Low Cost Car Insurance California

Securing affordable car insurance in California is a top priority for many drivers. The state's diverse landscapes and bustling cities present unique challenges and opportunities when it comes to finding the right coverage at the best price. This comprehensive guide aims to provide an in-depth exploration of low-cost car insurance options in the Golden State, offering expert insights and practical advice to help you navigate the complex world of automotive insurance.

Understanding California’s Insurance Landscape

California is known for its stringent insurance regulations, ensuring a high level of protection for drivers and their vehicles. The state mandates a minimum level of liability coverage for all registered vehicles, including bodily injury and property damage liability. This requirement, while ensuring safety, can also drive up insurance costs.

The cost of car insurance in California varies significantly depending on numerous factors. These include the type of vehicle, the driver's age and driving history, the area where the vehicle is garaged, and the level of coverage desired. Additionally, California's unique laws, such as those governing uninsured motorist coverage and personal injury protection, can impact insurance rates.

One of the most influential factors in determining insurance rates is the driver's record. A clean driving history can lead to significant savings, while violations, accidents, and claims can drive up premiums. It's crucial for California drivers to maintain a safe and responsible driving record to keep insurance costs low.

California’s Unique Insurance Requirements

California has specific insurance laws that every driver should be aware of. The state requires a minimum of 15,000 bodily injury liability coverage per person, 30,000 bodily injury liability coverage per accident, and 5,000 property damage liability coverage. Additionally, uninsured motorist bodily injury coverage is also mandatory, with minimum limits of 15,000 per person and $30,000 per accident.

Furthermore, California offers an optional insurance endorsement known as the California Low Cost Automobile Insurance Program (CLCA). This program provides reduced-cost liability coverage to eligible drivers, offering a great option for those seeking low-cost insurance. Eligibility is based on income, with individuals earning less than $33,050 annually and families earning less than $66,100 potentially qualifying.

| California's Insurance Requirements | Minimum Limits |

|---|---|

| Bodily Injury Liability (per person) | $15,000 |

| Bodily Injury Liability (per accident) | $30,000 |

| Property Damage Liability | $5,000 |

| Uninsured Motorist Bodily Injury (per person) | $15,000 |

| Uninsured Motorist Bodily Injury (per accident) | $30,000 |

Tips for Finding Low-Cost Insurance

Navigating the insurance market can be daunting, but with the right strategies, you can find affordable coverage that meets your needs. Here are some expert tips to help you secure low-cost car insurance in California.

Compare Quotes from Multiple Insurers

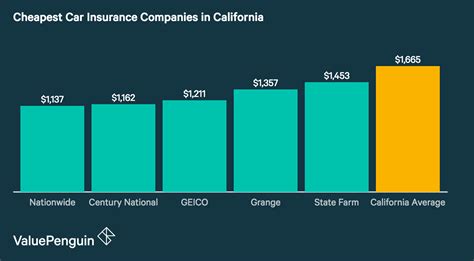

The insurance market is highly competitive, and rates can vary significantly between companies. It’s crucial to shop around and compare quotes from various insurers. Online quote comparison tools can be a great starting point, allowing you to quickly see the range of rates available. However, it’s also important to delve deeper and understand the specific coverages and benefits offered by each insurer.

When comparing quotes, pay attention to the details. Ensure that the quotes you're comparing are for the same level of coverage. Look beyond just the price and consider the reputation and financial stability of the insurer, as well as any additional benefits or perks they may offer. Some insurers, for instance, provide discounts for bundling policies or for using certain safety features in your vehicle.

Utilize Discounts and Savings Opportunities

Insurance companies offer a wide range of discounts to attract and retain customers. These discounts can significantly reduce your insurance premiums. Some common discounts include:

- Multi-Policy Discounts: If you bundle your auto insurance with other policies, such as homeowners or renters insurance, you can often qualify for a discount.

- Safe Driver Discounts: Insurers often reward drivers with clean records by offering discounts. These discounts can be significant, especially for long-term, accident-free drivers.

- Good Student Discounts: Many insurers provide discounts for young drivers who maintain good grades in school.

