Home Mortgage Calculator Including Taxes And Insurance

For individuals or families planning to purchase a home, understanding the true cost of homeownership is crucial. This comprehensive guide delves into the intricacies of calculating your monthly mortgage payments, taking into account not just the principal and interest but also the often-overlooked expenses of taxes and insurance. By providing a detailed breakdown of these essential components, we aim to empower prospective homeowners with the knowledge to make informed decisions and budget effectively.

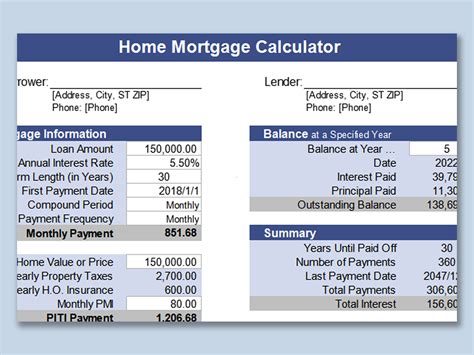

The Home Mortgage Calculator: A Comprehensive Tool

A home mortgage calculator is an invaluable resource for anyone considering a home purchase. It allows you to estimate your monthly mortgage payments, offering a realistic view of your financial commitment. However, to gain an accurate understanding, it’s essential to consider more than just the loan amount and interest rate. Taxes and insurance, while often variable, significantly impact your overall housing costs.

Principal and Interest: The Foundation of Your Mortgage

The principal and interest form the backbone of your mortgage payment. The principal refers to the actual loan amount, while interest is the cost of borrowing that money. Typically, your monthly mortgage payment is divided into these two components, with the proportion changing over time as you pay down the loan.

For instance, consider a $300,000 loan with a 4% interest rate over 30 years. The initial monthly payment would be approximately $1,440, with around $864 going towards interest and $576 towards the principal. As time passes, the interest component decreases, and more of your payment goes towards reducing the loan balance.

| Year | Principal Paid | Interest Paid | Total Payment |

|---|---|---|---|

| 1st Year | $6,912 | $10,368 | $17,280 |

| 10th Year | $12,171 | $5,193 | $17,364 |

| 20th Year | $17,125 | $3,239 | $20,364 |

| 30th Year | $21,912 | $864 | $22,776 |

As seen in the table, while the total monthly payment remains relatively stable, the amount going towards the principal increases significantly over time.

Taxes: A Necessary Expense

Property taxes are an inescapable part of homeownership. These taxes are levied by local governments and are typically based on the assessed value of your property. The amount can vary widely depending on your location and the services provided by your local government, such as schools, infrastructure, and emergency services.

For a home with a market value of $500,000, the annual property tax could range from a few thousand dollars in areas with lower tax rates to over $10,000 in high-tax regions. To illustrate, let's consider an example where the property tax is $6,000 annually. This amounts to $500 per month, which would be included in your monthly mortgage payment.

Insurance: Protecting Your Investment

Homeowner’s insurance is another vital expense to consider. This insurance provides coverage for your home and possessions against various risks, including fire, theft, and natural disasters. The cost of insurance can vary based on your home’s location, its age, and the level of coverage you choose.

On average, homeowner's insurance costs between $500 and $2,000 annually. However, factors like the size and location of your home, as well as any additional coverage for valuables, can significantly impact this cost. For our example, let's assume an annual insurance premium of $1,200, which equates to $100 per month.

Calculating Your Monthly Mortgage Payment

Now, let’s put it all together. Using our example figures, a 300,000 loan with a 4% interest rate over 30 years, including 6,000 in annual property taxes and $1,200 in annual insurance, your monthly mortgage payment would be as follows:

| Component | Monthly Cost |

|---|---|

| Principal and Interest | $1,440 |

| Property Taxes | $500 |

| Insurance | $100 |

| Total Monthly Payment | $2,040 |

As you can see, taxes and insurance can significantly increase your monthly housing costs. It's crucial to factor these expenses into your budgeting to ensure you can comfortably afford your new home.

The Impact of Escrow Accounts

Many lenders require borrowers to pay their property taxes and insurance through an escrow account. This account is funded by a portion of your monthly mortgage payment, ensuring that these expenses are consistently covered. The lender then pays the insurance premium and property taxes on your behalf.

Escrow accounts provide a level of financial security, as they guarantee that your taxes and insurance are always up to date. However, it's important to understand that the amount you pay into the escrow account can change over time as taxes and insurance costs fluctuate. Your lender is required to provide an annual escrow analysis, which details any changes and provides an updated monthly payment amount.

Escrow Shortages and Surpluses

Sometimes, an escrow analysis may reveal that the funds in your account are insufficient to cover the upcoming year’s expenses. This is known as an escrow shortage. In such cases, your lender may require you to pay the shortage amount in full or increase your monthly payments to cover the shortfall.

Conversely, if your escrow account has a surplus (more funds than needed), your lender will typically refund the excess amount or apply it towards future payments. It's essential to review your escrow statements regularly to ensure accuracy and understand any changes to your payments.

Tips for Managing Your Mortgage Payments

Understanding and managing your mortgage payments, including taxes and insurance, is crucial for successful homeownership. Here are some tips to help you navigate this financial commitment:

- Stay Informed: Keep track of changes in your property taxes and insurance rates. These costs can fluctuate, and being aware of any increases can help you budget effectively.

- Shop Around for Insurance: Compare quotes from multiple insurance providers to find the best coverage at the most competitive rates. Don't be afraid to negotiate or seek discounts.

- Consider Refinancing: If interest rates drop significantly, refinancing your mortgage can lower your monthly payments and potentially save you thousands over the life of your loan.

- Make Extra Payments: If you can afford it, making additional payments towards your principal can help you pay off your mortgage faster and save on interest.

- Understand Your Escrow: Familiarize yourself with how your escrow account works and review statements regularly. This ensures you're prepared for any changes and can budget accordingly.

By staying informed and proactive, you can effectively manage your mortgage payments and navigate the complexities of homeownership with confidence.

Conclusion

Calculating your monthly mortgage payments is a critical step in the home-buying process. By understanding the components that make up your mortgage, including principal, interest, taxes, and insurance, you can make informed decisions and budget effectively for your new home. Remember, while the process can be complex, tools like mortgage calculators and the guidance of financial professionals can make it more manageable.

As you embark on your homeownership journey, stay informed, plan ahead, and don't hesitate to seek expert advice. With the right knowledge and tools, you can navigate the financial aspects of homeownership with confidence and ensure a stable and rewarding experience.

How do I calculate my monthly mortgage payment accurately?

+To calculate your monthly mortgage payment accurately, you’ll need to consider the principal (the loan amount), interest rate, loan term, property taxes, and insurance costs. You can use an online mortgage calculator or a spreadsheet to input these values and determine your monthly payment. Remember to update these calculations regularly as taxes and insurance rates can change.

What is an escrow account, and why is it important for my mortgage payments?

+An escrow account is a dedicated account where a portion of your monthly mortgage payment is held to cover your property taxes and insurance. It ensures that these expenses are consistently paid and provides financial security. Lenders often require escrow accounts to manage these payments on your behalf.

How often do my mortgage payments change, and why?

+Your mortgage payments can change for various reasons. The most common reason is an increase or decrease in property taxes or insurance rates. These expenses are often variable and subject to change annually. Additionally, if you have an adjustable-rate mortgage (ARM), your interest rate may adjust periodically, impacting your monthly payment.