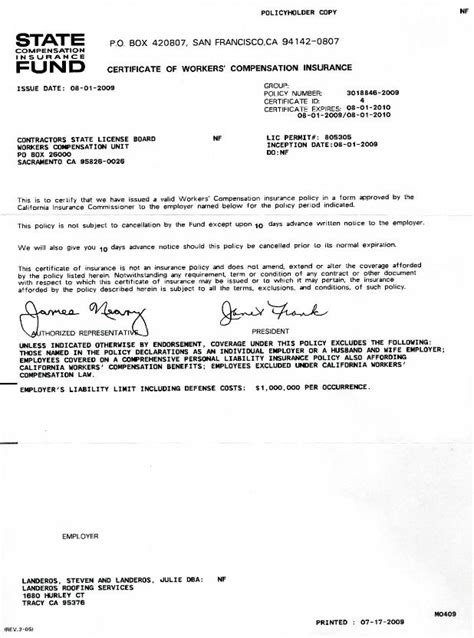

State Compensation Insurance

State Compensation Insurance Fund, often referred to as State Fund, is a vital component of California's workers' compensation system. Established in 1914, State Fund has a rich history of providing insurance coverage and ensuring workplace safety for employers and employees across the state. With a mission to promote a safe and stable workers' compensation market, State Fund has evolved to become a trusted partner for businesses, offering a range of services and resources to mitigate risks and protect workers.

A Historical Overview: The Birth of State Compensation Insurance Fund

In the early 20th century, the concept of workers’ compensation was gaining momentum, driven by the need to protect workers and provide financial support in the event of work-related injuries or illnesses. California, a pioneer in many social reforms, recognized the importance of establishing a state-run insurance fund to ensure the accessibility and affordability of workers’ compensation coverage. Thus, the State Compensation Insurance Fund was born, becoming one of the first such funds in the nation.

The creation of State Fund was not just a legislative feat but a response to the evolving needs of a growing industrial economy. By offering insurance coverage and fostering a culture of workplace safety, State Fund played a pivotal role in shaping California's economic landscape. Over the decades, State Fund has adapted to changing times, introducing innovative services and leveraging technology to enhance its operations.

The Breadth of Services: A Comprehensive Approach to Workers’ Compensation

State Compensation Insurance Fund’s services extend far beyond traditional insurance coverage. The organization is dedicated to providing a holistic approach to workers’ compensation, encompassing risk management, loss prevention, and injury management strategies. By offering a diverse range of services, State Fund empowers employers to create safer work environments and navigate the complexities of workers’ compensation regulations with confidence.

Insurance Coverage: The Foundation of Protection

At its core, State Fund offers insurance coverage to a wide range of businesses, including those considered high-risk or challenging to insure. The fund provides workers’ compensation insurance policies that comply with California’s strict regulations, ensuring employers meet their legal obligations. This coverage not only protects businesses from financial liabilities but also provides injured workers with the necessary medical care and benefits they deserve.

| Policy Type | Coverage Highlights |

|---|---|

| Standard Policies | Comprehensive coverage for a range of industries, including construction, healthcare, and manufacturing. |

| Special Policies | Tailored coverage for unique business needs, such as coverage for specific occupational diseases or specialty risk exposures. |

| Excess Policies | Additional coverage to supplement standard policies, providing higher limits for businesses with significant risk exposures. |

State Fund's insurance policies are not just about meeting legal requirements; they are designed to provide peace of mind and financial security to businesses, knowing their employees are protected in the event of a workplace accident or illness.

Risk Management: Proactive Measures for a Safer Workplace

Understanding that prevention is better than cure, State Fund places a strong emphasis on risk management. The organization offers a suite of risk management services aimed at helping employers identify and mitigate potential hazards in the workplace. These services include:

- Safety Consultations: Expert advisors provide on-site consultations to identify safety hazards and recommend improvements.

- Safety Training: State Fund conducts training sessions to educate employers and employees on workplace safety practices and regulations.

- Loss Control Services: These services help businesses implement effective safety programs and reduce the likelihood of workplace injuries.

- Online Resources: A wealth of online tools and guides are available, offering practical advice and best practices for workplace safety.

