Ltc Insurance

Long-term care (LTC) insurance is a vital aspect of financial planning and risk management, especially as life expectancies increase and healthcare costs continue to rise. This comprehensive guide will delve into the world of LTC insurance, exploring its importance, how it works, and why it should be a consideration for individuals and families looking to secure their future well-being.

Understanding Long-Term Care Insurance

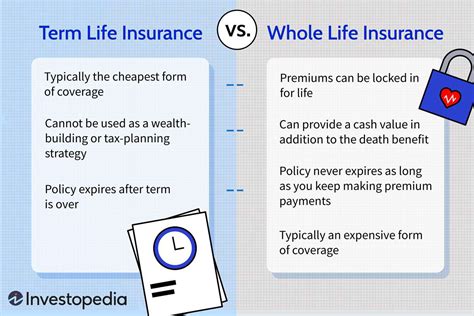

Long-term care insurance is a specialized form of coverage designed to protect individuals from the high costs associated with extended care needs. Unlike traditional health insurance, which primarily covers short-term medical treatments, LTC insurance focuses on providing financial support for the ongoing care and assistance required by individuals with chronic illnesses, disabilities, or age-related ailments.

The need for long-term care is a reality for many individuals, with the potential to impact not only their financial stability but also their quality of life. LTC insurance aims to address this by offering a safety net, ensuring that individuals have access to the necessary care services without depleting their savings or relying solely on public assistance programs.

Key Features of LTC Insurance

-

Coverage Options: LTC policies offer a range of coverage levels, allowing policyholders to choose the amount and duration of benefits they require. This flexibility ensures that individuals can tailor their coverage to their specific needs and financial circumstances.

-

Eligibility and Waiting Periods: To qualify for LTC insurance, individuals typically need to meet certain health criteria. Policies often include waiting periods, known as elimination periods, during which the insured must cover their own care costs before the policy kicks in. These periods can range from a few days to several months.

-

Benefit Triggers: LTC insurance policies typically require a medical assessment to determine the need for long-term care. This assessment evaluates an individual’s ability to perform daily activities, such as bathing, dressing, and eating. Once the need for long-term care is established, the policy’s benefits can be activated.

The Impact of Long-Term Care Needs

The demand for long-term care services is a growing concern, particularly in aging populations. According to a study by the National Center for Health Statistics, the number of adults aged 65 and older requiring long-term care is projected to increase significantly over the next few decades. This trend highlights the importance of planning for long-term care needs, as the financial burden can be substantial without adequate insurance coverage.

Furthermore, the cost of long-term care services varies depending on the type of care and the region. For instance, the Genworth Cost of Care Survey reveals that the average cost of a private room in a nursing home can exceed $100,000 per year. These expenses can quickly deplete an individual's savings, emphasizing the value of LTC insurance in safeguarding one's financial security.

How Long-Term Care Insurance Works

LTC insurance operates by providing a predetermined benefit amount for a specified period, ensuring individuals have the financial means to access the care they require. The policyholder pays regular premiums to maintain their coverage, and in return, the insurance company assumes the financial risk associated with long-term care needs.

Policy Components

-

Premium Payments: Policyholders pay regular premiums, which can be structured as monthly, quarterly, or annual payments. These premiums are determined based on factors such as the policyholder’s age, health status, and the level of coverage chosen.

-

Benefit Period: The benefit period defines the duration for which the policy will provide coverage. Common benefit periods range from a few years to lifelong coverage. The longer the benefit period, the more comprehensive the policy but also the higher the premium costs.

-

Daily Benefit Amount: LTC insurance policies typically provide a daily benefit amount, which represents the maximum amount the insured can receive per day for their long-term care expenses. This amount can be used to cover a variety of care services, including home health aides, assisted living facilities, or nursing home care.

Utilizing LTC Insurance Benefits

When an individual requires long-term care, they can file a claim with their insurance provider. The insurer will then assess the claim and, if approved, begin disbursing the daily benefit amount. This benefit can be used to pay for a range of care services, providing flexibility in choosing the most suitable care option.

It's important to note that LTC insurance does not cover all long-term care expenses. Policyholders may still incur out-of-pocket costs, particularly during the elimination period and for services not covered by the policy. Understanding the specific terms and limitations of one's policy is crucial to effective long-term care planning.

The Benefits of Long-Term Care Insurance

Investing in LTC insurance offers a multitude of advantages, providing peace of mind and financial security for policyholders and their families.

Financial Protection

One of the primary benefits of LTC insurance is its ability to protect an individual’s financial assets. By covering the costs of long-term care, the policy ensures that savings and investments are preserved, allowing individuals to maintain their desired lifestyle and financial stability.

Choice of Care Providers

LTC insurance empowers policyholders to choose their preferred care providers, be it a home health aide, assisted living facility, or a specific nursing home. This flexibility ensures that individuals can receive care in an environment that best suits their needs and preferences.

Tax Advantages

In many jurisdictions, LTC insurance premiums are tax-deductible, providing an additional financial benefit. Policyholders can consult with tax professionals to understand the specific tax advantages associated with their LTC insurance policy.

