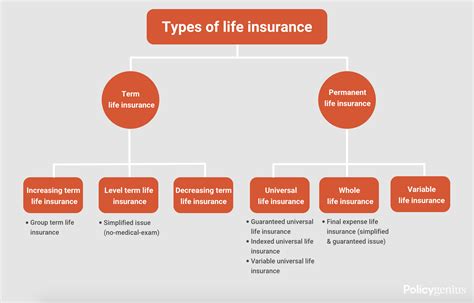

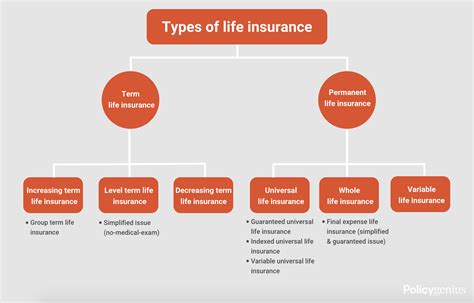

Life Insurance Types

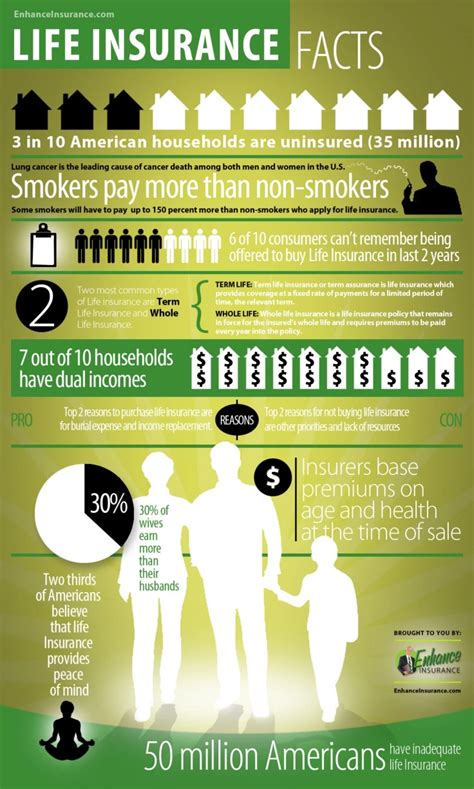

Life insurance is an essential financial tool that provides security and peace of mind to individuals and their loved ones. With a wide range of life insurance policies available, it's crucial to understand the different types and how they can benefit you. In this comprehensive guide, we will delve into the various life insurance types, their features, and the advantages they offer. By the end, you'll have a clearer understanding of which policy aligns best with your specific needs and goals.

Term Life Insurance

Term life insurance is a popular and affordable option for many individuals. It offers coverage for a specified term, typically ranging from 10 to 30 years. During this term, the policyholder pays a fixed premium, and in the event of their death, the beneficiaries receive a lump-sum payout. This type of insurance is ideal for those seeking financial protection for a specific period, such as while their children are young or during their working years.

Key Features of Term Life Insurance:

- Affordable premiums: Term life insurance is known for its cost-effectiveness, making it accessible to a wide range of individuals.

- Flexibility: Policies can be tailored to fit specific needs, with various term lengths and coverage amounts available.

- Renewal options: Some term policies offer the option to renew the coverage at the end of the term, providing continued protection.

- No cash value: Unlike permanent life insurance, term life policies do not accumulate cash value over time.

| Policy Term | Premium Cost |

|---|---|

| 10-year Term | $25/month for a healthy 30-year-old |

| 20-year Term | $35/month for a healthy 35-year-old |

| 30-year Term | $50/month for a healthy 40-year-old |

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, provides lifelong coverage and offers additional benefits beyond death benefits. This type of policy accumulates cash value over time, which can be accessed through policy loans or withdrawals. Whole life insurance is a popular choice for individuals seeking long-term financial protection and stability.

Key Features of Whole Life Insurance:

- Lifetime coverage: As the name suggests, whole life insurance provides coverage for the insured’s entire life, ensuring peace of mind.