By investing in risk management, businesses can create a safer work environment, reduce the frequency and severity of workplace incidents, and ultimately lower their insurance costs.

Injury Management: Prompt and Efficient Care for Injured Workers

When workplace injuries do occur, State Fund’s injury management services come into play. The organization ensures injured workers receive prompt medical attention and the necessary benefits to support their recovery. This includes:

- Medical Case Management: Dedicated case managers work closely with injured workers and their healthcare providers to ensure efficient and effective treatment plans.

- Return-to-Work Programs: State Fund assists employers in developing strategies to facilitate the return of injured workers to their jobs, helping them regain their independence and productivity.

- Benefits Administration: The fund administers a range of benefits, including temporary disability payments, permanent disability awards, and vocational rehabilitation services.

By focusing on efficient injury management, State Fund aims to minimize the impact of workplace injuries on both the employee and the employer, promoting a swift and successful recovery process.

Performance and Impact: State Fund’s Contributions to California’s Economy

State Compensation Insurance Fund’s impact on California’s economy is profound and multifaceted. By providing insurance coverage and promoting workplace safety, State Fund contributes to a stable and productive workforce. The organization’s efforts have led to significant reductions in workplace injuries and illnesses, benefiting both employers and employees.

State Fund's performance is not just measured by its financial stability but also by its ability to support California's diverse business landscape. The fund has consistently demonstrated its commitment to providing accessible and affordable insurance coverage, especially for small businesses and those in high-risk industries. This has been instrumental in fostering economic growth and job creation across the state.

| Key Performance Metrics | Data |

|---|---|

| Policyholders | Over 130,000 active policyholders as of [year] |

| Claim Satisfaction Rate | 95% of claimants reported satisfaction with their claim experience [year] |

| Injury Frequency Rate | A steady decline of 10% over the past 5 years |

| Financial Strength | Maintained an A (Excellent) rating from AM Best for [number of] consecutive years |

Moreover, State Fund's risk management and injury management services have been instrumental in shaping a culture of safety in California's workplaces. By providing resources and support to employers, the fund has helped create a safer and more resilient workforce, reducing the human and economic costs associated with workplace injuries.

Looking Ahead: State Fund’s Future Endeavors and Innovations

As the landscape of work continues to evolve, State Compensation Insurance Fund remains committed to innovation and adaptation. The organization is focused on leveraging technology to enhance its services and better serve its policyholders. This includes developing digital tools for easier policy management, claims processing, and risk assessment.

State Fund is also dedicated to staying at the forefront of workplace safety practices. By partnering with industry experts and academic institutions, the fund aims to stay abreast of the latest research and trends in occupational health and safety. This commitment to continuous improvement ensures that State Fund's services remain relevant and effective in protecting California's workers.

Furthermore, State Fund recognizes the importance of community engagement and education. The organization actively participates in outreach programs and initiatives to raise awareness about workplace safety and the benefits of workers' compensation. By fostering a culture of safety and understanding, State Fund aims to create a safer and more informed community.

Conclusion

State Compensation Insurance Fund is more than just an insurance provider; it is a pillar of California’s workers’ compensation system. With a rich history, a comprehensive suite of services, and a commitment to innovation, State Fund continues to shape a safer and more prosperous future for California’s businesses and workers. As the organization adapts to the changing dynamics of work, its role in promoting workplace safety and supporting economic growth remains invaluable.

How can State Fund help small businesses with their workers’ compensation needs?

+

State Fund understands the unique challenges faced by small businesses. They offer tailored insurance policies and provide resources to help small businesses establish effective safety programs. Additionally, their customer service team is dedicated to providing personalized support to ensure small businesses receive the guidance they need.

What are the benefits of risk management services provided by State Fund?

+

Risk management services help businesses identify and mitigate potential hazards, reducing the likelihood of workplace injuries. This not only improves safety but also lowers insurance costs. By investing in risk management, businesses can create a safer work environment and enhance their overall operational efficiency.

How does State Fund ensure efficient claim processing for injured workers?

+

State Fund has implemented streamlined claim processes and dedicated claim specialists to ensure timely and efficient claim handling. They prioritize prompt medical attention for injured workers and work closely with employers to facilitate a swift return-to-work process, minimizing the impact of workplace injuries on all parties involved.