Peace of Mind

Knowing that one has the financial means to access quality long-term care can bring immense peace of mind. LTC insurance removes the worry of becoming a burden on loved ones and ensures that individuals can maintain their independence and dignity as they age.

Choosing the Right LTC Insurance Policy

Selecting the appropriate LTC insurance policy is a critical decision that requires careful consideration. Several factors come into play, and it’s essential to tailor the policy to one’s unique circumstances and needs.

Assessing Individual Needs

Start by evaluating your personal circumstances and potential long-term care needs. Consider factors such as age, health status, family history, and lifestyle. Understanding these aspects will help determine the level of coverage required.

Policy Features and Coverage

When comparing LTC insurance policies, pay close attention to the coverage details. Consider the daily benefit amount, benefit period, and any additional features or riders that may be beneficial. Some policies offer inflation protection, ensuring that benefits keep pace with rising healthcare costs.

Reputable Insurers

Choose a reputable and financially stable insurance company with a proven track record in the LTC insurance market. Researching the insurer’s financial strength and customer satisfaction ratings can provide valuable insights into the reliability of their policies.

Professional Guidance

Consulting with a financial advisor or insurance professional can be immensely helpful in navigating the complex world of LTC insurance. These experts can provide personalized advice and help you make informed decisions based on your specific needs and goals.

Long-Term Care Insurance and Retirement Planning

Integrating LTC insurance into one’s retirement planning strategy is a prudent move. It ensures that retirement funds are protected and can be utilized for other aspects of retirement, such as travel, hobbies, or legacy planning.

Retirement Income Protection

LTC insurance safeguards retirement income by preventing it from being depleted by long-term care expenses. This protection ensures that retirees can maintain their desired standard of living and have the financial flexibility to enjoy their golden years.

Estate Planning Considerations

LTC insurance can also play a role in estate planning. By including LTC insurance in your overall financial strategy, you can ensure that your assets are preserved and can be passed on to your loved ones as intended. This aspect of financial planning is particularly important for individuals with significant wealth or complex estates.

The Role of Inflation

Inflation is a critical factor to consider when planning for long-term care needs. As healthcare costs rise over time, the value of one’s LTC insurance coverage can diminish. Policies with inflation protection can help mitigate this risk, ensuring that benefits remain adequate to cover future care expenses.

The Future of Long-Term Care Insurance

The landscape of LTC insurance is evolving, driven by changing demographics, healthcare advancements, and shifts in societal attitudes towards aging and care.

Technology and Innovation

The integration of technology is transforming the LTC insurance industry. Insurers are leveraging data analytics and digital tools to enhance policy customization and risk assessment. Additionally, telehealth services and remote monitoring are becoming increasingly prevalent, offering new care options and improving the overall efficiency of long-term care delivery.

Public Policy and Support

Governments and healthcare policymakers are recognizing the importance of long-term care and are implementing measures to support individuals and families. This includes the development of public-private partnerships, the expansion of Medicaid benefits, and the promotion of long-term care planning initiatives. These efforts aim to ensure that individuals have access to the care they need while reducing the financial burden on both individuals and the healthcare system.

Community-Based Care Solutions

There is a growing trend towards community-based care solutions, which offer more affordable and flexible alternatives to traditional nursing home care. These solutions, such as assisted living facilities and home-based care services, provide individuals with the support they need while allowing them to maintain a sense of independence and community connection.

Conclusion

Long-term care insurance is a crucial component of comprehensive financial planning, offering protection, flexibility, and peace of mind for individuals and their families. As the demand for long-term care services continues to rise, the importance of LTC insurance becomes increasingly evident. By understanding the benefits, features, and considerations associated with LTC insurance, individuals can make informed decisions to secure their future well-being.

The world of LTC insurance is ever-evolving, driven by technological advancements, policy reforms, and societal shifts. Staying informed and adapting to these changes ensures that individuals can navigate the complexities of long-term care planning with confidence and assurance.

What is the typical age range for purchasing LTC insurance?

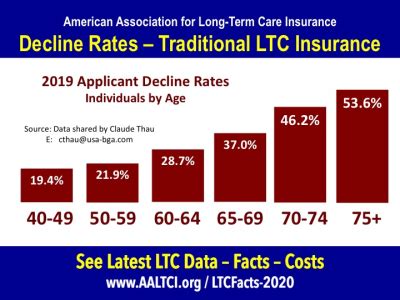

+The ideal age for purchasing LTC insurance is typically between 40 and 65 years. This range offers the best balance between affordability and coverage options. As individuals age, the cost of LTC insurance tends to increase, and health conditions may limit their eligibility.

Can LTC insurance be purchased after retirement?

+While it is possible to purchase LTC insurance after retirement, it may be more challenging and costly. Some insurers may have age restrictions or require more comprehensive health assessments. It’s best to explore LTC insurance options well in advance of retirement to secure the most favorable terms.

Are there any tax benefits associated with LTC insurance premiums?

+Yes, in many countries, LTC insurance premiums are tax-deductible. However, the specific tax benefits and eligibility criteria may vary by jurisdiction. Consulting with a tax professional can provide accurate information on the tax advantages associated with LTC insurance in your region.