- Cash value accumulation: The policy builds cash value, which can be used for various financial needs, such as retirement planning or emergency funds.

- Fixed premiums: Whole life insurance offers stable and predictable premiums, which remain consistent throughout the policy’s duration.

- Tax advantages: The cash value growth within the policy is tax-deferred, providing potential tax benefits.

| Policy Type | Premium Cost | Cash Value Growth |

|---|---|---|

| Whole Life (Basic) | $150/month for a 45-year-old | 3% annual growth |

| Whole Life (Enhanced) | $200/month for a 50-year-old | 4% annual growth |

Universal Life Insurance

Universal life insurance is a flexible permanent life insurance policy that offers adjustable premiums and coverage amounts. It provides the policyholder with more control over their policy, allowing them to adjust the death benefit and premium payments to fit their changing needs and financial circumstances.

Key Features of Universal Life Insurance:

- Flexibility: Policyholders can adjust the death benefit and premiums, making it ideal for those with fluctuating financial situations.

- Cash value accumulation: Similar to whole life insurance, universal life policies build cash value over time, which can be accessed or used for various financial goals.

- Premium payment options: Policyholders have the flexibility to pay premiums regularly or make lump-sum payments.

- Living benefits: Some universal life policies offer additional living benefits, such as chronic illness or long-term care coverage.

| Policy Type | Premium Cost | Cash Value Growth |

|---|---|---|

| Universal Life (Basic) | $180/month for a 35-year-old | 2% annual growth |

| Universal Life (Enhanced) | $220/month for a 40-year-old | 5% annual growth |

Variable Life Insurance

Variable life insurance is a type of permanent life insurance that allows policyholders to invest a portion of their premiums in different investment options, such as stocks, bonds, or mutual funds. This type of policy offers the potential for higher returns but also carries a higher level of risk compared to other life insurance types.

Key Features of Variable Life Insurance:

- Investment options: Policyholders can choose from a range of investment vehicles to grow their cash value, providing the potential for higher returns.

- Flexibility: Similar to universal life insurance, variable life policies offer adjustable death benefits and premiums.

- Death benefit protection: The policy provides a guaranteed death benefit, ensuring financial protection for beneficiaries.

- Market risk: The cash value growth is dependent on the performance of the chosen investment options, which can fluctuate.

| Policy Type | Premium Cost | Investment Options |

|---|---|---|

| Variable Life (Conservative) | $160/month for a 30-year-old | Bond Funds |

| Variable Life (Moderate) | $210/month for a 35-year-old | Balanced Funds |

| Variable Life (Aggressive) | $250/month for a 40-year-old | Stock Funds |

Final Thoughts

Choosing the right life insurance policy depends on your unique circumstances, financial goals, and risk tolerance. Term life insurance provides affordable, temporary coverage, while permanent life insurance options like whole life, universal life, and variable life offer lifelong protection and additional financial benefits. It’s essential to carefully evaluate your needs and consult with a qualified financial advisor to make an informed decision.

Remember, life insurance is a crucial component of your financial plan, providing security and peace of mind for you and your loved ones. By understanding the different types of life insurance and their features, you can make a well-informed choice that aligns with your specific requirements.

FAQ

What is the main difference between term and permanent life insurance?

+

Term life insurance offers coverage for a specific period, typically ranging from 10 to 30 years, and is known for its affordability. On the other hand, permanent life insurance, including whole life, universal life, and variable life, provides lifelong coverage and often includes additional benefits like cash value accumulation.

Can I convert my term life insurance policy into a permanent one?

+

Yes, many term life insurance policies offer a conversion option, allowing policyholders to convert their term policy into a permanent life insurance policy without undergoing additional medical underwriting. However, it’s essential to check the specific terms and conditions of your policy.

How do I choose the right life insurance policy for my needs?

+

When selecting a life insurance policy, consider your financial goals, the duration of coverage needed, and your risk tolerance. Term life insurance is ideal for temporary coverage, while permanent life insurance offers lifelong protection and additional benefits. Consulting with a financial advisor can help you make an informed decision based on your unique circumstances.