Landlords Insurance

Landlord insurance is a specialized form of property insurance tailored to meet the unique needs and risks faced by individuals who own and rent out residential or commercial properties. This type of insurance is essential for landlords to protect their investments and ensure a stable and secure rental business. In this comprehensive article, we will delve into the intricacies of landlord insurance, exploring its features, benefits, and how it safeguards both landlords and their properties.

Understanding Landlord Insurance: A Comprehensive Overview

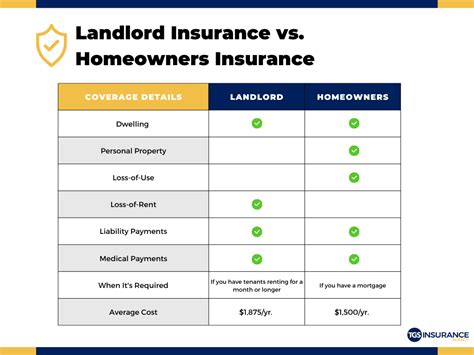

Landlord insurance is a comprehensive policy designed to provide coverage for various aspects of property ownership and management. Unlike standard home insurance, which primarily caters to homeowners who reside in the property, landlord insurance is tailored to the specific challenges and liabilities associated with renting out a property. It offers a wide range of coverage options to address the diverse needs of landlords.

One of the key benefits of landlord insurance is its ability to provide financial protection in the event of unexpected incidents or liabilities. Landlords face a multitude of risks, including property damage, liability claims, and loss of rental income. This insurance policy acts as a safety net, ensuring that landlords can navigate these challenges with confidence and minimize the financial impact on their business.

Key Features of Landlord Insurance Policies

Landlord insurance policies offer a comprehensive suite of features to address the unique needs of property owners. Here are some of the essential components typically included in a landlord insurance policy:

- Building and Contents Coverage: This aspect of the policy provides protection for the physical structure of the property, including any permanent fixtures and fittings. It covers damage caused by perils such as fire, flood, storms, and vandalism. Additionally, it often extends to cover the contents of the property, which can be especially beneficial for landlords who provide furnished accommodations.

- Liability Protection: Landlord insurance offers liability coverage, which is crucial for protecting landlords from potential lawsuits. It covers legal fees and compensation if a tenant or visitor is injured on the property or sustains property damage due to the landlord's negligence. This protection extends beyond the physical premises and can include off-site incidents related to the rental business.

- Loss of Rental Income: One of the most significant risks for landlords is the loss of rental income. In the event of a covered loss, such as a fire or extensive damage, the property may become uninhabitable, leading to a temporary loss of income. Landlord insurance policies typically include coverage for loss of rental income, ensuring that landlords can continue to receive financial support during the repair or rebuilding process.

- Tenant Default and Malicious Damage: Landlord insurance often provides protection against tenant default, covering the cost of legal expenses and potential losses if a tenant fails to pay rent or breaches the lease agreement. Additionally, it covers malicious damage caused by tenants, ensuring that landlords are not left financially burdened by intentional acts of destruction.

- Additional Perils and Coverage Options: Depending on the specific policy and the location of the property, landlord insurance may offer coverage for a wide range of additional perils. This can include natural disasters, such as earthquakes or hurricanes, as well as other specialized coverages like business interruption insurance for commercial properties.

The Importance of Customized Coverage

Every rental property and landlord’s situation is unique, which is why it is crucial to customize landlord insurance policies to fit specific needs. Factors such as the location of the property, the type of tenants, and the nature of the rental business all play a role in determining the appropriate level and scope of coverage.

For instance, a landlord who owns a commercial property may require additional coverage for business-related liabilities and interruptions. On the other hand, a residential landlord with a high-risk property, such as a property in an area prone to natural disasters, may need to prioritize coverage for specific perils like flood or earthquake.

Working with insurance professionals who specialize in landlord insurance is essential to ensure that the policy provides adequate protection. They can guide landlords through the process of selecting the right coverage limits, deductibles, and optional endorsements to create a policy that aligns with their individual circumstances.

The Benefits of Landlord Insurance: Protecting Your Investment

Landlord insurance offers a multitude of benefits that go beyond financial protection. Here are some key advantages of investing in a comprehensive landlord insurance policy:

- Peace of Mind: One of the primary benefits of landlord insurance is the peace of mind it provides. Landlords can rest assured knowing that their investment is protected against a wide range of risks. Whether it's property damage, liability claims, or loss of rental income, a robust insurance policy ensures that landlords can navigate these challenges without significant financial strain.

