Cheap Car Insurance Quotes Near Me

Finding cheap car insurance quotes near you can be a challenging task, but with the right approach and knowledge, it is possible to secure affordable coverage for your vehicle. The insurance industry is highly competitive, and understanding the factors that influence rates can help you make informed decisions and potentially save money. This comprehensive guide will delve into the intricacies of obtaining cheap car insurance quotes, exploring the key considerations, strategies, and tips to ensure you get the best value for your insurance needs.

Understanding Car Insurance Quotes

Car insurance quotes are tailored estimates provided by insurance companies, detailing the cost of coverage for your specific vehicle and circumstances. These quotes are influenced by a multitude of factors, each playing a crucial role in determining the final insurance premium. By familiarizing yourself with these factors, you can better navigate the insurance landscape and make informed choices to secure the most affordable rates.

Key Factors Influencing Car Insurance Quotes

Several critical factors significantly impact the cost of car insurance quotes. These include:

- Vehicle Type and Age: The make, model, and year of your vehicle play a pivotal role. Newer, high-end cars often come with higher insurance premiums due to their higher replacement and repair costs.

- Driving History: Your past driving record is a key consideration. A clean driving history with no accidents or traffic violations can lead to more favorable insurance rates.

- Location: The area where you live and park your vehicle can affect insurance rates. Urban areas with higher population density and increased traffic often have higher insurance costs due to the higher likelihood of accidents.

- Coverage Options: The level of coverage you choose also impacts the cost. Comprehensive and collision coverage, while offering more protection, can increase your premium. Understanding your specific needs and choosing the right coverage is essential.

- Deductibles: Opting for higher deductibles can lower your insurance premiums. However, it's crucial to ensure you can afford the deductible in the event of a claim.

| Factor | Impact on Insurance Rates |

|---|---|

| Vehicle Type | Varies significantly; newer, high-end cars often cost more to insure. |

| Driving History | Clean records lead to lower rates; violations and accidents increase costs. |

| Location | Urban areas with high population density often have higher insurance costs. |

| Coverage Options | Comprehensive and collision coverage can increase premiums. |

| Deductibles | Higher deductibles can lower premiums but require careful consideration. |

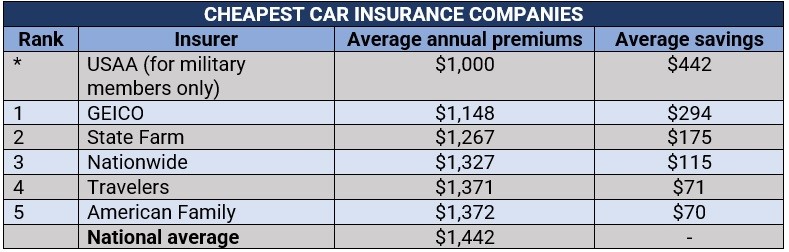

The Importance of Comparison

Comparing quotes from multiple insurance providers is a fundamental step in securing cheap car insurance. Each insurance company has its own rating system and pricing structure, so obtaining quotes from a variety of sources can help you identify the most competitive rates for your specific situation.

Strategies for Securing Cheap Car Insurance Quotes

Securing cheap car insurance quotes requires a strategic approach. Here are some effective strategies to consider:

Research and Comparison

Begin your search by researching reputable insurance providers in your area. Online comparison tools and insurance brokerages can be valuable resources for obtaining multiple quotes simultaneously. Ensure you understand the coverage options and any potential discounts offered by each provider.

Bundle Your Policies

If you have multiple insurance needs, such as home and auto insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts for customers who bundle their policies, making it a cost-effective strategy.

Explore Discounts

Insurance providers often offer a range of discounts to attract customers. Common discounts include:

- Good Driver Discount: Rewards drivers with clean driving records.

- Multi-Car Discount: Applies if you insure more than one vehicle with the same provider.

- Safety Features Discount: For vehicles equipped with advanced safety features like anti-lock brakes or airbags.

