Individual Health Insurance Quotes

In today's dynamic healthcare landscape, understanding your insurance options is crucial. This article will delve into the world of individual health insurance quotes, exploring the factors that influence these quotes, the process of obtaining them, and the steps you can take to secure the best coverage for your unique needs. Whether you're self-employed, between jobs, or simply seeking personalized healthcare coverage, this guide will provide valuable insights to navigate the complex world of health insurance.

The Fundamentals of Individual Health Insurance Quotes

Individual health insurance quotes are personalized estimates of the cost of healthcare coverage for individuals and their families. These quotes are generated based on a variety of factors, offering a tailored view of the financial commitment required for comprehensive healthcare. Understanding these quotes is a critical step in securing affordable and adequate health insurance.

Key Factors Influencing Quotes

Several elements come into play when determining individual health insurance quotes. Age is a primary factor, with younger individuals generally paying lower premiums due to their reduced risk of serious health issues. Gender can also be a consideration, with insurance companies sometimes charging different rates based on statistical health differences between men and women. Tobacco usage often leads to higher premiums, reflecting the increased health risks associated with smoking or chewing tobacco.

The geographic location is another critical factor, as healthcare costs can vary significantly across different regions. Additionally, health status plays a vital role; pre-existing conditions or chronic illnesses may impact the quote, sometimes requiring a medical underwriting process to assess the individual's risk level.

| Factor | Impact |

|---|---|

| Age | Lower premiums for younger individuals |

| Gender | Differentiated rates based on health statistics |

| Tobacco Usage | Higher premiums for tobacco users |

| Geographic Location | Varying healthcare costs across regions |

| Health Status | Pre-existing conditions may impact quote |

The Process of Obtaining Quotes

Obtaining individual health insurance quotes involves a systematic process. It typically begins with a thorough evaluation of your personal circumstances, including age, health status, and family size. This information is then used to generate a personalized quote, detailing the cost of premiums, deductibles, and out-of-pocket expenses.

Many insurance providers offer online quote tools, allowing you to input your details and receive an immediate estimate. These tools provide a quick and convenient way to compare different plans and their associated costs. However, it's important to note that these quotes are often estimates and may not include all the specific details of your coverage.

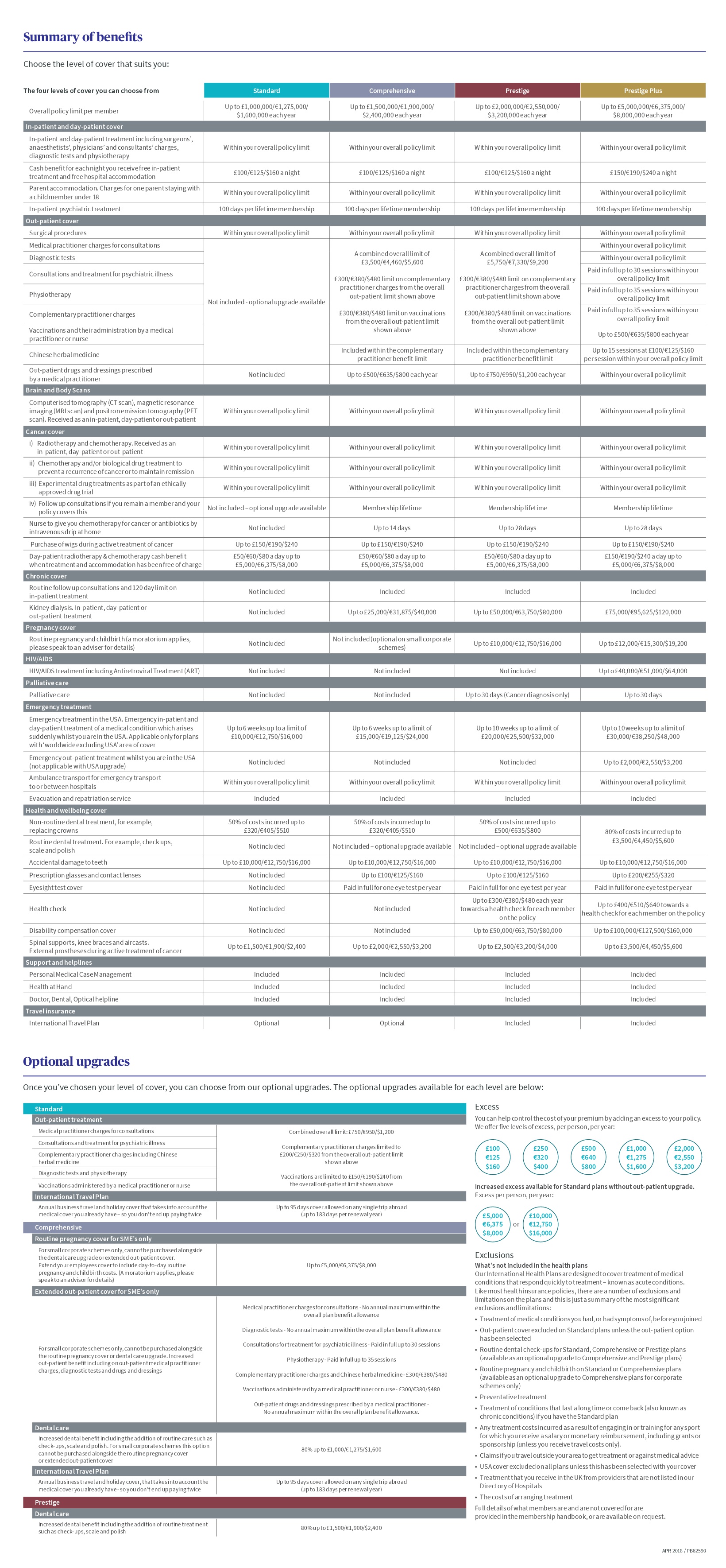

Exploring Different Health Insurance Plans

Individual health insurance plans come in various forms, each designed to cater to different needs and budgets. Understanding the types of plans available is essential to make an informed decision about your healthcare coverage.

