Worldwide Health Insurance

Embarking on international adventures, whether for work or leisure, often requires careful consideration of health insurance options. This comprehensive guide aims to shed light on the complex world of worldwide health insurance, offering insights and strategies to help you make informed decisions. From understanding the basics to delving into the intricacies of coverage, we'll explore how to navigate this essential aspect of global travel and living.

Understanding the Basics of Worldwide Health Insurance

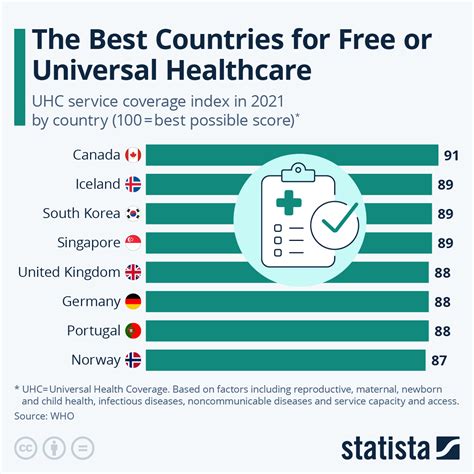

Worldwide health insurance, often referred to as international health insurance or global health insurance, is a specialized form of coverage designed to cater to individuals who are regularly outside their home country. This could include expatriates, frequent travelers, or those with international lifestyles. Unlike traditional domestic health insurance, worldwide policies are tailored to provide medical coverage across multiple countries, ensuring access to quality healthcare regardless of location.

The fundamental principle behind worldwide health insurance is to offer comprehensive protection against unexpected medical expenses incurred while abroad. These policies typically cover a range of services, including hospitalization, emergency medical treatment, prescription medications, and sometimes even dental and optical care. They aim to provide peace of mind, ensuring that individuals can access the healthcare they need without facing significant financial burdens.

Key Features and Benefits

One of the standout features of worldwide health insurance is its flexibility. Policies can be customized to meet individual needs, allowing for adjustments in coverage limits, deductibles, and optional add-ons. This customization ensures that the policy aligns with an individual's specific circumstances, whether they're traveling for a few months or residing abroad long-term.

Additionally, many worldwide health insurance providers offer global networks of healthcare providers, ensuring that policyholders have access to a wide range of medical facilities and professionals. This network can include hospitals, clinics, and even specialized treatment centers, providing a level of convenience and reassurance when seeking medical care abroad.

Another advantage is the portability of these policies. Unlike some domestic health insurance plans that are restricted to specific regions or countries, worldwide health insurance policies can be used wherever the policyholder is located. This makes them ideal for those with unpredictable travel schedules or those who regularly move between different countries.

Types of Worldwide Health Insurance

Worldwide health insurance policies can be broadly categorized into two main types: short-term and long-term coverage.

- Short-Term Worldwide Health Insurance: These policies are designed for individuals who are traveling or residing abroad for a limited period, typically ranging from a few weeks to a year. They are often more affordable and provide essential coverage for unexpected medical emergencies. Short-term policies are ideal for students studying abroad, business travelers, or those on extended vacations.

- Long-Term Worldwide Health Insurance: Long-term policies are tailored for expatriates, digital nomads, or individuals who plan to reside abroad for an extended period, often several years or indefinitely. These policies offer more comprehensive coverage, including options for maternity care, chronic condition management, and specialized treatments. Long-term plans provide the necessary flexibility and peace of mind for those establishing a new life in a foreign country.

Navigating the Complexity of Worldwide Health Insurance

While worldwide health insurance offers numerous benefits, navigating the complexities of these policies can be daunting. Here's a closer look at some key considerations to keep in mind when selecting a policy that best suits your needs.

