Insurance Insurance

In the vast and complex world of finance and risk management, few concepts are as ubiquitous and essential as insurance. From the moment we're born, insurance policies shape our lives, offering protection and peace of mind against life's uncertainties. This comprehensive article aims to delve deep into the world of insurance, exploring its history, mechanics, and modern-day applications.

The Evolution of Insurance: A Historical Perspective

The concept of insurance has ancient roots, with early forms of risk management emerging in various civilizations. The Babylonians, for instance, developed a system where merchants could insure their goods against theft or loss, with the code of Hammurabi outlining the principles of such agreements. Similarly, the ancient Greeks and Romans had rudimentary forms of insurance, where individuals could protect themselves against maritime perils.

However, the modern insurance industry as we know it today took shape during the Renaissance in Europe. The establishment of Lloyd's of London in the 17th century marked a significant milestone, as it became a hub for insurance brokers and underwriters, facilitating the insurance of ships and cargo. This era also saw the emergence of life insurance, with the first life assurance policy being taken out in 1583 by an English businessman.

Key Milestones in Insurance History

The evolution of insurance has been marked by several pivotal moments:

- 1752: The Equitable Society, considered the world’s first mutual insurance society, was founded in London.

- 1837: The first fire insurance company, the Philadelphia Contributionship, was established in the United States.

- 1935: The Social Security Act in the US marked a significant shift towards social insurance, providing retirement and disability benefits.

- 1956: The first private health insurance policy in the UK was issued, marking the beginning of private healthcare insurance.

How Insurance Works: Understanding the Fundamentals

At its core, insurance is a form of risk management primarily designed to hedge against the financial impacts of uncertain events. It operates on the principle of spreading risk, where a large number of individuals or entities pay a small, regular sum (known as a premium) to an insurance company. In return, the insurer promises to financially compensate policyholders in the event of a covered loss.

Key Components of an Insurance Policy

An insurance policy is a legally binding contract between an insurer and a policyholder. It outlines the specific terms and conditions of coverage, including:

- Coverage: The specific risks or perils covered by the policy.

- Premiums: The regular payments made by the policyholder to the insurer.

- Deductibles: The amount the policyholder must pay out-of-pocket before the insurance coverage kicks in.

- Exclusions: Events or circumstances not covered by the policy.

- Benefits or Payouts: The financial compensation the insurer provides in the event of a covered loss.

Risk Assessment and Underwriting

A crucial aspect of insurance is risk assessment, where insurers evaluate the likelihood and potential cost of the risks they’re insuring against. This process, known as underwriting, involves analyzing various factors, such as the insured’s age, health, occupation, and lifestyle, to determine the premium and coverage terms.

For instance, in life insurance, the underwriting process may involve medical examinations and the evaluation of lifestyle factors like smoking or dangerous hobbies. In property insurance, the assessment might include the location, construction, and value of the property, as well as the risk of natural disasters.

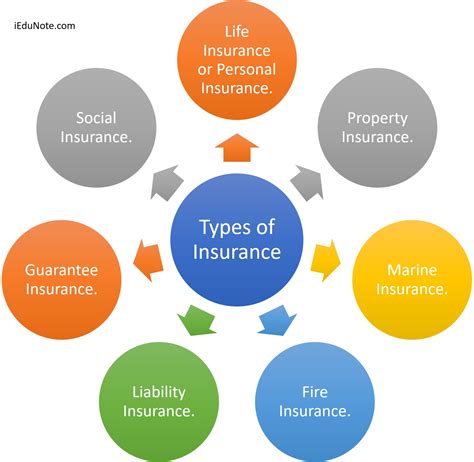

Types of Insurance: A Comprehensive Overview

The insurance industry is incredibly diverse, offering coverage for a wide range of risks. Here’s a glimpse into some of the most common types of insurance:

Life Insurance

Life insurance provides financial protection to beneficiaries in the event of the insured’s death. It’s a crucial tool for estate planning and can help ensure financial stability for loved ones left behind. There are two primary types of life insurance:

- Term Life Insurance: Offers coverage for a specific period (the term), typically ranging from 10 to 30 years. It’s generally more affordable but provides coverage only during the term.

- Permanent Life Insurance: Provides coverage for the insured’s entire life. This includes whole life, universal life, and variable life insurance, each with its own unique features and benefits.

