Collision Insurance Vs Comprehensive

Understanding the difference between collision insurance and comprehensive insurance is crucial for vehicle owners seeking adequate protection for their assets. These two types of insurance policies offer distinct coverage, each designed to address specific risks and situations. In this article, we will delve into the intricacies of collision and comprehensive insurance, exploring their definitions, coverage details, and real-world examples to help you make informed decisions about your vehicle's insurance coverage.

Collision Insurance: Navigating the Risks of Road Incidents

Collision insurance, as the name suggests, is a type of vehicle insurance that specifically covers damages resulting from a collision involving your vehicle. This coverage is designed to protect you financially in the event of an accident, regardless of who is at fault. Here’s a closer look at what collision insurance entails:

Definition and Coverage

Collision insurance provides coverage for damages to your vehicle when it collides with another vehicle, object, or structure. This includes accidents such as:

- Colliding with another car during a traffic incident.

- Hitting a stationary object like a pole or a building.

- Rolling over due to loss of control.

- Damage caused by potholes or road debris.

However, it’s important to note that collision insurance does not cover damages resulting from natural disasters, theft, or vandalism. For these types of incidents, you would need comprehensive insurance, as we will discuss in the following section.

Real-World Example

Imagine you’re driving on a rainy day, and due to reduced visibility, you collide with a tree on the side of the road. Your vehicle sustains significant damage, including a cracked windshield, damaged fenders, and a bent frame. With collision insurance, you can file a claim to have these repairs covered, ensuring your vehicle is restored to its pre-accident condition.

Cost Considerations

Collision insurance typically comes with a deductible, which is the amount you must pay out of pocket before your insurance coverage kicks in. Deductibles can vary based on your insurance provider and the level of coverage you choose. Additionally, the cost of collision insurance can depend on several factors, including:

- The make and model of your vehicle.

- Your driving history and accident record.

- The location where your vehicle is primarily driven.

- The age and condition of your vehicle.

Comprehensive Insurance: A Broader Protection Net

While collision insurance focuses on accident-related damages, comprehensive insurance offers a more extensive coverage net, protecting your vehicle from a wider range of potential risks. This type of insurance is often referred to as “Other Than Collision” (OTC) coverage, indicating its broad scope.

Definition and Coverage

Comprehensive insurance covers damages to your vehicle that are not directly related to collisions. This includes incidents such as:

- Damage caused by natural disasters, including hurricanes, tornadoes, floods, or earthquakes.

- Theft or attempted theft of your vehicle or its parts.

- Vandalism, such as broken windows or graffiti.

- Damage caused by animals, including collisions with deer or other wildlife.

- Falling objects, like tree branches or debris.

- Fire, explosions, or other similar incidents.

- Damage caused by civil unrest or riots.

Comprehensive insurance provides peace of mind by offering protection against unforeseen events that can cause significant damage to your vehicle.

Real-World Example

Let’s say you live in an area prone to severe weather. One night, a strong thunderstorm hits your region, causing a tree branch to fall and damage the roof of your parked car. With comprehensive insurance, you can file a claim to have the necessary repairs covered, ensuring your vehicle is back in shape after the storm.

Cost and Deductible

Similar to collision insurance, comprehensive coverage also comes with a deductible. The cost of comprehensive insurance can vary based on factors such as:

- The value of your vehicle.

- Your location and the associated risk of natural disasters.

- Your insurance provider’s rates and policies.

- Any additional coverage options you choose, such as rental car reimbursement.

