Health Insurance In Michigan

Understanding health insurance in Michigan is crucial for residents and employers alike. With a diverse healthcare landscape and varying coverage options, it's essential to navigate the intricacies of the system to ensure adequate protection and financial security. This comprehensive guide aims to provide an in-depth analysis of health insurance in the Great Lakes State, covering everything from policy types to industry trends and expert insights.

The Diverse Landscape of Health Insurance in Michigan

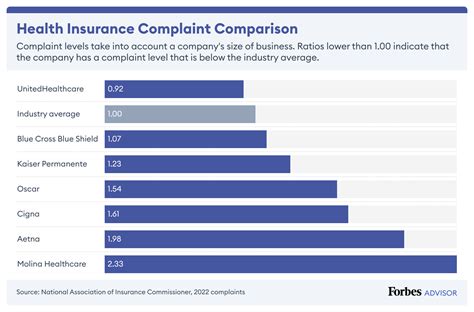

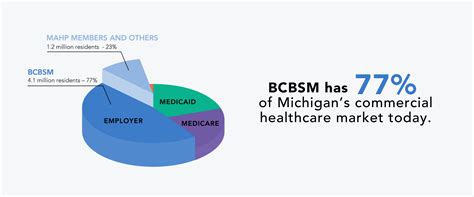

Michigan’s health insurance market offers a wide array of plans catering to different demographics and needs. From individual policies to employer-sponsored group plans, the state provides ample opportunities for residents to secure essential healthcare coverage.

Individual Health Insurance Plans

For those not covered by employer-sponsored plans, individual health insurance is a vital option. In Michigan, there’s a range of providers offering comprehensive plans that include essential health benefits such as outpatient care, prescription drugs, and hospitalization. These plans often come with a choice of deductibles and out-of-pocket maximums, allowing individuals to tailor their coverage to their financial circumstances.

| Provider | Plan Type | Key Benefits |

|---|---|---|

| Blue Cross Blue Shield of Michigan | PPO | Nationwide coverage, extensive provider network |

| Priority Health | HMO, PPO | Focus on preventive care, lower premiums |

| UnitedHealthcare | PPO, HMO | Flexible plans, broad coverage options |

Employer-Sponsored Group Plans

Many Michiganders receive health insurance through their employers. Group plans often provide more comprehensive coverage at a lower cost, as the risk is spread across a larger pool of individuals. Employers may offer a choice of plans, allowing employees to select the coverage that best suits their needs.

Key considerations for employer-sponsored plans include:

- Premium contributions: Employers often cover a significant portion of the premium, but employees may still have to contribute a percentage.

- Network providers: Group plans typically have a network of preferred providers, impacting where and how services are accessed.

- Covered services: While group plans must include essential health benefits, the specifics can vary, impacting out-of-pocket costs.

Navigating the Cost of Health Insurance in Michigan

The cost of health insurance is a significant concern for Michiganders. With rising healthcare expenses, finding an affordable plan that provides adequate coverage can be a challenge. Several factors influence the cost of health insurance in the state, including age, location, and the chosen level of coverage.

Impact of Age and Location

Age plays a significant role in determining insurance premiums. Younger individuals tend to pay lower premiums as they generally require less medical care. In contrast, older adults often face higher costs due to the increased likelihood of needing medical services. Additionally, insurance rates can vary by region within Michigan, with urban areas often experiencing higher costs due to increased healthcare utilization.

Choosing the Right Level of Coverage

When selecting a health insurance plan, it’s crucial to strike a balance between comprehensive coverage and affordability. Plans with lower premiums often come with higher deductibles and out-of-pocket maximums, which can be a cost-effective option for those who rarely need medical care. Conversely, plans with higher premiums typically offer lower deductibles and out-of-pocket limits, providing more financial protection for those with ongoing medical needs.

Utilizing Cost-Saving Strategies

To mitigate the financial burden of health insurance, Michiganders can employ several cost-saving strategies. These include:

- Health Savings Accounts (HSAs): HSAs allow individuals to save pre-tax dollars for medical expenses, providing a tax-efficient way to manage healthcare costs.

- Flexible Spending Accounts (FSAs): FSAs are another tax-advantaged option, allowing employees to set aside pre-tax dollars for qualified medical expenses.

- Comparing plans: Shopping around and comparing different insurance providers and plans can lead to significant savings. Online marketplaces and insurance brokers can be valuable resources for this.

The Future of Health Insurance in Michigan

The health insurance landscape in Michigan is continually evolving, influenced by both state and federal policies. As the state navigates the complexities of healthcare reform, Michiganders can expect ongoing changes in coverage options and costs. Understanding these trends and staying informed is essential for making informed decisions about health insurance.

Industry Trends and Expert Insights

Industry experts anticipate several key trends shaping health insurance in Michigan in the coming years. These include:

- Focus on preventive care: Insurance providers are increasingly emphasizing preventive services to reduce long-term healthcare costs and improve overall population health.

- Expansion of telehealth services: The COVID-19 pandemic accelerated the adoption of telehealth, and this trend is expected to continue, offering Michiganders more accessible and convenient healthcare options.

- Rising healthcare costs: Despite efforts to control costs, healthcare expenses are projected to continue rising, impacting insurance premiums and out-of-pocket expenses.

Conclusion: Empowering Michiganders with Knowledge

Health insurance is a complex topic, but with the right information and resources, Michiganders can make informed decisions about their healthcare coverage. By understanding the diverse landscape of health insurance options, navigating the cost considerations, and staying informed about industry trends, residents can secure the protection they need while managing their financial well-being.

Frequently Asked Questions

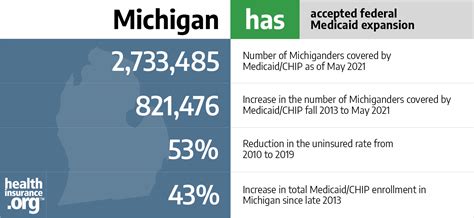

What is the Affordable Care Act (ACA) and how does it impact health insurance in Michigan?

+The ACA, often referred to as Obamacare, is a federal law that aims to make health insurance more affordable and accessible. In Michigan, the ACA has led to the establishment of the state’s health insurance marketplace, where individuals can shop for and enroll in health plans. The law also mandates that all health plans cover essential health benefits, such as preventive care, hospitalization, and prescription drugs.

Are there any subsidies available to help with health insurance costs in Michigan?

+Yes, the ACA provides financial assistance in the form of subsidies to help lower- and middle-income individuals and families afford health insurance. These subsidies, in the form of tax credits, can reduce the monthly premium costs for eligible individuals. To determine eligibility and the amount of subsidy, you can use the Health Insurance Marketplace calculator or consult with a licensed insurance agent.

How can I find the best health insurance plan for my specific needs in Michigan?

+The key to finding the best health insurance plan is to understand your specific needs and preferences. Consider factors such as your regular healthcare requirements, the frequency of doctor visits, prescription drug needs, and any chronic conditions. Evaluate plans based on their coverage for these specific needs, as well as the cost of premiums, deductibles, and out-of-pocket expenses. You can use online comparison tools or consult with an insurance broker to narrow down your options and find the plan that best suits your circumstances.