- Loyalty Discounts: Staying with the same insurer for an extended period can lead to loyalty discounts.

- Safety Feature Discounts: Some insurers offer discounts for vehicles equipped with advanced safety features like anti-lock brakes, air bags, or anti-theft devices.

When obtaining quotes, ask about the discounts available and how you can qualify for them. Also, consider whether your current insurer is offering you the best rates and discounts. Switching insurers can sometimes result in significant savings.

Adjust Your Coverage Levels

The level of coverage you choose has a direct impact on your insurance premiums. While it’s important to have adequate coverage, you may be able to save money by adjusting your coverage limits. Here are some considerations:

- Liability Coverage: California's minimum liability limits may not provide sufficient protection in the event of a serious accident. Consider increasing your liability coverage to ensure you're adequately protected.

- Comprehensive and Collision Coverage: If you have an older vehicle with a low market value, you may want to consider dropping comprehensive and collision coverage. These coverages protect your vehicle from damage, but they can be costly, especially for older vehicles.

- Deductibles: Increasing your deductible (the amount you pay out-of-pocket before your insurance kicks in) can lower your premiums. However, this strategy carries more financial risk, so choose a deductible amount that you're comfortable paying out-of-pocket.

Remember, while lowering coverage limits or increasing deductibles can save you money, it's important to ensure you still have adequate protection. It's a fine balance between saving money and maintaining sufficient coverage.

Exploring Additional Savings Strategies

Beyond the standard discounts and coverage adjustments, there are other strategies you can employ to save on your car insurance in California.

Safe Driving Practices

Maintaining a clean driving record is crucial for keeping insurance costs down. Avoid violations, such as speeding or running red lights, and always drive defensively. Safe driving not only reduces your risk of accidents but also helps you qualify for safe driver discounts.

Additionally, consider taking a defensive driving course. These courses can help you become a safer, more confident driver, and may even qualify you for insurance discounts. Many insurers offer discounts for drivers who complete approved defensive driving courses.

Vehicle Safety and Anti-Theft Measures

Insurers often offer discounts for vehicles equipped with advanced safety features or anti-theft devices. These features not only enhance your safety on the road but can also reduce your insurance premiums. When shopping for a new vehicle, consider models with high safety ratings and built-in security features.

If you're not in the market for a new vehicle, you can still take steps to enhance your current vehicle's safety and security. Installing an approved anti-theft device, such as a car alarm or GPS tracking system, can qualify you for insurance discounts. Additionally, regular vehicle maintenance can help prevent breakdowns and accidents, keeping your insurance claims low.

Paying Your Premium in Full

Many insurers offer a discount if you pay your annual premium in full rather than in monthly installments. While this may require a larger upfront payment, it can result in significant savings over the year. If you have the financial means, paying your premium in full can be a smart strategy to reduce your insurance costs.

The Impact of Credit Score on Insurance Rates

Your credit score is a significant factor in determining your insurance rates. Insurers use credit-based insurance scores to assess your risk as a driver. These scores are based on information in your credit report, such as your payment history, the types of credit you have, and the length of your credit history. Generally, the higher your credit score, the lower your insurance rates will be.

Improving your credit score can lead to substantial savings on your car insurance. While it may take time and effort, taking steps to improve your credit can pay off in the long run. Here are some strategies to consider:

- Pay your bills on time.

- Reduce your credit card balances and aim to use less than 30% of your available credit.

- Check your credit report for errors and dispute any inaccuracies.

- Consider a credit-builder loan or secured credit card to establish a positive payment history.

- Be patient. Building a strong credit history takes time, but it's a worthwhile investment.

Understanding Coverage Options

When shopping for car insurance, it’s important to understand the different types of coverage available and how they can protect you in various situations. Here’s a breakdown of the key coverages you should consider:

Liability Coverage

Liability coverage is the most basic and legally required type of car insurance in California. It covers the costs associated with bodily injury and property damage you cause to others in an accident. It’s crucial to have adequate liability coverage to protect your assets in the event of a serious accident. The minimum liability limits in California are 15,000 per person, 30,000 per accident for bodily injury, and $5,000 for property damage.

