Home Renter Insurance

Protecting your belongings and securing your peace of mind as a home renter is crucial, especially in an unpredictable world. Home renter insurance, often overlooked, plays a pivotal role in safeguarding you from financial losses and providing essential coverage for various unforeseen events. This comprehensive guide aims to delve into the intricacies of home renter insurance, offering an expert's perspective on why it's indispensable and how it can significantly impact your rental experience.

Understanding the Necessity of Home Renter Insurance

In the realm of real estate, renting a home is a common practice, offering flexibility and convenience. However, it also comes with its share of risks. From unexpected damages to theft, renters face a myriad of potential issues that can result in substantial financial burdens. This is where home renter insurance steps in as a critical tool to mitigate these risks and provide a safety net for renters.

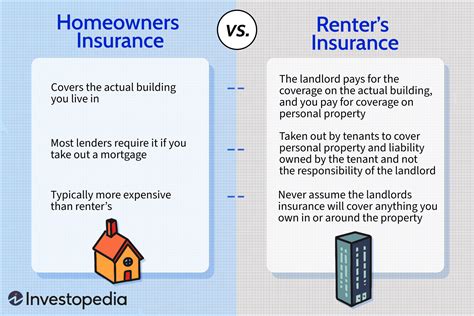

Home renter insurance, also known as renters' insurance or tenant insurance, is a type of property insurance that specifically caters to individuals who rent their living spaces. It's designed to protect your personal belongings and provide liability coverage in case of accidents or damages caused by you or your guests.

Key Benefits of Home Renter Insurance

The advantages of home renter insurance are multifaceted and significantly enhance your rental experience:

- Protection for Personal Belongings: One of the primary benefits is the coverage it provides for your personal property. In the event of a fire, theft, or other covered perils, your insurance can help replace or repair your belongings.

- Liability Coverage: This insurance also offers liability protection. If someone gets injured in your rental property and decides to sue you, your insurance can help cover the legal costs and any damages awarded.

- Additional Living Expenses: In certain situations, such as a covered loss that renders your rental uninhabitable, home renter insurance can cover your additional living expenses, like hotel stays or temporary housing.

- Personal Injury Protection: Some policies also include personal injury protection, which can cover you if you’re falsely accused of causing injury or property damage to others.

What Does Home Renter Insurance Typically Cover?

The coverage provided by home renter insurance can vary depending on the policy and the insurer. However, there are several common aspects that are typically included in most policies:

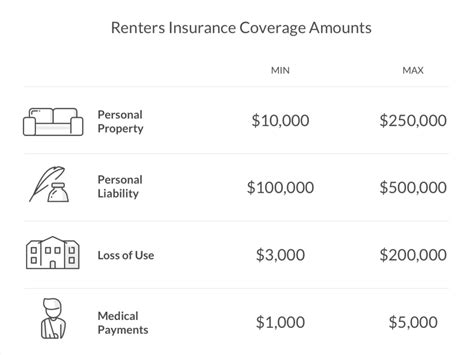

- Personal Property: This covers your furniture, electronics, clothing, and other personal items against damages or losses from covered perils. It’s important to note that certain high-value items like jewelry or artwork might require additional coverage.

- Liability: Liability coverage protects you if you’re legally responsible for causing bodily injury or property damage to others. It can cover medical expenses, legal fees, and damages.

- Medical Payments: This coverage pays for medical expenses if someone is injured on your rental property, regardless of fault.

- Additional Living Expenses: As mentioned earlier, this coverage helps with the cost of temporary housing and other living expenses if your rental becomes uninhabitable due to a covered loss.

- Loss of Use: Similar to additional living expenses, this coverage reimburses you for the extra costs incurred when you’re unable to use your rental due to a covered loss.

| Coverage Type | Description |

|---|---|

| Personal Property | Covers your belongings against damage or loss from covered perils. |

| Liability | Protects you if you're legally responsible for causing injury or damage to others. |

| Medical Payments | Pays for medical expenses for injuries on your rental property. |

| Additional Living Expenses | Covers temporary housing costs if your rental becomes uninhabitable. |

| Loss of Use | Reimburses extra costs when you can't use your rental due to a covered loss. |

The Process of Obtaining Home Renter Insurance

Securing home renter insurance is a straightforward process, and it’s highly recommended to do so before you move into your new rental property. Here’s a step-by-step guide to help you navigate the process:

- Research Insurers: Start by researching reputable insurance companies that offer renter’s insurance. You can check online reviews, compare prices, and look for companies with a solid track record of customer satisfaction.

- Understand Your Needs: Before obtaining quotes, it’s crucial to understand your specific insurance needs. Consider the value of your personal belongings, the level of liability coverage you require, and any additional coverages you might need, such as for high-value items.

- Get Quotes: Once you’ve identified a few potential insurers, request quotes. Most insurance companies offer online quote tools, making it convenient to compare prices and coverages.

