Homeowner Insurance Average Cost

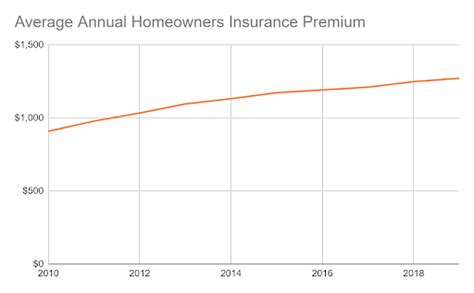

Understanding the average cost of homeowner insurance is essential for any homeowner, as it provides financial protection and peace of mind. This comprehensive guide will delve into the factors that influence homeowner insurance rates and offer insights into the average expenses homeowners can expect. By exploring real-world data and industry trends, we aim to provide an in-depth analysis to help homeowners make informed decisions about their insurance coverage.

Factors Influencing Homeowner Insurance Costs

The cost of homeowner insurance varies significantly depending on several key factors. These factors include the location of the property, the age and condition of the home, the coverage limits chosen, and the deductible amount selected by the policyholder. Additionally, the insurance company’s rates and the specific policy’s terms and conditions play a crucial role in determining the overall cost.

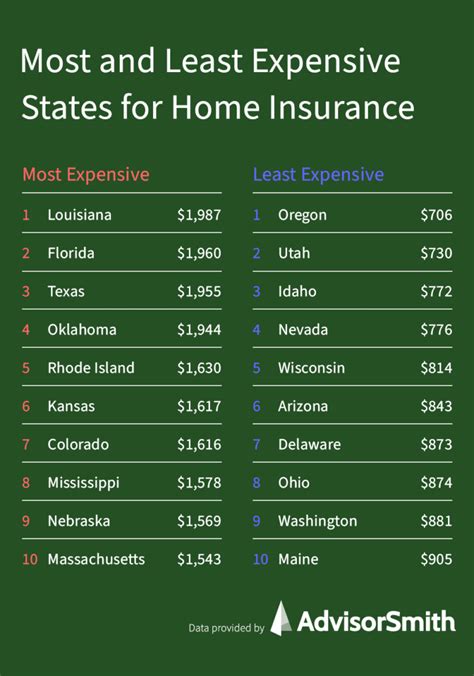

Location-Specific Considerations

One of the primary factors influencing homeowner insurance rates is the geographic location of the property. Areas prone to natural disasters, such as hurricanes, earthquakes, or wildfires, generally face higher insurance costs. For instance, a home located in a flood-prone region will likely require additional coverage, leading to increased premiums. Similarly, regions with high crime rates may also see elevated insurance costs due to the potential risk of theft or vandalism.

| Location | Average Annual Premium |

|---|---|

| Hurricane-Prone Region | $2,500 - $5,000 |

| Earthquake Zone | $1,800 - $3,000 |

| Urban Area with High Crime Rate | $1,500 - $2,500 |

It's important to note that while these averages provide a general idea, the specific insurance cost for a particular location can vary greatly. Local factors, such as the proximity to fire stations, emergency services, and the neighborhood's overall safety record, can further impact insurance rates.

Home Age and Condition

The age and condition of a home are critical factors in determining insurance costs. Older homes, especially those built before modern safety standards were implemented, often require higher insurance premiums due to potential structural issues and outdated electrical or plumbing systems. Conversely, newly constructed homes with modern amenities and safety features may enjoy lower insurance rates.

| Home Age | Average Annual Premium |

|---|---|

| Newly Built (Less than 5 years) | $1,200 - $1,800 |

| Middle-Aged (10-20 years) | $1,500 - $2,200 |

| Older Homes (Over 30 years) | $2,000 - $3,000 |

Coverage Limits and Deductibles

The coverage limits and deductibles chosen by the policyholder have a direct impact on the cost of homeowner insurance. Higher coverage limits, which provide more financial protection, naturally result in higher premiums. Similarly, a lower deductible, which means the policyholder pays less out-of-pocket in the event of a claim, can lead to increased insurance costs.

| Coverage Limit | Average Annual Premium |

|---|---|

| $100,000 | $1,000 - $1,500 |

| $200,000 | $1,500 - $2,000 |

| $300,000 | $2,000 - $2,500 |

It's essential to strike a balance between adequate coverage and manageable costs. Policyholders should assess their specific needs and financial capabilities to determine the right coverage limits and deductible amounts.

Insurance Company Rates and Terms

Insurance companies set their rates based on various factors, including their financial stability, claim history, and the specific policy terms. Some companies may offer more competitive rates for certain types of homes or locations, while others may have a broader range of coverage options. It’s crucial to shop around and compare quotes from multiple insurers to find the best fit for your needs and budget.

| Insurance Company | Average Annual Premium |

|---|---|

| Company A | $1,200 - $1,800 |

| Company B | $1,500 - $2,000 |

| Company C | $1,800 - $2,500 |

Understanding Average Costs: A Regional Analysis

To gain a deeper understanding of homeowner insurance costs, let’s explore average premiums across different regions of the United States. This analysis will provide a clearer picture of how geographic factors influence insurance rates.