Collision and Comprehensive Coverage

Collision coverage pays for damage to your vehicle in an accident, regardless of who is at fault. Comprehensive coverage, on the other hand, covers damage to your vehicle from non-accident events, such as theft, vandalism, weather-related incidents, or collisions with animals. Both collision and comprehensive coverage typically come with a deductible, which is the amount you pay out-of-pocket before your insurance kicks in.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage (UM/UIM) protects you if you’re involved in an accident with a driver who has little or no insurance. In California, uninsured motorist bodily injury coverage is mandatory, with minimum limits of 15,000 per person and 30,000 per accident. This coverage is essential to ensure you’re protected in the event of an accident with an uninsured or underinsured driver.

Medical Payments Coverage

Medical payments coverage, also known as Personal Injury Protection (PIP), covers medical expenses for you and your passengers in the event of an accident, regardless of fault. This coverage can help ensure you have quick access to medical treatment without having to wait for liability claims to be resolved. It’s an important coverage to consider, especially if you or your passengers have high medical expenses.

Additional Coverages and Endorsements

Beyond the basic coverages, there are a variety of additional coverages and endorsements you can add to your policy to customize your protection. These may include rental car reimbursement, towing and labor coverage, custom parts and equipment coverage, and more. It’s important to review these options and choose the coverages that best fit your needs and budget.

Choosing the Right Insurance Provider

With so many insurance providers to choose from, selecting the right one can be a daunting task. Here are some factors to consider when making your decision:

Financial Stability and Reputation

Look for an insurer with a strong financial rating. This ensures that the company is financially stable and can pay out claims in the event of an accident. Reputable insurance companies are often rated by independent agencies like AM Best, Moody’s, or Standard & Poor’s. Check these ratings to ensure the insurer you choose has the financial strength to back up their promises.

Customer Service and Claims Handling

Excellent customer service and efficient claims handling are crucial when it comes to insurance. Look for insurers with a reputation for quick, fair claims processing and friendly, knowledgeable customer service representatives. Online reviews and ratings can be a good indicator of an insurer’s customer service quality.

Policy Features and Coverage Options

Review the policy features and coverage options offered by different insurers. Compare the types of coverage they provide, the discounts they offer, and any additional benefits or perks they include with their policies. Some insurers may offer unique coverage options or endorsements that better suit your needs.

Online Tools and Resources

In today’s digital age, many insurers offer online tools and resources to enhance the customer experience. Look for insurers that provide convenient online services, such as policy management, billing, and claims reporting. These tools can save you time and make managing your insurance policy more efficient.

Conclusion: Navigating the California Insurance Market

Securing low-cost car insurance in California requires a combination of smart shopping strategies, understanding your coverage options, and taking advantage of savings opportunities. By comparing quotes from multiple insurers, utilizing discounts, adjusting your coverage levels, and maintaining a clean driving record, you can find affordable insurance that provides the protection you need.

Remember, insurance is a long-term investment in your financial security. While it's important to save money, it's also crucial to ensure you have adequate coverage to protect yourself and your assets. Take the time to research and understand your options, and don't hesitate to reach out to insurance professionals for guidance. With the right approach, you can find low-cost car insurance that meets your needs and fits your budget.

How often should I review my car insurance policy and rates?

+It’s a good practice to review your car insurance policy and rates at least once a year. Insurance markets and personal circumstances can change, so it’s important to ensure your coverage and rates remain competitive. Additionally, life events such as getting married, buying a new home, or adding a teen driver to your policy can significantly impact your insurance needs and rates.

Can I switch insurance providers mid-policy term?

+Yes, you can switch insurance providers at any time. However, it’s important to note that if you cancel your existing policy before its term ends, you may be subject to cancellation fees or penalties. Make sure to understand the terms of your current policy before switching to a new insurer.

What are some common mistakes to avoid when shopping for car insurance?

+Some common mistakes to avoid include choosing an insurer solely based on price, neglecting to read the fine print of your policy, and failing to take advantage of available discounts. It’s important to thoroughly research and compare insurers, understand the coverage you’re purchasing, and make use of any discounts you qualify for.