- Review Policy Details: When you receive your quotes, carefully review the policy details. Ensure you understand the coverage limits, deductibles, and any exclusions. Don’t hesitate to ask questions if something is unclear.

- Choose a Policy: After reviewing the quotes and understanding the coverages, select the policy that best suits your needs and budget. Ensure you understand the renewal process and any potential changes in coverage over time.

- Purchase the Policy: Once you’ve decided on a policy, purchase it and ensure you receive a confirmation of coverage. Keep the policy documents in a safe place and review them periodically to ensure they remain up-to-date with your needs.

Tips for Choosing the Right Home Renter Insurance

Selecting the right home renter insurance policy is crucial to ensure you have adequate coverage. Here are some tips to help you make an informed decision:

- Consider Your Risk Profile: Assess your personal risk profile. If you live in an area prone to natural disasters or have valuable possessions, you might need a policy with higher coverage limits.

- Compare Deductibles: Deductibles can vary significantly between policies. Choose a deductible that you’re comfortable paying out-of-pocket in the event of a claim.

- Review Exclusions: Every policy has exclusions, so it’s essential to understand what’s not covered. If there are specific risks you’re concerned about, ensure your policy provides coverage for those.

- Bundle for Savings: If you have other insurance needs, such as auto insurance, consider bundling your policies with the same insurer. This can often lead to significant savings.

- Read Reviews: Check online reviews and ratings to gauge the insurer’s reputation and customer satisfaction. This can give you valuable insights into the quality of their service and claims handling.

Claims Process and Handling

In the unfortunate event that you need to make a claim on your home renter insurance, it’s important to understand the process and your responsibilities. Here’s a guide to help you navigate the claims process:

- Report the Claim: As soon as possible after a covered loss occurs, report the claim to your insurance company. Most insurers offer 24⁄7 claims reporting, either online or over the phone.

- Provide Necessary Information: When reporting your claim, be prepared to provide details about the incident, including the date, time, and circumstances. You might also need to provide documentation, such as photos or receipts.

- Cooperate with the Claims Adjuster: The insurance company will assign a claims adjuster to handle your case. Cooperate fully with the adjuster and provide any additional information or documentation they request.

- Understand the Claims Decision: Once the adjuster has all the necessary information, they will make a decision on your claim. They might approve the claim as submitted, approve it with adjustments, or deny it if it’s not covered by your policy.

- Receive Payment or Denial: If your claim is approved, you’ll receive payment for the covered loss. The amount and method of payment will depend on your policy and the specific circumstances of your claim.

Tips for a Smooth Claims Process

To ensure a smooth and efficient claims process, consider the following tips:

- Document Everything: Take photos or videos of any damage or loss, and keep detailed records of all conversations and interactions with your insurance company.

- Understand Your Policy: Familiarize yourself with your policy and its coverage limits and exclusions. This will help you understand what to expect during the claims process.

- Be Prompt and Cooperative: Report your claim promptly and cooperate fully with the claims adjuster. This will help expedite the process and ensure a fair and accurate resolution.

- Seek Professional Help: If your claim is complex or you’re unsure about the process, consider seeking help from an insurance professional or an attorney who specializes in insurance claims.

Common Misconceptions and Frequently Asked Questions

Home renter insurance is often misunderstood, leading to misconceptions and confusion. Here, we address some common questions and misconceptions to provide clarity:

Is Home Renter Insurance Mandatory?

+No, home renter insurance is not mandatory in most places. However, it's highly recommended to protect your belongings and personal liability. Some rental agreements might require it, so be sure to check your lease agreement.

Does Home Renter Insurance Cover Natural Disasters?

+It depends on the policy and the specific natural disaster. Some policies might cover certain natural disasters like fire or lightning, but others like floods or earthquakes might require additional coverage.

How Much Does Home Renter Insurance Cost?

+The cost of home renter insurance can vary depending on factors like the value of your belongings, the location of your rental property, and your liability coverage limits. On average, it ranges from $15 to $30 per month, but it can be higher or lower based on your specific circumstances.

Can I Get Home Renter Insurance for Short-Term Rentals?

+Yes, home renter insurance is available for short-term rentals, including Airbnb and other vacation rentals. However, the coverage and pricing might be different, so be sure to check with your insurer.

What Should I Do If My Claim Is Denied?

+If your claim is denied, first review the denial letter and understand the reasons for the denial. If you disagree with the decision, you can appeal the denial by providing additional information or evidence to support your claim. You might also consider seeking legal advice if necessary.

Home renter insurance is an essential aspect of responsible renting. It provides peace of mind, knowing that your belongings and personal liability are protected. By understanding the coverage, choosing the right policy, and being prepared for the claims process, you can ensure that you're adequately protected during your rental experience.

Remember, while home renter insurance is crucial, it’s only one part of your financial protection. It’s always a good idea to review your overall insurance needs and ensure you have the right coverage for your situation.