Online Quote For Home Insurance

Home insurance is an essential aspect of protecting one's most valuable asset. With the rise of digital platforms, obtaining an online quote for home insurance has become a convenient and efficient process. In this comprehensive guide, we will delve into the world of online home insurance quotes, exploring the steps, considerations, and benefits involved. By the end, you'll have a clear understanding of how to navigate this digital landscape and make informed decisions about safeguarding your home.

Understanding the Online Home Insurance Quote Process

The journey towards securing an online quote for home insurance begins with a simple search on a reputable insurance provider’s website. This process is designed to be user-friendly and efficient, allowing you to obtain a personalized quote tailored to your specific needs.

To initiate the quote process, you'll typically be guided through a series of steps, each aimed at gathering the necessary information to generate an accurate estimate. This may include providing details about your home, such as its location, size, and construction materials. Additionally, you'll be asked about any unique features or amenities that may impact the insurance coverage required.

Step-by-Step Guide to Obtaining an Online Quote

-

Choose a Reputable Insurance Provider:

Start by selecting a well-known and trusted insurance company that offers online quoting services. Look for providers with a strong reputation and positive reviews to ensure a reliable and secure experience.

-

Provide Basic Home Information:

You’ll be prompted to input details about your home, including its address, square footage, and the year it was built. This initial information helps the insurance provider understand the scope of your insurance needs.

-

Select Coverage Options:

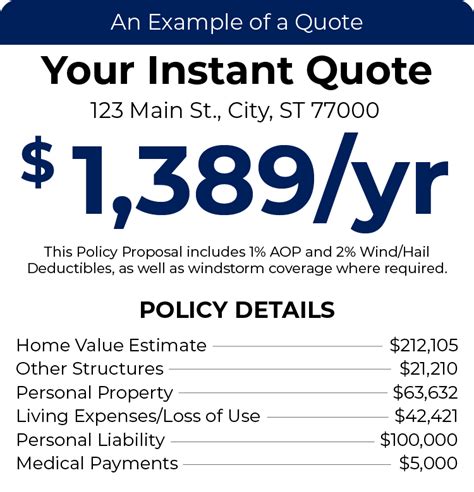

At this stage, you’ll have the opportunity to choose the type and extent of coverage you desire. Options may include liability protection, dwelling coverage, personal property insurance, and additional endorsements for specific valuables or unique circumstances.

-

Enter Personal Details:

The insurance provider will request personal information such as your name, date of birth, and contact details. This information is crucial for creating a personalized quote and ensuring accurate coverage recommendations.

-

Review and Confirm Quote:

Once you’ve provided all the necessary details, the insurance provider’s system will generate a quote based on your inputs. Take the time to carefully review the quote, ensuring that it aligns with your expectations and requirements. If satisfied, you can proceed to confirm and purchase the insurance policy.

The Benefits of Obtaining an Online Home Insurance Quote

Obtaining an online quote for home insurance offers several advantages that make it a preferred choice for many homeowners.

Convenience and Accessibility

One of the most significant benefits is the convenience it provides. You can access multiple insurance providers and compare quotes from the comfort of your home, at any time that suits your schedule. This flexibility eliminates the need for in-person meetings or lengthy phone calls, saving you valuable time and effort.

Customized Coverage

Online quote platforms allow you to tailor your insurance coverage to your specific needs. By providing detailed information about your home and personal preferences, you can receive a quote that reflects the exact coverage you require. This ensures that you’re not overpaying for unnecessary features while still maintaining adequate protection.

Quick Turnaround Times

Unlike traditional insurance quote processes, which may involve multiple back-and-forth communications, online quotes offer rapid turnaround times. Once you’ve provided the necessary information, you can expect to receive your quote promptly, often within a matter of minutes or hours. This efficiency streamlines the decision-making process and allows you to take swift action in securing the right insurance coverage.

Comparison Shopping Made Easy

The online quote process facilitates comparison shopping, enabling you to easily assess multiple insurance providers and their offerings. By utilizing comparison websites or visiting individual provider platforms, you can quickly gather and compare quotes, ensuring you find the most competitive rates and comprehensive coverage options available.

Factors Influencing Home Insurance Quotes

When obtaining an online quote for home insurance, it’s essential to understand the various factors that can influence the final cost. These factors play a significant role in determining the level of risk associated with insuring your home and, consequently, the premium you’ll be required to pay.

Home Location and Risk Factors

The geographical location of your home is a critical factor in insurance quotes. Different regions carry varying levels of risk, such as the likelihood of natural disasters, crime rates, and proximity to emergency services. Insurance providers carefully assess these risks when determining the cost of your insurance policy.

| Region | Risk Factors |

|---|---|

| Coastal Areas | Hurricanes, Floods, High Winds |

| Urban Centers | Crime, Traffic Accidents, Fire Hazards |

| Rural Areas | Wildfires, Storms, Limited Emergency Access |

Home Construction and Materials

The construction materials and design of your home can also impact insurance quotes. Homes built with fire-resistant materials or those featuring advanced security systems may be viewed more favorably by insurance providers, potentially leading to lower premiums. Additionally, the age of your home and any recent renovations or improvements can influence the perceived risk level.

