Average Cost Of Health Insurance In California

The cost of health insurance is a significant concern for individuals and families, and it can vary greatly depending on various factors such as location, age, and the specific coverage needed. In the state of California, known for its diverse population and expansive healthcare system, understanding the average costs and the factors influencing them is crucial. Let's delve into the intricacies of health insurance costs in the Golden State.

Unraveling the Average Health Insurance Costs in California

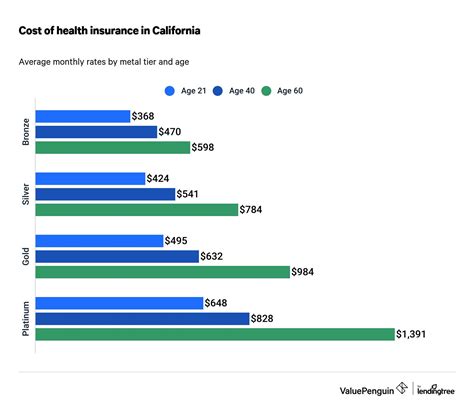

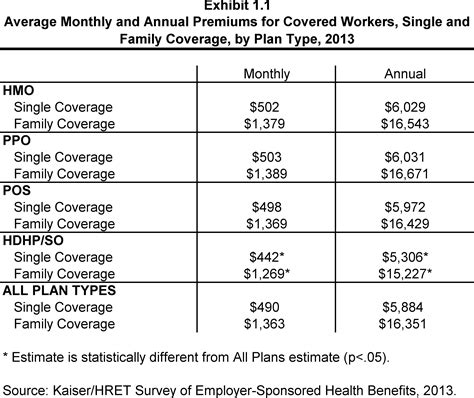

California, being the most populous state in the US, boasts a vibrant healthcare landscape with numerous insurance providers and a wide range of plans. This diversity, however, also brings complexity when it comes to understanding the average costs. According to recent data, the average monthly premium for an individual health insurance plan in California is approximately $500, while family plans average around $1,500 per month. These figures, however, are just a starting point, and the actual cost can vary significantly based on individual circumstances.

The Impact of Age and Location

Age is a critical factor influencing health insurance costs. In California, younger individuals, typically those under 30, can expect to pay lower premiums, often around $400 or less per month. This is due to the generally lower healthcare needs and risks associated with younger age groups. However, as individuals age, premiums tend to increase, with those over 60 potentially paying upwards of $700 or more per month. This age-based pricing is a common practice across the industry and is a reflection of the higher healthcare utilization and costs associated with older populations.

Location also plays a significant role in determining insurance costs. California's vast geography and diverse population mean that premiums can vary significantly between different regions. For instance, urban areas like Los Angeles and San Francisco often have higher costs due to the concentration of healthcare providers and facilities. In contrast, more rural areas may offer more affordable options, with premiums potentially starting from $450 for individuals and $1,200 for families.

| Age Group | Average Monthly Premium (Individual) | Average Monthly Premium (Family) |

|---|---|---|

| Under 30 | $400 | $1,200 |

| 30-60 | $500 | $1,500 |

| Over 60 | $700 | $2,000 |

The Role of Deductibles and Coverage Options

When considering health insurance costs, it's essential to understand the concept of deductibles and the various coverage options available. Deductibles represent the amount an insured individual must pay out of pocket before the insurance coverage kicks in. In California, deductibles can range from $500 to $5,000 or more, with higher deductibles often correlated with lower monthly premiums. This trade-off allows individuals to choose a plan that balances their upfront costs with their expected healthcare needs.

California also offers a wide array of coverage options, from basic catastrophic plans with high deductibles and lower premiums, to comprehensive plans with lower deductibles and higher monthly costs. Additionally, specialty plans are available for specific needs, such as dental, vision, or prescription drug coverage. These specialized plans can be added to a primary health insurance plan or purchased separately, further impacting the overall cost.

Understanding the Impact of Subsidies and Programs

California, in its commitment to healthcare accessibility, provides various subsidies and programs to make insurance more affordable for its residents. The Covered California program, for instance, offers financial assistance to eligible individuals and families, reducing their monthly premiums. This program is particularly beneficial for those with lower incomes, helping them secure essential healthcare coverage.

Additionally, California's Medicaid program, known as Medi-Cal, provides no-cost or low-cost healthcare coverage for eligible low-income adults, children, pregnant women, seniors, and people with disabilities. This program is a vital safety net for many Californians, ensuring they have access to necessary medical services without the burden of high insurance costs.

Navigating the Complexity of Health Insurance in California

Understanding the average costs of health insurance in California is just the first step. The true complexity lies in tailoring an insurance plan to individual needs and budgets. This often involves a careful consideration of age, location, deductibles, coverage options, and available subsidies.

For instance, a young, healthy individual living in a rural area may opt for a high-deductible plan with lower monthly premiums, knowing that they are unlikely to require extensive healthcare services. On the other hand, an older individual with specific healthcare needs might prioritize a plan with a lower deductible and more comprehensive coverage, despite the higher monthly cost.

Additionally, exploring the various programs and subsidies available in California can significantly reduce the financial burden of health insurance. From Covered California's financial assistance to Medi-Cal's no-cost coverage, these programs are designed to ensure that healthcare is accessible to all Californians, regardless of their financial situation.

In conclusion, while the average costs of health insurance in California provide a useful benchmark, the true cost of insurance is highly individualized. By understanding the various factors influencing premiums and exploring the range of coverage options and subsidies available, individuals can make informed decisions about their healthcare coverage. This ensures that they not only secure the necessary insurance but also do so in a way that aligns with their unique circumstances and financial means.

How can I find out if I’m eligible for subsidies or programs like Covered California or Medi-Cal?

+Eligibility for subsidies and programs like Covered California and Medi-Cal is determined by various factors, including income, age, and family size. You can visit the official websites of these programs to use their eligibility calculators or contact their customer support for guidance. They will provide you with the necessary information and help you determine if you qualify for reduced premiums or no-cost coverage.

Are there any other programs or initiatives in California to make health insurance more affordable?

+Yes, California has several initiatives to enhance healthcare accessibility and affordability. For example, the Healthy San Francisco program provides affordable healthcare coverage to eligible residents of San Francisco, regardless of their immigration status. Additionally, the state has implemented various health care reforms aimed at improving affordability and access to care.

What are some tips for reducing health insurance costs in California?

+There are several strategies to consider when aiming to reduce health insurance costs in California. Firstly, explore the various plan options available, considering deductibles, copays, and coverage limits. Opting for a higher deductible plan can lead to lower premiums. Additionally, take advantage of the state’s subsidies and programs, like Covered California and Medi-Cal, which can significantly reduce your out-of-pocket expenses. Lastly, maintain a healthy lifestyle, as this can lead to lower healthcare utilization and, consequently, lower insurance costs.