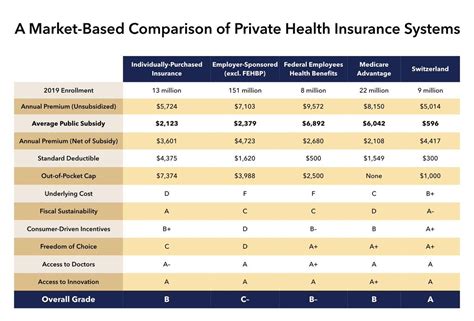

Coverage Limits and Deductibles

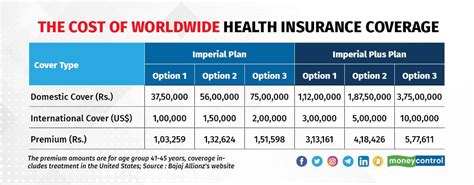

Understanding the coverage limits and deductibles is crucial when evaluating worldwide health insurance policies. Coverage limits refer to the maximum amount the insurance provider will pay out for a specific type of treatment or during a policy period. Deductibles, on the other hand, are the amount you, as the policyholder, are responsible for paying before the insurance coverage kicks in. Both factors significantly impact the overall cost and protection provided by the policy.

For instance, a policy with a high coverage limit might offer more extensive protection, ensuring that even costly medical treatments are covered. However, policies with high coverage limits often come with higher premiums. Similarly, while a policy with a lower deductible might be more appealing, it could result in higher overall costs due to increased premiums.

| Coverage Limit | Deductible |

|---|---|

| USD 500,000 | USD 500 |

| USD 1,000,000 | USD 1,000 |

| USD 2,000,000 | USD 2,000 |

Note: The table above provides an example of how coverage limits and deductibles can vary between policies.

Network of Healthcare Providers

The network of healthcare providers associated with a worldwide health insurance policy is another critical consideration. This network determines the range of medical facilities and professionals you can access while abroad. A robust network can provide convenience and peace of mind, ensuring that you have options for treatment regardless of your location.

When researching policies, it's beneficial to explore the specific healthcare providers covered within the network. This includes not only hospitals and clinics but also specialists, such as cardiologists, oncologists, and mental health professionals. Understanding the network's scope can help you make an informed decision, especially if you have specific medical needs or conditions.

Exclusions and Limitations

Every worldwide health insurance policy comes with its set of exclusions and limitations. These are specific situations or conditions that are not covered by the policy. It's crucial to carefully review these exclusions to ensure that your policy aligns with your healthcare needs and expectations.

Common exclusions may include pre-existing conditions, pregnancy-related expenses (unless specifically covered), and certain high-risk activities like extreme sports. Some policies might also exclude coverage for mental health issues or specific chronic conditions. Being aware of these limitations can help you make necessary adjustments to your coverage or lifestyle to ensure you're adequately protected.

Selecting the Right Worldwide Health Insurance Policy

Choosing the right worldwide health insurance policy involves a thoughtful evaluation of your personal circumstances and healthcare needs. Here's a step-by-step guide to help you through the selection process.

Assess Your Needs

Start by evaluating your specific requirements. Consider factors such as the duration of your stay abroad, your age and health status, and any pre-existing conditions. Determine whether you'll be traveling frequently or residing in one location. Understanding your needs will help narrow down the types of policies that are most suitable for you.

