Insurance Agents In My Area

When it comes to finding the right insurance coverage, having a reliable and knowledgeable insurance agent can make all the difference. Insurance agents play a crucial role in guiding individuals and businesses through the complex world of insurance policies, ensuring they receive the protection they need. In this comprehensive guide, we will delve into the world of insurance agents, exploring their expertise, the services they provide, and how to find the best agents in your local area.

Understanding the Role of Insurance Agents

Insurance agents are professionals who act as intermediaries between insurance companies and policyholders. They are licensed and trained to offer advice, educate clients, and provide personalized insurance solutions. These agents possess a deep understanding of various insurance products, including health, life, auto, home, and business insurance.

The primary objective of insurance agents is to help individuals and businesses navigate the intricate insurance landscape. They assess their clients' unique needs, risks, and financial situations to recommend suitable coverage options. By tailoring insurance plans to specific requirements, agents ensure that policyholders receive adequate protection without overspending.

The Benefits of Working with Insurance Agents

Engaging the services of an insurance agent offers numerous advantages. Firstly, agents provide valuable expertise and guidance, ensuring clients understand the complexities of insurance policies. They explain coverage options, deductibles, and potential exclusions, empowering clients to make informed decisions.

Secondly, insurance agents offer a personalized approach. They take the time to understand their clients' lifestyles, financial goals, and potential risks. By conducting thorough assessments, agents can identify gaps in coverage and recommend tailored solutions. This personalized service ensures clients receive the right level of protection for their specific circumstances.

Additionally, insurance agents act as advocates for their clients. In the event of a claim, they assist policyholders in navigating the claims process, ensuring a smooth and efficient resolution. Agents can also provide ongoing support and advice, helping clients make necessary adjustments to their coverage as their needs evolve over time.

Locating Insurance Agents in Your Area

Finding insurance agents in your local area is a straightforward process. Here are some effective strategies to identify reputable agents nearby:

Online Searches

Utilize online search engines to locate insurance agents in your region. Search for terms like “insurance agents near me” or “insurance brokers in [your city]” to uncover a list of local options. Many insurance companies and independent agents have well-established online presences, making it easy to find and contact them.

Referrals and Recommendations

Word-of-mouth referrals can be incredibly valuable when seeking insurance agents. Ask friends, family, colleagues, or business associates for recommendations. Personal referrals often lead to trusted and reliable agents who have proven their worth through positive experiences.

Insurance Company Websites

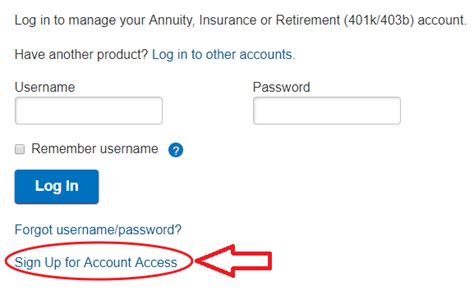

Visit the websites of reputable insurance companies to locate their local agents. Many insurance providers have agent locator tools on their websites, allowing you to search for agents based on your location. This ensures that you connect with agents authorized to represent the company and offer their products.

Industry Directories

Explore industry directories and databases that list insurance agents and brokers. These resources often provide detailed information about agents, including their specialties, qualifications, and customer reviews. Some popular industry directories include the National Association of Insurance and Financial Advisors (NAIFA) and the Independent Insurance Agents & Brokers of America (IIABA).

Local Business Directories

Check local business directories, such as Yellow Pages or online platforms like Yelp, to find insurance agents in your area. These directories often include reviews and ratings from previous clients, offering valuable insights into the quality of service provided by different agents.

Evaluating Insurance Agents

Once you have identified a list of potential insurance agents, it’s essential to evaluate them to find the best fit for your needs. Consider the following factors when assessing agents:

Experience and Expertise

Look for insurance agents with extensive experience in the industry. Experienced agents have a deeper understanding of insurance products, market trends, and regulatory changes. They can offer more tailored advice and navigate complex situations effectively.

Specialties and Qualifications

Determine the agents’ specialties and qualifications. Some agents focus on specific types of insurance, such as health, life, or business insurance. Ensure that the agent you choose has the necessary expertise and certifications to handle your unique insurance needs.

Client Reviews and Testimonials

Read client reviews and testimonials to gauge the agents’ reputation and level of service. Positive feedback and recommendations from satisfied clients indicate a reliable and trustworthy agent. Pay attention to reviews that highlight the agent’s responsiveness, knowledge, and ability to find suitable coverage options.

Communication and Availability

Evaluate the agents’ communication skills and availability. Effective communication is vital when working with insurance agents. Choose an agent who responds promptly to your inquiries, provides clear explanations, and is easily accessible when you need assistance.

Personal Chemistry

Building a strong relationship with your insurance agent is crucial. Consider whether you feel comfortable and at ease discussing personal and financial matters with the agent. A good fit is essential for a long-term professional partnership.