- Loyalty Discount: Recognizes long-term customers who have maintained their policies.

- Low Mileage Discount: For drivers who don't rack up excessive mileage on their vehicles.

Improve Your Driving Record

Maintaining a clean driving record is essential for securing affordable insurance. If you have a history of traffic violations or accidents, consider taking defensive driving courses to improve your record and potentially qualify for lower insurance rates.

Shop Around Regularly

Insurance rates can fluctuate, and what was a great deal a year ago might not be as competitive now. Regularly shopping around and comparing quotes can help you stay on top of the market and potentially identify more affordable options.

Consider Usage-Based Insurance

Some insurance providers offer usage-based insurance programs, where your driving behavior is tracked and used to determine your premium. These programs can be beneficial for safe drivers who don't log excessive mileage. However, it's essential to understand the potential privacy implications and ensure the program suits your driving habits.

Evaluating Car Insurance Quotes

When evaluating car insurance quotes, it's crucial to look beyond the headline price. Consider the following aspects:

Coverage Limits and Deductibles

Ensure the quote provides adequate coverage limits for your specific needs. Higher coverage limits can provide greater financial protection but may increase your premium. Similarly, assess the deductibles and consider whether you can afford them in the event of a claim.

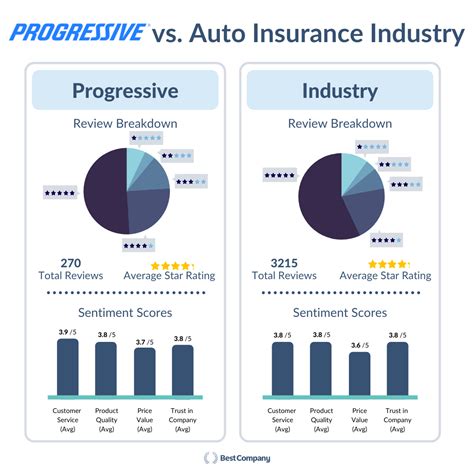

Reputation and Financial Stability

Research the insurance provider's reputation and financial stability. A reputable insurer with a strong financial standing is more likely to be reliable and able to pay out claims promptly.

Customer Service and Claims Handling

Consider the insurer's customer service reputation and claims handling process. Efficient and responsive customer service can make a significant difference, especially during the claims process.

Policy Exclusions and Fine Print

Read the policy's fine print carefully to understand any exclusions or limitations. Some policies may have specific exclusions that could impact your coverage in certain situations.

Additional Benefits and Perks

Look for insurers that offer additional benefits or perks, such as roadside assistance or rental car coverage. These can add value to your insurance policy.

Frequently Asked Questions

How often should I compare car insurance quotes?

+It's recommended to compare quotes at least once a year, especially during policy renewal periods. This ensures you stay updated on the market and can identify any more affordable options.

Can I negotiate car insurance quotes?

+While insurance quotes are typically based on standardized formulas, you can negotiate certain aspects, such as coverage limits and deductibles. Discussing your needs with an insurance agent can help you find the right balance.

What if I have a poor driving record?

+A poor driving record can lead to higher insurance premiums. However, some insurers offer programs to help drivers with a history of violations or accidents improve their record and potentially qualify for lower rates over time.

Are there any online tools to help me find cheap car insurance quotes?

+Yes, there are numerous online comparison tools and insurance brokerages that allow you to obtain multiple quotes simultaneously. These tools can be a convenient way to compare rates and coverage options.

What should I do if I find a cheaper quote elsewhere?

+If you find a cheaper quote elsewhere, it's worth discussing it with your current insurer. They may be willing to match or beat the competitor's offer to retain your business.

Finding cheap car insurance quotes near you requires a combination of research, comparison, and strategic decision-making. By understanding the key factors that influence insurance rates and implementing the strategies outlined above, you can navigate the insurance landscape effectively and secure affordable coverage for your vehicle.