Champva Insurance Card

ChampVA, also known as the Civilian Health and Medical Program of the Department of Veterans Affairs, is a comprehensive health care program designed to provide medical benefits to eligible beneficiaries. This program is an essential component of the U.S. Department of Veterans Affairs' (VA) healthcare system, offering vital support to veterans and their families. The ChampVA Insurance Card is a crucial element of this program, serving as a primary tool for beneficiaries to access their healthcare benefits.

In this in-depth analysis, we will explore the ChampVA Insurance Card, delving into its significance, functionality, and impact on the lives of veterans and their families. By understanding the intricacies of this card and the program it represents, we can gain insights into the critical role the VA plays in ensuring the well-being of those who have served our nation.

The Significance of ChampVA

ChampVA is a vital healthcare program within the VA’s extensive network of services. Established to address the unique healthcare needs of veterans and their families, it provides an essential safety net for those who may not qualify for other VA healthcare programs or traditional health insurance plans.

Eligible beneficiaries of ChampVA include spouses, surviving spouses, and children of veterans who meet specific criteria. These criteria are based on the veteran's military service, disability status, and income level. By offering healthcare coverage to this population, ChampVA ensures that veterans' families have access to the medical care they need, regardless of their financial situation or the veteran's eligibility for other VA programs.

Benefits and Coverage

ChampVA offers a comprehensive range of medical benefits, covering a wide array of healthcare services. These include but are not limited to:

- Inpatient and outpatient hospital care

- Primary and specialty medical services

- Prescription medications

- Mental health and substance abuse treatment

- Preventive care and screenings

- Dental and vision care (limited coverage)

- Durable medical equipment and supplies

- Home healthcare services

The program's benefits are designed to meet the diverse healthcare needs of beneficiaries, ensuring that they receive the care they require to maintain their health and well-being. By offering such a comprehensive set of services, ChampVA plays a critical role in promoting the overall health of veterans' families.

| Benefit Category | Coverage Highlights |

|---|---|

| Inpatient Care | Covers hospital stays, surgeries, and other procedures requiring overnight admission. |

| Outpatient Services | Includes visits to doctors, specialists, and clinics for non-emergency medical issues. |

| Prescription Drugs | Provides coverage for a wide range of medications, with options for mail-order and VA pharmacy services. |

| Mental Health | Offers access to counseling, therapy, and psychiatric care for various mental health conditions. |

| Preventive Care | Covers annual physicals, immunizations, and screenings for early detection of health issues. |

The ChampVA Insurance Card: A Gateway to Care

The ChampVA Insurance Card is a physical or digital representation of an individual’s eligibility for ChampVA benefits. It serves as a critical tool for beneficiaries to access their healthcare services and is a vital component of the ChampVA program.

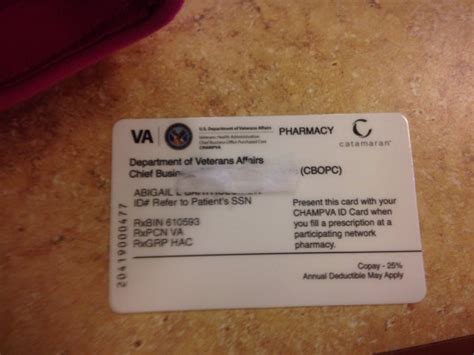

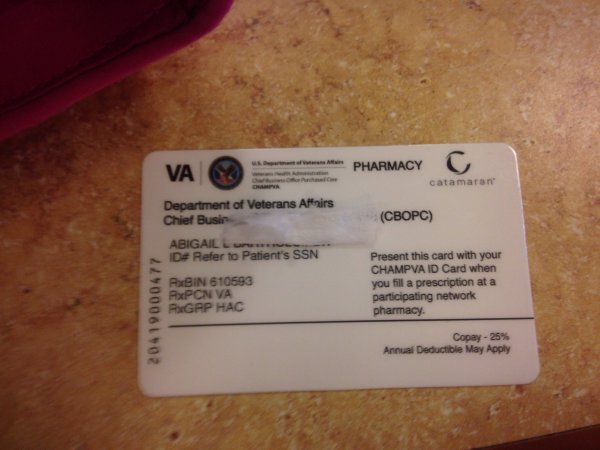

Card Design and Features

The design of the ChampVA Insurance Card is intentionally straightforward and functional. It typically features the following information:

- Beneficiary's name

- Beneficiary's date of birth

- ChampVA identification number

- VA medical facility assignment

- Eligibility category (spouse, child, etc.)

- Card expiration date

The card also includes a barcode or magnetic strip for easy scanning and verification by healthcare providers. This design ensures that beneficiaries can quickly and efficiently access their benefits without unnecessary complications.

Card Functionality and Use

The ChampVA Insurance Card is used at the point of service, whether it’s a doctor’s office, hospital, pharmacy, or other healthcare facility. When presenting the card, beneficiaries can expect the following process:

- Verification: The card is scanned or manually entered into the healthcare provider's system to verify the beneficiary's eligibility and coverage.

- Authorization: Once verified, the provider can authorize the requested healthcare services or procedures based on the beneficiary's ChampVA coverage.