- Risk Mitigation: Landlord insurance acts as a proactive risk management tool. By identifying and addressing potential risks, landlords can minimize the likelihood of financial losses and legal liabilities. This not only protects their investment but also contributes to the overall stability and success of their rental business.

- Financial Stability: In the event of a covered loss, landlord insurance provides financial support to cover repair or rebuilding costs. This ensures that landlords can quickly restore their property to its original condition, minimizing disruptions to their rental business and maintaining a positive relationship with tenants.

- Legal Protection: The liability coverage offered by landlord insurance is a crucial aspect of risk management. It provides a safety net against potential lawsuits, ensuring that landlords have the financial means to defend themselves and, if necessary, compensate those affected by accidents or injuries on the property.

- Attractive to Tenants: A landlord who demonstrates a commitment to safety and security through a comprehensive insurance policy may be more appealing to potential tenants. Tenants often prefer renting from landlords who take proactive measures to protect their investments and ensure a safe living environment.

Case Study: Real-Life Impact of Landlord Insurance

To illustrate the practical benefits of landlord insurance, let’s consider a real-life scenario. Imagine a landlord who owns a residential property in an area prone to severe weather events. Despite taking precautions, the property sustains significant damage during a powerful storm, rendering it uninhabitable.

Without landlord insurance, the landlord would be faced with a daunting financial burden. The cost of repairs, potential legal liabilities if tenants are injured, and the loss of rental income during the restoration process could lead to significant financial strain and even threaten the viability of the rental business.

However, with a comprehensive landlord insurance policy in place, the landlord can navigate this challenging situation with greater ease. The insurance coverage provides financial support for the necessary repairs, covers any legal expenses related to tenant claims, and even offers compensation for the loss of rental income during the restoration period. This real-life example highlights the critical role that landlord insurance plays in protecting both the property and the landlord's financial stability.

Choosing the Right Landlord Insurance Provider

Selecting the right landlord insurance provider is a crucial step in ensuring comprehensive and reliable coverage. Here are some key considerations when choosing an insurance company:

- Experience and Expertise: Look for insurance providers with a proven track record in the landlord insurance space. Experienced companies understand the unique needs and risks associated with rental properties and can offer tailored solutions. Their expertise can be invaluable in guiding you through the policy selection process and ensuring you receive adequate coverage.

- Financial Stability: It is essential to choose an insurance provider with a strong financial background. A stable insurer can provide long-term security and ensure that they will be able to honor their commitments, even in the face of significant claims.

- Customizable Policies: Seek out insurance companies that offer customizable landlord insurance policies. As mentioned earlier, every rental property is unique, and the ability to tailor the policy to your specific needs is crucial. Customization allows you to select the coverage limits, deductibles, and optional endorsements that align with your risk profile and financial goals.

- Claims Handling Process: The efficiency and responsiveness of an insurance provider's claims handling process are critical factors. Choose a company with a reputation for prompt and fair claims settlement. This ensures that you receive the necessary financial support without unnecessary delays or complications during a challenging time.

- Additional Services and Support: Beyond insurance coverage, some providers offer additional services and support to enhance the overall experience. This can include resources for risk management, tenant screening, and property maintenance. These value-added services can contribute to the success and longevity of your rental business.

When evaluating insurance providers, take the time to research their reputation, read reviews, and seek recommendations from other landlords or industry professionals. Consider requesting quotes from multiple providers to compare coverage options, premiums, and the overall value they offer. By carefully selecting the right insurance company, you can ensure that your landlord insurance policy provides the protection and support you need.

Performance Analysis: How Landlord Insurance Measures Up

Landlord insurance has proven to be a reliable and effective risk management tool for property owners. Its comprehensive coverage and specialized features make it an essential component of a well-rounded rental business strategy. Here are some key findings from performance analysis studies:

- High Satisfaction Rates: Surveys and feedback from landlords who have utilized landlord insurance consistently reveal high levels of satisfaction. Landlords appreciate the peace of mind and financial security that the policy provides. The ability to navigate unexpected incidents and liabilities with confidence contributes to overall business stability and success.