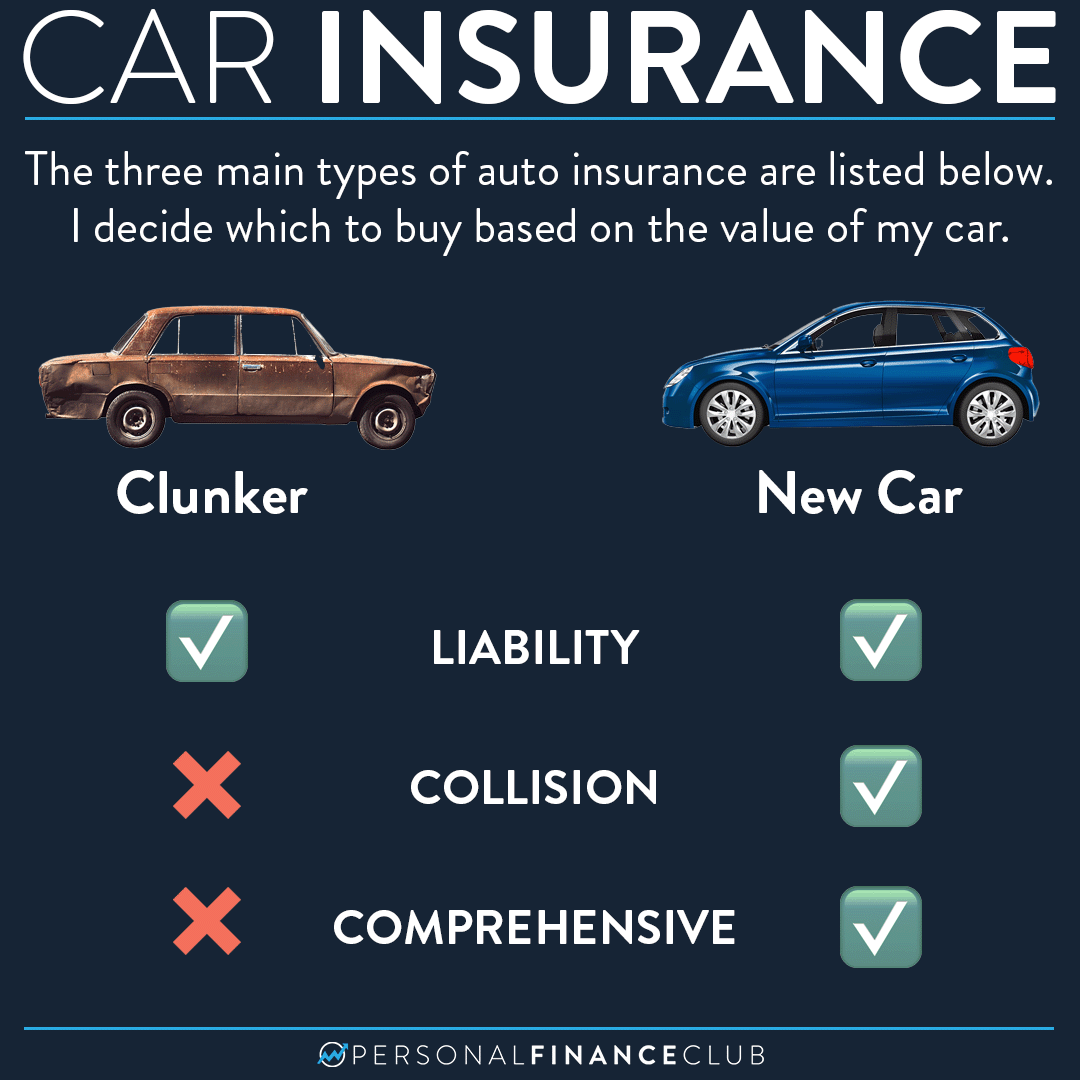

Comparing Collision and Comprehensive Insurance

When deciding between collision and comprehensive insurance, it’s essential to consider your specific needs and the potential risks your vehicle may face. Here’s a comparison table highlighting the key differences:

| Coverage Type | Collision Insurance | Comprehensive Insurance |

|---|---|---|

| Coverage Scope | Covers damages from collisions with other vehicles, objects, or structures. | Protects against a wide range of non-collision incidents, including natural disasters, theft, and vandalism. |

| Common Incidents Covered | Accidents, pothole damage, rolling over. | Natural disasters, theft, vandalism, animal collisions, fire, falling objects. |

| Deductible | Varies based on provider and coverage level. | Varies similarly to collision insurance. |

| Cost Factors | Vehicle make/model, driving history, location, age of vehicle. | Vehicle value, location, provider rates, additional coverage options. |

By understanding the distinctions between collision and comprehensive insurance, you can make an informed decision about which coverage best suits your needs and provides the protection your vehicle deserves.

What is the primary difference between collision and comprehensive insurance?

+Collision insurance covers damages resulting from collisions, while comprehensive insurance provides broader protection against non-collision incidents, including natural disasters, theft, and vandalism.

Do I need both collision and comprehensive insurance?

+The need for both types of insurance depends on your specific circumstances and the risks your vehicle may face. Some drivers opt for both for comprehensive coverage, while others choose one or the other based on their needs and budget.

Can I customize my collision or comprehensive insurance coverage?

+Yes, you can often customize your insurance coverage by choosing different deductibles, coverage limits, and optional add-ons. Consult with your insurance provider to explore the available options and find the best fit for your needs.