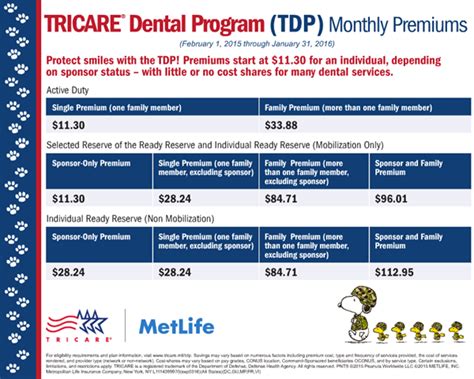

- Co-pays and Deductibles: In some cases, beneficiaries may be required to pay a co-pay or deductible, which is typically a small portion of the total cost of the service. These costs are set by the VA and vary depending on the type of service.

- Receipt and Documentation: Beneficiaries will receive a receipt or documentation of the services received, which can be useful for tracking personal health records and for any future reference.

💡 Expert Tip: While the ChampVA Insurance Card is a powerful tool, it's essential for beneficiaries to understand their specific coverage and benefits. This knowledge can help them navigate their healthcare needs more effectively and ensure they receive the full extent of their eligible benefits.

Navigating the ChampVA System

Understanding the ChampVA program and utilizing the Insurance Card effectively can be a complex process. However, with the right guidance and resources, beneficiaries can successfully navigate the system and access their healthcare benefits seamlessly.

Enrollment and Eligibility

Enrollment in ChampVA is typically initiated by the veteran or their spouse. The process involves completing an application, providing necessary documentation, and meeting specific eligibility criteria. These criteria include the veteran’s service history, disability status, and income level. Once enrolled, beneficiaries receive their ChampVA Insurance Card and can begin utilizing their benefits.

Understanding Coverage and Benefits

Each beneficiary’s ChampVA coverage is unique, based on their individual circumstances and eligibility. It’s crucial for beneficiaries to understand their specific coverage, including any limitations, exclusions, and co-pays. This knowledge empowers them to make informed decisions about their healthcare and ensures they are prepared for any potential out-of-pocket costs.

Accessing Care and Services

ChampVA beneficiaries have the option to receive care through the VA healthcare system or through private healthcare providers. When utilizing VA facilities, the process is generally straightforward, as the VA network is designed to accommodate ChampVA beneficiaries. However, when seeking care from private providers, beneficiaries may need to select healthcare professionals who accept ChampVA insurance.

| Healthcare Setting | Considerations |

|---|---|

| VA Facilities | Usually covered in full with no co-pays or deductibles. Offers a comprehensive network of services and specialists. |

| Private Providers | May require co-pays or deductibles. Beneficiaries should choose providers who accept ChampVA insurance to ensure coverage. |

The Impact of ChampVA

The ChampVA program and its Insurance Card have a significant impact on the lives of veterans and their families. By providing comprehensive healthcare coverage, ChampVA ensures that beneficiaries can access the medical care they need, regardless of their financial situation or other eligibility factors.

Improving Health Outcomes

Access to healthcare is a fundamental aspect of maintaining good health. ChampVA’s comprehensive benefits allow beneficiaries to receive preventive care, manage chronic conditions, and address acute health issues. This access to timely and appropriate healthcare can lead to improved health outcomes and an enhanced quality of life.

Financial Protection

Healthcare costs can be a significant financial burden, especially for those with limited income or no other insurance coverage. ChampVA helps alleviate this financial strain by covering a wide range of healthcare services. While beneficiaries may still incur some out-of-pocket costs, such as co-pays or deductibles, these expenses are generally minimal compared to the cost of healthcare without insurance.

Peace of Mind

For veterans and their families, the ChampVA Insurance Card provides a sense of security and peace of mind. Knowing that they have access to quality healthcare services without worrying about unaffordable costs can significantly reduce stress and anxiety. This peace of mind is invaluable and allows beneficiaries to focus on their health and well-being without the added worry of financial hardship.

Conclusion

The ChampVA Insurance Card is more than just a piece of plastic or digital data. It represents a commitment by the VA to ensure that veterans and their families have access to the healthcare they deserve. By understanding the significance of ChampVA and utilizing the Insurance Card effectively, beneficiaries can navigate the healthcare system with confidence and access the benefits they are entitled to.

As we continue to recognize and honor the sacrifices made by our veterans, programs like ChampVA are a testament to our nation's commitment to caring for those who have served. The ChampVA Insurance Card is a powerful symbol of this commitment, and its impact on the lives of veterans and their families cannot be overstated.

Who is eligible for ChampVA benefits?

+Eligibility for ChampVA benefits is primarily based on the veteran’s service history, disability status, and income level. Spouses, surviving spouses, and children of eligible veterans can also qualify for ChampVA coverage.

How do I enroll in ChampVA?

+Enrollment in ChampVA is typically initiated by the veteran or their spouse. The process involves completing an application, providing necessary documentation, and meeting specific eligibility criteria. You can start the enrollment process by visiting the VA’s website or contacting your local VA medical facility.

What services are covered by ChampVA?

+ChampVA offers a comprehensive range of medical benefits, including inpatient and outpatient care, prescription medications, mental health services, preventive care, and more. The exact coverage can vary based on individual eligibility and specific circumstances.

Do I need to pay for ChampVA coverage?

+ChampVA coverage is generally provided at no cost to eligible beneficiaries. However, there may be some out-of-pocket expenses, such as co-pays or deductibles, depending on the specific services received.

Can I use ChampVA at any healthcare provider?

+ChampVA beneficiaries can receive care through the VA healthcare system or from private healthcare providers who accept ChampVA insurance. When utilizing private providers, it’s essential to verify their acceptance of ChampVA coverage to ensure you receive the full extent of your benefits.