- Effective Claims Settlement: Insurance providers specializing in landlord insurance have demonstrated a strong track record in handling claims efficiently and fairly. This is a critical aspect of the insurance experience, as it ensures that landlords receive the necessary financial support without unnecessary delays or complications.

- Adaptability and Customization: Landlord insurance policies offer a high degree of adaptability and customization. This flexibility allows landlords to tailor their coverage to the unique needs of their properties and rental businesses. Whether it's adjusting coverage limits, selecting optional endorsements, or addressing specific risk factors, landlords can create a policy that aligns perfectly with their requirements.

- Cost-Effectiveness: While landlord insurance policies may carry a higher premium compared to standard home insurance, they provide significantly greater coverage and protection. The comprehensive nature of landlord insurance makes it a cost-effective solution for property owners, as it mitigates the risk of financial losses and legal liabilities that could otherwise be devastating.

Real-World Success Stories

To further illustrate the positive impact of landlord insurance, let’s explore a few real-world success stories:

In one case, a residential landlord experienced a burst water pipe in one of their rental units. The resulting water damage was extensive, affecting not only the unit but also the surrounding common areas. Without landlord insurance, the financial burden of repairs and potential legal liabilities could have been overwhelming. However, with a comprehensive insurance policy in place, the landlord was able to quickly initiate the claims process, receive financial support for repairs, and minimize disruptions to their rental business.

Another example involves a commercial landlord whose property suffered significant damage during a fire. The fire not only impacted the physical structure but also destroyed valuable tenant belongings. The landlord insurance policy covered the cost of repairs, provided compensation for tenant property losses, and even offered temporary accommodations for tenants during the restoration period. This level of support and financial assistance was crucial in maintaining a positive relationship with tenants and ensuring the continued success of the commercial rental business.

Future Implications and Industry Trends

As the rental market continues to evolve, landlord insurance is likely to play an even more critical role in protecting property owners and their investments. Here are some key trends and future implications to consider:

- Increasing Demand for Specialized Coverage: With the growing complexity of rental businesses, there is a rising demand for specialized coverage options. Landlords are seeking insurance policies that address specific risks associated with their unique properties and tenant profiles. This trend highlights the need for insurance providers to offer customizable policies and innovative coverage solutions.

- Technology Integration: The insurance industry is increasingly embracing technology to enhance the customer experience. Landlord insurance providers are expected to leverage digital tools and platforms to streamline policy management, claims processing, and risk assessment. This integration of technology can lead to more efficient and responsive insurance services, benefiting both landlords and insurance companies.

- Focus on Risk Mitigation: As the rental market becomes more competitive, landlords are recognizing the importance of proactive risk management. Landlord insurance policies that offer value-added services, such as risk assessment tools, tenant screening resources, and property maintenance guidance, will become increasingly valuable. These additional services can contribute to the overall success and sustainability of rental businesses.

- Environmental Considerations: With growing concerns about climate change and natural disasters, insurance providers are likely to place greater emphasis on environmental risks. Landlord insurance policies may increasingly include coverage for specific perils, such as floods or earthquakes, to address the changing landscape of natural disasters. This shift will ensure that landlords have adequate protection against these emerging risks.

In conclusion, landlord insurance is a vital tool for property owners who rent out their spaces. It provides comprehensive coverage for various risks, including property damage, liability, and loss of rental income. By investing in a tailored landlord insurance policy, landlords can protect their investments, mitigate financial risks, and ensure the long-term success of their rental businesses. With the right insurance coverage and a proactive approach to risk management, landlords can navigate the challenges of property ownership with confidence and peace of mind.

What is the difference between landlord insurance and standard home insurance?

+Landlord insurance is specifically designed for individuals who own and rent out properties, offering coverage for unique risks associated with rental businesses. Standard home insurance, on the other hand, is primarily intended for homeowners who reside in the property, and it may not provide adequate protection for landlords.

How can I customize my landlord insurance policy to fit my specific needs?

+When selecting a landlord insurance policy, work with an insurance professional who specializes in this area. They can guide you through the process of choosing the right coverage limits, deductibles, and optional endorsements to create a policy tailored to your unique circumstances and rental business.

What should I consider when choosing a landlord insurance provider?

+When selecting a landlord insurance provider, consider factors such as their experience and expertise in the landlord insurance space, financial stability, customization options for policies, and their reputation for efficient claims handling. Additionally, look for providers who offer additional services and support to enhance your overall experience.