Home Value and Replacement Cost

The value of your home, as well as the estimated cost to rebuild or repair it, is a crucial factor in insurance quotes. Insurance providers aim to ensure that the coverage provided aligns with the actual value of your property. As such, accurate assessments of your home’s worth are essential to avoid underinsurance or overinsurance situations.

Insurance History and Claims Record

Your personal insurance history, including any previous claims made, can impact the quotes you receive. Insurance providers carefully analyze your claims record to assess your level of risk. A clean claims history may result in more favorable rates, while frequent or costly claims could lead to higher premiums or even policy denials.

Tips for Optimizing Your Online Home Insurance Quote

To ensure you receive the most accurate and competitive online quote for home insurance, consider implementing the following strategies:

Accurate Home Assessment

Take the time to conduct a thorough assessment of your home’s features and unique characteristics. This includes noting any recent upgrades, security enhancements, or energy-efficient improvements. Providing accurate and detailed information will help insurance providers offer more precise quotes tailored to your specific circumstances.

Bundle Policies for Discounts

Explore the option of bundling your insurance policies with the same provider. Many insurance companies offer discounts when you combine multiple policies, such as home and auto insurance. By bundling, you not only simplify your insurance management but also potentially save money on your overall premiums.

Review and Update Regularly

Insurance needs can evolve over time, so it’s important to regularly review and update your home insurance policy. Stay informed about changes in your home’s value, any renovations or additions, and shifts in your personal circumstances. By keeping your policy up-to-date, you can ensure that your coverage remains adequate and that you’re not overpaying for unnecessary features.

Compare Quotes and Seek Professional Advice

While online quotes provide a convenient starting point, it’s beneficial to compare multiple quotes from different providers. Utilize comparison websites or seek advice from insurance professionals to gain a comprehensive understanding of the market. Additionally, consider consulting with an insurance broker who can offer personalized recommendations based on your specific needs and circumstances.

Future Trends in Online Home Insurance Quoting

The landscape of online home insurance quoting is continuously evolving, driven by advancements in technology and changing consumer preferences. As we look to the future, several trends are expected to shape this industry:

Artificial Intelligence and Machine Learning

The integration of AI and machine learning algorithms is set to revolutionize the online quoting process. These technologies will enable insurance providers to analyze vast amounts of data more efficiently, leading to more accurate and personalized quotes. AI-powered platforms may also offer real-time risk assessments, allowing for dynamic quote adjustments based on changing circumstances.

Enhanced Digital Security Measures

With the increasing reliance on digital platforms, ensuring the security and privacy of customer data becomes paramount. Insurance providers will continue to invest in robust cybersecurity measures to protect sensitive information. This includes implementing advanced encryption protocols, two-factor authentication, and secure data storage practices to safeguard customer privacy and prevent data breaches.

Personalized Insurance Experiences

The future of online home insurance quoting is expected to focus on delivering highly personalized experiences. Insurance providers will leverage data analytics and customer insights to offer tailored coverage options and recommendations. By understanding individual customer needs and preferences, insurers can provide more relevant and valuable protection, enhancing customer satisfaction and loyalty.

Integration of Smart Home Technology

The rise of smart home technology presents an opportunity for insurance providers to offer innovative solutions. By integrating with smart home devices and systems, insurers can gain real-time insights into home conditions and risk factors. This data can be used to provide more accurate quotes and even offer incentives for homeowners who adopt smart home technologies, promoting safety and efficiency.

Frequently Asked Questions

How accurate are online home insurance quotes?

+Online quotes are designed to provide a personalized estimate based on the information you input. While they offer a good starting point, the accuracy can vary based on the completeness and accuracy of your provided details. It’s essential to review and verify the quote with an insurance professional to ensure it aligns with your specific needs.

Can I obtain multiple online quotes simultaneously?

+Absolutely! The convenience of online quoting allows you to gather multiple quotes from different providers in a short timeframe. This enables you to compare coverage options, premiums, and provider reputations, ensuring you make an informed decision about your home insurance.

What happens if my circumstances change after obtaining a quote?

+It’s essential to inform your insurance provider of any significant changes in your home or personal circumstances. These changes may impact your insurance needs and the accuracy of your quote. By keeping your provider updated, you can ensure your policy remains adequate and aligned with your current situation.

Are there any disadvantages to obtaining an online home insurance quote?

+While online quotes offer numerous advantages, it’s important to be aware of potential limitations. Online quoting may not account for unique circumstances or specific requirements that may require additional explanation. In such cases, consulting with an insurance professional can provide valuable insights and personalized advice.

As the world embraces digital transformation, obtaining an online quote for home insurance has become an efficient and convenient way to protect your most valuable asset. By understanding the process, considering the influencing factors, and staying informed about industry trends, you can make confident decisions about safeguarding your home. Remember, while online quotes are a valuable tool, consulting with insurance professionals can provide additional insights and personalized guidance to ensure your coverage meets your unique needs.