Quote For Vehicle Insurance

As a driver, one of the essential aspects to consider is securing comprehensive vehicle insurance to protect yourself and your vehicle in various scenarios. Obtaining a quote for vehicle insurance is a critical step towards ensuring you have the right coverage. In this expert guide, we will delve into the intricacies of vehicle insurance quotes, exploring the factors that influence them, the steps to obtain an accurate quote, and the benefits of having adequate coverage. By understanding the process and making informed decisions, you can navigate the world of vehicle insurance with confidence.

Understanding the Fundamentals of Vehicle Insurance Quotes

Vehicle insurance quotes serve as a foundation for drivers to evaluate their coverage needs and costs. These quotes are tailored to individual circumstances, taking into account a range of factors that influence the premium rates. By comprehending the fundamentals, drivers can make educated choices to secure the best insurance plan for their specific requirements.

Factors Influencing Vehicle Insurance Quotes

Numerous variables come into play when determining the cost of vehicle insurance. These factors include:

- Driver’s Profile: Age, gender, driving history, and location significantly impact insurance rates. Younger drivers, for instance, often face higher premiums due to their lack of experience.

- Vehicle Type: The make, model, and year of the vehicle play a role in insurance costs. Sports cars or luxury vehicles may attract higher premiums due to their higher repair or replacement costs.

- Coverage Level: The extent of coverage chosen, such as liability-only or comprehensive coverage, affects the overall quote. Comprehensive plans offer more protection but typically come at a higher cost.

- Deductibles: Opting for higher deductibles can lead to lower premiums, as you agree to pay more out-of-pocket in the event of a claim.

- Additional Drivers: Adding extra drivers to your policy, especially younger or inexperienced ones, can increase the overall quote.

- Discounts and Rewards: Many insurance providers offer discounts for safe driving records, loyalty, or specific vehicle safety features.

Understanding these factors empowers drivers to make informed decisions when obtaining quotes. By assessing their individual circumstances and considering the potential impact of these variables, drivers can tailor their insurance coverage to their needs and budget.

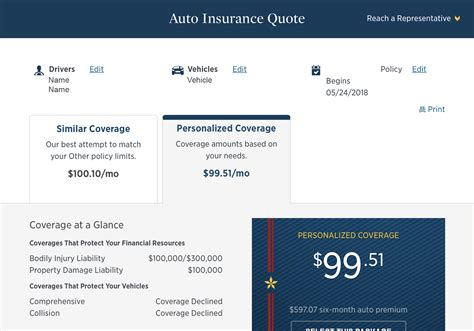

Obtaining an Accurate Vehicle Insurance Quote

To secure an accurate quote, it’s essential to provide detailed and honest information to your insurance provider. Here’s a step-by-step guide to obtaining an accurate vehicle insurance quote:

- Gather Necessary Information: Prepare the following details:

- Personal information: Name, date of birth, driver’s license number, and address.

- Vehicle details: Make, model, year, and vehicle identification number (VIN).

- Driving history: Record of accidents, tickets, and claims.

- Coverage preferences: Desired coverage limits and deductibles.

- Compare Multiple Quotes: Shop around and obtain quotes from several insurance providers. Comparison shopping allows you to identify the best rates and coverage options.

- Review Coverage Options: Understand the different coverage types and their benefits. Consider the specific risks you want to protect against and choose the coverage that aligns with your needs.

- Assess Your Budget: Determine the premium amount you can comfortably afford. Consider your financial situation and choose a coverage level and deductible that suits your budget.

- Consider Additional Coverage: Evaluate add-on coverage options such as rental car reimbursement or roadside assistance. These can provide extra protection and peace of mind.

- Review Discounts: Explore potential discounts you may qualify for, such as safe driver discounts, multi-policy discounts, or loyalty rewards. Applying for these discounts can help lower your overall premium.

- Finalize Your Choice: Once you’ve compared quotes and assessed your options, select the insurance provider and coverage that best meet your needs and budget.

The Importance of Comprehensive Vehicle Insurance

Having comprehensive vehicle insurance is crucial for several reasons. It provides financial protection in the event of accidents, vandalism, natural disasters, or other unforeseen circumstances. With comprehensive coverage, you can:

- Protect yourself and your passengers from liability claims.

- Cover the cost of repairs or replacements for your vehicle.

- Avoid out-of-pocket expenses for unexpected damages.

- Enjoy peace of mind knowing you’re covered in various situations.

Benefits of Adequate Coverage

Obtaining the right level of coverage offers numerous advantages, including:

- Financial Security: Comprehensive insurance provides financial protection, ensuring you’re not left with significant expenses in the event of an accident or damage to your vehicle.

- Legal Compliance: In many regions, vehicle insurance is mandatory by law. Adequate coverage ensures you meet legal requirements and avoid penalties.

- Peace of Mind: With comprehensive coverage, you can drive with confidence, knowing you’re protected against a wide range of risks.

- Additional Benefits: Many insurance policies offer added perks such as rental car coverage, emergency roadside assistance, or accident forgiveness, enhancing your overall driving experience.

Case Study: Real-Life Insurance Scenario

Let’s explore a real-life scenario to understand the impact of vehicle insurance. John, a 25-year-old driver, recently purchased a new car. He obtained quotes from three insurance providers, comparing the coverage and costs.

| Insurance Provider | Coverage Level | Premium Cost |

|---|---|---|

| Provider A | Comprehensive with high deductibles | 800 annually</td> </tr> <tr> <td>Provider B</td> <td>Liability-only coverage</td> <td>500 annually |

| Provider C | Comprehensive with moderate deductibles | $950 annually |

After careful consideration, John chose Provider C's comprehensive plan, recognizing the importance of having adequate coverage despite the slightly higher premium. This decision provided him with peace of mind and ensured he was protected in various driving situations.

Frequently Asked Questions

What is the difference between liability-only and comprehensive coverage?

+

Liability-only coverage provides protection for damages you cause to others’ property or injuries to others. It does not cover your own vehicle’s damages. Comprehensive coverage, on the other hand, offers broader protection, covering damages to your vehicle caused by accidents, theft, vandalism, or natural disasters.

How can I lower my vehicle insurance premiums?

+

To reduce your premiums, consider increasing your deductibles, maintaining a clean driving record, exploring multi-policy discounts, or taking advantage of loyalty rewards. Additionally, regularly reviewing and comparing quotes can help you find the best rates.

Are there any discounts available for vehicle insurance?

+

Yes, many insurance providers offer discounts for safe driving records, multi-policy coverage, loyalty, or specific vehicle safety features. It’s worth inquiring about these discounts when obtaining quotes to lower your overall premium.

How often should I review my vehicle insurance policy?

+

It’s recommended to review your policy annually or whenever your circumstances change significantly. Life events such as marriage, purchasing a new vehicle, or relocating may impact your insurance needs and coverage requirements.

Can I customize my vehicle insurance coverage to my specific needs?

+

Absolutely! Most insurance providers offer customizable coverage options. You can choose the level of coverage, deductibles, and add-ons that best suit your driving habits, vehicle type, and financial situation.