Difference Between Whole Life And Term Life Insurance

Understanding the distinction between whole life and term life insurance is crucial for individuals seeking to protect their financial well-being and ensure the security of their loved ones. This comprehensive guide will delve into the nuances of these two primary types of life insurance, highlighting their key differences, advantages, and considerations to help you make an informed decision.

Whole Life Insurance: A Comprehensive Lifetime Protection

Whole life insurance, often referred to as permanent life insurance, is a long-term financial commitment designed to provide coverage throughout an individual's lifetime. It combines the benefits of life insurance with a savings component, offering a range of features that make it an attractive option for those seeking financial stability and security.

Key Characteristics of Whole Life Insurance

Whole life policies are characterized by the following features:

- Guaranteed Coverage for Life: As the name suggests, whole life insurance offers lifetime coverage, ensuring that your beneficiaries receive the death benefit whenever you pass away.

- Cash Value Accumulation: One of the unique aspects of whole life insurance is the cash value component. A portion of your premium payments goes towards building up a cash value account, which earns interest over time. This cash value can be accessed through loans or withdrawals during your lifetime, providing a source of emergency funds or supplementary retirement income.

- Fixed Premiums: Whole life insurance policies typically have level premiums, meaning you pay the same amount each month or year throughout the policy's duration. This predictability makes it easier to budget for your insurance costs.

- Tax Benefits: The cash value in a whole life policy grows on a tax-deferred basis, and any death benefit received by your beneficiaries is generally income tax-free.

Additionally, whole life insurance often includes riders or additional benefits, such as the ability to accelerate death benefits for terminal illnesses or to provide financial support for long-term care needs.

| Whole Life Insurance Features | Description |

|---|---|

| Lifetime Coverage | Guarantees a death benefit regardless of when the insured passes away. |

| Cash Value Accumulation | Allows for the growth of a cash value account over time. |

| Fixed Premiums | Offers predictable and stable premium payments. |

| Tax Advantages | Provides tax-deferred growth and tax-free death benefits. |

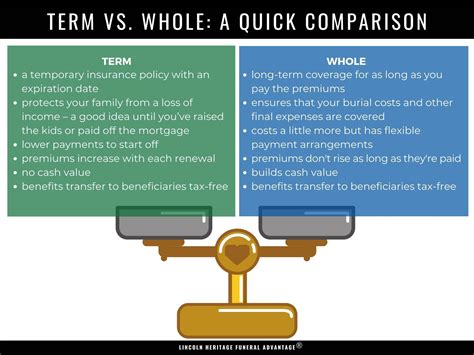

Term Life Insurance: Temporary Coverage with High Value

Term life insurance, as the name implies, provides coverage for a specific period or "term." It is a more straightforward and often more affordable option compared to whole life insurance, making it a popular choice for individuals who want temporary protection during critical life stages.

Key Characteristics of Term Life Insurance

Term life insurance policies are known for their simplicity and focus on providing high coverage amounts at a lower cost.

- Fixed Coverage Period: Term life insurance policies typically last for a defined period, such as 10, 20, or 30 years. The coverage ends at the end of the term, and no cash value or benefits are payable if the insured survives the term.

- Lower Premiums: One of the primary advantages of term life insurance is its affordability. Premiums are often significantly lower compared to whole life insurance, making it an attractive option for those on a budget.

- High Coverage Amounts: Despite the lower premiums, term life insurance can provide substantial coverage amounts, ensuring that your loved ones are financially secure during the term of the policy.