Types of Health Insurance Plans

HMO (Health Maintenance Organization): HMO plans typically offer comprehensive coverage but require you to choose a primary care physician and obtain referrals for specialist care. They often have a limited network of providers, which can restrict your healthcare options but also keep costs down.

PPO (Preferred Provider Organization): PPO plans offer more flexibility, allowing you to visit any healthcare provider without a referral. They usually have a larger network of providers and offer more coverage options. However, premiums and out-of-pocket costs can be higher compared to HMO plans.

EPO (Exclusive Provider Organization): EPO plans are similar to PPO plans in that they don't require referrals, but they have a more limited network of providers. If you go outside the network, you may have to pay out-of-pocket expenses.

POS (Point of Service): POS plans combine elements of HMO and PPO plans. You choose a primary care physician, but you have the flexibility to see providers outside the network with some out-of-pocket costs.

| Plan Type | Description | Pros | Cons |

|---|---|---|---|

| HMO | Comprehensive coverage with a primary care physician | Lower costs, comprehensive coverage | Limited provider network, referral requirements |

| PPO | Flexible plan with a wider network | Flexibility, no referral needed | Higher costs, larger out-of-pocket expenses |

| EPO | Similar to PPO but with a limited network | Flexibility without referrals | Limited provider options, out-of-pocket costs outside network |

| POS | Combines HMO and PPO features | Flexibility, comprehensive coverage | Referrals needed, potential out-of-pocket costs |

Evaluating Coverage and Costs

When evaluating different health insurance plans, it's crucial to consider both the coverage provided and the associated costs. Premiums are the monthly payments you make to maintain your coverage, while deductibles are the amounts you must pay out of pocket before your insurance coverage kicks in. Understanding these costs is essential for managing your healthcare expenses effectively.

Additionally, consider the co-payments and coinsurance involved. Co-payments are fixed amounts you pay for specific services, like a doctor's visit or prescription medication. Coinsurance, on the other hand, is a percentage of the cost of a covered healthcare service that you pay after you've met your deductible. For example, if your coinsurance is 20%, you pay 20% of the bill while your insurance covers the remaining 80%.

Lastly, don't overlook the importance of out-of-pocket maximums. This is the most you'll pay for covered services in a year. Once you reach this limit, your health insurance plan will cover 100% of the costs of covered services for the rest of the year.

Securing the Best Individual Health Insurance

Navigating the complex world of individual health insurance quotes and plans requires a strategic approach. Here are some steps to help you secure the best coverage for your needs.

Assessing Your Healthcare Needs

Begin by assessing your current and potential future healthcare needs. Consider your medical history, any ongoing treatments or medications, and the likelihood of requiring specialized care. This self-assessment will guide you toward the type of coverage that suits your requirements most effectively.

Comparing Quotes and Plans

Utilize online resources and insurance brokers to compare quotes and plans. Online tools can provide a quick overview of different options, while brokers can offer more personalized advice based on your specific circumstances. Compare not only the premiums but also the coverage, deductibles, and out-of-pocket expenses to ensure you're getting the best value for your money.

Understanding Policy Exclusions

Read the fine print of any policy you're considering. Health insurance policies often have exclusions, which are services or treatments that aren't covered. Understanding these exclusions is crucial to avoid unexpected out-of-pocket expenses. Make sure the plan you choose covers the services you're likely to need.

Exploring Additional Benefits

Some health insurance plans offer additional benefits that can enhance your coverage. These may include vision and dental coverage, mental health services, or alternative therapy options. Consider these benefits when comparing plans, as they can provide significant value beyond basic healthcare coverage.

FAQs about Individual Health Insurance Quotes

How often should I review my health insurance coverage and quotes?

+It's a good practice to review your health insurance coverage and quotes annually, especially during open enrollment periods. This allows you to stay informed about any changes in your needs, coverage options, and costs.

Can I switch health insurance plans during the year?

+Generally, switching health insurance plans during the year is possible, but it often requires a qualifying event, such as a job change, marriage, or birth of a child. However, during special enrollment periods, you may have more flexibility to switch plans.

What is the difference between a premium and a deductible?

+A premium is the monthly payment you make to maintain your health insurance coverage, while a deductible is the amount you must pay out of pocket before your insurance coverage starts paying for covered services. In simple terms, the premium is the cost of having insurance, and the deductible is the cost of using that insurance.

Are there any tax benefits associated with individual health insurance plans?

+Yes, there can be tax benefits associated with individual health insurance plans. Depending on your income and the type of plan you have, you may be eligible for a premium tax credit, which can help offset the cost of your insurance premiums. It's advisable to consult a tax professional for more specific guidance.

Individual health insurance quotes and plans are a vital aspect of managing your healthcare and financial well-being. By understanding the factors that influence quotes, exploring different plan options, and taking a strategic approach to coverage, you can secure the best health insurance for your unique needs.