Provider | Average Premium | Financial Rating |

|---|---|---|

| Provider A | $1,200 annually | A++ (Excellent) |

| Provider B | $1,150 annually | A+ (Superior) |

| Provider C | $1,300 annually | A (Excellent) |

FAQ

What is the difference between liability and comprehensive coverage in auto insurance?

+Liability coverage protects you from financial losses if you are at fault in an accident, covering damages to the other party’s vehicle and medical expenses. Comprehensive coverage, on the other hand, provides protection for non-accident-related events, such as theft, vandalism, or natural disasters.

How often should I review my auto insurance policy?

+It’s recommended to review your auto insurance policy annually, or whenever your circumstances change significantly. This ensures your coverage remains adequate and you’re not overpaying for unnecessary coverage.

Can I negotiate auto insurance quotes with insurance providers?

+While auto insurance quotes are typically non-negotiable, you can still discuss your options with insurance agents. They may be able to offer alternative coverage options or provide insights into discounts you may qualify for.