- Renewable and Convertible: Many term life policies offer the option to renew the policy or convert it to a permanent life insurance policy as the term expires. This flexibility allows individuals to adapt their coverage needs as their circumstances change.

| Term Life Insurance Features | Description |

|---|---|

| Fixed Coverage Period | Provides coverage for a specific term, typically 10-30 years. |

| Affordable Premiums | Offers lower costs compared to whole life insurance. |

| High Coverage Amounts | Provides substantial death benefits during the term. |

| Renewal and Conversion Options | Allows for policy renewal or conversion to permanent life insurance. |

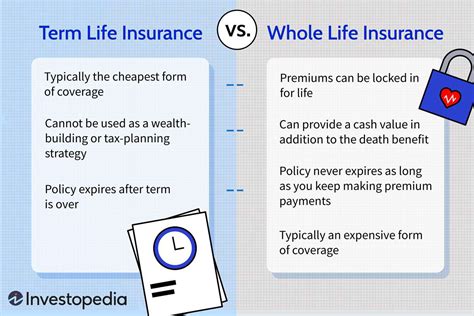

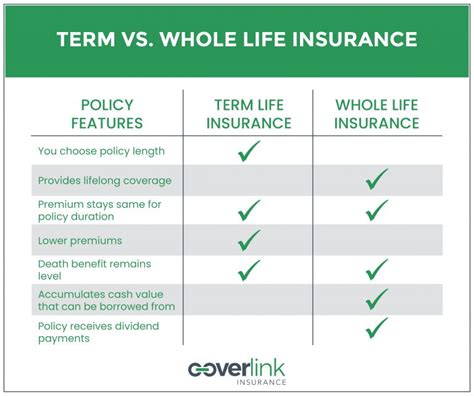

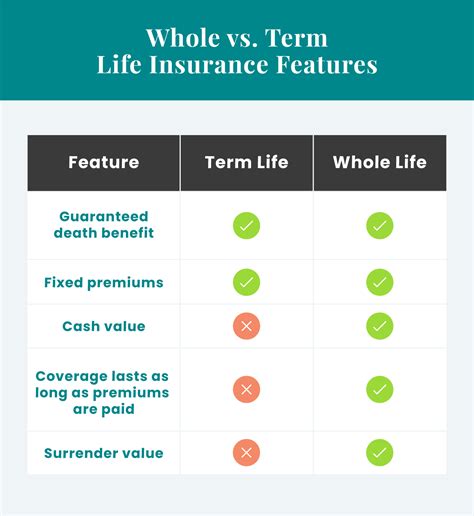

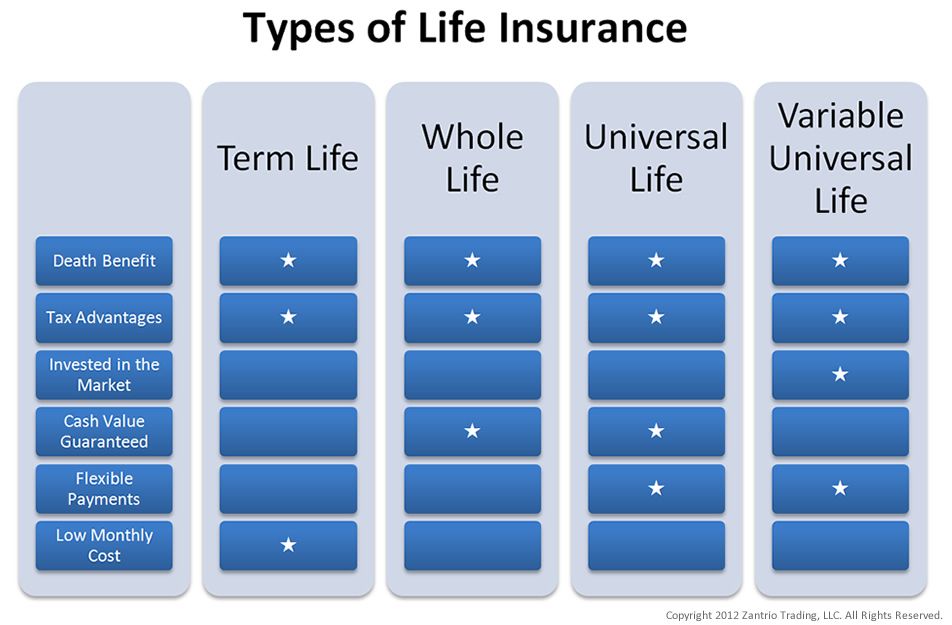

Comparing Whole Life and Term Life Insurance

When deciding between whole life and term life insurance, it's essential to consider your unique financial situation, goals, and needs. Here's a comparison to help you make an informed decision:

Coverage Duration

Whole life insurance offers lifelong coverage, providing peace of mind that your beneficiaries will receive the death benefit regardless of when you pass away. Term life insurance, on the other hand, provides coverage for a fixed period, typically 10-30 years. It is suitable for individuals who need coverage during specific life stages, such as while their children are young or they have outstanding debts.

