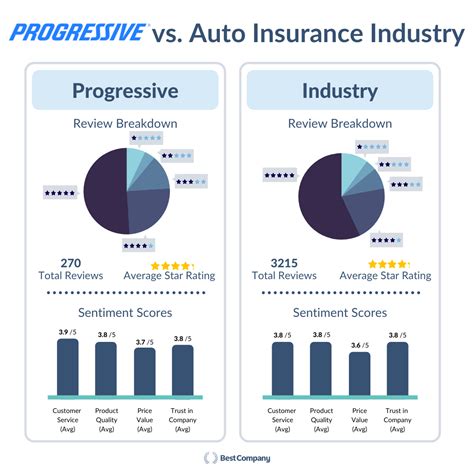

Car Insurance Companies Progressive

The car insurance industry is a vast and complex landscape, with numerous companies vying for the attention of drivers across the globe. Among them, Progressive has established itself as a prominent player, offering a range of insurance products and services. In this in-depth analysis, we will delve into the world of Progressive Car Insurance, exploring its history, products, and the impact it has on the industry and its customers.

A Journey Through Progressive’s Evolution

Progressive Insurance, often referred to simply as Progressive, is an American insurance company that has left an indelible mark on the automotive insurance sector. Founded in 1937 by Joseph Lewis and Jack Green in Ohio, the company began its journey with a bold mission: to provide auto insurance that was both affordable and accessible to the masses.

Over the decades, Progressive has consistently innovated and adapted to the changing landscape of the insurance industry. It was one of the first companies to embrace technology, leveraging it to streamline processes and enhance the customer experience. From introducing the concept of "pay-as-you-drive" insurance to developing cutting-edge mobile apps, Progressive has consistently pushed the boundaries of what's possible in the industry.

The company's commitment to innovation has not only benefited its customers but has also influenced the entire insurance sector. Progressive's early adoption of technology has set a precedent, encouraging other insurers to follow suit and invest in digital transformation. As a result, the industry as a whole has become more efficient, offering consumers a wider range of options and better services.

A Comprehensive Overview of Progressive’s Car Insurance Products

Progressive offers a comprehensive suite of car insurance products designed to cater to the diverse needs of its customers. Let’s explore some of the key offerings:

Standard Auto Insurance

The cornerstone of Progressive’s car insurance portfolio is its standard auto insurance policy. This policy provides coverage for a range of scenarios, including liability, collision, comprehensive, medical payments, and uninsured/underinsured motorist protection. Customers can tailor their policies to include additional coverage options, such as rental car reimbursement and roadside assistance.

One of the standout features of Progressive's standard auto insurance is its flexible payment options. The company understands that not all customers can afford to pay a full year's premium upfront, so it offers monthly payment plans without any additional fees. This flexibility has made insurance more accessible to a wider range of drivers.

| Policy Type | Coverage Highlights |

|---|---|

| Liability | Covers bodily injury and property damage claims made against the policyholder in an at-fault accident. |

| Collision | Pays for repairs or replacement of the insured vehicle in the event of a collision, regardless of fault. |

| Comprehensive | Provides coverage for damages caused by events other than collisions, such as theft, vandalism, and natural disasters. |

| Medical Payments | Offers reimbursement for medical expenses incurred by the policyholder and their passengers after an accident. |

| Uninsured/Underinsured Motorist | Protects the policyholder against financial loss in the event of an accident with a driver who lacks sufficient insurance coverage. |

Specialized Insurance Products

In addition to its standard auto insurance, Progressive offers a range of specialized products to cater to specific customer needs. These include:

- Motorcycle Insurance: Progressive provides coverage for a variety of motorcycles, scooters, and mopeds. The company's policies include collision, comprehensive, and liability coverage, as well as optional accessories and equipment coverage.

- RV Insurance: For recreational vehicle enthusiasts, Progressive offers customized policies that cover RVs, motorhomes, and travel trailers. These policies include liability, comprehensive, and collision coverage, as well as emergency expense coverage for unexpected breakdowns or accidents.

- Boat Insurance: Progressive's boat insurance policies protect against a range of risks, including collision, theft, and liability. The company also offers optional coverage for personal watercraft, fishing gear, and marine equipment.

- Commercial Auto Insurance: Progressive understands the unique needs of businesses and offers tailored commercial auto insurance policies. These policies cover a range of commercial vehicles, from trucks and vans to specialized equipment, and can be customized to include liability, collision, and comprehensive coverage, as well as additional protections like garagekeepers liability and hired/non-owned auto coverage.

