Mexican Insurance

In the vast landscape of international travel and commerce, navigating the intricacies of insurance coverage is paramount. When it comes to Mexico, a country renowned for its vibrant culture, breathtaking landscapes, and bustling cities, understanding Mexican insurance becomes a crucial aspect for both tourists and businesses alike.

This comprehensive guide delves into the world of Mexican insurance, shedding light on its significance, types, coverage options, and the key considerations one must make when obtaining insurance for travel, business ventures, or even medical emergencies in Mexico.

The Importance of Mexican Insurance

Mexico, with its thriving tourism industry and strategic location for international trade, presents unique challenges and opportunities. Whether you’re a leisure traveler seeking adventure or a business professional exploring new markets, ensuring adequate insurance coverage is essential for a seamless and secure experience.

Mexican insurance, tailored to the specific needs and regulations of the country, provides a safety net for individuals and businesses. It offers protection against various risks, ensuring peace of mind and financial security during your time in Mexico.

Types of Mexican Insurance

The world of Mexican insurance is diverse, catering to a wide range of needs. Here’s an overview of the primary types of insurance policies you might encounter:

Travel Insurance

Travel insurance for Mexico is a vital consideration for any visitor. It covers a spectrum of travel-related risks, including medical emergencies, trip cancellations, lost luggage, and personal liability. With Mexico’s diverse landscapes and adventurous activities, having travel insurance provides crucial support should any unexpected events occur.

Auto Insurance

For those driving in Mexico, whether on a road trip or as part of business operations, auto insurance is non-negotiable. Mexican law requires all vehicles to have liability insurance, and many policies also offer additional coverage for collision, comprehensive, and medical expenses. Ensuring you have the right auto insurance is essential to avoid legal and financial complications.

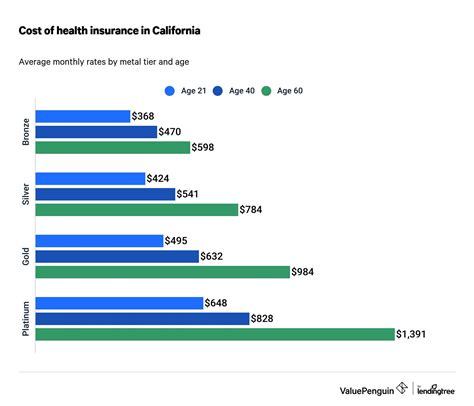

Health Insurance

Mexico’s healthcare system, while advanced, can present challenges for foreign visitors. Health insurance specifically designed for Mexico covers medical expenses, hospitalization, and emergency services. With varying healthcare costs, having adequate health insurance ensures access to quality medical care without financial strain.

Business Insurance

Businesses operating in Mexico or engaging in cross-border trade require specialized insurance coverage. This can include liability insurance for business operations, property insurance for offices or warehouses, and cargo insurance for goods in transit. Securing the right business insurance is crucial for mitigating risks and protecting your enterprise.

Coverage Options and Considerations

When navigating the landscape of Mexican insurance, several key considerations come into play. These considerations shape the type of coverage you opt for and ensure it aligns with your specific needs.

Policy Limits and Deductibles

Understanding the policy limits and deductibles is essential. Policy limits define the maximum amount an insurance company will pay for a covered loss, while deductibles are the portion of the loss you must pay out of pocket before the insurance coverage kicks in. Tailor these to your financial capabilities and the potential risks you anticipate.

Coverage Duration

Insurance policies often have specific time frames. Whether you’re planning a short vacation or a long-term business venture, ensure your insurance coverage aligns with your stay. Some policies offer flexible durations, while others may require extensions or new policies for longer stays.

Inclusions and Exclusions

Carefully review the inclusions and exclusions outlined in your insurance policy. These details specify what is and isn’t covered. For instance, certain adventurous activities or pre-existing medical conditions might be excluded, so it’s crucial to understand these nuances to avoid any surprises.

Network of Providers

For medical and auto insurance, understanding the network of providers is vital. Ensure the insurance policy you choose has a wide network of medical facilities and repair shops, especially in the areas you’ll be frequenting. This guarantees easy access to necessary services should the need arise.

Emergency Assistance

Inquire about emergency assistance services provided by your insurance company. This can include 24⁄7 customer support, medical evacuation coverage, and other critical services during times of need. Having reliable emergency assistance can make a significant difference in urgent situations.

Cost and Payment Options

The cost of insurance policies can vary significantly based on coverage, duration, and other factors. Explore payment options and consider whether you prefer a one-time payment or installment plans. Some insurance providers offer flexible payment terms to accommodate different financial situations.

Performance and Analysis

The performance and reliability of Mexican insurance policies are crucial considerations. Here’s a real-world example of how Mexican insurance can make a difference:

Imagine a small business owner, Sarah, who frequently travels to Mexico for meetings and product sourcing. She understands the importance of insurance and has tailored her policy to cover her specific needs. During one of her trips, Sarah is involved in a minor car accident. Thanks to her comprehensive auto insurance, she receives prompt assistance, her vehicle is repaired efficiently, and she faces no financial strain.

On the other hand, consider the experience of Mike, a tourist who underestimated the need for travel insurance. During his vacation, he suffers a severe injury requiring hospitalization. Without adequate health insurance, he faces not only a challenging recovery but also a significant financial burden, as medical costs in Mexico can be substantial.

These real-life scenarios highlight the critical role of Mexican insurance. Having the right coverage can provide essential support, peace of mind, and financial protection during your time in Mexico.

Future Implications and Expert Insights

As Mexico continues to evolve as a global destination for travel and business, the importance of Mexican insurance will only grow. Here are some expert insights and predictions for the future:

- Enhanced Digitalization: Insurance providers are expected to embrace digital platforms and technologies, making it easier for individuals and businesses to compare, purchase, and manage their insurance policies online.

- Customized Coverage: With increasing awareness and demand, insurance companies will likely offer more tailored coverage options, catering to specific needs and industries. This could include specialized policies for adventure sports, niche businesses, or unique medical conditions.

- Integration with Travel Services: There may be a growing trend of integrating insurance services with travel agencies and tour operators, providing seamless and comprehensive travel packages that include insurance.

- Increased Awareness and Education: Efforts to educate travelers and businesses about the importance of Mexican insurance are likely to gain momentum. This will empower individuals to make informed decisions and ensure they are adequately protected during their time in Mexico.

As you navigate the complex world of Mexican insurance, remember that your choice of coverage can significantly impact your experience in Mexico. By understanding the types of insurance, considering key factors, and staying informed about industry developments, you can make informed decisions and ensure a secure and enjoyable journey.

What happens if I drive in Mexico without auto insurance?

+Driving in Mexico without auto insurance is illegal and can result in severe penalties, including vehicle impoundment and fines. It’s crucial to obtain the necessary liability insurance to comply with Mexican laws and avoid legal complications.

Can I purchase Mexican insurance at the border?

+While it’s possible to purchase insurance at the border, it’s often more convenient and cost-effective to arrange coverage in advance. Online insurance providers offer a wide range of policies, making it easy to compare and purchase before your trip.

How do I choose the right health insurance for Mexico?

+Consider your specific healthcare needs, the duration of your stay, and the network of medical providers. Opt for a policy that offers comprehensive coverage, including emergency services, and ensure it aligns with your financial capabilities.