Cost

Whole life insurance tends to have higher premiums compared to term life insurance. The premiums for whole life insurance remain level throughout the policy's duration, ensuring predictable costs. In contrast, term life insurance premiums are often more affordable, making it an attractive option for those on a budget.

Cash Value and Savings

One of the unique features of whole life insurance is the cash value component. This savings element allows policyholders to build up cash value over time, which can be accessed through loans or withdrawals. Term life insurance, however, does not offer a savings component; it is purely focused on providing coverage during the policy term.

Flexibility and Customization

Whole life insurance policies can be customized with various riders and benefits, providing flexibility to meet individual needs. For example, riders can be added to accelerate death benefits for terminal illnesses or to provide financial support for long-term care. Term life insurance policies are more straightforward and less customizable, as they are designed for temporary coverage.

Tax Advantages

Whole life insurance offers tax advantages, as the cash value within the policy grows on a tax-deferred basis. The death benefit received by beneficiaries is generally income tax-free. Term life insurance does not provide the same tax benefits, as it does not have a cash value component.

Choosing the Right Life Insurance

The decision between whole life and term life insurance depends on your individual circumstances and financial goals. Here are some considerations to guide your choice:

- Financial Stability: If you prioritize long-term financial security and stability, whole life insurance may be the better option. It provides a guaranteed death benefit and a savings component that can be accessed during your lifetime.

- Budgetary Concerns: Term life insurance is an affordable option for those on a tight budget. It offers high coverage amounts at a lower cost, making it ideal for temporary protection during specific life stages.

- Coverage Duration: Consider how long you need coverage. If you require lifelong protection, whole life insurance is the obvious choice. However, if you only need coverage for a specific period, such as while your children are young, term life insurance is a suitable and cost-effective solution.

- Flexibility: Whole life insurance offers more flexibility with its customizable riders and benefits. If you have specific financial needs or want the option to access cash value during your lifetime, whole life insurance provides more options.

Conclusion

Understanding the difference between whole life and term life insurance is crucial for making informed decisions about your financial future and the well-being of your loved ones. Whole life insurance offers lifelong coverage, a savings component, and tax advantages, making it an attractive option for those seeking long-term financial security. Term life insurance, on the other hand, provides temporary coverage at a lower cost, making it ideal for specific life stages.

By carefully considering your financial goals, coverage needs, and budget, you can choose the life insurance option that best aligns with your unique circumstances. Remember, life insurance is a vital component of financial planning, and having the right coverage can provide peace of mind and ensure the financial stability of your loved ones.

What is the primary difference between whole life and term life insurance?

+The main difference lies in the duration of coverage and the savings component. Whole life insurance offers lifelong coverage and a savings element, while term life insurance provides coverage for a fixed period, typically 10-30 years, without a savings component.

Are whole life insurance premiums more expensive than term life insurance premiums?

+Yes, whole life insurance premiums are generally higher compared to term life insurance. However, the predictability of level premiums throughout the policy’s duration can make budgeting easier.

Can I access the cash value in my whole life insurance policy during my lifetime?

+Yes, the cash value in a whole life insurance policy can be accessed through loans or withdrawals, providing a source of emergency funds or supplementary retirement income.

Is term life insurance suitable for individuals with young children?

+Yes, term life insurance is often recommended for individuals with young children or significant financial obligations. It provides high coverage amounts at a lower cost, ensuring financial protection during critical life stages.