The Services Offered by Insurance Agents

Insurance agents provide a wide range of services to assist clients in obtaining the right insurance coverage. Here are some key services they offer:

Policy Selection and Comparison

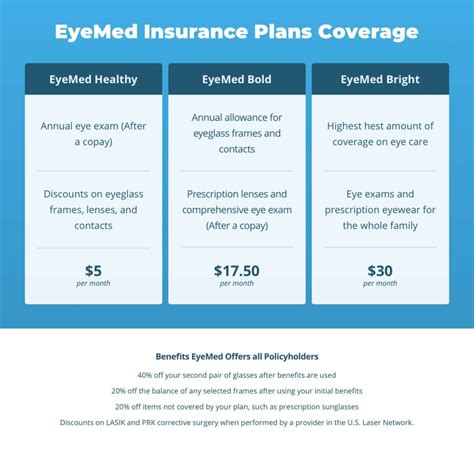

Insurance agents have access to a variety of insurance products from different providers. They can compare policies, explain the differences, and help you choose the most suitable option based on your needs and budget. Their expertise ensures you receive the best value for your insurance investment.

Personalized Coverage Recommendations

Based on your unique circumstances, insurance agents can provide personalized coverage recommendations. They consider factors such as your age, health status, assets, and financial goals to tailor insurance plans that offer the right level of protection. This personalized approach ensures you have adequate coverage without paying for unnecessary features.

Claims Assistance

In the event of an insurance claim, insurance agents act as your advocate. They guide you through the claims process, ensuring you receive the benefits you are entitled to. Agents can assist with filing claims, communicating with insurance companies, and providing the necessary documentation. Their expertise helps streamline the claims process, reducing stress and potential delays.

Policy Review and Updates

Insurance agents regularly review your existing policies to ensure they remain up-to-date and aligned with your changing needs. They assess your life changes, such as marriage, home ownership, or business expansion, and recommend necessary adjustments to your coverage. This proactive approach ensures you maintain adequate protection as your circumstances evolve.

Education and Guidance

Insurance agents are committed to educating their clients about insurance. They provide valuable insights, explain complex insurance terminology, and offer guidance on making informed decisions. Their expertise empowers clients to understand their coverage, ask the right questions, and make adjustments as needed.

Tips for a Successful Relationship with Your Insurance Agent

Building a strong and lasting relationship with your insurance agent is essential for optimal insurance coverage and peace of mind. Here are some tips to foster a successful partnership:

Open and Honest Communication

Maintain open and honest communication with your insurance agent. Be transparent about your needs, concerns, and any changes in your circumstances. Providing accurate information allows your agent to offer the most suitable advice and recommendations.

Regular Policy Reviews

Schedule regular reviews of your insurance policies with your agent. Life circumstances can change rapidly, and your insurance needs may evolve. Regular reviews ensure that your coverage remains aligned with your current situation, providing the necessary protection when you need it most.

Ask Questions and Seek Clarification

Don’t hesitate to ask questions or seek clarification from your insurance agent. Insurance policies can be complex, and understanding the fine print is crucial. Your agent is there to provide guidance and ensure you have a clear understanding of your coverage.

Provide Necessary Documentation

When applying for insurance or making changes to your policies, provide your agent with all the necessary documentation. This includes accurate and up-to-date information about your personal and financial circumstances. Accurate documentation ensures that your insurance coverage is tailored to your specific needs.

Stay Informed and Educated

Take the initiative to stay informed about insurance-related topics. Read articles, blogs, and resources provided by your insurance agent or reputable industry sources. Educating yourself about insurance can help you make more informed decisions and better understand your coverage.

Conclusion

Finding the right insurance agent in your area is a critical step towards securing adequate insurance coverage. By understanding the role of insurance agents, evaluating their expertise, and following the provided strategies, you can locate reputable agents who can guide you through the insurance landscape. Remember, building a strong relationship with your insurance agent ensures you receive the personalized advice and support you need to protect what matters most.

What should I do if I’m not satisfied with my current insurance agent?

+If you’re dissatisfied with your current insurance agent, it’s important to explore your options. Evaluate your needs and consider the services and expertise offered by other agents in your area. You can request referrals from trusted sources or utilize online resources to find alternative agents. Remember, you have the right to choose an agent who aligns with your expectations and provides the level of service you require.

Can insurance agents provide coverage for specific industries or professions?

+Absolutely! Insurance agents specialize in various insurance segments, including coverage for specific industries and professions. Whether you’re a healthcare professional, a small business owner, or work in a niche industry, there are insurance agents who specialize in understanding the unique risks and requirements of your field. They can provide tailored coverage solutions to protect your business or profession.

How can I ensure I’m getting the best insurance rates?

+To ensure you’re getting the best insurance rates, it’s important to shop around and compare quotes from multiple insurance providers. Insurance agents can assist in this process by accessing a wide range of insurance companies and policies. They can negotiate on your behalf and provide you with the most competitive rates based on your specific needs and circumstances.