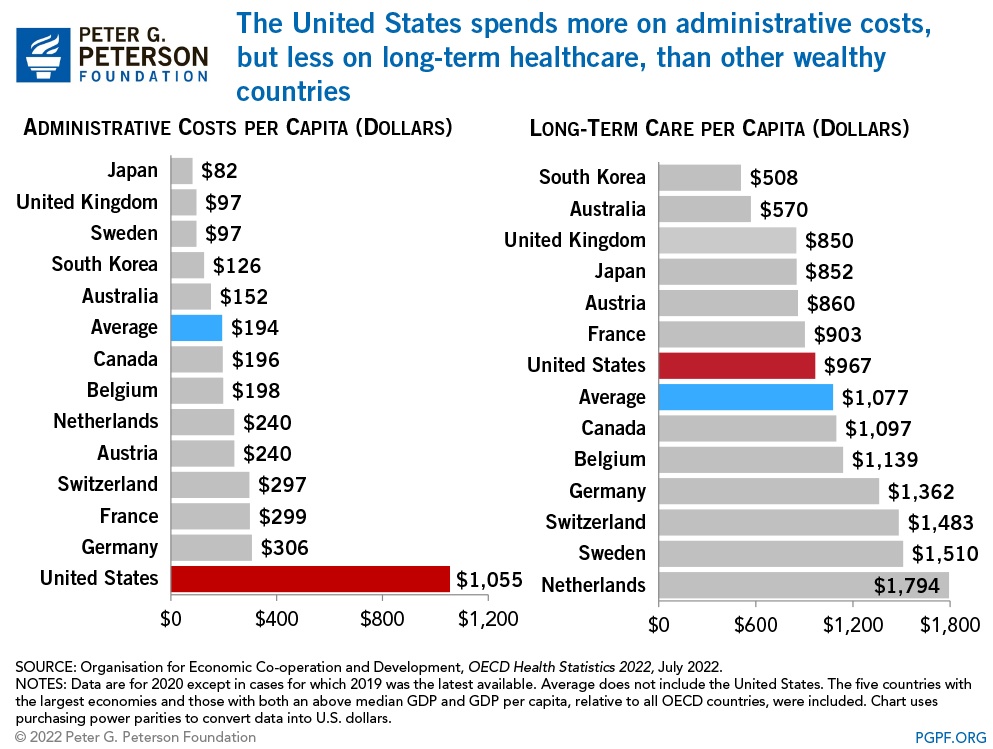

Compare Providers and Plans

Once you've identified your needs, it's time to research and compare different providers and their respective plans. Look for reputable insurance companies that specialize in worldwide health insurance. Compare their coverage options, including the scope of benefits, coverage limits, and deductibles. Don't forget to review the network of healthcare providers and any exclusions or limitations.

Online resources and comparison websites can be invaluable tools during this process. They often provide comprehensive overviews of various policies, allowing you to quickly assess their key features and benefits.

Consider Additional Benefits

In addition to the standard coverage, some worldwide health insurance policies offer optional add-ons or additional benefits. These can include travel assistance services, evacuation coverage, and even wellness programs. While these benefits might come at an extra cost, they can provide significant value, especially for those with unique circumstances or health concerns.

Read the Fine Print

Before finalizing your decision, take the time to carefully read the policy documents. Understand the terms and conditions, including any exclusions or limitations that might not be immediately apparent. This step is crucial to ensuring that you're fully aware of what your policy covers and what it doesn't.

Seek Professional Advice

If you're unsure or need further guidance, consider seeking advice from an insurance broker or financial advisor specializing in worldwide health insurance. These professionals can provide valuable insights and recommendations based on your specific situation. They can also help you navigate any complex aspects of the policy and ensure that you're making an informed choice.

Conclusion: Empowering Your Global Journey with the Right Insurance

Navigating worldwide health insurance is an essential aspect of preparing for international travels or relocating abroad. By understanding the basics, exploring the complexities, and making informed decisions, you can ensure that you're adequately protected and prepared for any medical eventualities. Remember, the right worldwide health insurance policy can provide the peace of mind and support you need to fully embrace your global adventures.

How do I choose between short-term and long-term worldwide health insurance policies?

+The choice between short-term and long-term policies depends on the duration of your stay abroad. If you’re traveling or residing abroad for a limited period (typically less than a year), short-term policies offer essential coverage at a more affordable rate. However, for extended stays or indefinite periods, long-term policies provide more comprehensive coverage, including options for specialized treatments and chronic condition management.

Are worldwide health insurance policies expensive?

+The cost of worldwide health insurance policies can vary significantly based on factors such as coverage limits, deductibles, and the policy’s scope. While some policies can be relatively affordable, especially for short-term coverage, others may be more costly, particularly if they offer extensive coverage and specialized benefits. It’s essential to balance your budget with your healthcare needs when selecting a policy.

Can I get worldwide health insurance if I have a pre-existing medical condition?

+Yes, many worldwide health insurance providers offer policies that cover pre-existing conditions. However, it’s crucial to disclose any pre-existing conditions when applying for the policy. Some providers may require a medical examination or additional information about your condition. The coverage for pre-existing conditions might come with specific limitations or additional costs, so it’s important to carefully review the policy terms.