Northeastern States

The Northeastern region of the United States is known for its harsh winters and the potential for severe storms and flooding. As a result, homeowner insurance costs in this region can be relatively high. The average annual premium for homeowner insurance in the Northeast is approximately 1,800 to 2,500.

| Northeastern State | Average Annual Premium |

|---|---|

| New York | $2,000 - $2,800 |

| Massachusetts | $1,800 - $2,500 |

| New Jersey | $1,900 - $2,600 |

Southern States

The Southern region experiences a range of weather conditions, including hurricanes and tornadoes. This variability in weather patterns can impact insurance costs. On average, homeowner insurance in the Southern states costs between 1,500 and 2,200 annually.

| Southern State | Average Annual Premium |

|---|---|

| Florida | $2,200 - $3,000 |

| Texas | $1,600 - $2,100 |

| Georgia | $1,400 - $1,900 |

Midwestern States

The Midwest is known for its relatively stable weather conditions, with occasional tornadoes and severe storms. As a result, homeowner insurance costs in this region are generally more affordable compared to other regions. The average annual premium for homeowner insurance in the Midwest is approximately 1,200 to 1,600.

| Midwestern State | Average Annual Premium |

|---|---|

| Illinois | $1,300 - $1,500 |

| Ohio | $1,200 - $1,400 |

| Minnesota | $1,100 - $1,300 |

Western States

The Western region encompasses a wide range of climates, from coastal areas prone to earthquakes and wildfires to inland regions with more stable weather. As a result, insurance costs can vary significantly within this region. On average, homeowner insurance in the Western states costs between 1,600 and 2,400 annually.

| Western State | Average Annual Premium |

|---|---|

| California | $2,200 - $3,000 |

| Washington | $1,800 - $2,400 |

| Arizona | $1,500 - $2,000 |

Tips for Managing Homeowner Insurance Costs

While homeowner insurance costs can vary based on several factors, there are strategies homeowners can employ to manage and potentially reduce their insurance premiums. Here are some practical tips to consider:

- Shop Around: Compare quotes from multiple insurance companies. Different insurers may offer varying rates and coverage options, so it's essential to explore your options to find the best deal.

- Bundle Policies: Consider bundling your homeowner insurance with other policies, such as auto insurance or life insurance. Many insurers offer discounts for customers who bundle multiple policies, leading to potential savings.

- Increase Deductibles: While it may seem counterintuitive, increasing your deductible can lower your insurance premiums. By agreeing to pay a higher out-of-pocket amount in the event of a claim, you can reduce your overall insurance costs.

- Improve Home Security: Installing security systems, such as alarm systems, smoke detectors, and fire extinguishers, can make your home safer and potentially reduce insurance costs. Many insurers offer discounts for homes with enhanced security features.

- Maintain Regular Home Maintenance: Regularly maintaining your home, including fixing any potential issues promptly, can prevent larger problems down the line. This not only ensures the safety and longevity of your home but can also reduce insurance costs by mitigating potential risks.

- Review Coverage Regularly: As your home and personal circumstances change, your insurance needs may also evolve. Regularly review your coverage to ensure it aligns with your current needs and make adjustments as necessary to avoid overpaying for unnecessary coverage.

Conclusion: A Well-Informed Decision

Understanding the average cost of homeowner insurance is crucial for making informed decisions about your financial protection. By considering the various factors that influence insurance rates, including location, home age and condition, coverage limits, and insurance company rates, homeowners can better navigate the insurance landscape. Additionally, by implementing cost-saving strategies and staying vigilant about their insurance coverage, homeowners can ensure they have the right protection at a manageable cost.

Remember, while the average costs provide a useful benchmark, your specific insurance costs will depend on your unique circumstances. Take the time to research, compare quotes, and consult with insurance professionals to find the best homeowner insurance coverage for your needs and budget.

How often should I review my homeowner insurance policy?

+It’s recommended to review your homeowner insurance policy annually or whenever there are significant changes to your home or personal circumstances. Regular reviews ensure your coverage remains adequate and up-to-date.

What are some common discounts available for homeowner insurance?

+Common discounts for homeowner insurance include multi-policy discounts (when you bundle multiple policies with the same insurer), loyalty discounts for long-term customers, and safety feature discounts for homes with enhanced security systems.

Can I negotiate my homeowner insurance rates?

+While homeowner insurance rates are largely based on standardized formulas, it’s worth discussing your options with your insurance agent. They may be able to provide insights into potential discounts or suggest ways to optimize your coverage to reduce costs.