Health Insurance

Health insurance covers the cost of medical and surgical expenses. It’s a vital component of healthcare systems worldwide, helping individuals manage the financial burden of illness or injury. Health insurance can include coverage for:

- Hospitalization

- Doctor visits

- Prescription medications

- Preventive care

- Specialized treatments

Property Insurance

Property insurance provides financial protection against damage or loss of property due to various perils, including fire, theft, natural disasters, and vandalism. This category includes:

- Homeowner’s Insurance: Covers the structure of a home and its contents, as well as personal liability.

- Renter’s Insurance: Protects tenants against damage or loss of personal property and provides liability coverage.

- Commercial Property Insurance: Insures businesses against property damage and loss.

Vehicle Insurance

Vehicle insurance, also known as auto insurance, is a legal requirement in many countries. It provides financial protection against physical damage and bodily injury resulting from traffic accidents, as well as covering theft and other perils. Key types of vehicle insurance include:

- Liability Insurance: Covers the cost of damage or injury caused to others.

- Collision Insurance: Pays for repairs to the insured vehicle after an accident.

- Comprehensive Insurance: Covers damage caused by events other than collisions, such as fire, theft, or natural disasters.

The Insurance Industry Today: Trends and Innovations

The insurance industry is constantly evolving, driven by technological advancements, changing consumer needs, and regulatory shifts. Here are some key trends shaping the industry:

Digital Transformation

The digital age has brought about significant changes in the insurance sector. Insurers are increasingly leveraging technology to enhance customer experience, streamline operations, and improve efficiency. This includes the use of:

- Online platforms for policy purchasing and management

- Mobile apps for real-time policy access and claims reporting

- Telematics and IoT devices for risk assessment and policy personalization

Parametric Insurance

Parametric insurance is an innovative approach that provides coverage based on predefined parameters or triggers, rather than actual losses. This type of insurance is particularly useful in situations where traditional insurance claims can be complex or difficult to verify. For instance, parametric insurance can be used to cover weather-related risks, with payouts triggered by specific weather events like hurricanes or droughts.

Insurtech and Fintech Integration

The rise of insurtech and fintech startups has brought new technologies and business models to the insurance industry. These startups are leveraging data analytics, artificial intelligence, and blockchain to disrupt traditional insurance processes, offering faster, more efficient, and often more affordable coverage.

The Future of Insurance: Challenges and Opportunities

As the world continues to evolve, the insurance industry faces both challenges and opportunities. Here’s a glimpse into what the future might hold:

Climate Change and Catastrophe Risks

The increasing frequency and severity of natural disasters due to climate change pose significant challenges for the insurance industry. Insurers will need to adapt their risk assessment and pricing models to accurately reflect these changing risks.

Regulatory Changes

The insurance industry is highly regulated, and changes in regulatory frameworks can have significant impacts. Insurers will need to stay abreast of evolving regulations to ensure compliance and maintain competitive advantage.

Opportunities in Emerging Markets

While the insurance industry is well-established in many developed countries, there are significant opportunities for growth in emerging markets. As economies develop and incomes rise, the demand for insurance products is likely to increase, presenting insurers with new markets to explore.

Conclusion: The Enduring Relevance of Insurance

Insurance remains an indispensable tool for managing risk and ensuring financial stability in an uncertain world. From its ancient origins to the digital age, the insurance industry has continually adapted to meet the evolving needs of individuals and businesses. As we look to the future, the industry’s ability to innovate and respond to changing circumstances will be crucial in maintaining its relevance and importance.

How does insurance help the economy?

+Insurance plays a crucial role in stabilizing the economy by spreading risk across a large pool of policyholders. It encourages investment and entrepreneurship by providing a safety net against financial losses, thereby fostering economic growth and development.

What are the benefits of digital insurance platforms?

+Digital insurance platforms offer convenience, speed, and efficiency. They allow policyholders to manage their policies online, often with 24⁄7 access. These platforms also use advanced analytics to personalize coverage and pricing, providing more tailored and affordable insurance options.

How does parametric insurance work?

+Parametric insurance provides coverage based on predefined parameters or triggers, rather than actual losses. For example, a parametric weather insurance policy might pay out based on the intensity of a hurricane, regardless of the specific damage it causes. This simplifies the claims process and provides faster payouts.