The Impact of Progressive on the Insurance Industry

Progressive’s influence on the insurance industry extends far beyond its innovative products and services. The company’s commitment to customer-centricity and its willingness to challenge traditional insurance models have had a profound impact on the way the industry operates.

Technological Leadership

Progressive has been at the forefront of technological innovation in the insurance sector. Its early adoption of digital tools and platforms has revolutionized the way insurance is sold and serviced. The company’s website and mobile app, for instance, offer a seamless and intuitive experience, allowing customers to manage their policies, file claims, and even pay premiums with just a few clicks.

Progressive's embrace of technology has not only enhanced the customer experience but has also enabled the company to streamline its operations, reduce costs, and pass on those savings to its customers. This approach has set a new standard for the industry, encouraging other insurers to invest in digital transformation and improve their online presence.

Consumer-Friendly Pricing and Discounts

Progressive is known for its competitive pricing and a range of discounts that make insurance more affordable for its customers. The company offers a variety of discounts, including multi-policy discounts for customers who bundle their auto insurance with other Progressive policies, such as home or renters insurance.

Additionally, Progressive's "Name Your Price" tool allows customers to set their desired price range for insurance and then explore the coverage options that fit within that budget. This innovative approach puts the customer in the driver's seat, empowering them to make informed choices about their insurance coverage.

Claim Handling and Customer Service

Progressive’s claim handling process is designed to be efficient and customer-friendly. The company offers a range of options for filing claims, including online, over the phone, or through its mobile app. Customers can track the progress of their claims in real-time and receive regular updates.

Progressive's customer service team is highly trained and dedicated to providing exceptional support. The company's commitment to excellent service has been recognized by numerous industry awards, including the J.D. Power Award for Excellence in Customer Service. This level of service has set a high bar for other insurance providers, pushing them to enhance their own customer support offerings.

Progressive’s Commitment to Safety and Education

Beyond its insurance products and services, Progressive is committed to promoting road safety and educating drivers. The company’s initiatives in this area have had a significant impact on the broader community.

Safe Driver Rewards

Progressive’s Safe Driver Rewards program is designed to encourage safe driving behaviors. Customers who maintain a clean driving record and practice safe driving habits can earn discounts on their insurance premiums. This program not only rewards safe drivers but also serves as an incentive for all policyholders to drive more cautiously.

Teen Driver Programs

Recognizing the unique challenges faced by teen drivers, Progressive has developed specialized programs to help them become safer and more responsible on the road. These programs include resources for parents and teens, as well as innovative technologies like Snapshot, which monitors driving behavior and provides feedback to help teens improve their driving skills.

Community Initiatives

Progressive is actively involved in community initiatives aimed at promoting road safety. The company sponsors various events and campaigns, such as its annual “Drive Safe” campaign, which raises awareness about distracted driving and encourages drivers to make safer choices on the road.

Through these initiatives, Progressive not only fulfills its corporate social responsibility but also contributes to a safer and more responsible driving culture.

Conclusion: Progressive’s Role in Shaping the Insurance Landscape

In the dynamic world of car insurance, Progressive stands out as a visionary leader. Its journey from a small startup to a major industry player is a testament to its commitment to innovation, customer satisfaction, and safety. Progressive’s influence extends beyond its own success, shaping the entire insurance landscape and raising the bar for what consumers can expect from their insurance providers.

As the company continues to evolve and adapt to the changing needs of its customers, it is poised to remain a dominant force in the industry. With its focus on technology, customer-centricity, and safety, Progressive is well-positioned to navigate the challenges and opportunities of the future, ensuring that its customers are always at the heart of its operations.

What makes Progressive’s car insurance unique?

+Progressive’s car insurance stands out for its innovative approach, including flexible payment options, specialized products, and a focus on technology. The company’s commitment to customer satisfaction and safety also sets it apart in the industry.

How does Progressive’s pricing compare to other insurance companies?

+Progressive offers competitive pricing and a range of discounts, making insurance more affordable for its customers. Its “Name Your Price” tool also gives customers more control over their insurance costs.

What are some of Progressive’s notable safety initiatives?

+Progressive has several initiatives aimed at promoting road safety, including the Safe Driver Rewards program, teen driver programs, and community-focused campaigns. These efforts contribute to a safer driving culture.